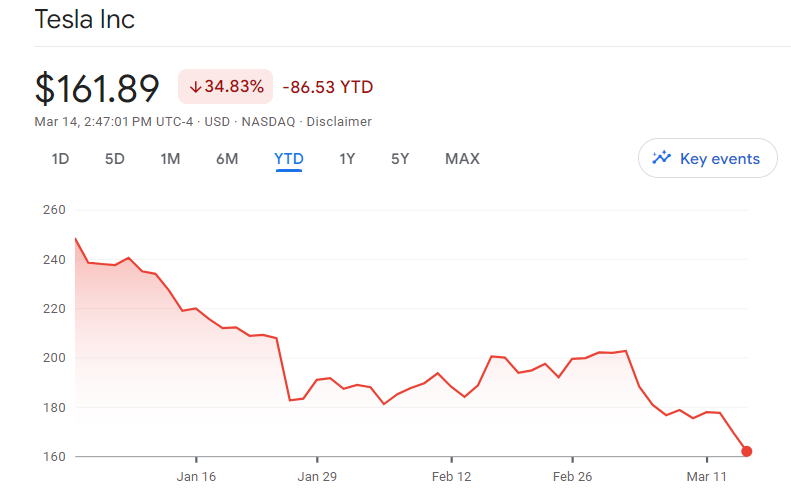

With Tesla share price down by double digits since the beginning of the year, investors may be eyeing this decline as a potential opportunity. However, recent actions by Wall Street analysts, including UBS, cutting their targets for Tesla due to concerns over earnings downside risk, have added to the uncertainty surrounding the company. Tesla faces various challenges, including lower car sales, operational disruptions, and skepticism from analysts, all contributing to the downward pressure on Tesla share price.

Amidst these challenges, the real question for Tesla investors is the long-term outlook. While the current circumstances may appear daunting, some view temporary drops in stock prices as potential buying opportunities. Whether Tesla can overcome its current obstacles and continue its trajectory of innovation and growth remains to be seen. As investors weigh the risks and rewards, they must carefully consider the evolving landscape of the electric vehicle market and Tesla’s ability to navigate through these turbulent times.

Factors behind the Tesla share price decline

In 2024, Tesla shares have experienced a notable downturn, plummeting over 34% since the beginning of the year. This downward trajectory has intensified in recent weeks, with a sharp decline of more than 14% observed over the past month alone.

Wednesday’s trading session saw Tesla shares face an additional setback, dropping by 4.5%. Unfortunately for investors, the downward trend continues into Thursday’s premarket trading, with shares declining a further 4.4%.

Following are the factors which have contributed to this significant decline in Tesla share price.

- Sales Decline: Tesla’s earnings report in January highlighted a concerning weakness in sales prices, signaling a broader issue within the company. Subsequent data from China, one of Tesla’s key markets, revealed a continued decline in sales. February saw a significant drop in car sales from Tesla’s Shanghai gigafactory, down 19% from the previous year. This decline is exacerbated by the timing of the Lunar New Year and is mirrored by a 36% year-on-year decrease reported by rival BYD, suggesting industry-wide challenges beyond Tesla’s specific circumstances.

- Production Disruption: Tesla faced a substantial setback with an arson attack at its gigafactory in Berlin, resulting in estimated damages close to $1 billion and halting production. While some may perceive limited output as beneficial for margins, the interruption poses serious implications for Tesla’s autonomous driving projects, heavily reliant on real-world data from cars on the road. This production issue contributed to the recent decline in Tesla Share Price.

- Cyclical Vulnerability: Tesla’s current challenges underscore its susceptibility to economic cycles, a factor not adequately priced into its stock valuation. Despite being perceived as a high-growth company, Tesla’s recent performance reflects its vulnerability to cyclical downturns. Analysts, who previously anticipated continued growth in sales, revenue, and earnings, have adjusted their price targets downward in response to Tesla’s underperformance.

So the stock was overpriced at the start of the year due to expectations that Tesla – unlike other car companies – would be immune to cyclical shifts. But what about now?

Evaluating Investment Opportunity

The recent decline in Tesla Share Price prompts the question: Is this an opportunity for investors? While Tesla possesses technological prowess and a culture of innovation, caution is warranted.

Tesla’s stock trades at a high price-to-earnings (P/E) ratio of 46, significantly above the industry average. This elevated valuation, coupled with Tesla’s history of volatility, raises concerns for value-oriented investors like Wright, who typically seek stocks with lower P/E ratios.

Analysts at HSBC have lowered their target price for Tesla and identified CEO Elon Musk as a “single-person risk” factor. Musk’s influential leadership has propelled Tesla’s success, but his actions have also led to stock price fluctuations. Such sentiment from analysts adds another layer of uncertainty for prospective investors.

Potential Impact of AI on Tesla Share Price

Tesla sees artificial intelligence (AI) as a significant contributor to its long-term value, particularly through the Full Self-Driving (FSD) system, which is projected to drive most of the company’s revenue in the 2030s through monthly subscriptions

Experts predict that AI will revolutionize the way we drive, with self-driving cars becoming a reality by 2035, potentially impacting Tesla Share Price positively.

FSD Revenue Potential: Analysts predict that Tesla’s FSD system could generate significant revenue, with an “upside case” projecting self-driving income to hit $75 billion by 2030, potentially leading to a substantial increase in the company’s market valuation and share price.

Challenges and Competition

Tesla faces competition, such as Waymo, which has reached level 4 autonomy using different technology, posing challenges in establishing a standard for self-driving technology.

Despite competition, Tesla’s plans to license its software to other manufacturers may provide it with an edge in the industry, potentially influencing its share price in the future.

Conclusion

The recent decline in Tesla share price presents both challenges and potential investment opportunities. While the company faces cyclical vulnerabilities and competitive pressures, the potential impact of AI, particularly through the FSD system, remains a key factor in assessing Tesla’s long-term value and share price outlook. Investors should carefully consider the implications of recent developments and the transformative potential of AI on Tesla’s future performance and stock valuation.

Also read: Unveiling The Tesla And Nvidia Rivalry And Exploring Diverse AI Stock Opportunities