Palantir Technologies stock has garnered significant attention in the investment community, reflecting its impressive growth trajectory and strong market presence. As of 2024, Palantir Technologies (PLTR) has positioned itself as a leading player in the data analytics and artificial intelligence (AI) sectors.

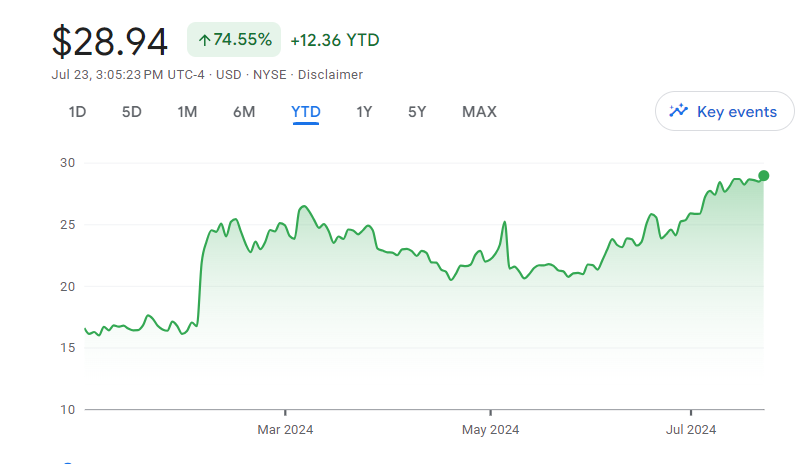

The stock (NYSE: PLTR) is up over 75% in 2024 and is continuously rising, driven by its expanding customer base and innovative product offerings. With Palantir’s strong performance in both commercial and government sectors, investors are keen to understand how to buy Palantir Technologies stock and why it could be a valuable addition to their portfolios this year.

How to Buy Palantir Technologies stock

Investing in Palantir Technologies stock involves a few straightforward steps. Here’s a concise guide on how to add this promising data software company to your portfolio:

Step 1: Open a Brokerage Account

To buy shares of Palantir, you first need to open a brokerage account. Research various brokers and trading platforms to find one that suits your needs. Look for features such as low fees, user-friendly interfaces, and robust research tools. Once you’ve chosen a broker, complete the registration process and fund your account.

Step 2: Determine Your Budget

Before making any trades, decide how much money you want to invest in Palantir Technologies stock. It’s wise to allocate a portion of your investment funds to Palantir while maintaining a diversified portfolio. The Motley Fool recommends building a portfolio of 25 or more stocks, held for at least five years, to mitigate risk and enhance potential returns.

Step 3: Conduct Thorough Research

Research is crucial before investing in any stock. Investigate Palantir’s financial health, market position, competitors, and growth prospects. Understanding the company’s business model, revenue streams, and strategic initiatives will help you make an informed decision.

Step 4: Place Your Order

Once you’ve opened a brokerage account, set your budget, and conducted research, it’s time to buy Palantir Technologies stock. Go to your brokerage account’s order page and enter the relevant details:

- The number of shares or the amount you want to invest in fractional shares.

- The stock ticker, PLTR, for Palantir Technologies.

- Choose between a limit order or a market order (a market order is recommended for immediate purchase at the current market price).

After completing the order form, submit your trade to become a Palantir shareholder.

Why Should You Invest in Palantir Technologies stock in 2024

Investing in Palantir stock in 2024 offers a unique opportunity to capitalize on its significant growth potential and market leadership.

Expanding Customer Base

Palantir’s growth is significantly driven by its expanding customer base and continuous innovation in its product offerings. At its recent AIPCon event, the company showcased its impressive advancements, including the launch of the Palantir Artificial Intelligence Platform (AIP). This platform has seen tremendous demand since its debut in 2023, with nearly 70 clients such as United Airlines, Nebraska Medicine, and AARP utilizing it to enhance their operations. These partnerships reflect Palantir’s growing market reach and the strong adoption of its AI solutions.

Robust Financial Performance

Palantir’s financial performance has been solid, marked by substantial revenue growth and increasing customer count. In Q1 2024, the company reported an annual revenue increase of 21%, driven by a 68% rise in U.S. commercial revenue. The addition of 41 new customers in the quarter boosted the total customer count by 69% year-over-year. These figures indicate Palantir’s ability to attract and retain clients across various industries, further strengthening its market position.

Strategic Government Contracts

Palantir has secured significant government contracts, including being the sole contractor for the U.S. Army’s TITAN program. This marks the first time a software company has entered a hardware contract, highlighting Palantir’s strategic importance in the defense sector. Such contracts open up new revenue streams and provide a stable source of income, contributing to the company’s overall growth and stability.

AI and Data Analytics Leadership

Palantir’s leadership in the AI and data analytics market sets it apart from competitors. The company’s AIP Bootcamp initiative has been highly successful, with over 1,300 boot camps completed. This program helps clients transition from prototype to production-grade AI quickly, leading to rapid deal closures and high top-line growth. The launch of the Palantir Developer Community and the Build with AIP initiative further solidified the company’s position as a leader in the AI and data analytics space.

Diversified Client Base

While Palantir has a strong presence in the government sector, it has also diversified its client base across various industries, including healthcare, retail, and energy. This diversification minimizes the risk associated with the potential loss of government contracts and ensures sustained growth. The company’s focus on expanding its commercial footprint and increasing client engagement positions it well for continued success.

Positive Market Sentiment

Palantir’s stock has outperformed the S&P 500 with a year-to-date price return of 66.45%. This positive market sentiment reflects investor confidence in the company’s growth prospects and its ability to deliver value to shareholders. Palantir’s Q2 2024 revenue forecast of $649 million to $653 million, along with an expected adjusted income from operations of $209 million to $213 million, indicates continued robust growth and profitability.

Strong Future Outlook

Palantir has raised its U.S. commercial revenue guidance for 2024 to exceed $661 million, representing an annual growth rate of at least 45%. This upward revision underscores the high demand for Palantir’s offerings and its strong traction in the U.S. commercial sector. The company’s focus on innovation, customer acquisition, and strategic partnerships positions it well for long-term success.

Also read: What Is The Outlook For Palantir Technologies Stock In 2024?

Final Thoughts

Investing in Palantir Technologies stock in 2024 presents a compelling opportunity due to the company’s strong market position, robust financial performance, and leadership in the AI and data analytics sectors.

By following the steps outlined to purchase Palantir Technologies stock and understanding the reasons behind its surging popularity, investors can make informed decisions and potentially benefit from the company’s growth trajectory.

Leave a Reply