In a world of passive income investment strategies, Visa stock has emerged as a frontrunner for dividend stock investors in 2024. Despite a modest dividend yield of 0.7%, Visa’s stellar performance throughout the year has caught the attention of investors. Since the beginning of the year, Visa has outperformed the S&P 500 dividend ETF by 150 basis points, showcasing its resilience and potential for growth in the dividend space.

Fundamental Strengths and Future Outlook

Visa’s appeal lies in its robust business fundamentals and promising outlook. With a track record of consistently increasing revenue, Visa has nearly tripled its revenue over the past decade, demonstrating its ability to navigate changing market dynamics successfully. Moreover, its operating profit margin of 67.34% surpasses even the most profitable companies globally, indicating its efficiency in generating profits. Analysts predict further earnings per share growth of 13.28% over the next five years, exceeding the expected growth rate of the S&P 500 index.

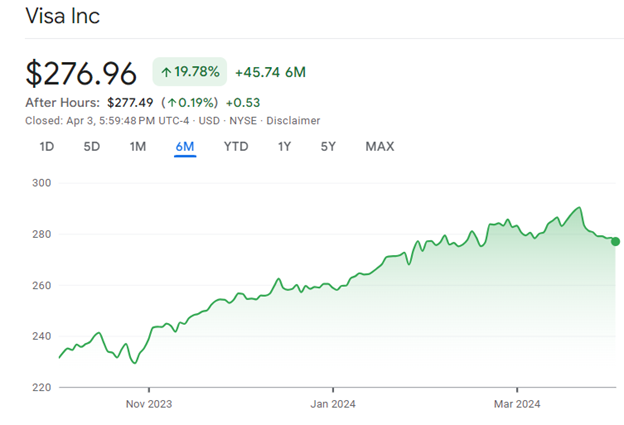

As of the time of writing, Visa stock price stands at $276.96. While Visa stock price is not considered cheap, trading at a forward price-to-earnings ratio of 24.8, it reflects the market’s recognition of Visa’s exceptional business model. Visa’s dominance in the payment processing industry, coupled with its strong competitive position alongside Mastercard, makes it a compelling long-term investment option.

As investors seek reliable sources of passive income, Visa emerges as a top contender for the title of the best dividend stock in 2024. Its ability to consistently grow revenue, maintain high profitability, and deliver strong earnings per share growth projections sets it apart in the market. While its dividend yield may not be the highest, Visa’s potential for dividend increases over time, backed by its solid business fundamentals and a promising outlook, make it an attractive choice for dividend-focused investors looking for sustained returns.

Leave a Reply