Commercial passenger flights started more than a century ago, but it has only lately become possible to invest in airline stocks. Currently, there are several airline share options available to investors on the London market.

In this guide, we will discuss the best UK Airlines stocks for 2022, along with information on how to invest in them.

Best Airline Stocks 2022

Here is a list of the best Airline stocks for 2022:

- International Consolidated Airlines (LON: IAG)

- easyJet (LON: EZJ)

- Wizz Air (LON: WIZZ)

- Jet2 (LON: JET2)

- Tui (LON: TUI)

- Southwest Airlines Co. (NYSE: LUV)

- Delta Air Lines, Inc. (NYSE: DAL)

- United Airlines Holdings, Inc. (NASDAQ: UAL)

- SkyWest, Inc. (NASDAQ: SKYW)

- Volaris (NYSE: VLRS)

Best Airline Stocks Analysis

International Consolidated Airlines (LON: IAG)

As a component of the Conservative government’s wave of state-owned company private enterprises in 1987, British Airways was launched on the stock market. British Airways with Iberia, the Spanish flag airline, merged to establish International Consolidated Airlines (IAG) in 2011. The Irish airlines Aer Lingus was soon added to the group’s operations.

The company transported 118 million people in the year before the Covid-19 pandemic. Its IAG Cargo division, which runs a vast airfreight network, provides additional diversification. Over 10,000 enterprises are served by this.

On the London Stock Exchange, IAG is the largest airline stock. With its several passenger brands and air freight operations, the firm also has the greatest level of diversification.

The share price of International Consolidated Airlines has had a dismal 2022 thus far, declining 30% during the previous 12 months. However, it improved in July, rising 10% in that month.

We do believe that as the year goes on, the share price of IAG could rise even further. It certainly appears that demand for air travel is rising. And assuming the UK’s challenging inflation doesn’t significantly hamper it, we believe the second half might be robust.

easyJet (LON: EZJ)

The company EasyJet has lately been in the news for all the bad reasons. Cancelled flights and lengthy delays have been a result of the carrier’s inability to keep up with the spike in interest for its operations over the past several weeks.

Before the summer, the group needs to organize its affairs. The management expects to operate 97% of 2019 capacity in the fourth quarter, up from about 90% in the third, according to its most recent trading update. Bookings for the summer are roughly 6% higher than they were in 2019.

These statistics suggest that EasyJet’s revival is trailing behind that of Wizz and Jet2. Infighting with the company’s founder, Stelios Haji-Ioannou, and a heavy debt load could potentially keep management off-balance.

Wizz Air (LON: WIZZ)

Wizz’s balance sheet is likewise quite cash-rich. The low-cost carrier reported having €1.4 billion in cash at the end of December 2021, which gave it lots of financial flexibility and capacity to continue to develop its network across Europe.

The company recorded an average ticket revenue per client of €33.10 in the six months ending in September. This investment appears to be profitable. It transported 4.1 million consumers in May, a 390% increase over the same month last year, and its load ratio was 84.2%. This year, the Wizz Air expects to fly 30 percent more passengers than it did in 2021.

With ambitions to significantly increase its presence in the coming months and years, Wizz appears to have no limits. The low-cost airline secured a contract last month to look into adding routes to Saudi Arabia.

The airline asserts to have the lowest CO2 emissions among all of its rivals. This could provide you a competitive edge in a world where people are becoming more concerned with their carbon footprints.

Jet2 (LON: JET2)

Jet2 went above and beyond to assist its clients when the pandemic occurred. The company was ranked first for refunds in 2020 in a MoneySavingExpert.com study of more than 77,000 travelers who had canceled their vacation plans. Following an assessment by the UK Civil Aviation Authority, Jet2.com was also regarded as the only airline in the UK to rapidly issue refunds without accumulating substantial backlogs (CAA).

The most recent trading update from Jet2 demonstrates that the manner the company handled its clients during the worst of the pandemic is now paying off.

The number of seats available for purchase this summer is around 14% higher than it was last year. In contrast to a 14% increase in seat capacity, average load factors—a vital indicator of how full a company’s aircraft are—for the summer 2022 season are now only 2.5% behind summer 2019 at this stage. Additionally, booking momentum is increasing, and pricing is “strong.”

Notably, Jet2 has more than £1 billion in cash on hand to handle any unexpected events.

Tui (LON: TUI)

Before the epidemic, Tui, the largest travel business in Europe, had already drawn criticism for utilizing off-balance sheet arrangements to conceal debt. The German government then saved it four times, not just once. Each influx of cash had its own set of restrictions.

The more than €4 billion in public subsidies that Tui received will now begin to be repaid, but this could take some time. In addition to announcing the payback, the group provided an update that revealed summer vacation attendance was already at 80% of that of 2019. Based on these patterns, management anticipates that trading will stabilize this year.

Tui, like EasyJet, is featured in the media, but for the wrong reasons. Flight cancellations and rescheduling by the biggest travel company in Europe have caused havoc for travelers in the UK.

Southwest Airlines Co. (NYSE: LUV)

Southwest Airlines Co. operates as a passenger airline and offers international and domestic air transportation services. The portfolio of the airline included 728 Aircraft 737s as of August, 2022. Southwest Airlines Co. ranks highly among the finest airline stocks to purchase right now since it is one of the biggest low-cost carriers in the world and one of the major airlines in the United States.

On May 2, a Citi analyst reiterated a Neutral rating for Southwest Airlines Co. and increased his price target from $48 to $53. The analyst told investors that he believes Southwest Airlines Co. is well-positioned to sustain profitability in 2022 and beyond, pointing to the company’s good Q1 results and positive Q2 outlook.

The interests that hedge funds have in Southwest Airlines Co. are growing. The company was staked by these funds for a total of $1.08 billion. 38 holdings with a combined stake value of $682,03 million were held in the previous quarter. The stock is receiving favorable feedback from hedge funds.

Southwest Airlines Co. saw a 73% increase in PAR Capital Management’s prior holdings in the first quarter of 2022. The value of the fund’s holdings in the business as of March 31 was $158.21 million, or 3.78% of its 13F portfolio.

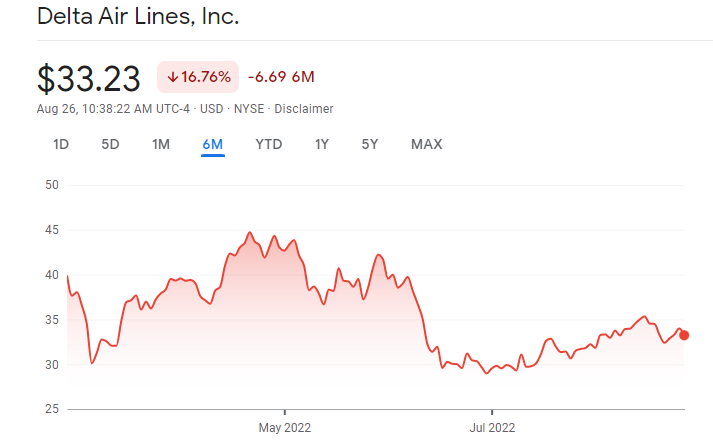

Delta Air Lines, Inc. (NYSE: DAL)

One of the greatest airline stocks to purchase is Delta Air Lines, Inc., a legacy airline operator and one of the biggest airlines in the United States. The company provides regular international and local shipping services and passenger service. In June, a Goldman Sachs analyst confirmed her Neutral rating for Delta Air Lines, Inc. while increasing her price objective from $44 to $45 on the stock.

On April 13, Delta Air Lines, Inc. disclosed its financial performance for Q1 of fiscal 2022. Despite posting a $1.23 loss per share, the company outperformed forecasts by $0.04. The company’s $9.35 billion in revenue, up 125.25% year over year, was $312.45 million higher than expected by Wall Street. The stock also seems to be undervalued. With a forward PE ratio of 13.96 and a share price of $39 as of June 7, Delta Air Lines, Inc. has increased 2.52% over the past six months. The airline company is worth $24.71 billion.

The largest stakeholder in Delta Air Lines, Inc. as of Q1 of 2022 is Millennium Management. According to reports, the fund increased its holdings in the company by 72% from Q4 2021 to Q1 2022, totaling $170.27 million.

United Airlines Holdings, Inc. (NASDAQ: UAL)

Asia, Europe, North America, Africa are all served by United Airlines Holdings, Inc.’s air transportation services. The firm released its fiscal 2022 first quarter results on April 20. The company recorded a $4.24 loss per share and undershot analyst expectations for EPS by $0.02. Although growing 134.90% year over year, the company’s quarterly sales of $7.57 billion fell short of analysts’ projections by $110.28 million.

United Airlines Holdings, Inc. is one of the greatest airline stocks to purchase right now despite experiencing a terrible quarter since it is actively participating in the airline sector. The business reportedly set aside $100 million in June to support the growth of a pilot training facility in Denver. This year, the business plans to hire about 2,000 new pilots.

The largest shareholder of United Airlines Holdings, Inc. as of March 31, 2022, is PAR Capital Management, which is the owner of 3.1 million shares of the firm. The fund’s entire stakes were worth $143.71 million, or 3.43% of its investment portfolio.

SkyWest, Inc. (NASDAQ: SKYW)

Through its two business sectors, SkyWest Airlines and SkyWest Leasing, SkyWest, Inc. operates as a regional airline in the United States. As of December 31, 2021, the business’s portfolio of 629 aircraft performed a total of almost 2,000 flights every day to locations in the US, Canada, Mexico, and the Caribbean. Additionally, the business provided scheduled passenger and aviation cargo services.

SkyWest, Inc. is a good airline stock to buy right now since it is one of the few airline firms that can boast a solid financial sheet. SkyWest, Inc. surpassed both the EPS and sales forecasts when it reported its quarterly earnings for Q1 of fiscal 2022 on April 28. The company’s $0.35 per share earnings per share above forecasts by $0.36. Additionally, the company’s revenue came in at $735.15 million, beating projections by $35.52 million and increasing by 37.53% year over year.

SkyWest, Inc. is receiving an influx of hedge funds. 22 hedge funds had positions in SkyWest, Inc. at the end of Q1 2022, totaling $87.98 million. In Q4 2021, there were 16 positions with stakes totaling $30.84 million. The stock is receiving favorable feedback from hedge funds.

The largest stakeholder of SkyWest, Inc. as of the first quarter of 2022 is Arrowstreet Capital. The fund increased its holdings in the world’s largest airline by 188% in Q4 2021, increasing them to $13.97 million in Q1 2022.

Volaris (NYSE: VLRS)

Another major airline that offers an appealing entry point for investors wishing to go into the aviation sector is Volaris. The business is a top international supplier of air transportation services for people, goods, and mail. 15 hedge funds had investments in Volaris totaling $337.38 million at the end of the first quarter of 2022. 16 hedge funds held holdings worth a combined $305.94 million in the preceding quarter.

Volaris released traffic statistics for May 2022 this June. The company claimed that demand had increased by 12.3% over the previous year and capacity had increased by 12.4%. According to Volaris, the number of passengers it carried increased by 17.5% in May to 2.5 million.

As of Q1 of 2022, Teewinot Capital Advisers had more than 6.12 million shares in Volaris, making it the company’s largest shareholder. The value of the fund’s interest in Volaris is $111.48 million, or 32.73% of its total investment portfolio.

How to buy Airline Stocks?

In the sections below, we’ll show you how to invest in Airlines Stocks.

Step 1: Choose a broker

Finding a broker who can assist you with your transaction is the next step after choosing which airline stocks to purchase. In the sections below, you’ll find a small list of regulated brokers that let you purchase airline stocks without paying a commission.

1. eToro

With more than 20 million clients, eToro is a licensed online broker. You can buy airline stocks with confidence because the platform is governed by the SEC, FCA, ASIC, and other reputable organizations. Upwards of 2,500 equities from 17 distinct global markets are available to you at eToro. This implies that a large range of airline stocks, including all of the suggestions on this page, are available for purchase and sale. No matter how much your preferred airline stock is presently trading for, you only need to spend $50.

All stocks are offered for purchase on eToro with no commission. Along with individual businesses, eToro offers airline stock ETFs. eToro offers commission-free ETF trading with a $50 minimum investment.

There are no fees for US investors, and the minimum deposit is $50. If not, all you need to do is pay a conversion fee of 0.5 percent to change your local currency into US dollars. After creating your account, you ought to take a look at the eToro Copy Trading tool, which enables passive investing. Because the platform was created with beginners in mind, eToro is a fantastic alternative if you want to buy airline stocks conveniently.

Learn more: eToro Broker Review UK 2022 – Complete Guide

2. Capital.com

On Capital.com, you can buy airline stocks as a CFD instrument. This suggests that you won’t actually own the stocks. Instead, you will be making trades by speculating on whether the value of the airline stocks will increase or decrease. Having access to short-selling tools is essential when trading airline stocks because this area of the financial markets is now extremely volatile.

In other words, you can utilize the Capital.com platform to short-sell an airline stock if you think it is dead in terms of its financial health and viability as a going concern. You can leverage your airline stock investments on this CFD trading website, which makes it quite alluring. There will be restrictions, and they will change based on your location. However, Capital.com offers leveraged or unleveraged airline stock trading for 0% commission.

The minimum deposit amount at Capital.com is determined by the payment method you select. Bank wires demand a minimum of $250, while debit/credit cards and e-wallets only require $20. Capital.com is licensed by the FCA, CySEC, ASIC, and the NBRB, so you can be confident in its security. Capital.com allows you to open an account in minutes, either online or through the platform’s investment app.

Learn more: Capital.com Broker Review UK 2022 – Complete Guide

Step 2: Create an account

The steps using FCA broker eToro, which has all of the best airline stocks to buy that we’ve mentioned in this article, are outlined in this guide.

As with all UK brokers governed by the FCA, the first step is to create an account with eToro. Downloading the eToro stock trading software will allow you to trade stocks on your phone.

eToro will need to know some of your personal data when you begin the registration process on the main website.

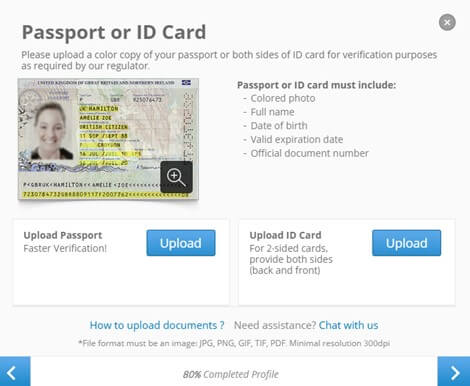

Step 3: Confirm Identity

At some point, you’ll need to upload certain verification documents. You must finish this before you may withdraw money, so do it right away.

All that is left to do is upload the following two files:

- valid driver’s license or passport

- bank statement or a utility bill

Step 4: Make a Deposit

Your freshly created eToro account needs to be funded right away. The broker requests a $50 (about £145) minimum deposit.

In the UK, you can pay using a variety of methods, including debit/credit cards, Paypal, Skrill, Neteller, and bank transfers.

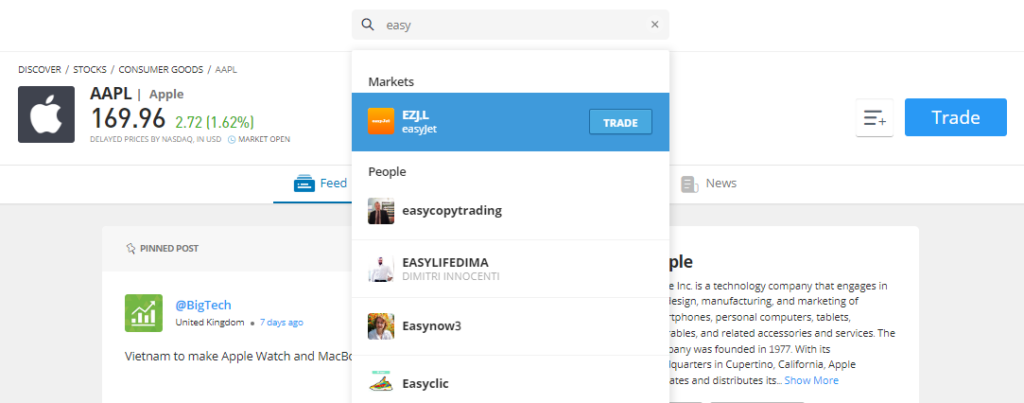

Step 5: Search for Airline Stocks

The easiest way to buy airline stock is to search for it if you already know which one you want.

Choose the ‘Trade Markets’ tab, then ‘Stocks’ if you’re unsure which airline stock to purchase. You may browse the many airline stocks that eToro supports by selecting the relevant exchange.

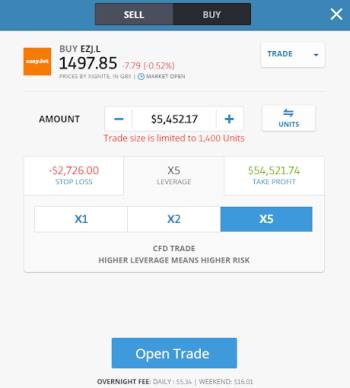

Step 6: Place an Order

When you click the ‘Trade’ button next to the airline shares you want to purchase, an order form will appear.

You must state your position in this section, which must be expressed in US dollars even if the equities are listed on the London Stock Exchange. Once more, the eToro minimum stock trade is $50.

Just click the “Open Trade” button to finish the deal.

Conclusion

Finding the finest airline stocks to buy at the moment can be challenging. After all, a sizable chunk of the sector is still experiencing the effects of COVID-19, including the global lockdowns and travel restrictions that resulted from it. Nevertheless, there is still a tonne of great deals out there, as several airline stocks are currently trading at reasonable starting points.

If you want to purchase airline stocks immediately and are aware of the companies that best match your investment objectives, you might prefer to complete the transaction at the licensed broker eToro. All stock investments are commission-free and have a $50 minimum investment requirement. eToro also provides airline stock ETFs, which are excellent for diversification.

Frequently Asked Questions

Do airline stocks have an exchange-traded fund?

Yes, only airline equities are included in the United States Global JETS ETF’s investments. A little over 40 international airline businesses are held by the ETF in question.

Is short-selling airline stocks a possibility?

Yes, you can use a CFD instrument to short-sell an airline stock if you think the company will collapse. On capital.com and eToro, sell orders can be used to short airline stock CFDs.

What further airline stocks exist?

Among the other airline equities that are offered are those of Boeing, Allegiant, Ryanair, Alaska Air, and many others.