We are including these FTSE 100 stocks in our portfolio in the first month of 2023 after they underperformed in 2022.

According to our forecast, traders will fare better in 2023 than they will in 2022. As a result, we are searching for FTSE 100 equities to add to our portfolio this month.

The world markets suffered last year as a result of the war in Ukraine and rapidly rising prices. It’s highly improbable and not assured that these issues will be resolved this year. Here are three FTSE members who are firmly on our watch list, though.

1. GSK

GSK is our top option out of the group. Since the stock has decreased by about 10% over the past 12 months, a share would currently cost us about £14.30.

The thing we appreciate best about GSK stock is its dividend yield because the soaring inflation indicated above is probably going to continue into this year. This is currently just under 7%. This surpasses the FTSE 100 average even though it falls short of beating inflation.

Even if GSK’s stock price dropped in 2022, the company still reported some impressive outcomes. In Q3, sales growth increased by 9%. It also experienced a sizable decrease in its net debt.

We are interested in the shares for other reasons, such as the Haleon demerger. We like the way GSK is positioned, even though it may have challenges in 2023 as costs continue to rise as a result of inflation.

2. Lloyds

Our next stop is Lloyds. The stock had a horrible 2022, losing significantly more than 10%, much like GSK. In actuality, the past five years have not been good for the shareholders of Lloyds.

But we believe that right now might be a good moment to buy. First off, in the near future, rising interest rates will be advantageous for Lloyds. This enables the bank to charge clients more when they borrow money because rates are rising to combat inflation.

A P/E ratio of just 7.9 indicates that the company is also cheap. And we like Lloyds even more now that it has a 4.4% dividend yield.

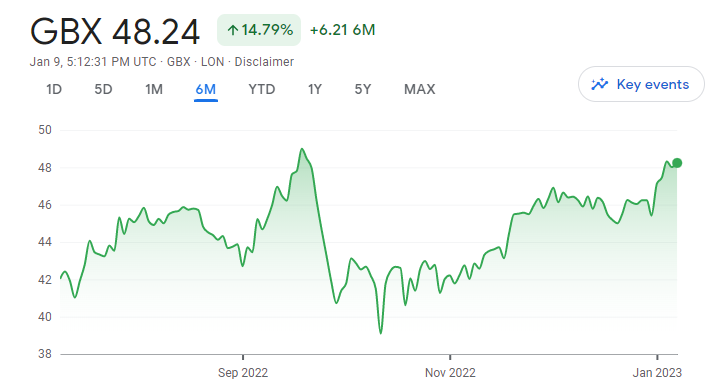

The current recession is the largest issue the company is now facing. In addition, it might suffer in its capacity as a mortgage lender. We will buy some Lloyds shares, though, for 48p per share.

3. Legal & General

Our list is completed by Legal & General. The stock has had a solid start to 2023 despite a 14% decline over the past year.

The company’s tremendous brand recognition is its main draw. Over 10 million people are currently its customers. Its powerful brand also gives them the capacity to draw in additional customers.

Impressive half-year results were reported by the company, which also saw increasing contributions to its five-year plan. One factor in this is the dividend payout, which is expected to total between £5.6 billion and £5.9 billion by 2024. Of course, it’s possible that this won’t happen, but with a yield of 9.3% and expansion ambitions, it’s still appealing.

As they continue to cut their budgets, the company might see that investors are reluctant to make investments. However, we believe the stock is a wise long-term investment.

Also read: 5 Stocks To Purchase In 2023 To Generate Passive Income