Palantir Technologies, a leading player in artificial intelligence (AI), experienced a stellar year in 2023, becoming one of the hottest stocks in the market. As AI continued to dominate the investing landscape, Palantir’s robust performance raised expectations and questions about its trajectory in 2024.

In the latest quarterly results, Palantir Technologies showcased significant achievements, notably achieving four consecutive quarters of Gap profitability. Commercial revenue growth, a previously lagging aspect, surged by 33% in the most recent quarter, demonstrating positive momentum. While the company has excelled in government contracts, there is room for improvement in expanding its commercial business internationally.

Cash flow from operations stood at an impressive $133 million, with a solid 24% cash flow from operations to sales margin. These factors contribute to Palantir’s appeal to investors, as profitability and positive cash flow signal financial stability.

Estimates for Palantir Technologies in 2024 and 2025 suggest a 19.8% revenue growth for 2024 and 20.5% for 2025. Earnings per share (EPS) growth is projected at 20.1% for 2024 and 19.2% for 2025, resulting in 35 cents EPS for 2025. These figures are a consensus forecast from financial analysts, providing a basis for evaluating the potential stock performance.

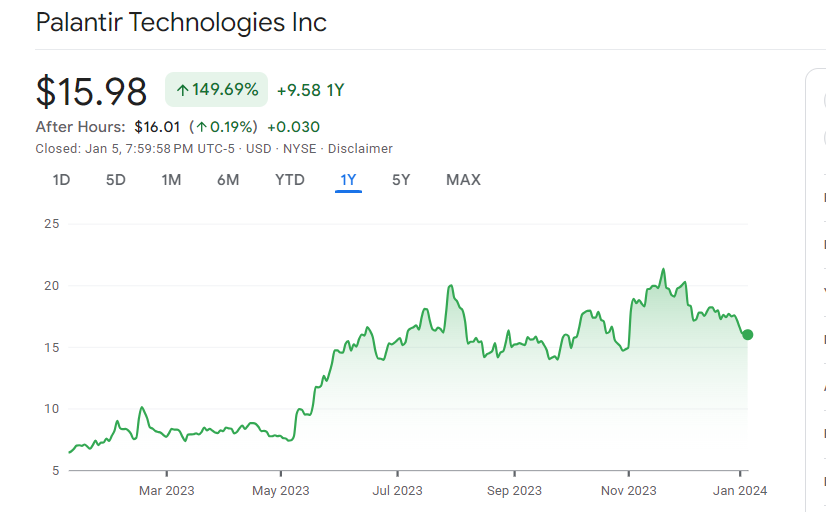

As of the latest recording, Palantir’s stock price was $15.98, with a forward price-to-earnings (PE) ratio of 60.22, indicating an already relatively high valuation.

Let’s explore various scenarios for Palantir’s stock in 2024, considering changes in the forward PE ratio.

In the base case scenario, with a stable forward PE of 60.22 and an EPS of 35 cents for 2025, Palantir stock price could reach $21 per share in 2024, representing a substantial 20% return on investment from the current price.

Exploring best and worst-case scenarios, a bullish outlook with a forward PE of 75 could push the stock price to $26.25, while a more conservative scenario with a PE of 50 might lead to a flat stock price of $17.50. In the worst-case scenario, where Palantir faces challenges and the PE drops to 35, the stock price could decline to $12.25, indicating a 30% decrease.

Considering these scenarios, our estimate places Palantir stock price in the range of $19.50 to $21 per share by 2024, assuming the current trends and estimates hold. It’s crucial to monitor potential changes in the AI landscape, as increased enthusiasm or skepticism could impact Palantir’s stock performance.

In conclusion, Palantir Technologies’s 2024 outlook hinges on its ability to navigate international expansion, capitalize on commercial opportunities, and maintain its profitability. Investors should stay vigilant for any shifts in the AI landscape and reassess their positions accordingly.

Also read: 5 Best Dividend Stocks to Buy in 2024 for Passive Income