Spirit Airlines stock has seen a dramatic decline in its stock value in recent days, primarily triggered by a court ruling blocking its proposed merger with JetBlue Airways.

As investors ponder whether to buy the dip, it’s crucial to delve into the complexities surrounding Spirit Airlines stock and evaluate the potential for a recovery.

Recent Events and Spirit Airlines Stock Performance

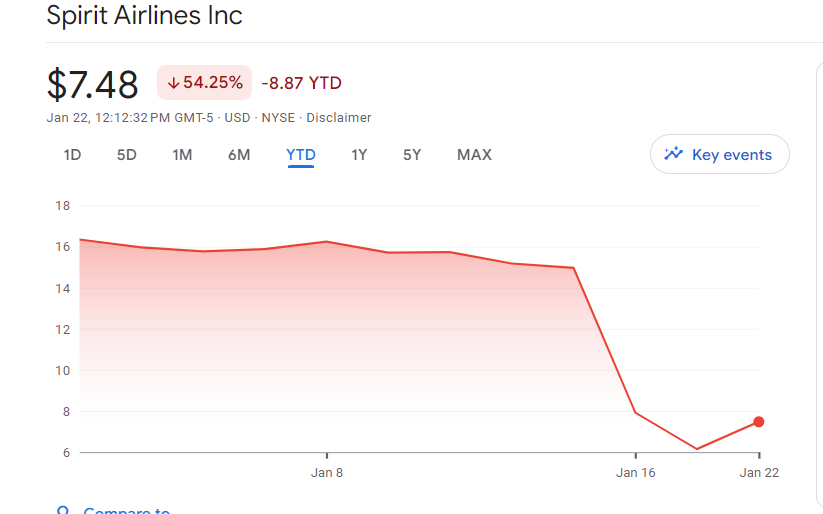

Spirit Airlines stock (NYSE: SAVE) has recently experienced a significant decline in its stock value, with a sharp drop of nearly 50% on January 16 followed by an additional ~24% decrease on January 17. The primary catalyst for this downturn was the U.S. Justice Department’s decision to block JetBlue Airways’ (NASDAQ: JBLU) proposed acquisition of Spirit Airlines, citing concerns over anti-competitive practices.

The rejection of the JetBlue-Spirit merger by U.S. District Judge William Young has cast a shadow over Spirit Airlines’ future. The judge’s decision emphasized the potential harm to consumers and the violation of antitrust principles. The market reaction was swift, with SAVE stock plummeting, while JetBlue’s stock saw a modest increase, reflecting relief that the $3.8 billion acquisition might be averted.

Analysts’ Perspectives on SAVE Stock

The rejection of the JetBlue-Spirit merger has raised concerns about the viability of Spirit Airlines as a standalone entity. Analysts, including those from Deutsche Bank and JPMorgan Chase, express skepticism about the company’s prospects, citing a low probability of the merger being consummated and limited valuation support for Spirit without the merger.

Moreover, TD Cowen analyst Helane Becker expresses a bearish perspective, envisioning Spirit Airlines filing for Chapter 11 and potentially liquidating its assets. The company faces significant challenges, including substantial debt and a questionable path to earnings recovery. Becker warns against overly optimistic expectations regarding the possibility of restructuring, suggesting limited scenarios that enable Spirit to navigate out of its financial woes.

According to data from TipRanks, analysts have assigned Spirit Airlines stock a “Hold” rating based on four Holds and one Sell rating in the past three months. The average price target for SAVE stock is $12.25, indicating a potential 64.2% upside. However, it’s crucial to interpret this with caution, as these projections may not fully account for the recent setbacks and uncertainties surrounding Spirit Airlines.

Key Concerns

- Bankruptcy Risk: The rejection of the merger deal has intensified concerns about Spirit Airlines’ financial viability. With substantial debt and limited options for refinancing, the possibility of bankruptcy looms large.

- Valuation Concerns: JPMorgan Chase analyst Jamie Baker highlights the lack of valuation support for Spirit in the absence of a merger. Investors should be cautious about assuming an automatic rebound based solely on a depressed valuation.

- Limited Options: Analysts, including Conor Cunningham from Melius Research, emphasize the challenging path ahead for Spirit Airlines. The “path forward for Spirit turns to survivability,” indicating that the company may face limited options to navigate its current predicament.

Spirit’s Response and Potential Scenarios

In a recent update, Spirit Airlines communicated its commitment to completing the deal with JetBlue and outlined its options in case the merger does not proceed. This announcement temporarily boosted investor confidence, leading to a 24% increase in Spirit’s stock value on Friday.

Despite the reassurance, challenges persist for Spirit, including the $1.1 billion debt due by 2025, an engine shortage linked to RTX issues, and potential weakening demand for travel due to economic uncertainties and higher interest rates. The company’s negotiations with RTX for compensation offer a potential source of liquidity, but the road ahead remains uncertain.

How has the Spirit Airlines stock performed today?

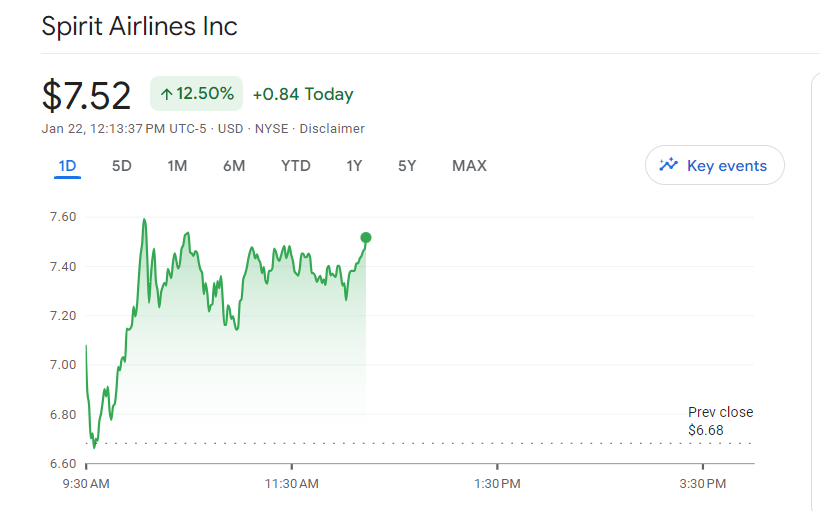

As of Monday’s trading session, Spirit Airlines stock demonstrated resilience in the face of recent challenges by recording a noteworthy gain in its stock price. The stock exhibited positive momentum, securing a modest increase, which translated into an impressive 12% rise over the previous day’s closing price.

This upward movement suggests that investors may be responding to recent developments or finding value in the stock, showcasing the dynamic nature of the market and the potential for sentiment shifts.

It will be interesting to observe how these fluctuations play out in the coming days and whether they indicate a more sustained trend in Spirit Airlines stock performance.

Should I buy Spirit Airlines stock?

Investing in Spirit Airlines stock at this juncture demands careful consideration of the risks and uncertainties outlined. While bargain hunting can be tempting, the bearish arguments presented by analysts and the company’s operational challenges suggest that the current situation may not be conducive to a quick rebound.

The potential for bankruptcy, limited restructuring scenarios, and the absence of a compelling case for SAVE stock make it a speculative investment at best. Investors should be cautious and weigh the ongoing developments, including any potential appeals by JetBlue and the broader health of the airline industry, before making any investment decisions.

In conclusion, while the recent uptick in Spirit’s stock value provides a glimmer of hope, the overall outlook remains clouded with uncertainty. Prudent investors should approach SAVE stock with caution and conduct thorough research, recognizing the risks inherent in the airline industry and the specific challenges facing Spirit Airlines.

Also read: Best Airline Stocks You Should Buy in UK

Leave a Reply