In the dynamic world of electric vehicle (EV) manufacturing, Rivian stock. has emerged as a captivating player with the potential to disrupt the industry. After a notable IPO in 2021 and a subsequent rollercoaster ride in its stock price, investors are closely monitoring Rivian’s journey. With an array of factors at play, from production goals and margins to emerging market opportunities, this article delves into the compelling reasons to consider investing in Rivian.

What is Rivian Automotive Inc?

Rivian Automotive Inc. is an American company headquartered in Irvine, California, that specializes in manufacturing electric vehicles (EVs). Co-founded by R.J. Scaringe, its primary focus is on creating electric SUVs and pickup trucks using a versatile skateboard platform. Rivian is dedicated to producing adventure-ready EVs and marked its entry into the market in 2021 with the launch of its all-electric R1T pickup truck. In the same year, the company conducted a successful Initial Public Offering (IPO) that raised $13.5 billion in funding.

As of 2023, Rivian was actively developing its delivery van and R1S SUV projects, with the aspiration of becoming a strong contender to Tesla. Notably, it also collaborated with Amazon to design an electric delivery van for the world’s largest e-commerce company. Rivian has garnered significant attention from investors who see it as a potential challenger to Tesla in the electric vehicle industry.

Rivian Stock Price Prediction

Rivian stock price is poised for long-term growth, driven by the expanding electric vehicle (EV) and clean energy market. As the EV industry matures, competition for Rivian’s products is expected to increase. However, the company’s strong positioning in sustainability and the rising demand for EVs provide a secure foothold in the growing EV sector.

For 2023, CNN Business predicts Rivian stock price to reach $70, with technical analysis supporting its ongoing growth trajectory. In 2024, analysts anticipate a range of $115.16 to $154.28, reflecting market dynamics and demand.

However, some experts have more conservative estimates, with Nasdaq suggesting a 2025 price of $37.28. Projections for 2025 vary widely, from $185.34 to $236.45, influenced by investor demand and the EV market’s expansion. The stock’s perceived lack of aggression may contribute to lower estimates, emphasizing the role of market conditions in determining actual prices.

Looking ahead to 2030, a prediction of $845 per share is based on the growing EV demand and technological advances. Analysts foresee an annual increase of up to 50% in Rivian stock prices, reflecting optimism about the company’s future.

By 2040, some experts suggest Rivian stock could range between $1500 and $1600, underlining the potential for significant growth as the company establishes itself in the market. Beyond 2040, predictions are highly speculative due to the extended timeframe and the unpredictable nature of the stock market.

As of 2050, Rivian is anticipated to remain a strong player in the EV sector, leveraging its extensive experience and competing with industry giants like Tesla. While these predictions offer insight, investors should remember that market conditions, competition, and unforeseen events can lead to price fluctuations and unexpected changes. It’s crucial to approach stock investments with a long-term perspective and a consideration of risk tolerance.

Also read: Tesla Share Price Prediction: Navigating the Road Ahead

Why Rivian Stock is Dropping?

Rivian stock experienced a significant decline due to its abrupt withdrawal from a planned partnership with Mercedes-Benz for electric vans in September 2022. The initial excitement among investors about this collaboration turned into disappointment when Rivian decided to redirect its capital into other areas. This unexpected move led to a loss of investor confidence, triggering a steady decline in the stock’s value. By December 2022, the stock had fallen from around $40 to approximately $15. The abrupt change in strategy and partnership dissolution played a pivotal role in the downward trend of Rivian stock price during that period.

Reasons to invest in Rivian Stock

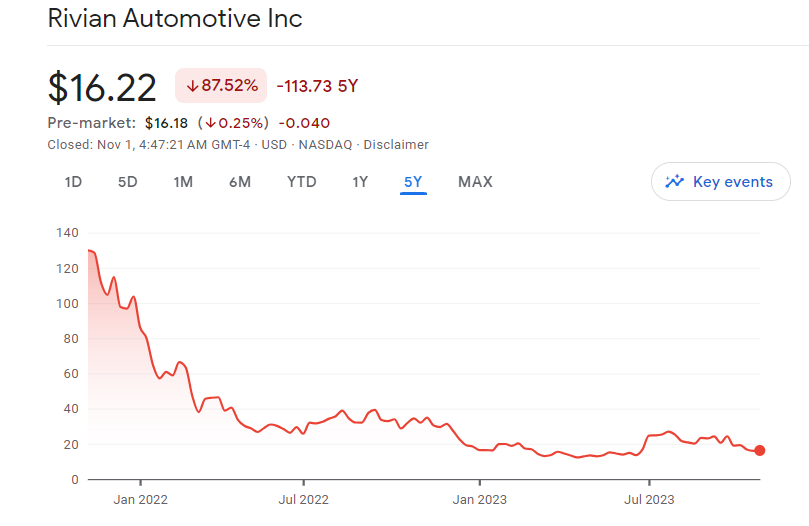

Investing in Rivian stocks presents a compelling opportunity, given its status as one of the standout IPOs of 2021. Initially going public at $78, the stock soared to a peak of $172.01 within a week. However, it’s now trading at approximately $16. This substantial decline could signal a bottoming out of the stock and the potential commencement of a sustained resurgence. Let’s explore four reasons to consider investing in Rivian.

1. Stabilizing Production and Reiterated Guidance

Rivian’s commitment to meeting its production targets is a positive signal for investors. Despite initial challenges, the company produced 24,337 vehicles in 2022 and has set a goal of producing 50,000 vehicles in 2023. While it may have slightly missed previous estimates, management’s ability to stick to and reiterate its full-year guidance suggests a growing commitment to meet its production goals.

2. Improving Margins and In-House Components

Rivian’s plan to develop its in-house Enduro drive unit and reduce reliance on third-party components is expected to boost its margins. The shift has already started to show results, with the gross margin improving from negative 193% to negative 37% between the second quarters of 2022 and 2023. As the company continues to develop its own components and operating systems, it can differentiate itself from competitors and insulate its business from potential supply chain disruptions.

3. UAW Strikes May Create Opportunities

The recent United Auto Workers (UAW) strikes at major automakers like General Motors, Ford, and Stellantis could potentially benefit Rivian. If the strikes lead these companies to delay their new EV launches, it could open up a market niche for Rivian to exploit. The company might find room to establish itself further in the EV space, taking advantage of any delays from the “Big Three” automakers.

4. Insider Confidence and Short Interest

Rivian’s insiders have shown a vote of confidence in the company by buying over 428,000 shares in the past three months, while only selling about 9,000 shares. This increase in insider ownership aligns with the stabilization of production rates and improving gross margins, indicating that those closest to the company believe in its potential.

Additionally, Rivian’s stock is trading at an attractive valuation, with a price-to-sales ratio of just 4 times this year’s sales. Furthermore, as of November 1, about 16% of its float was being shorted, which could potentially limit its downside and set the stage for a near-term recovery.

Final Thoughts

In conclusion, Rivian stock represents a fascinating investment opportunity in the rapidly evolving electric vehicle sector. Despite its initial stock price fluctuations, the company’s commitment to meeting production targets, improving margins through in-house components, and potential advantages stemming from industry labor strikes offer compelling reasons to consider investing. Moreover, insider confidence and an attractive valuation make Rivian a notable contender in the ever-expanding EV market. While market conditions remain unpredictable, Rivian’s strategic positioning and focus on innovation position it as a key player in the long-term electrification of the automotive industry, making it an enticing prospect for investors.

Leave a Reply