A number of high-quality firms have seen their stock prices fall as a result of the market’s shaky start to 2022, providing a few opportunities for long-term investors to buy cheap stocks. A stock is a risky investment if its share price is low, but there are also some hidden gems to be picked up when the market is down.

In this guide, we’ve mentioned the best cheap Stocks to Buy in the UK in 2022, along with a thorough analysis of each firm.

Best Cheap Stocks in 2022

The best cheap stocks to acquire right now in the United Kingdom are listed below.

- Ford (NYSE: F)

- Vodafone (LON: VOD)

- Microsoft Corp. (NASDAQ: MSFT)

- Amcor (NYSE: AMCR)

- American Airlines (NASDAQ: AAL)

- EPAM Systems, Inc. (NYSE: EPAM)

- SoFi Technologies (NASDAQ: SOFI)

- Carnival (NYSE: CCL)

- ASML Holding NV (NASDAQ: ASML)

- Smith Micro Software, Inc. (NASDAQ: SMSI)

Best Cheap Stocks Analysis

Ford (NYSE: F)

Ford Motor Company, based in the United States, has been manufacturing automobiles since 1903. Given that Ford is firmly committed to the future of electric vehicles, the corporation is one of the most well-liked cheap long-term stocks to buy. The new leader of the EV sector may depend on how well conventional automakers like Ford can adapt and compete with Tesla.

Ford has given the switch to electric vehicles significant consideration. Among the company’s Electrical variants are the F-150 Lightning, Ford Mustang Mach-E, and E-Transit-350 Cargo. Ford’s Mustang Mach-E bested Tesla’s successful Model 3 for the title of the most popular electric vehicle in a consumer report published in February 2022.

Ford will also increase its investment in electric cars from $30 billion in 2025 to $50 billion in 2026. Ford acknowledged that its electric vehicle business will be managed independently from its combustion engine business. Through its newly established dedicated subsidiary, Ford Model e, the corporation anticipates producing more than 2 million electric vehicles by 2026.

This will account for a third of its annual global production, with electric vehicles predicted to make up half of all volume by 2030. The success of Ford’s electric vehicle sales will be closely watched by investors in the next months and years, but the company’s aggressive strategy to take against Tesla is encouraging.

In February 2022 alone, Ford received 72,000 orders for automobiles, up from 54,000 the previous month. The majority of those sales are of trucks and SUVs, although Ford EV sales increased by more than 55% in the same month. As of this writing, the P/E ratio is more than 8. The running dividend yield is approximately 2.5 percent as of this writing.

Vodafone (LON: VOD)

With more than 300 million mobile subscribers, Vodafone is a telecom corporation that operates the biggest 5G network in Europe. The business was started in the UK in 1984 and currently has a global presence. The business is also the proprietor of the M-PESA mobile money transfer app.

The largest platform for money services of its sort in Kenya is this one. In addition, Vodafone has grown its business in a number of countries, including South Africa, Tanzania, Ghana, Mozambique, Egypt, and Lesotho. Investors have had poor returns from Vodafone stock, which is especially disappointing when you consider that throughout the past five years of trade, its shares have dropped by more than 34%.

Without a doubt, the company’s declining sales and high debt levels turned off investors. In addition, when COVID-19 became more well known, the company’s sales fell. Nevertheless, Vodafone reported better-than-expected revenue performance in the final few months of 2021.

In the entire world, Vodafone recorded a rise in revenue of more than 4% to €11.7 billion (about $12.7 billion) during this time. In Africa, where it has about 190 million users spread across eight nations, the company noted strong growth. Following the UK’s departure from the EU, the business will also profit from roaming charges.

Vodafone’s earnings prediction for 2022 has been reduced from €15 billion to €15.2 billion (about $16.3 billion to $16.5 billion). It has also boosted its objective for free cash flow by €100 million (about $108.6 million).

Vodafone is another well-known cheap stock that pays dividends. At the time of writing, the running dividend yield is 6%.

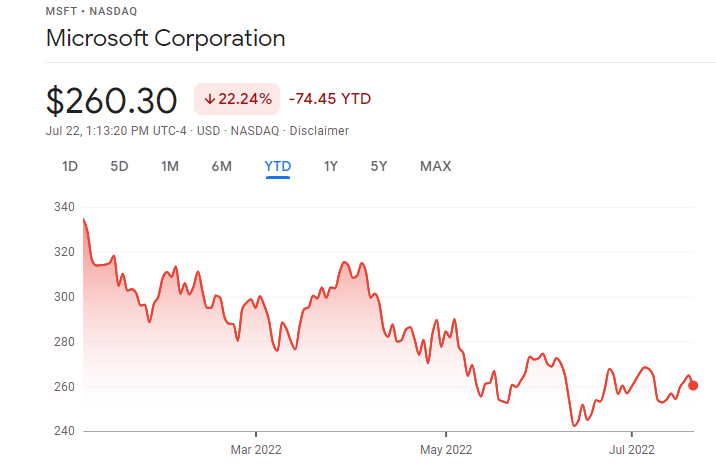

Microsoft Corp. (NASDAQ: MSFT)

Nobody needs an introduction to Microsoft; anyone who is knowledgeable with the stock market or a personal computer is familiar to this tech giant. Microsoft may be attractive to investors seeking a blue-chip “buy the dip” investment compared to some of the other firms on our list that are less well-known.

The $2 trillion corporation has hardly slowed down despite dominating the IT sector and having a mega-cap size. Over the past three years, MSFT’s yearly EPS has climbed by an average of 24 percent, fueled by an average sales growth of 15.2 percent annually.

Over the past five years, MSFT shares have done admirably, increasing by more than 290 percent. The current 22 percent decline in MSFT’s price from its November peak presents a potential buying opportunity. This is MSFT’s greatest decrease since 2010, bigger than the decline that took place during the Covid-19 pandemic’s early phases in early 2020.

Over the next five years, analysts anticipate a 16 percent yearly increase in EPS.

Microsoft has consistently increased its dividend every year for more than ten years. 0.9 percent is the current dividend yield.

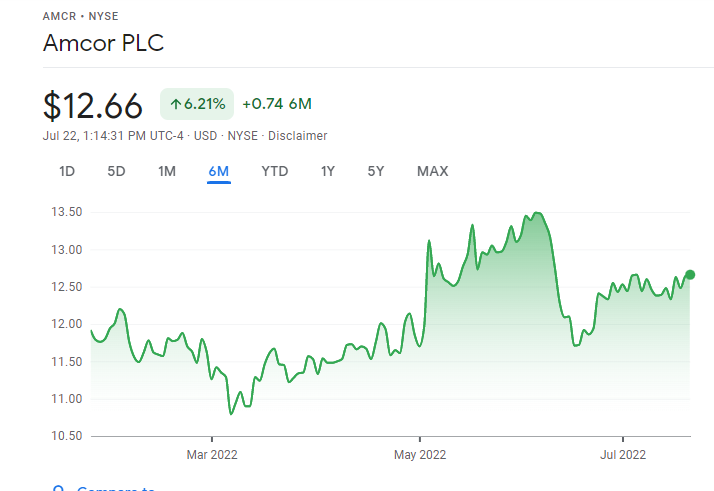

Amcor (NYSE: AMCR)

Amcor is a packaging company with global operations. The business produces closures, rigid packaging, flexible packaging, personalized cartons, as well as other services. Products from Amcor are utilized in beverages, food, pharmaceuticals, medical equipment, and things for personal and home care.

The headquarters of this reputable packaging business is in Zurich, Switzerland. Amcor has expanded rapidly in recent years. This is especially true now that the purchase of the Bemis Company was finalized in June 2019. The acquisition expanded the business’s global footprint.

As a result, it has expanded and brought in new customers for its products. As a result, there are better scale economies, more productivity, and higher profitability. Amcor currently serves across Asia, Africa, Europe, as well as North and Latin America. The business estimates that overall cost savings will exceed its initial goal of $180 million in fiscal 2022 by at least 10%.

The global packaging market is expected to be worth over $400 billion by 2027. Amcor’s sales have benefited from the COVID-19 pandemic. A wide range of industries, including high-value end markets like cheese, protein, pet food, and coffee, have seen growth from the company.

Additionally, there is a rising demand from consumers for rigid packaging. The amount of its hot-fill containers and beverages has increased, according to the business. Brand extensions also contribute to growth. This also applies to the introduction of fresh health and wellness products in PET containers.

As already mentioned, Amcor benefited from the worldwide pandemic. The stock reached an all-time high of $12.90 per share in August 2021. As of this writing, the P/E ratio is around 19 times, and the running dividend yield is a little over 4%.

American Airlines (NASDAQ: AAL)

American Airlines, the biggest airline in the world, was founded in 1930. Like most aircraft businesses, American Airlines struggled on the stock market during the COVID-19 pandemic. After all, the epidemic virtually eliminated the demand for air travel.

Having said that, the industry is rebounding, in part because vaccinations are now widely available. American Airlines is currently developing its future. This makes sense given that the aviation sector as a whole is presently coping with the financial effects of COVID-19 restrictions and the harm they inflicted.

American Airlines’ P/E ratio is -6.2 times at the time of writing. Leisure travel is on course to return to pre-pandemic levels, as we briefly said.

Additionally, the business reported decreased capital expenditure needs in 2021, which ought to aid in debt reduction throughout the ensuing years. Regulators gave American Airlines the go-ahead to collaborate with former rival JetBlue in early 2022.

With 33 new routes and nearly 80 codeshares, the former adversaries got things started. In airline stock-related news, a federal judge in Florida determined in early 2022 that the Biden administration’s masking laws on public transit were unlawful.

As a result of big airlines canceling their mask obligations, airline stocks rose. Over the past year of trade, American Airlines has beaten rival Spirit Airlines in terms of its industry rivals. In a year of trade, American Airlines’ stock price dropped by more than 3.8 percent, and Spirit Airlines’ shares lost a staggering 26 percent of their value.

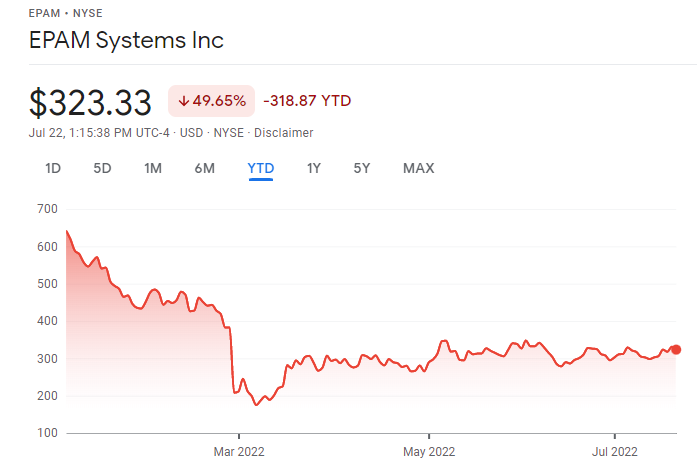

EPAM Systems, Inc. (NYSE: EPAM)

EPAM Systems is a software engineering and design organization that serves companies in over 45 countries across the world.

EPAM’s stock has taken a beating in the recent market downturn. When compared to its peak in November 2021, EPAM was as much as 76 percent lower in March. Although it has already made substantial progress, it is still more than 50% below its November highs.

Despite the latest decline, the $19 billion IT firm had increased 311 percent in the last five years.

Since the company went public in 2012, this is an exceptional sell-off. Even if the extent of the decline was rather significant historically, it can still offer a good entry opportunity. This is due to the company’s outstanding growth trajectory.

Over the last five years, the company has had consistent yearly revenue and profitability growth. The three-year average yearly EPS and sales improvements are both greater than 23%. Over the following five years, analysts forecast yearly earnings growth of over 19 percent.

There is no dividend paid by EPAM.

SoFi Technologies (NASDAQ: SOFI)

A fintech disruptor named SoFi Technologies was established in 2011 with the intention of helping Americans achieve financial independence. Basically, this business provides a cutting-edge platform with banking, investment, and financial services. The platform has nearly doubled its membership in a little more than a year and is still doing well.

2020 saw SoFi purchase Galileo Financial Technologies for $1.2 billion. This company, which specializes in digital payment technologies, permits SoFi to provide its own checking and savings accounts.

SoFi is one of the NASDAQ’s most reasonably priced stocks. In June 2021, following a merger with Social Capital Holdings, shares were first listed. Shares were selling at roughly $22 after their first day of trading, up more than 12%. A $23 record high was set for SoFi shares in the same month.

SoFi gained an incredible 523,000 new members to its financial app in the final three months of 2021.

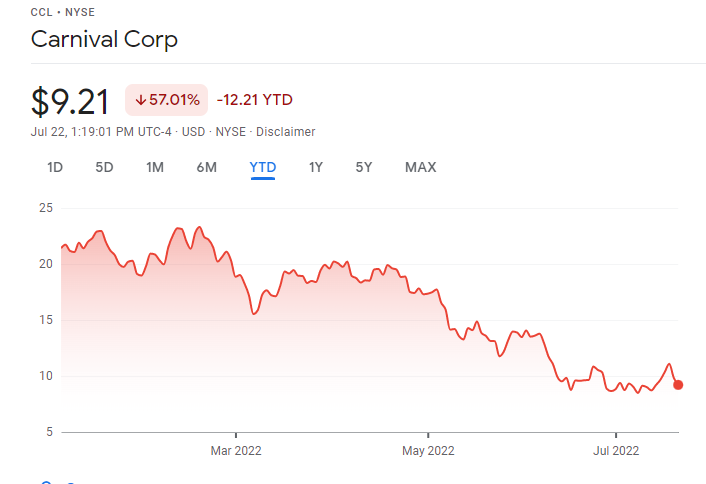

Carnival (NYSE: CCL)

The biggest cruise line in its field, Carnival was formed in 1972. In July 1987, the company went public on the NYSE, going for just under $3.90. This accounts for the business’s two stock splits. This stock’s all-time high was about $70 in January 2018, and during the course of the next two trading years, shares dropped to lows of $41.

Shares of Carnival traded at $52 at the end of January 2020. After COVID-19 conquered the globe, the stock dropped to $8.50, its lowest price since April 1993, in just three months. Between January and April, the value of this decreased by roughly 84 percent.

The cruise industry was among those hardest hit by the COVID-19 outbreak, practically shutting down to stop travelers from spreading the illness. The company did everything it could to cut costs, but in the end, it also needed to sell additional shares and raise a lot of money to survive.

Potential investors would undoubtedly be put off by Carnival’s debt given that it rose from over $12 billion before the outbreak to almost $35 billion in the first quarter of 2022. Carnival was able to carry 850,000 passengers in the final three months of 2021, more than twice as many as it did in the first three.

It appears that there is a sizable latent demand for cruises, which will grow over time. It’s predicted that the company’s whole fleet of cruise ships will start operating again in the spring of 2022.

Bookings are pouring in for itineraries in 2022 and 2023 at a rate comparable to what Carnival saw in 2019 prior to the COVID-19 epidemic. The last quarter of 2021 saw an increase in revenue for Carnival of almost 3,574 percent, to $1.29 billion.

ASML Holding NV (NASDAQ: ASML)

ASML, a Dutch company, develops and produces the equipment needed by businesses that fabricate microchips. Some of its main clients include Samsung Electronics, Intel, and Taiwan Semiconductor.

Despite the fact that the price of ASML shares is currently roughly 48% below its all-time high of $895.93 per share in September 2021, the company’s shares have increased by a total of 200 percent over the last five years.

Most of ASML’s pullbacks have not exceeded 45 percent, with the exception of 2008, when the stock plunged roughly 60 percent. While past performance is no guarantee of future results, buying ASML on a decline of 30% or more has historically been a strong long-term entry opportunity.

The average yearly earnings and revenue of the $231 billion semiconductor equipment company have climbed annually for at least the last five years. Over the following five years, economists anticipate further strong growth, with yearly gains in the 30 percent area.

ASML pays a dividend, and during the past ten years, it has generally climbed. The present dividend yield is 1.1 percent.

Smith Micro Software, Inc. (NASDAQ: SMSI)

Mobile app maker Smith Micro Software had a mixed month, sliding down 3.53 percent but recovering just a little by 5.13 percent over the most recent week.

Despite its relatively disappointing performance, the investment thesis for SMSI is still looking excellent. Earnings per share (EPS) are anticipated to climb by more than 160 percent the next year as Tier-1 carriers are anticipated to integrate the company’s SafePath application onto their phones. A gross margin of 75% shows how effectively the company runs its activities.

How to purchase the best cheap Stocks in UK?

After talking about the top cheap Stocks in the UK, we’ll walk you through the investment process.

Step 1: Choose a broker

Once you’ve selected the cheap stocks you want to purchase, you’ll need to choose a reputable stockbroker. In addition to offering your preferred shares, the broker must charge a fair commission.

You should also take into account factors like legal requirements, accepted payment methods, and the required minimum investment.

We’ve listed the top two trading platforms that offer some of the best cheap stocks to buy now in the UK to lead you in the correct direction.

1. eToro

eToro, a famous online stock broker, offers over 2,400 shares from 17 different exchanges. You can actually buy all of the best cheap stocks listed on this page using the platform.

eToro is a commission-free broker. This suggests that there won’t be any share trading fees associated with purchasing the stocks you choose. This holds true for equities listed elsewhere as well as those listed in the United Kingdom. This implies that whether you purchase Microsoft or SoFI, you won’t have to pay a foreign currency cost.

Additionally, you will avoid paying the standard stamp duty tax of 0.5 percent if your inexpensive stocks are listed on the London Stock Exchange. The site is unquestionably the least expensive broker for accessing the best cheap stocks to purchase now in the UK because eToro pays the tax. In addition to offering a cheap way to enter the international stock markets, eToro is well-known for enabling the purchase of fractional shares.

This suggests that if you invest at least $50, you can purchase a fraction of a share of stock. For instance, if you invest $50 and the stock is worth $200, you will own 25% of the stock. With its Copy Trading function, you may mimic a seasoned eToro investor. There is a $50 minimum investment requirement, and there are no commissions or fees on eToro.

If you’re new to eToro, you shouldn’t be concerned about your safety. The FCA, ASIC, and CySEC all regulate this broker, which currently has over 17 million investors. The FSCS scheme also protects your investments. Your eToro account can be funded with a UK debit/credit card, e-wallet, or bank wire. The procedure can be conducted online or using the eToro investment app, which is available for both iOS and Android smartphones.

2. Capital.com

Capital.com is a CFD broker that trades over 3,000 stocks from various markets. The broker does not charge commissions, and its spreads are among the lowest we’ve seen in the UK. There are no fees for deposits, withdrawals, or inactivity, so you won’t be hit with any unexpected costs in your account.

In addition to stock CFDs, Capital.com offers a comprehensive range of assets to trade. Over 140 currency pairings, 84 cryptocurrencies, and dozens of commodities, ETFs, and stock indexes are available for trading.

One of the primary aspects that distinguish Capital.com is its proprietary trading platform, which is accessible via the web and mobile devices. Numerous technical indicators are at your disposal, and the charts are quite user-friendly. You can put up unique indicators on Capital.com’s TradingView integration to study market trends. And to make matters worse, Capital.com’s technology employs artificial intelligence to identify patterns in your transactions and suggest trading tactics that can increase your win rate.

There are numerous courses and videos available that will lead you through the fundamentals of CFD trading and describe common trading methods. The platform even provides a specific mobile education app with tests to gauge your trading prowess.

FCA and CySEC are in charge of Capital.com. You can easily resolve any issues you might have with your account because the brokerage offers customer care via phone, email, and live chat twenty-four hours a day, seven days a week. You only need £20 to start an account with Capital.com, and you may fund it using a bank transfer, credit card, or debit card.

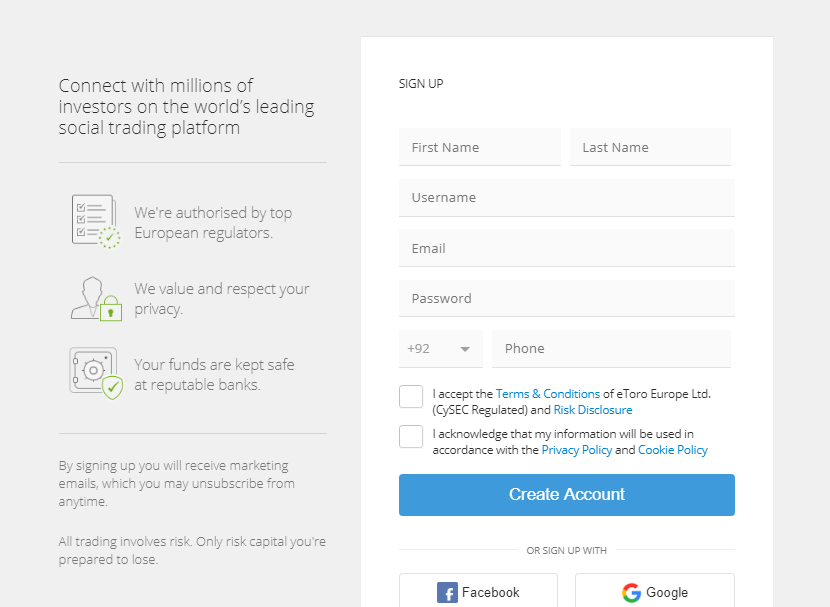

Step 2: Open an Account

We have selected eToro, a commission-free and FCA-regulated website, for this example of buying cheap stocks.

To begin, create an account on the eToro website. As with any other share dealing platform subject to FCA regulation, personal information is required. Your name, address, birth date, and phone number will all be required. You must also submit your social security number.

You will next be requested to upload copies of your driver’s licence, passport, and address proof. Either take a clear photo with your phone or upload the document from your PC.

Within a minute, eToro ought to be able to confirm the documents, at which point all deposit and withdrawal restrictions will be lifted.

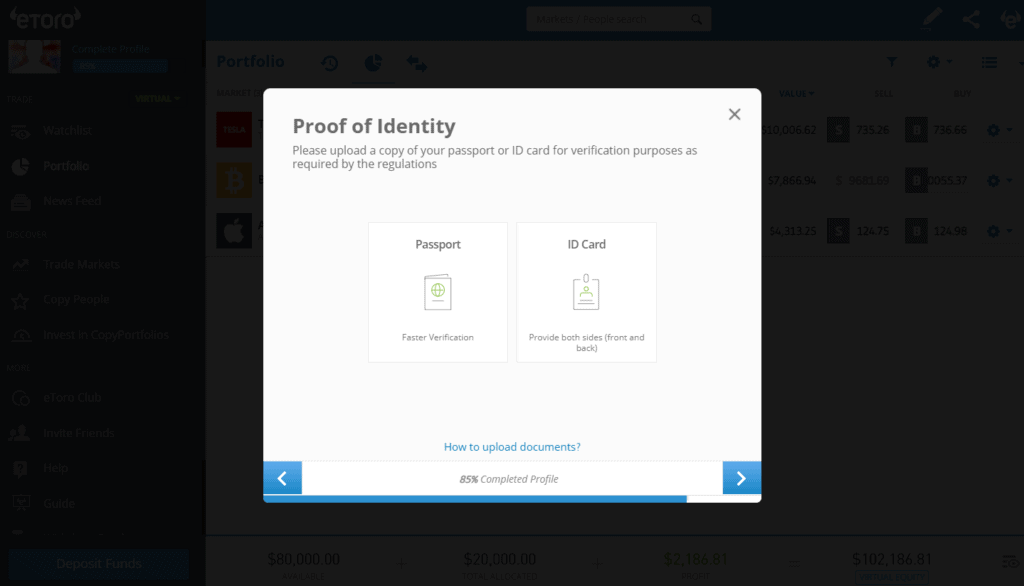

Step 3: Make a Deposit

Making a deposit at eToro is simple. You can do this immediately by using your UK debit/credit card or an e-wallet.

Step 4: Search for Cheap Stock you want to buy

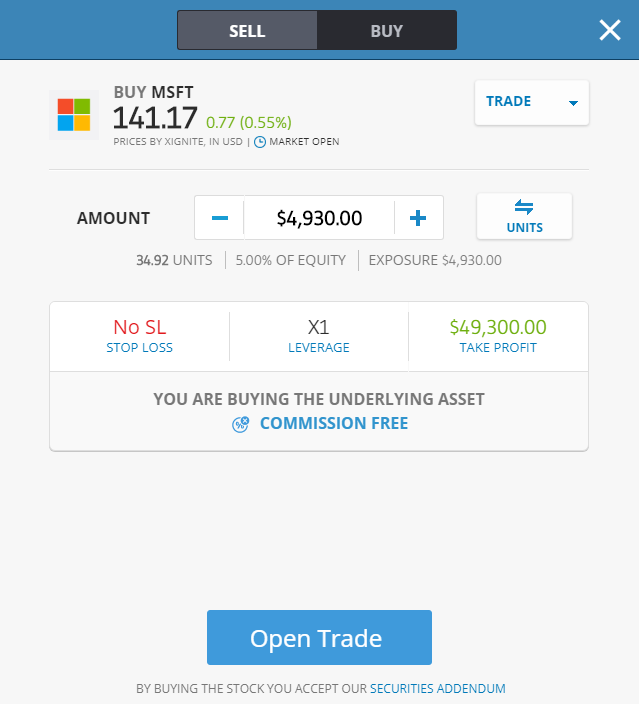

You probably already know which stocks to buy if you’ve read our guide to the UK’s best cheap stocks to buy right now. Simply search for the cheap stock at the top of the page. We’re seeking cheap Microsoft stock in the example below.

Step 5: Buy Cheap Stocks

Filling out an order form is the last step in the process. As soon as you click the cheap stock you wish to purchase, the ‘Trade’ button will appear next to it on the screen.

Then, put the amount of your investment in the “Amount” box. You can put as little as $50 or as much as you want into it.

In order to purchase the cheap stock without paying a commission, finally, click the “Open Trade” button!

Conclusion

Whatever qualifies as the popularly priced stock for you will rely on your risk tolerance, interests, and objectives. By selecting a preferred stock platform, users can invest in their favorite cheap stocks.

We suggest eToro, where you can buy the shares of your choice without paying a commission. The service also allows you to start investing in inexpensive companies for as little as $50, which is fantastic for diversification. To purchase inexpensive stocks on eToro in less than 10 minutes, only click the button below.

Frequently Asked Questions

What are the best cheap stocks in 2022?

Ford, Vodafone, Microsoft, American Airlines, and SoFi Technologies are a few of the well-known inexpensive stocks.

Can you purchase shares for $10?

Any stock that is available on eToro can be purchased for $10 thanks to the broker’s support for fractional share trading.

What makes cheap stocks so affordable?

Due to the low market valuation of the companies they represent, cheap stocks are frequently inexpensive.