Investing in Tesla stock has always been akin to riding a roller coaster, with its share prices soaring to dizzying heights and plummeting to alarming lows. As we step into 2024, the landscape for Tesla stock appears turbulent, marked by a series of dramatic events and market fluctuations. In this article, we’ll delve into the recent developments surrounding Tesla, analyze its prospects for the year ahead, and explore whether investing in Tesla in 2024 is a prudent decision.

Tesla Stock Analysis

Tesla stock (NASDAQ: TSLA) has been on a roller coaster ride, experiencing significant fluctuations in recent years. Despite a 120% gain in 2023, with prices soaring from $113.06 to $248.48, 2024 has seen a sharp decline. Early April 2023 saw the stock rise to $293.34, only to plummet by 43% to $175.38 by April 9, 2024. This volatility has left investors grappling with unpredictable market swings.

Although the stock is currently down 5% over the past year, it’s important to note that these figures tell only part of the story. Despite the recent downturn, Tesla’s current prices remain significantly below its all-time high of $409.97 achieved in November 2021.

Also read: Why Does The Tesla Share Price Keep On Declining?

Key Developments in 2024:

In the tumultuous landscape of Tesla stock, recent events have showcased the company’s characteristic volatility. With sharp fluctuations triggered by a series of announcements and developments, investors are left pondering their next move.

- Disappointing Q1 Delivery Numbers: Tesla’s first-quarter delivery figures fell short of expectations, marking a concerning deviation from previous performance. The company delivered 386,810 electric vehicles, compared to 422,875 in the same period last year. This miss in delivery numbers underscores the challenges posed by higher interest rates and consumer reluctance to make significant purchases amid economic uncertainties. As Tesla’s sales face headwinds amidst economic shifts, the duration of this EV slump remains uncertain. The looming question of sustainability in the face of market challenges underscores the need for cautious evaluation.

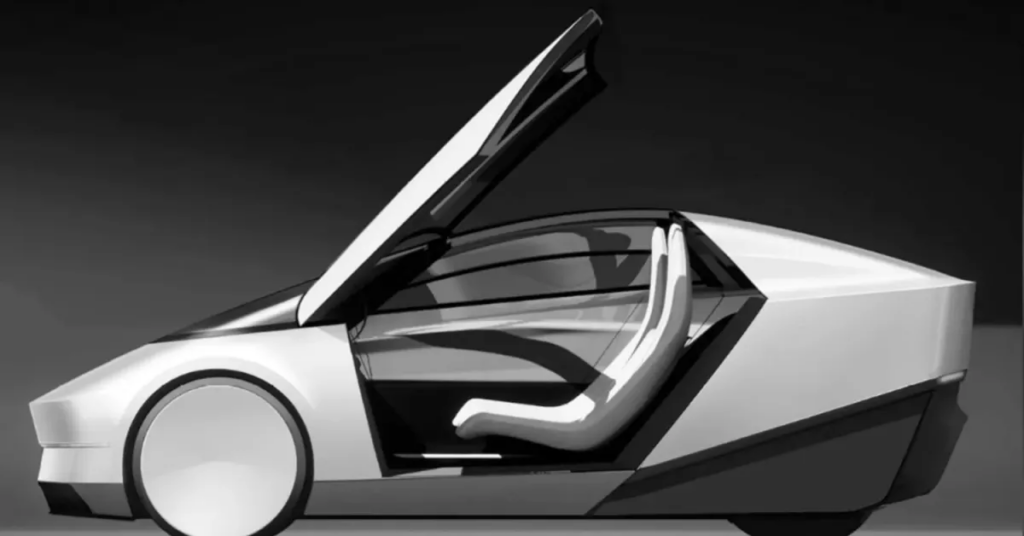

- Scrapping of Model 2 Plans: Tesla’s decision to abandon its plans for the mass-market Model 2 car dealt a blow to investor sentiment. The absence of a budget-friendly electric vehicle in Tesla’s lineup could potentially impact its ability to tap into a broader consumer base, particularly amidst stiff competition from Chinese electric vehicle manufacturers offering more affordable options.

- Robotaxi Announcement: Amidst the backdrop of weakening sales, Tesla’s pivot towards unveiling its long-awaited robotaxi service introduces a new dimension to the company’s trajectory. This venture promises transformative potential, presenting a paradigm shift in autonomous transportation. However, despite the allure of a burgeoning market, the realization of Tesla’s robotaxi vision remains a distant prospect. Competition from established players like Alphabet’s Waymo underscores the hurdles ahead, emphasizing the need for strategic maneuvering in an evolving landscape.

Analyzing Tesla’s Long-Term Prospects

Despite the short-term challenges facing Tesla, the company’s long-term outlook remains promising. The global transition towards electric vehicles continues to gather momentum, presenting Tesla with ample growth opportunities. Moreover, Tesla’s foray into new markets such as India, coupled with its burgeoning energy storage business, underscores its diversified revenue streams and resilience amidst market volatility.

Tesla Stock Predictions: Where Could the Price Go?

Tesla’s stock predictions for 2024 and beyond reflect a mixed outlook, with analysts and algorithmic forecast providers offering divergent perspectives. While 15 analysts suggest holding Tesla stock, 9 recommend selling, and 8 advise buying. The consensus forecast anticipates a modest 19.97% increase to $202 over the next year, though predictions range widely. Some analysts foresee a bullish scenario, with prices potentially soaring to $320, representing a substantial 90% surge. Conversely, pessimistic forecasts predict a 49% plunge to $85.

Algorithmic forecasts add further complexity to the picture. WalletInvestor predicts a gloomier outlook, with a projected 18% decline to $137.77 by 2025. Their 2024 forecast expects the price to reach $165 before slipping to $152 by year-end. In contrast, GovCapital offers a bullish long-term forecast, estimating Tesla’s stock to surge to $1,648 by March 2029.

This divergence underscores the uncertainty surrounding Tesla’s future trajectory, influenced by factors such as market sentiment, regulatory developments, competition, and technological advancements. Investors should carefully evaluate these forecasts alongside their own risk tolerance and investment objectives when making decisions about Tesla stock. The volatile nature of Tesla’s stock underscores the importance of thorough research and prudent portfolio diversification strategies.

Where Will Tesla Stock Be in 2030?

In forecasting the trajectory of Tesla stock by 2030, several factors must be considered, including current stock price, earnings per share (EPS) estimates, growth projections, and industry dynamics. As of the latest data available, Tesla’s stock price stands at $170.189 per share, down from its peak in 2021. The forward price-to-earnings (P/E) ratio is at 4019, reflecting high investor expectations. However, EPS estimates for 2025 have been downgraded, indicating challenges in demand for electric vehicles (EVs) and increased competition.

Tesla’s EPS estimate for 2025 is $46, with a projected growth rate of 10.31% for the next five years. This growth rate is lower than the S&P 500 average, suggesting a more conservative outlook for Tesla’s earnings. Given this forecast, the EPS for 2031 is projected to reach $73.32. Applying the forward P/E ratio, the stock price estimate for 2030 ranges from $293.99 to $365.05 per share, depending on variations in the P/E ratio.

However, it’s crucial to acknowledge the uncertainties and challenges facing Tesla. The EV market is becoming increasingly competitive, with traditional automakers entering the space and consumer demand showing signs of tepidity. Tesla’s ability to maintain its dominant position and sustain high growth rates remains uncertain. Moreover, regulatory challenges, technological advancements, and supply chain disruptions could impact Tesla’s performance.

Despite these challenges, Tesla maintains a premium valuation compared to traditional automakers due to investor expectations of significant technological advancements and growth opportunities. However, this premium valuation also implies high expectations, leaving little room for disappointment.

Considering these factors, a more conservative estimate places Tesla’s stock price in the range of $300 to $350 per share by 2030. This estimate reflects a balance between Tesla’s growth potential and the challenges it faces in the EV market.

Should I invest in Tesla stock?

Investing in Tesla stock in 2024 requires a nuanced evaluation of its current standing, future prospects, and personal investment strategy. While Tesla has showcased impressive growth in recent years, its stock has been subject to significant volatility, influenced by factors ranging from delivery numbers to technological innovations and regulatory developments. Despite enduring challenges like missed targets and heightened competition, Tesla remains a pioneering force in the electric vehicle industry, with a diversified business model encompassing energy storage and autonomous driving technology.

However, investing in Tesla entails inherent risks due to its high valuation and the unpredictability of the market. Potential investors should carefully consider their risk tolerance, investment timeframe, and portfolio diversification strategy before making a decision. While Tesla’s long-term potential is compelling, short-term fluctuations can test investors’ resolve. Thorough research, staying informed about industry trends, and consulting with financial advisors can help mitigate risks and inform investment decisions. Ultimately, whether to invest in Tesla stock depends on individual circumstances and objectives. If you believe in Tesla’s vision, are prepared for potential volatility, and have a long-term investment horizon, investing in Tesla could align with your investment goals. However, it’s crucial to approach such investments with caution and prudence.

Leave a Reply