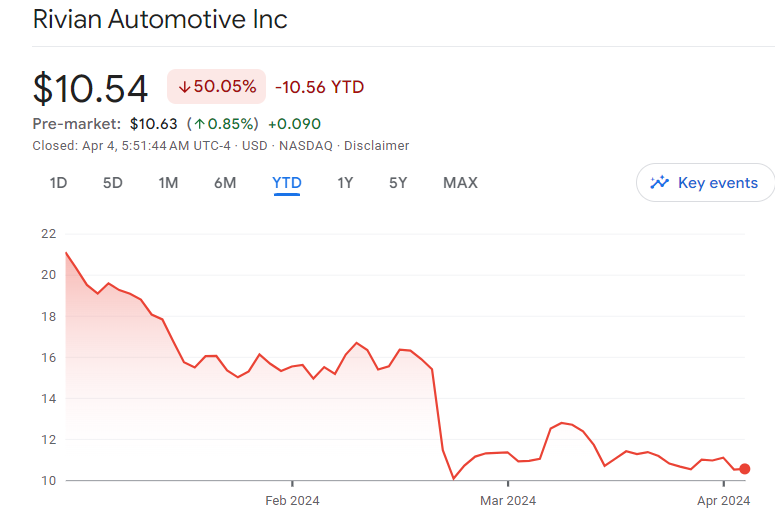

Rivian stock has experienced a tumultuous start to 2024, with its stock plummeting by 50% year-to-date. The EV industry, in general, has faced challenges, with Rivian, Tesla, Neo, and Lucid all suffering considerable losses.

The root of the issue lies in diminishing consumer demand coupled with a surplus of EV manufacturers flooding the market with vehicles. This oversupply dynamic has severely impacted the growth potential of companies like Rivian.

The company recently reported production and delivery numbers for the first quarter in line with management’s guidance, yet the stock price fell by 5%. This unexpected decline has left investors questioning the future prospects of Rivian stock.

Despite Rivian meeting its production and delivery targets, investors were disappointed by the lack of upward revision in the annual production forecast. Initially set at 57,000 vehicles for 2024, this figure was believed to be conservative by Wall Street analysts. However, Rivian’s reaffirmation of this target, coupled with flat revenue expectations for the year, failed to inspire confidence among investors. The company’s inability to significantly increase production numbers has raised concerns about its growth potential, particularly as it continues to operate at significant losses.

Investment Outlook and Recommendation

Given Rivian’s current challenges and uncertain growth trajectory, investors are advised to exercise caution when considering investing in Rivian stock. Despite trading at a growth valuation with a price-to-sales ratio of 1324, Rivian’s lackluster performance and the broader challenges facing the EV industry suggest that significant growth may not materialize in the near term.

With Rivian stock price down significantly and no immediate catalysts for growth on the horizon, it may be prudent for investors to adopt a wait-and-see approach. While the company’s potential for profitability in the fourth quarter of 2024 is promising, it remains to be seen whether this will be sufficient to offset its current losses.

In conclusion, while Rivian may offer long-term potential as the EV market evolves, the current uncertainties surrounding the company’s growth prospects and its significant losses suggest that it may not be an attractive investment opportunity at present. Investors are advised to closely monitor Rivian’s performance and wait for clearer signs of sustained growth before considering investing in its stock.

Also read: Why Does The Tesla Share Price Keep On Declining?

Leave a Reply