Does it matter if we invest in growth or dividend paying stocks? We purchase both, but we now prefer the first.

Investors buy a variety of shares. There is a lot of overlap between growth shares, dividend paying shares, value shares, penny shares, etc.

In the end, it is our overall profits that matter, not how we got them.

However, we have grown to prefer dividend paying shares the most, and we want to explain why to everyone.

Great wealth

First off, is not the money itself the main focus here? We all, I mean, want more of the thing.

People frequently use share prices and charts to demonstrate their riches. But we can only spend cash; we cannot spend shares or charts.

Now that we are aware that the majority of us are in it for the long haul, we nevertheless invest the money in more shares. However, for us, seeing actual money coming in from our shares keeps everything grounded.

More options

With our cash, we might purchase additional shares, but we are free to keep it and use it as we like. Need a little bit more for your holidays this year? Done.

It is simpler to save some dividend money than to sell some shares. Additionally, we are not given the choice if we own shares that do not pay out cash annually.

It also means that when we retire and decide to receive income, we can continue with the same shares. The shares we currently own will not need to be changed in any way.

Showing strength

A company’s resilience may be indicated well by a steady dividend cash flow. Because it is not always the case, we say that it can be.

Companies have been paying what we consider to be excessive cash for years while failing to generate enough revenue to cover it. And when the money flows out, the share price declines over time.

However, consistent dividends from a corporation in a cash cow industry are well covered by earnings. That may perhaps be a sign of strength.

Regular income

Need money since you are retired? Dividends are one source, but the cash flow might be unpredictable. In a year like 2020, when many payouts were severely reduced due to Covid worries, how would we manage?

Some investment trusts, however, place a greater emphasis on steady income than we can usually expect from equities.

Some of these so-called Dividend Heroes have increased their cash payouts every year for the past more than 50 years.

Dividend plan

There is one dividend plan type that we believe to be the finest.

Dividend paying stocks can increase and decrease along with profits. Some businesses, like miners, tend to leap from high yields to low ones, which can cause booms and busts in their share values.

We prefer to see an ordinary dividend yield that companies consider to be sustainable. In prosperous years, add to that with special dividends.

That acknowledges how profits fluctuate, and in our opinion, it can help stabilize stock prices.

2 dividend paying stocks to buy now

In this environment, which UK dividend paying stocks should we buy? Here are two that are currently on our radar for when we have extra money.

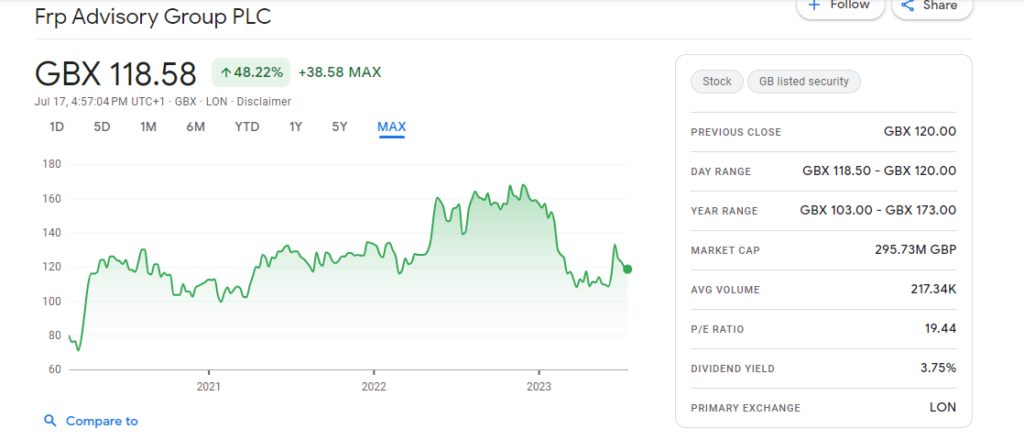

1. FRP Advisory Group

FRP Advisory Group (LSE: FRP), a company that specializes in corporate restructuring, may anticipate that robust trading will continue as Britain’s economy struggles and interest rates rise.

There are a huge number of debt-ridden enterprises in the UK as a result of the pandemic. These ‘zombie’ businesses are in grave danger as borrowing costs rise and consumer spending falters.

The executive chairman of insolvency firm Begbies Traynor, Ric Traynor, told Bloomberg last week that almost all of them will finally come to an end within the next 18 months. This means that businesses like FRP will continue to experience high levels of short- to medium-term activity.

The company’s dividend yield for the current fiscal year is a respectable 3.75%.

As a result, this AIM share may be a surefire purchase for dividend income. Additionally, the business has a strong balance sheet that it can use to pay out shareholders if earnings fall short of expectations. As of April, it had a net cash balance of £22.9 million.

It is important to note that the forecasted earnings for this fiscal year (through April 2024) do not adequately support the projected dividends. Dividend cover is currently at 1.4 times, much below the 2-times safety threshold.

Overall though, we believe FRP has a strong chance of beating the current dividend projections. And especially given its recent track record of generating results that exceeded expectations.

2. Grainger

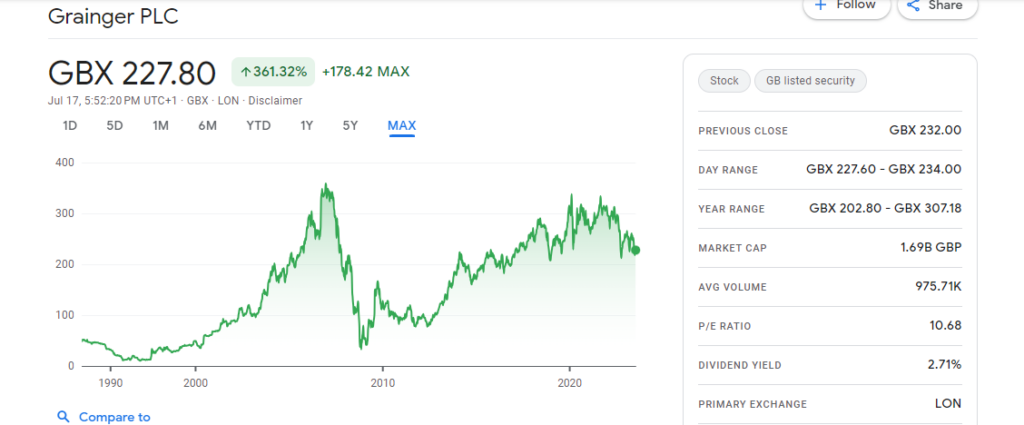

We believe that Rent Expert Grainger (LSE: GRI) is another alluring safe-haven stock to buy now.

Rent increases like these can typically help keep up with inflation. As a result, profits are shielded from the calamity of rising inflation.

Businesses that manage residential real estate should anticipate solid rent rolls throughout economic downturns. After all, we all require a place to call home. The most recent financial reports revealed record occupancy of 98.7% for the entire fiscal year. Additionally, like-for-like rents increased by 7.1% throughout that time.

This is why City analysts anticipate Grainger’s dividends to increase significantly over at least the next few years. As a result, the FTSE 250 firm has a respectable 2.7% dividend yield for the current fiscal year (through September 2023).

Dividend cover is not ideal, just like FRP Advisory. Additionally, it only counts for 1.4 times. However, due to the defensive nature of its activities, it should still be able to make the anticipated payout.

Even if high expenses and a labor shortage would limit the rise of profits, we would purchase Grainger shares.

Leave a Reply