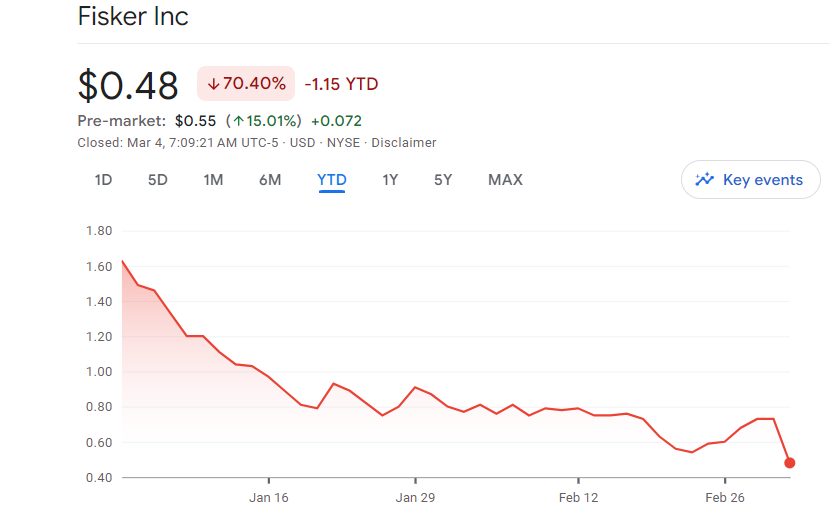

Fisker stock, the electric vehicle (EV) manufacturer, faced a substantial setback as its price plummeted by over 40% following the release of its fourth-quarter and full-year 2023 financial results. The company’s struggles were laid bare in the report, prompting investors to question the viability of their investment in the EV sector.

In the earnings release, Fisker revealed a myriad of challenges it encountered throughout 2023, including delays with suppliers and difficulties in establishing a direct-to-consumer sales model in both North America and Europe. The company’s attempt to transition to a dealer partner model also faced hurdles, with only 13 dealers onboarded, raising concerns about the effectiveness of the new strategy.

Despite a slight increase in total revenue to $200 million in the fourth quarter, Fisker’s bottom line painted a grim picture. The company reported a staggering loss of $761.5 million for the full year 2023, nearly triple its generated revenue. This alarming figure underscored the immense financial strain Fisker is under, with the company burning through $1.3 billion of investor money in just the past two years.

Furthermore, Fisker issued a sobering statement, expressing doubts about its ability to continue as a going concern. This admission, coming only two quarters after commencing production, raised significant red flags among investors and analysts alike.

Industry Headwinds and Analyst Caution

The EV industry’s broader challenges exacerbated Fisker’s woes. Slowing sales growth, supply chain disruptions, and increasing competition have dampened demand for electric vehicles. With consumers weighing the convenience and affordability of traditional internal combustion engine vehicles against EVs, Fisker’s prospects appear increasingly bleak.

CEO commentary highlighted the company’s ambitious production targets for 2024, aiming to deliver 20,000 to 22,000 vehicles. However, skepticism abounds regarding Fisker’s ability to achieve these goals amidst its current predicament.

In light of these developments, analysts and experts remain cautious about Fisker stock future outlook. Many advise against buying the Fisker stock, citing the company’s dire financial situation and the broader challenges facing the EV industry. As Fisker grapples with its existential crisis, investors brace for further volatility in the EV sector.

Also read: Best Performing Low Price Shares in 2024

Leave a Reply