Today, a lot of investors overlook dividend stocks in favor of tech stocks. Ed Sheldon believes that now would be a good moment to make a purchase of the latter.

Investors from all around the world are rushing to purchase artificial intelligence (AI) equities at the moment. And that makes sense given that AI appears to have a significant impact on our lives in the years to come.

However, history demonstrates that when investors are pursuing hot growth equities, it is frequently a fantastic moment to be investing in more ‘boring’ dividend stocks. In light of this, here are three excellent dividend stocks to purchase right away.

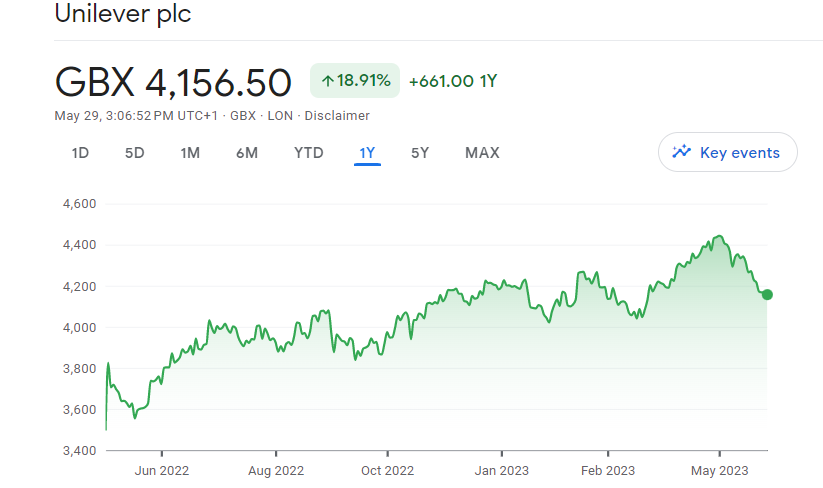

Unilever (LSE: ULVR)

Dove, Domestos, Hellmann’s, and a number of other well-known brands are owned by Unilever, a household name in the consumer goods industry.

There are a few reasons why stock purchases of Unilever have increased recently.

One is that because customers frequently purchase the company’s goods throughout the economic cycle, it is comparatively recession-proof. This is noteworthy because global economies are currently going through a considerable downturn.

Another is that many traders anticipate the stock to continue growing because it has been quietly rising over the past year. For instance, Jefferies recently increased its target price from 4,650p to 5,000p, or nearly 20% above the share price at the moment.

The danger here is inflation. Future profitability may suffer as a result.

However, we like the risk/reward setup given that the stock has a P/E ratio of 19 and offers a dividend yield of 3.6%.

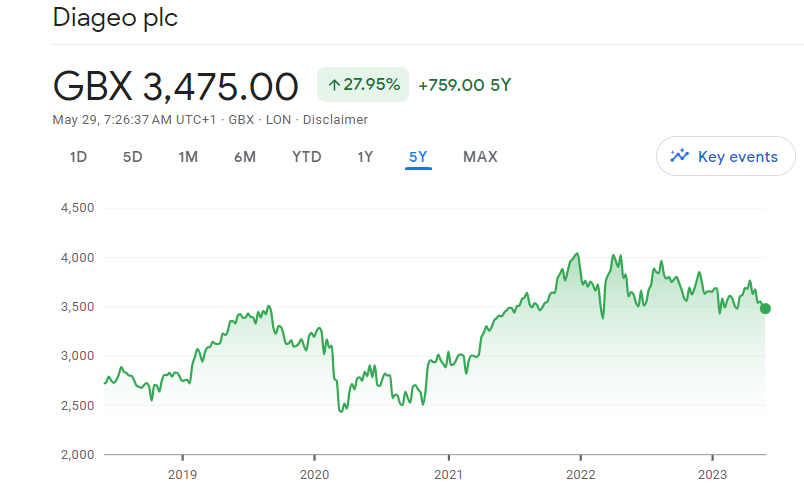

Diageo (LSE: DGE)

Diageo is another dividend stocks that we are thinking about adding to our portfolio right now. It is the proprietor of numerous other well-known spirits brands, including Tanqueray and Smirnoff.

One of the FTSE 100’s highest-quality stocks is typically thought to be Diageo. It has a fantastic long-term track record (20+ years of uninterrupted dividend increases), excellent brands, and good growth potential, and it is largely recession-proof. As a result, it has historically been a particularly well-liked stock.

However, shares of Diageo are currently trading around 15% below their record highs. Many investors appear to have lost interest.

This dividend stocks is currently at a fantastic price, in our opinion.

Yes, this location’s yield is not very high. It is only about 2.3% right now.

However, we believe there is potential for favorable overall returns in the coming years given that the company is expected to gain from growing wealth in emerging nations.

National Grid (LSE: NG)

National Grid is a third dividend stocks that has a lot of appeals right now, in our opinion. It is a utility firm that specializes in the distribution and transmission of gas and electricity.

Of the three stocks, this one provides the highest yield. For the fiscal year that concluded on March 31, the firm announced dividends of 55.44p per share, an increase of 8.8% over the previous year. That translates into a yield of almost 5.1% at the share price of today.

However, this stock offers more than just a big yield. It is protective in nature, much like Unilever and Diageo. Therefore, it is a stock that will help you sleep soundly at night.

It also offers room for expansion. The energy transformation is being driven by this company. And it anticipates producing strong earnings growth in the next years.

Debt is one concern to be aware of here. Net debt as of March 31 totaled £41 billion.

Overall though, we believe that buying National Grid stock now is a wise option.

How much money should I put into dividend stocks?

Concerns over US debt ceiling negotiations, greater UK inflation, and a recession in Germany have all contributed to a recent decline in UK equities.

Falling share prices offer opportunities even though these are market concerns. the chance to purchase at a discount and obtain higher dividend returns.

And that is helpful since today we are examining how much money we would need to put into UK equities if we wanted to quit our jobs and only live off dividends.

It will undoubtedly cost a lot of money. But how do we get there is the crucial question?

How does it work?

Owning a portfolio of dividend stocks that provides enough income to live on throughout the course of the year is the basic idea behind this method. This would then enable us to quit working.

First, we would wish to bundle our investments in an ISA. Because they are tax-free, dividends are received on shares held under an ISA. I get to keep everything if we can make £30,000 a year from stocks in an ISA.

But in order to create £30,000, we will need to invest a sizable sum of money in UK equities. The highest sustainable dividends, in our opinion, are currently around 8%.

Diversify risk, entails investing in a number of businesses that do not typically offer much in the way of share price increases but instead reward shareholders with big dividends. But this means that in order to hopefully earn £30,000 in dividends, we would need to invest £375,000.

How to get there

Very few people have the good fortune to have £375,000 in their bank account. That will seem like an impossible financial goal to many. However, it is feasible to grow a small pot of money into a much bigger one over time with frequent donations.

With 8% yields and a compound returns strategy, it would take 19 years to increase £35,000 to $375,000 in value. This entails reinvesting the dividends annually and making a consistent payment of £300 per month, with an annual increase of 5%.

Also read: Best Blockchain Stocks

Leave a Reply