We highlight the top three investment trusts to purchase right now for dividend income, global growth, and prospects in renewable energy.

We would undoubtedly invest some of our money in investment trusts if we were beginning as investors today. These have similarities with investment funds but differ structurally in some ways. Additionally, trusts frequently have lower costs, which is always a plus.

1. City of London Investment Trust

The first trust we’d like to talk about today has consistently raised its dividend for 55 years. This trust was established in 1860 and has participated in the stock market since 1932 in its current format.

As you might expect, this investment trust’s primary goal is to offer a steady income supported by long-term capital growth. The trust’s principal investments are in dividend-paying FTSE 100 firms.

As an illustration, among the top 10 holdings at the moment are British American Tobacco, Shell, the beverage juggernaut Diageo, and the pharmaceutical company AstraZeneca.

There is no assurance that the trust’s performance will repeat itself in the future. But given its long history, we’re optimistic that this tactic will keep working well.

2. Scottish Mortgage Investment Trust

The long-term emphasis on disruptive development firms of this trust is well known. Top stakes include Amazon, Tesla, the luxury conglomerate Kering, and the vaccine company Moderna.

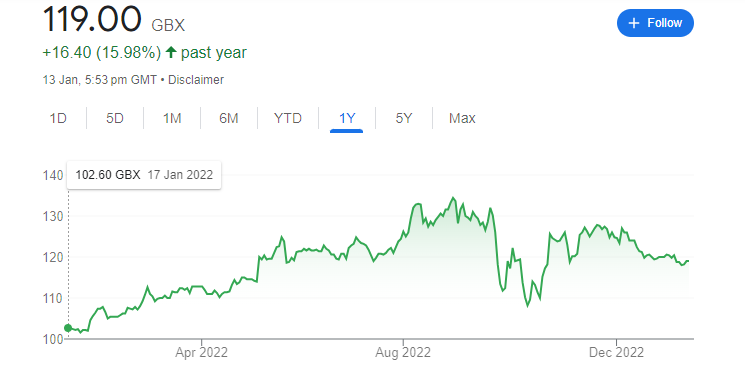

During the epidemic, the trust’s share price increased, but it has now fallen to more acceptable levels. We are beginning to believe that now might be a good moment to buy.

The management of Scottish Mortgage is exceptional in that it genuinely selects growth stocks by employing a specialised strategy. Even while their top holdings are well-known brands now, the trust frequently made its investments years ago, when the companies were much smaller.

Scottish Mortgage shares have increased by 360% over the past ten years, despite last year’s sell-off. According to us, investors in this situation need to have that kind of perspective.

We might not learn for many years whether Scottish Mortgage has effectively identified the following significant growth possibilities due to the trust’s long-term perspective.

We would devote a portion of our portfolio to Scottish Mortgage notwithstanding this risk. It is actually unusual and has a very strong track record.

3. JLEN Environmental Assets

This trust invests in several projects using renewable energy. Around 40% of the trust’s investments are in wind and solar, but it also has stakes in waste and bioenergy, anaerobic digestion, and a number of other expanding industries.

The trust is responsible for managing £12 billion in assets, including 3.1 GW of power generation capacity. There is considerable visibility for the upcoming years because fixed price agreements and subsidies support a large portion of its annual income.

In fact, subsidies also draw attention to danger. Governmental directives may alter. Future profits from these initiatives could be lower.

JLEN Environmental Assets, on the other hand, is led by knowledgeable managers and has been active in this industry for about ten years. In terms of renewable energy, that’s quite a while.

The dividend has increased annually since the trust’s IPO in 2014 thanks to management. Currently, the shares have a 6% yield. We’re considering making a purchase.

Leave a Reply