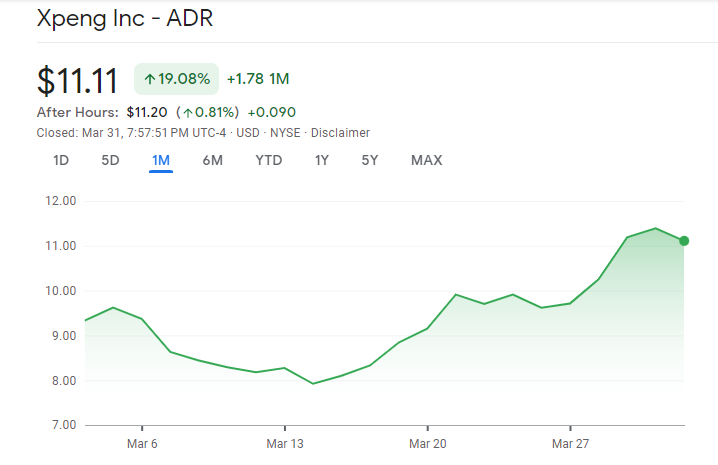

NIO and Xpeng Motors, two Chinese EV (electric vehicle) companies, will shortly begin shipping their March deliveries to us. Prior to the delivery report, Cathie Wood of ARK Invest had sold almost all of the Xpeng Motors shares.

Earlier this week, the ARK Autonomous Technology & Robotics ETF sold 226,727 shares of XPEV. Wood constantly rebalances her portfolio and has increased her holdings in Coinbase and Block following their declines.

To those who have been following the Chinese EV company’s recent delivery reports, Wood reducing the shareholding before the March delivery report may not come as much of a surprise.

In February, the company supplied 6,010 cars, and in January, 5,218. Its deliveries were below 10,000 in both months and decreased year over year. For the past several months, rivals NIO and Li Auto have outsold Xpeng Motors (NYSE: XPEV), and Li Auto’s cumulative deliveries now surpass XPEV.

According to Xpeng Motors’ forecast, the company anticipates a further miserable month.

In the first quarter, Xpeng Motors anticipates delivering 18,000–19,000 vehicles, which would represent a YoY decline of between 45% and 47.9%.

In the first two months of 2023, the business shipped 11,228 vehicles, and even the high end of the guidance suggests deliveries of 7,772 in March, which is roughly half of its March 2022 deliveries.

Xpeng Motors anticipates a decrease in deliveries

For context, NIO predicted Q1 2023 deliveries between 31,000 and 33,000, which would indicate a YoY rise between 20.3% and 28.1%. The upper limit of the forecast predicts deliveries of 12,337 vehicles in March.

NIO, a Chinese EV company, has developed a strong brand in the luxury market and is viewed by many analysts as a legitimate Tesla rival.

52,000 to 55,000 deliveries were anticipated by Li Auto for the first quarter of 2023. The top end of the estimate predicts deliveries of 23,239 cars in March, which would be a new monthly high for the Chinese EV company. It has already delivered 31,761 cars in the first two months of the year.

Investors have been alarmed by Xpeng Motors’ financial performance in addition to its delivery.

In Q4 2022, XPeng Motors reported revenues of $0.75 billion, a YoY decrease of 39.9%. The company’s revenues fell somewhat short of what experts had predicted due to a 43.1% decrease in vehicle sales revenue to $0.68 billion.

In the quarter, Xpeng Motors’ net losses also increased significantly to $0.34 billion. The losses were over twice what they had reported in Q4 2021 while being identical to those from the previous quarter.

Also read: How To Buy Tesla Shares – Complete Guide

EV startups are feeling the heat

In light of the intensifying competition and pricing war in the sector, startup EV companies have been feeling the pressure. Price pressure might make EV companies’ cash burn even worse, and they would need to raise money frequently.

The second offering of Nikola’s shares since last year was announced yesterday with a goal of raising $100 million. The situation is the same for other emerging EV startups, and Rivian, which is comparatively well-funded, just announced a $1.3 billion convertible bond issuance.

At the end of 2022, Xpeng Motors reported having $5.55 billion in cash and cash equivalents.

The decrease in deliveries has caused the company to lose market share.

Dr. Hongdi Brian Gu, co-President of Xpeng Motors, stated at the Q4 2022 earnings call that the firm aims to increase operational efficiency through cost reductions.

Autonomous Driving Advances at Xpeng Motors

Xpeng Motors has been making progress in its autonomous driving business despite its dismal delivery and financial results.

The company is presently providing Shanghai with its most recent driving assistance system. In the past, it was limited to Shenzhen and Guangzhou.

It began a trial program for Navigation Guided Pilot, a version of its semi-autonomous driving system, in September and referred to it as “China’s most advanced ADAS system for urban driving.”

Tesla, which offers both the Autopilot and its more advanced version FSD, also sees enormous prospects in the autonomous driving industry (full-self driving).

With regard to marketing its self-driving as “full” self-driving, which is potentially misleading because the system is not entirely autonomous as the name suggests, Tesla has been at odds with US regulators.

In the meantime, Musk predicts that the FSD will eventually cost $100,000 as opposed to its present $15,000 pricing.

Regarding Tesla’s software skills, many analysts are equally optimistic.

Regarding Xpeng, despite the company’s gloomy March delivery forecast, the markets would nonetheless closely examine the report for details on the sales of some of its new models and the outlook for second-quarter demand.

Also read: Three Best Investment Trusts To Purchase Right Away