Investment For Retirement brings a crucial change in both your lifestyle and your investment portfolio. Your attention shifts from acquiring assets and increasing your money to planning how you will live off of your savings, possibly for decades to come.

According to the Centers for Disease Control and Prevention, the average American’s life expectancy at age 65 in 2020 was 18.8 years. This means that people who retire at the conventional age need to have enough money saved up to cover their living expenses for at least another two decades.

In this article, we’ll highlight the best investment for retirement in UK. We’ll also go through the top platforms from which you can purchase or invest in the investments you want.

Best Investment For Retirement UK 2022

The eight investments listed below can assist retirees in generating a respectable return in the current market without taking on excessive risk:

1. Tax-Advantaged Accounts

Investment accounts are not all created the same. When investing for retirement, online brokerage accounts give you freedom but no tax benefits. Tax-advantaged retirement accounts, such as 401(k)s and IRAs, offer tax-deferred or tax-free growth, making them the best vehicles for retirement investment.

Traditional and Roth IRAs and 401(k)s are both options. If you use traditional accounts, you might be able to deduct your contributions from your current taxes, delaying income taxes until you start taking money out in retirement.

Similar to online brokerage accounts, Roth accounts allow you to save for retirement using money that has already been taxed. The distinction is that withdrawals from Roth accounts during retirement are tax-free. That’s a significant benefit, but there are additional Roth account regulations to be aware of.

Although there are yearly contribution caps for both 401(k)s and IRAs, over the course of your working career, they can enable you to accumulate hundreds of thousands of tax-advantaged funds for retirement.

2. Certificates of deposit

In exchange for a fixed interest rate, you agree to lock up your funds in a certificate of deposit (CD), a sort of savings account. The bank returns your initial deposit plus any interest you have accrued when you redeem your CD. Since they are immune to market swings, they are regarded as one of the safest investment options. The deposit on a CD bought from an FDIC-insured bank is also protected by up to $250,000, so even if the issuing bank runs into problems, you can still receive your money back.

As a reliable source of income and a low-risk investment, CDs might be advantageous for retirees. The rates provided are frequently low and may not keep up with inflation, which is a drawback. To assist reduce the risk of longevity, it is best to combine them with options that are more focused on growth.

3. Annuities

Insurance contracts known as annuities offer steady, enduring income payments. When saving for retirement, some people opt for annuities because of their security. Additionally, annuities are heavily promoted as a secure way to get consistent income throughout retirement.

However, there are many different annuities available, and there is plenty to understand about these products. The first task is to keep an eye out for excessive prices. Certain annuities may contain cryptic language and obfuscated or hidden fees.

Annuities first seem to function very similarly to other investments. When you purchase insurance, you will eventually get your money back plus some extra. Bonds or certificates of deposit (CDs) are sometimes contrasted with them, but they offer better yields. You may even buy equities into some annuities and profit from stock market growth with what seems to be less risk with them.

The three primary forms of annuity contracts are as follows. The advice of many retirement professionals is to continue with fixed annuities. They have cheaper fees than other varieties and guarantee payback of your purchase price plus a little return. Additionally, fixed annuities make comparison shopping much simpler due to their often cleaner terminology and organizational systems.

Variable annuities and index annuities are the other two primary categories. Variable annuities include unclear language, no guaranteed payouts, and may actually result in you losing some of the money you invested if the annuity’s investments underperform.

Fixed index annuities, which are also known as index annuities, resemble a cross between fixed and variable annuities. Compared to variable annuities, they offer less investment growth, but they do offer some market downturn protection. You will be informed of the maximum gain or loss from an index annuity when you sign up for one.

4. Bonds

Bonds are a form of debt. Therefore, purchasing a bond indicates that someone owes you money and will likely pay you interest on it. The safest bonds, such as those issued by the federal government, government agencies, and financially solid firms, can be a dependable source of retirement income when combined into a properly diversified portfolio. Building a laddered portfolio of bonds with varying maturities is one wise way to invest in bonds.

By holding bonds with varying maturities in a bond ladder, you can employ a classic retirement investing technique. To generate a consistent income stream and reduce the risk of interest rate changes, you can utilize the proceeds from maturing older bonds to purchase new longer-term bonds.

5. Dividend stocks

Some investors favor the best dividend-paying stocks because they can generate continuous, dependable income. The stock market has historically offered good average returns, but it hasn’t always moved in a straight, predictable upward direction. For example, the S&P 500 has experienced some significant falls but has also experienced annual gains of approximately 10% on average.

Some stock investors prefer to lock in profits as soon as they can because it makes them feel more secure. The goal of dividend investing is to have a portfolio of stocks that consistently pay out large dividends.

Businesses that offer dividend payments give you a consistent portion of their profits in the form of monthly, quarterly, or yearly payments. These dividend payments may come in the form of cash or new stock. Although dividends are not guaranteed, they frequently continue for extended periods of time since missed dividend payments may indicate that a company is experiencing financial difficulties.

It’s generally not a good idea to invest all of your retirement portfolio balance in dividend equities. The companies that pay dividends are typically older and more established, therefore their share values might not rise as rapidly as those of newer, smaller companies. After all, it is simpler to double your share value when it is only $20 as opposed to $2,000 at that point.

6. Robo-Advisors

Investing for retirement with a robo-advisor or a target date fund can provide you with the advantages of the straightforward asset allocation strategy discussed above without any the maintenance. Robo-advisors and target date funds demand extra fees, but as you get older and markets to shift, they automatically adjust your portfolio.

The annual cost for robo-advisors ranges from 0.25 percent to 0.50 percent of the assets they manage for you. Target date funds have significantly higher cost ratios than you’d pay if you made your own independent selection of comparable index funds. Just keep in mind that while somewhat higher fees might seem like a modest thing to pay now, they can build up over many years. Over the course of your investment, an additional 0.25 percent fee might cost you tens of thousands of dollars.

7. ETFs

An investment that combines mutual funds and equities is known as an exchange-traded fund or ETF. Similar to mutual funds, an ETF also allows investors to combine their funds in a fund that makes investments in a variety of stocks, bonds, and other securities. ETFs can be purchased and sold throughout the day, just like stocks.

The fee ratio of ETFs is far lower than that of mutual funds, making them perfect for a variety of investments. As a result, it has inexpensive prices. The ETF offers improved transparency and immediate liquidity in addition to low costs. It allows you the chance to invest in and gain exposure to a specific asset for a little fee.

8. Real Estate

Similar to dividends, many people consider real estate to be a reliable source of income regardless of the situation of the market. Real estate can also be used as a retirement investment, but not everyone is a good candidate for real estate investing.

Even though rents might generate consistent income flow, managing your investment properties comes with a cost. As a result, you’ll need to generate enough income from rental properties to pay your mortgage, damages, and repairs. By employing a management business, you can reduce some of the most taxing aspects of real estate investing, but the total returns you’ll see will also go down.

Consider purchasing shares of a real estate investment trust if you want the advantages of real estate investing with less trouble. REITs are collections of rental properties that historically have offered better dividend yields than bonds and even equities.

Best Platforms to Invest in the best investment for Retirement

There are many trading platforms available, but finding one that matches your financial objectives can be very taxing. In order to save you time and effort, we have listed below the top trading platforms in the UK that you may use to purchase the greatest investment assets for retirement.

1. eToro

The best trading platform in the world, eToro, provides markets for all the main asset classes. This platform possesses all the outstanding features that make it the greatest brokerage platform according to our standards. For a number of reasons, it is the most popular trading broker in the UK. However, the fact that it provides a variety of assets and doesn’t charge any commission is the primary factor that draws thousands of traders to it. The only difference is that you will be charged a 0.5 percent fee on all deposits and $5 on each withdrawal. It is the UK’s least expensive brokerage platform.

eToro offers the copy trading feature for new users. You can imitate the active transactions of seasoned traders using this option. Since a copy must be at least $1 in size, you should make sure you have enough money in your account to replicate every trade made by the trader you are copying. You can diversify your investment portfolio by using the Copy Portfolio option as well.

Account creation on this platform is quicker than on other sites. An eToro account can be created in a matter of minutes. You must fund your trading account after you’ve finished creating it in order to begin trading. It accepts a variety of payment options for deposits, including debit/credit cards, bank accounts, e-wallets, and so forth, for the convenience of its traders. For the convenience of its users, the platform also provides a mobile application.

2. Fineco Bank

Fineco Bank is the next online broker platform on our list of the Best Platforms to Invest in the best investment for Retirement. This online broker is FCA-approved and collaborates with FSCS to protect the money of its clients. You have access to a number of asset classes, thousands of foreign equities, dozens of exchanges and markets, and a selection of value investment shares through this platform.

The absence of support for cryptocurrencies and copy trading tools is Fineco Bank’s lone flaw. It has modest investment requirements and charges an annual fee of 0.25 percent of the value of your entire account. This tiny fee is charged for each international exchange you use to trade. The fact that Fineco offers you access to a variety of portfolio management tools is among the best aspects of investing with them. These tools can assist you in determining whether or not you are overexposed to a particular industry. Additionally, it enables you to diversify your portfolio of value stocks.

How to invest in the best investment for retirement in UK?

If you know where to go, investing in investment for retirement is a straightforward process. To help you understand the purchase process, we’re using eToro as an example here. Because eToro has everything we need for investment, we heartily recommend it.

The procedures you must take to purchase your desired asset for retirement investment in the UK are listed below.

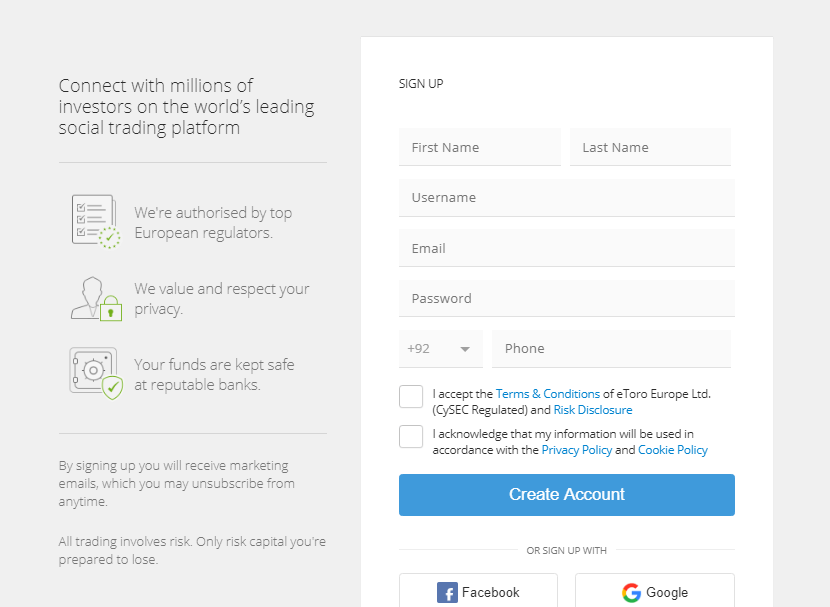

Step 1: Open an account

You must first register on the firm’s official website by completing the registration form. Users will need to fill out this registration form with some personal information, like your name, email address, and phone number. You must also create a secure password for your trading account. You must accept the terms and conditions after completing all the needed information in order to proceed to the next stage.

eToro will request that you verify your identification by submitting some of your documents; nevertheless, don’t worry, your documents are completely secure on this platform.

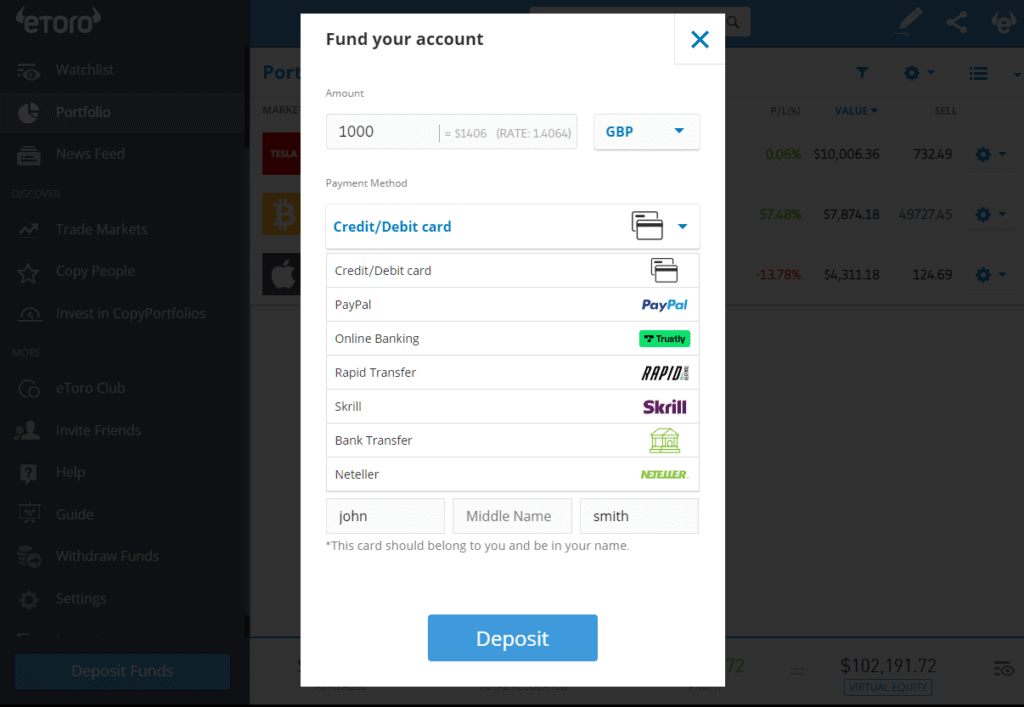

Step 2: Fund your account

After successfully registering on the site, you must fund your trading account in order to start earning additional money by making the necessary deposits. $50 is the minimum transaction amount on this site. This funding amount, which represents the working money required by the traders to carry out deals, is not the robot’s charge.

For the convenience of its traders, eToro provides a variety of payment options. You can select the option with which you are most familiar. Debit/Credit Card, PayPal, Skrill, Nettler, and Bank Transfer are all accepted payment options by eToro.

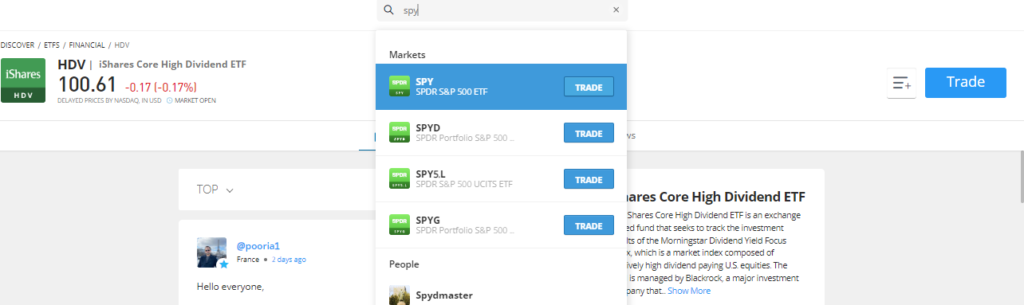

Step 3: Search the investment for retirement in which you want to invest in

It’s time to look for the retirement investment that you’ve decided to make. In our example, we’re considering investing in the SPDR S&P 500 ETF.

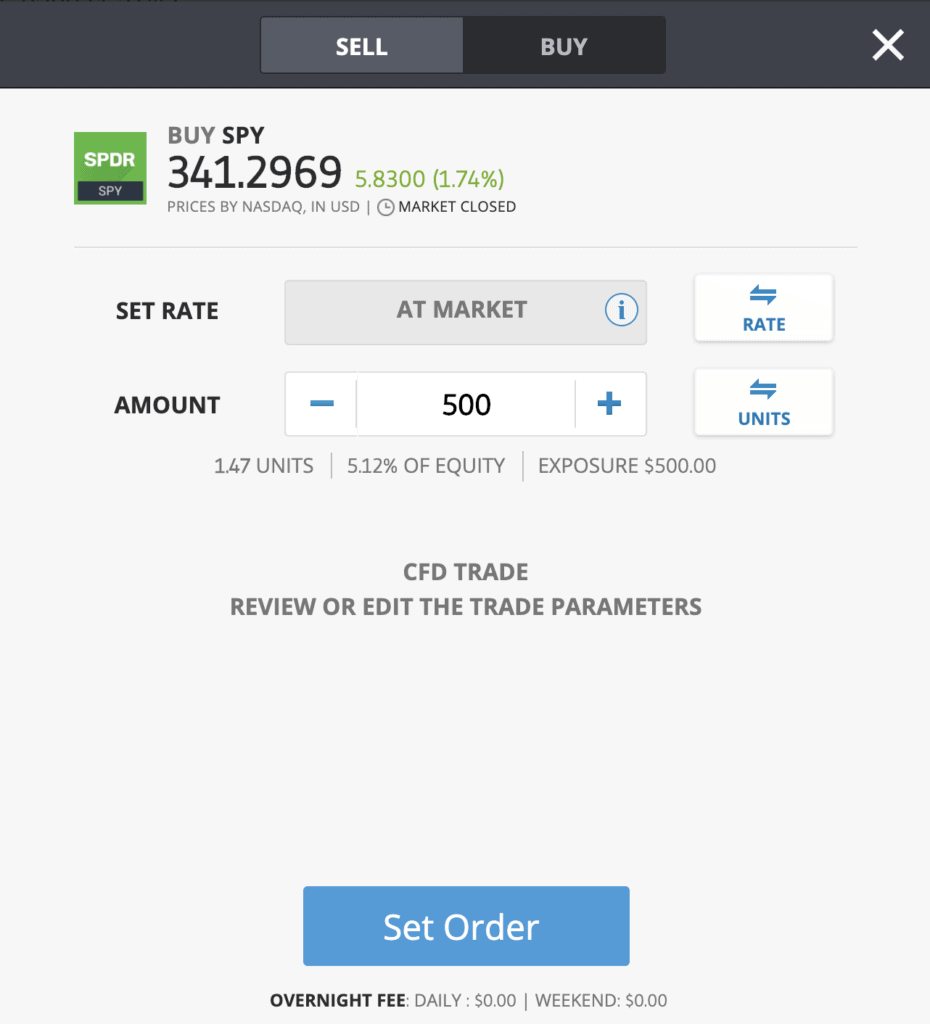

Step 4: Place your order

After that you just need to enter how much money you wish to put into your chosen investment. Simply click the ‘Set Order’ button to finish the passive investment process.

And with that, you’ve completed your first commission-free Investment for Retirement!

Conclusion

Retirement does not mark the end of investing. Every retirement is unique, even though managing market and longevity risk is a task that practically all retirees must overcome. The ways and amount to which the investment options presented in this article are employed will differ from person to person, but they can all be a part of a sound retirement investing plan.

After conducting an extensive study, we have come to the conclusion that the best course of action for investing in retirement in the UK is to make a long-term investment.

The best broker for you is eToro because it doesn’t charge any commission and provides all of the above-mentioned investing assets. Additionally, use its Copy Portfolio feature to generate passive revenue. You may diversify your investment portfolio and get more out of the dividends they offer by using ETFs and Real Estate Investment Trusts.

Frequently Asked Questions

How can I begin retirement investing in the UK?

You only need to select an investment, register with a broker, fund your trading account, and then begin investing monthly to begin investing for retirement in the UK. You should start investing as early and as frequently as you can if you want to have more in the future.

Is buying real estate a wise investment for retirement in the UK?

Yes, it is a wise choice for investors in the UK looking to save for retirement. And using a real estate investment trust (REIT) is the ideal way to go about real estate investment.

What types of bonds should I buy to get a monthly income?

You are good to go as long as you are investing in government bonds in a country with a robust economy and effective leadership. You can also think about purchasing corporate bonds. There is a fixed yield associated with these bonds. For instance, if you invest £1000 in a bond that offers a 10% annual return, you will get £100 in interest payments per year. Another choice is to invest in the Vanguard Total Bond Market ETF (BND), which relieves you of the responsibility by allowing someone else to conduct the necessary research on your behalf.

What dividend yield on a stock is deemed to be advantageous?

A corporation is deemed to be paying a reasonable dividend yield as long as it pays a dividend between 2 and 6 percent, but when it pays an 8 percent or higher payout, it is either not reinvested in profits, borrowing money, or selling assets to sustain the dividend.