LSEG Stocks have increased 78% over the past five years, and they also pay a good dividend. Can investors anticipate future growth?

LSEG Stocks have performed nicely for long-term investors recently. Most people recognize the FTSE 100 financial exchange corporation for owning and running the London Stock Exchange Group.

However, the company’s data and analytics services are now its main revenue generators, particularly after it paid £22.5 billion to Blackstone and Thomson Reuters in 2021 to acquire Refinitiv, a provider of financial software and risk management services.

What are the prospects for the LSEG Stocks? Do the shares have any value right now? Here’s our opinion.

Strong position

Let us begin with the numbers first. In its Q1 trading update, the company reported a 7.5% increase in overall income on a constant currency basis (excluding recoveries), indicating a strong start to the year.

In fact, income growth is quickening across a number of crucial divisions, notwithstanding a decline in the company’s equity section. Due to the client’s desire to manage risk during a time of increased volatility, the group’s post-trade solutions witnessed an especially exceptional 16.8% improvement in income.

Additionally, the business reiterated its 2023 outlook, indicating it will probably keep going in this direction throughout the year. It expects to generate total revenue growth of 6% to 8% in constant currency and an excellent EBITDA margin of about 48%.

These optimistic numbers have not passed the notice of UBS analysts, who earlier this year raised their price objective for the company to £98. It has a current price of £80.32 and a dividend yield of 1.34%.

The group’s 10-year relationship with Microsoft, which was revealed in late 2022, is one enticing move in particular. The US IT giant will create the data infrastructure for the LSE Group and offer the business AI and cloud-based analytics solutions.

Microsoft has also acquired a 4% share in the business as part of the agreement. It has skin in the game in terms of generating profitable business results from cooperation, which is a healthy indicator.

Also read: Five Benefits Of Dividend Paying Stocks For Our Financial Well-Being

What Is the Growth Rate of LSEG Stocks?

A company’s share price should eventually increase if its profits per share (EPS) can continue to rise for an extended period of time. Because of this, EPS growth is a desirable feature for any organization. As we can see, LSEG Stocks increased its EPS by 6.2% annually over the previous three years. This may not be revolutionary, but it does indicate that EPS is increasing.

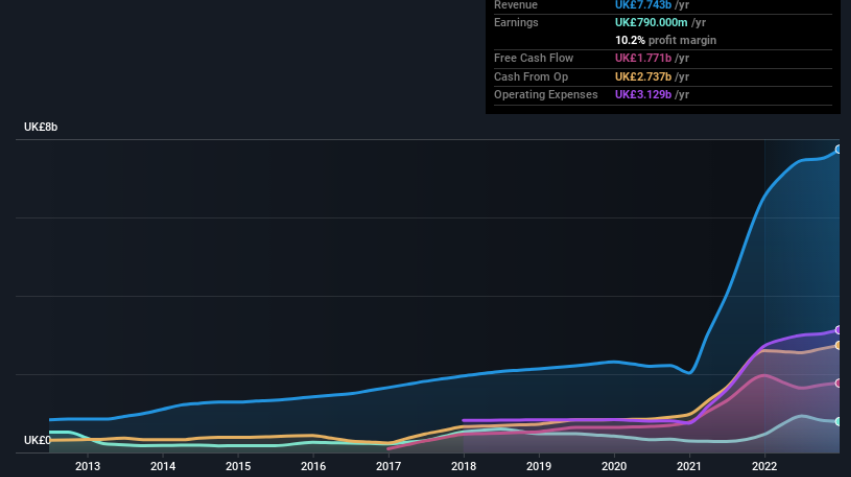

Examining how a company’s revenue and earnings before interest and tax (EBIT) margins are changing is one technique to confirm its expansion. Our research has shown that LSEG’s revenue from operations did not total the company’s revenue in the previous year, therefore our study of its margins might not be a reliable representation of the company’s core operations. The LSEG’s EBIT margins have remained largely stable over the past year, but the company should be pleased to report an 18% increase in revenue for the time period to UK£7.7b. That is definitely a plus.

The bottom and top lines of the business are depicted in the graph below as they have changed over time.

Are LSEG Insiders Aligned With All Stockholders?

Insider buying is one of the primary signs of market optimism, which is something investors always look for in the firms they own. This point of view is predicated on the idea that stock purchases might indicate that the buyer is bullish. Of course, we can only guess what those on the inside are thinking based on their behavior.

Since neither the management nor any board members of the company have sold any shares, insiders continue to have a high level of confidence in the company. What is more significant, though, is that Dominic Blakemore, an Independent Non-Executive Director, paid UK£50,000 to purchase shares at an average cost of UK£73.18. It appears that at least one insider has identified promise in the company’s future and is prepared to take a risk.

Is LSEG Stock Worth Keeping An Eye On?

The fact that the EPS of LSEG Stocks is increasing is one plus. It is good to see that. The London Stock Exchange Group does not appear to be experiencing the gloomy affliction that some businesses are experiencing with EPS growth. The cherry on top is that an insider purchased shares throughout the year, which will be of interest to those who want to maintain a close check on this stock.

Conclusion

Overall, we believe that LSEG Stocks merit careful thought. The company’s long-term plan appears to be sound, and there are indications that its investments in data and analytics are already paying off.

Nevertheless, the company has challenges in the broader macro environment, and investors would be advised to prepare for future volatility.

However, we believe that overall, the risk/reward profile appears favorable. We would invest in this business right now if we had more money.