Investing in dividend stocks proves to be a robust strategy for investors aiming for a blend of passive income and potential capital appreciation.

Currently, there are several companies offering attractive yields, but it’s crucial to recognize that higher dividend yields often accompany increased risks. Therefore, investors should prioritize shares of companies displaying a growing earnings base and a reliable history of dividend distributions. Companies with a robust earnings base can comfortably cover their regular payouts, establishing them as dependable dividend stocks.

Taking these considerations into account, PennantPark Floating Rate Capital, Phoenix Group Holdings, Altria Group, Aviva, and AT&T emerge as noteworthy options for income investors seeking well-protected dividend stocks for passive income in 2024. Notably, these companies have consistently paid and increased their dividends for decades, earning them the esteemed status of Dividend Aristocrats.

Let’s delve deeper into each of these five stocks.

1. Phoenix Group Holdings (PHNX): 10% Yield

Phoenix Group Holdings emerges as the best dividend stock for passive income investors in the new year, boasting a double-digit dividend yield and a commendable track record of dividend growth, despite concerns about the lack of dividend cover, where expected earnings for 2024 fall short of the predicted shareholder payout, Phoenix’s robust cash generation and an upgraded cash generation target of £1.8bn (up from £1.3bn-£1.4bn) instill confidence in its ability to meet dividend commitments.

The company’s strategic focus on the growing demand for savings and pensions services, driven by expanding older populations in the UK and overseas markets, positions Phoenix for sustained growth. The recent acquisition of Sun Life of Canada UK for £248m underscores its commitment to expansion through mergers and acquisitions, leveraging its strong balance sheet.

While potential concerns about dividend cover exist, the company’s impressive cash position, raised cash generation targets, and strategic market positioning make Phoenix Group Holdings an FTSE 100 share with the potential for exceptional long-term returns. Investors may find the combination of a robust dividend yield, dividend growth, and strategic expansion plans make Phoenix an attractive choice for passive income in the evolving financial landscape.

2. PennantPark Floating Rate Capital (PFLT): 9.72% Yield

PennantPark Floating Rate Capital shines as the second best dividend stock for passive income investors in 2024, offering an impressive 9.72% yield. As a business development company (BDC) specializing in debt and equity investments in middle-market companies, PFLT strategically leans towards debt investments due to the attractive yields offered by smaller, less established businesses with limited access to traditional credit markets. PFLT’s success has been supported by its fully variable-rate debt-securities portfolio, with a weighted average yield on debt assets reaching 12.6% on September 30, 2023.

The management’s adept risk mitigation is evident in PFLT’s modest average investment of $8.1 million across 131 companies, reducing reliance on any single entity for success. Notably, 99.99% of the debt-securities portfolio consists of first-lien secured debt, positioning PFLT at the forefront for repayment in case of borrower bankruptcy.

While investing in smaller enterprises carries inherent risks, PFLT’s prudent approach and impressive operating performance make it a gem for income seekers. The company’s monthly dividend distribution, coupled with its commitment to increasing payouts twice in the past year, underscores PFLT’s appeal as a robust choice for investors seeking both passive income and growth in 2024.

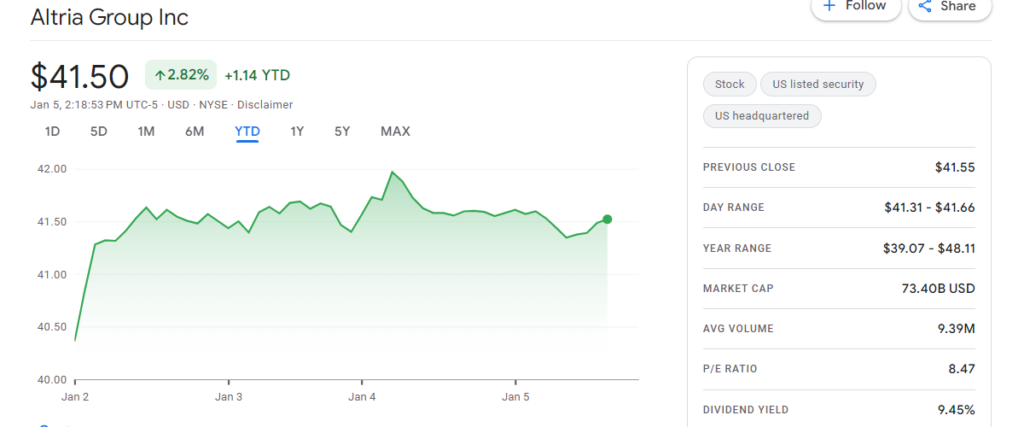

3. Altria Group (MO): 9.45% Yield

The tobacco behemoth Altria Group presents itself as the third top dividend stock for passive income investors in 2024, boasting a robust 9.45% yield. Despite the industry-wide challenge of declining smoking rates, Altria distinguishes itself through unwavering pricing power driven by the addictive nature of nicotine. Marlboro’s dominant 42% share of the cigarette market further solidifies Altria’s market presence. The company is not solely dependent on traditional tobacco products, as seen in its strategic shift towards a smokeless future, evidenced by the $2.75 billion acquisition of NJOY Holdings, a move aimed at capitalizing on the growing e-vapor market.

Altria’s commitment to dividend growth is noteworthy, having increased its payout 58 times in the last 54 years. With a CAGR of 4.3% in dividend increases from 2018 to 2022 and a recent 4.3% hike in August 2023, Altria’s dividends are backed by a strong earnings base, growing at a CAGR of 7.3% over the same period. The company anticipates mid-single-digit annual earnings growth through 2028, aligning with its dividend growth projections.

Supported by a solid balance sheet, a focus on increasing smoke-free net revenues, and debt reduction, Altria’s outlook remains optimistic. Analyst sentiment is positive, with a majority recommending a “Strong Buy” or “Hold,” and an average price target of $45.92, suggesting a 14% upside potential. In essence, Altria Group emerges as an attractive income stock with a compelling combination of yield, dividend growth, and strategic adaptation to evolving market trends.

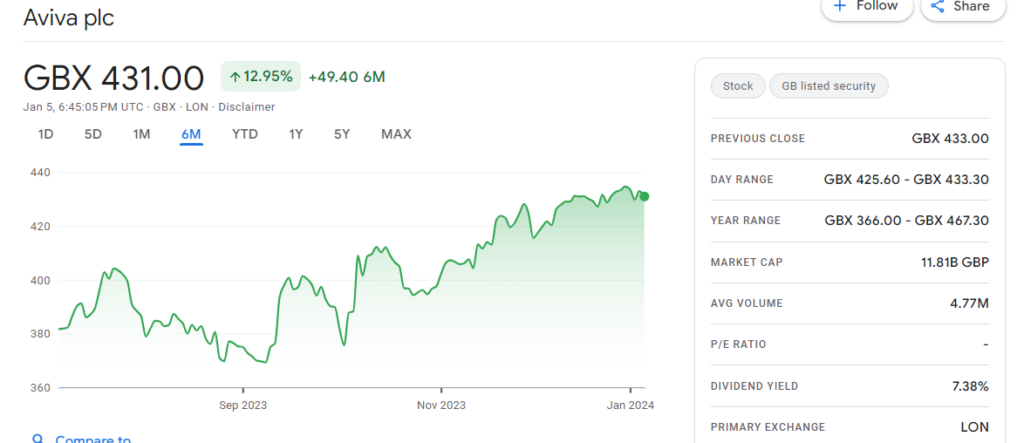

4. Aviva (AV): 7.38% Yield

Life insurance giant Aviva stands out as a robust dividend stock choice for passive income in 2024, with projected dividends appearing more secure than some peers, including Phoenix Group. While dividend cover falls slightly below the safety benchmark of 2 times, it remains above, suggesting reasonable stability. Aviva’s impressive cash position and a Solvency II capital ratio at an impressive 200% as of September provide a strong foundation for delivering the anticipated large shareholder payouts.

Recent changes at Aviva have strengthened its financial position and made it possible for the company to offer market-leading dividends and large share buybacks. Aviva’s portfolio now consists primarily of capital-light and high-growth companies, which further boosts the company’s profitability and dividend prospects. The company is positioned to benefit from the rising demand for financial services because of its strategic focus on markets with aging populations, such as the UK, Ireland, and Canada.

Moreover, Aviva’s digitalization strategy sets the stage for superior cross-selling of pensions, insurance, and investment products, offering a pathway to enhanced profits. While competition is fierce, Aviva’s proactive approach and strong financial standing make it a resilient passive income share for 2024 and beyond, appealing to investors seeking stability and dividends in the dynamic financial landscape.

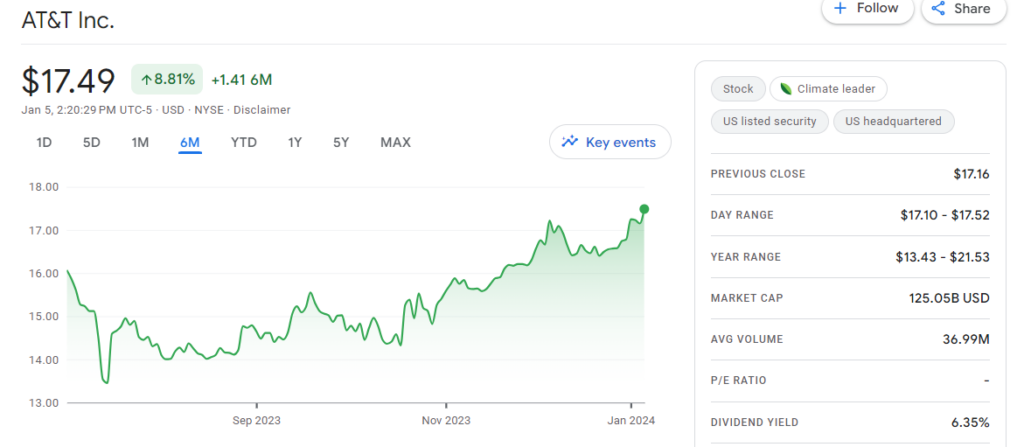

5. AT&T (T): 6.35% Yield

With a strong 6.35% yield, AT&T stands out as a dividend stock that appeals to investors seeking passive income in 2024. The future of AT&T is bright even though it had difficulties last year, such as the effect of quickly rising interest rates and worries expressed by The Wall Street Journal regarding outdated lead-sheathed cables.

The lead-clad cable concerns appear to be overstated, with AT&T finding no evidence of hazard to workers or the environment. Any potential financial liability claims are likely to be protracted, offering a manageable timeline for resolution. The company’s balance sheet has notably improved over the past two years, with a reduction in net debt from $169 billion in March 2022 to $128.7 billion as of September 30, 2023, facilitated by the spinoff of WarnerMedia.

Crucially, AT&T is strategically positioned to benefit from the 5G revolution, with network upgrades supporting faster download speeds and driving increased data consumption by wireless customers. Investments in mid-band spectrum have fueled consistent growth, marked by five consecutive years of at least 1 million net broadband additions.

With a forward P/E ratio of less than 7, AT&T not only provides a safe floor for investors but also stands as an attractive opportunity for those seeking both dividend income and potential capital appreciation in the evolving landscape of the telecommunications industry.

Also read: 10 Best Stocks To Invest In 2024

Why Should you invest in Dividend Stocks for passive income?

Investing in dividend stocks can be a compelling strategy for those seeking passive income, offering a unique combination of income generation and long-term growth potential. Here are several reasons why investing in dividend stocks can be advantageous for passive income:

- Steady Income Stream: Dividend stocks are a desirable choice for investors seeking steady cash flow because they offer a dependable and regular income stream. Dividends provide a measurable return on investment independent of market conditions, in contrast to relying exclusively on capital appreciation.

- Income Growth Potential: Companies that have a history of steadily raising their dividends can offer investors protection from inflation. Investors can profit from prospective increases in dividend payments over time in addition to receiving income by selecting equities with a track record of dividend growth.

- Historical Stability: Dividend-paying stocks, particularly those from well-established companies, have historically demonstrated greater stability during market downturns. This resilience can be reassuring for investors, especially those looking for reliable income during economic uncertainties.

- Compounding Effect: Reinvesting dividends can lead to the compounding effect, where your investment grows not only through capital appreciation but also by reinvesting the dividends received. Over time, this compounding can significantly enhance the overall return on your initial investment.

- Quality Company Selection: Companies that consistently pay dividends are often financially stable and well-established. Investors can use dividend history and payout ratios to assess a company’s financial health, helping them make more informed investment decisions.

Conclusion

The landscape for passive income favors dividend stocks, and notable choices like PennantPark Floating Rate Capital, Phoenix Group Holdings, Altria Group, Aviva, and AT&T offer a blend of robust yields, dividend growth, and strategic resilience. The appeal of these stocks lies in their ability to provide a steady income stream, potential for growth, historical stability, and tax advantages. Investors should carefully assess each stock’s financial health and alignment with their goals. With diligence, these dividend stocks can serve as pillars for income generation, offering a reliable avenue for passive income amidst the dynamic currents of the financial market.