Nvidia has been at the forefront of the AI revolution, captivating Artificial Intelligence stock investors with its meteoric rise. The company’s stock surged to unprecedented heights, driven by the excitement surrounding AI technologies. Just a week ago, Nvidia achieved a peak market capitalization, becoming the world’s most valuable company.

However, the past three days have been disastrous for Nvidia stock value. The company’s shares fell by 6.7% in a single day, the largest single-day drop since April. Over three days, Nvidia’s stock (NASDAQ: NVDA) plummeted by a total of 13%, resulting in a staggering loss of $646 billion in market value. This drop is historic, marking the largest three-day loss for any company ever.

Moreover, notable investors, including Cathie Wood’s Ark Investment Management, have been selling Nvidia stock this year. Wood believes that software companies could generate $8 of revenue for every $1 they invest in Nvidia’s chips, suggesting that the next big AI opportunity lies within the software sector.

Given this context, investors looking for substantial growth potential in AI might want to consider other Artificial Intelligence stocks. Here are three alternative AI stocks with huge upside potential:

Alternative Artificial Intelligence Stocks with Huge Upside Potential

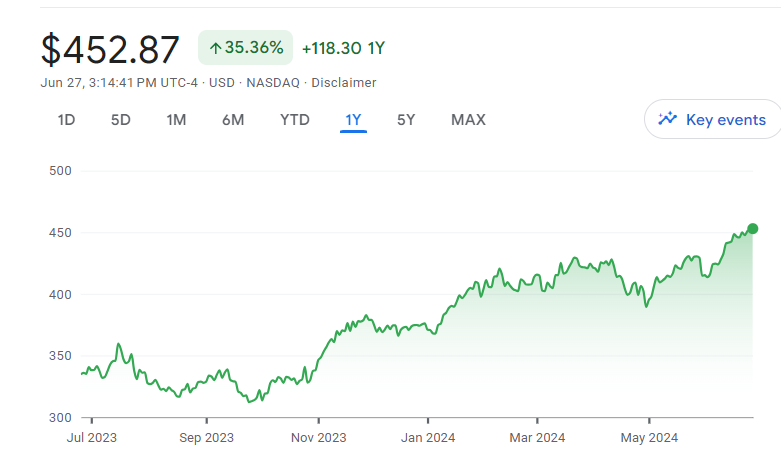

1. Microsoft (NASDAQ: MSFT)

Microsoft, with a market cap of $3.3 trillion, is already slightly bigger than Nvidia. The company has made strategic moves in the AI space that could extend its market cap advantage through the end of this decade. Microsoft announced a $10 billion investment in OpenAI, leveraging its latest GPT-4 models to create an AI assistant called Copilot, available with most of Microsoft’s flagship software products.

Businesses can now pay an additional monthly subscription fee for the Copilot-enabled version of Microsoft 365, potentially translating into billions of dollars in extra annual recurring revenue. Microsoft’s Azure cloud platform has also become a key distributor of the latest AI models for tens of thousands of organizations, including 65% of Fortune 500 companies using the Azure OpenAI Service to build their own AI applications.

Microsoft is on track to generate $244.9 billion in total revenue in fiscal 2024, surpassing Nvidia’s expected revenue nearly two years from now. With a current price-to-earnings (P/E) ratio of 38.1, Microsoft offers a more attractive valuation compared to Nvidia’s current P/E ratio of 70.2. Microsoft’s long track record of success and continued growth on the top and bottom lines make it a strong contender in the Artificial Intelligence stocks market.

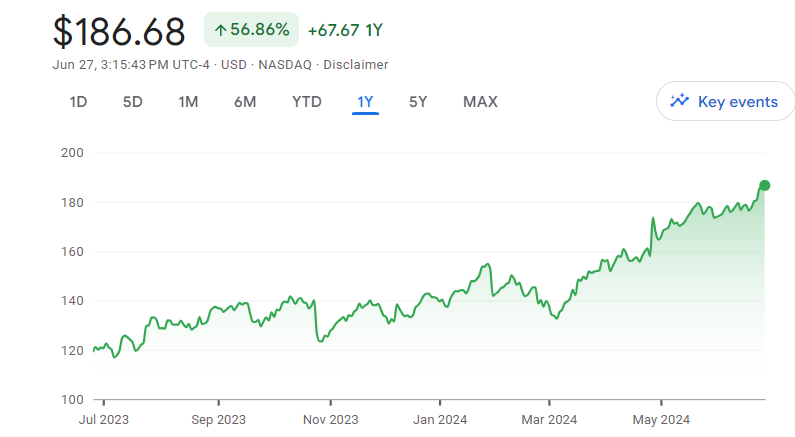

2. Apple (NASDAQ: AAPL)

Apple, another $3 trillion giant, might also have an edge over Nvidia in the long run due to its incredible hardware and software ecosystem. With more than 2.2 billion active Apple devices worldwide, Apple is positioned to become the largest distributor of AI to consumers. This will be achieved through Apple Intelligence, set to launch in September within the new iOS 18 operating system. Developed in partnership with OpenAI, Apple Intelligence will feature industry-leading models that promise to transform Apple’s existing software.

The Siri voice assistant will draw on the expansive knowledge of ChatGPT, and apps like Mail, Notes, and Messages will be overhauled with new writing tools to help users draft content more quickly. Apple Intelligence is expected to drive a large upgrade cycle with the launch of the iPhone 16, featuring a more powerful chip designed specifically for processing AI workloads.

Wall Street expects Apple to generate $386 billion in revenue during fiscal 2024, more than Microsoft and Nvidia combined in their current fiscal years. Apple’s current P/E ratio of 32.2 makes it a more affordable investment compared to its peers. Given its robust ecosystem and forthcoming AI innovations, Apple has substantial long-term growth potential in the Artificial Intelligence stocks sector.

3. Alphabet (NASDAQ: GOOG)

Alphabet, the parent company of Google, YouTube, Waymo, and DeepMind, is another strong contender in the AI space. Google Search dominates the internet search industry with a 90% market share. However, AI applications like ChatGPT posed a potential threat by offering a more convenient way to access information.

Alphabet responded by launching its own series of AI chatbots, culminating in the new Gemini models. Additionally, Google Search now uses generative AI to provide users with text-based answers to their queries, protecting the platform’s dominance. In the first quarter of 2024, revenue from Google Search increased by 14.3% compared to the year-ago period, marking the fastest growth rate in almost two years.

Alphabet also offers Gemini to existing Google Workspace subscribers for an additional fee, similar to Microsoft’s Copilot for 365, creating a new recurring revenue stream. Alphabet’s stock trades at a P/E ratio of about 27.5, making it significantly cheaper than Nvidia, Microsoft, and Apple. With its diverse portfolio and strategic AI initiatives, Alphabet is well-positioned for substantial growth in the Artificial Intelligence stocks sector.

Final Thoughts

While Nvidia has been a standout performer in the AI industry, recent volatility suggests that investors should consider diversifying their Artificial Intelligence stocks portfolio. Microsoft, Apple, and Alphabet offer compelling opportunities with substantial upside potential. Each of these companies has made strategic moves in the AI space, positioning them for long-term growth and stability. As AI continues to reshape industries, these tech giants are poised to capitalize on the next wave of innovation.

Leave a Reply