The unique technique of algorithmic trading eliminates the emotional component of trading, which can limit the performance of even the most seasoned traders. In this method, prospective trading signals are identified using technology and robust artificial intelligence, and trades can be opened and closed by bots automatically depending on parameters from human users.

The best algorithmic trading platforms will be discussed in this article, but first, let’s understand what algorithmic trading is all about and what the benefits and drawbacks of using it are.

What is Algorithmic Trading?

As an occupation, trading demands a lot of endurance, perseverance, and patience. The traders must maintain an intense focus on their trades and refrain from daydreaming. Every trader is mindful that he must remain calm and focused, yet many times, traders allow mental and emotional factors to mislead them, which results in unfavourable conclusions. The development of technology has made it possible to deal with these inevitable human faults. Trading with algorithms accomplishes the same goal.

The process by which computer-generated algorithms are employed to execute transactions is known as algo trading or algorithmic trading. A system of established rules is used to make trades. Algorithms are used to design the trading software with the trading instructions, which take into account variables like time, volume, and price. The computer then executes the deal in accordance with the directives provided to it. Algorithmic trading is hence quite accurate, well-executed, well-timed, and free from the majority of potential human errors.

The algorithms can be developed with little or no human involvement. Zero-touch algorithms are referred to regarded as such. The trading software has these programs pre-entered, and trades are conducted as soon as an opportunity is noticed. There is no human control or interference throughout the entire process; it happens instantly.

The alternative approach to algo trading, however, requires greater human involvement. Application Programming Interfaces are the name of it. In this instance, the traders decide the approach they wish to use in a particular scenario. The trade is then carried out based on the information collected through the API after the software is taught appropriately.

How Does Algorithmic Trading Work?

Algorithm trading is a cutting-edge trading strategy that makes use of algorithms as a pre-set list of instructions. These algorithms or instructions are carried out by the system to generate a wide variety of data. The programme collects trading signals, and based on those signals, makes and executes trading orders.

Since inherent inefficiencies are not a factor, algo trading operates extremely effectively. The traders are not required to stare at their computer screens nonstop. The algorithm automatically recognizes when the predetermined criteria are satisfied and alerts the trader to purchase or sell. Thus, the trader need not continue to be involved in the tedious tasks and only contributes significantly to the crucial step of strategy building.

Types of Algorithmic Trading Systems

Financial professionals and developers have created cutting-edge solutions for you to automate your investing decisions in response to the rising demand for Algo trading systems.

To help you identify the best algorithmic trading platform for your needs, we provide an overview of the most popular software categories in this section.

Copy Trading

The source is not automated, but the copy-trading elements of the copier are. A copy portfolio can be characterised as an algorithmic trading strategy since it will be revised as soon as the reference portfolio is changed.

A number of platforms have created copy trading services to make the process of building a portfolio simpler for newcomers who would rather draw on the knowledge of more seasoned market players than do it alone.

Bots

A bot is computer software created to carry out trades automatically using a set of criteria provided by a human trader.

A bot’s advantage is that it can conduct trades accurately and in accordance with a strategy, doing away with the psychological and emotional factors that can affect even the most seasoned traders’ performance.

Best Trading Platforms for Algorithmic Trading

There are numerous trading systems that allow you to trade using algorithmic trading. However, not all platforms that provide access to Algorithmic Trading are trustworthy. When selecting a Algorithmic trading platform, there are a few key factors to consider. However, going through all of this can be time-consuming and stressful. As a result, in order to save you time and energy, we have compiled a list of the finest trading platforms available in the market today for Algorithmic Trading.

1. eToro

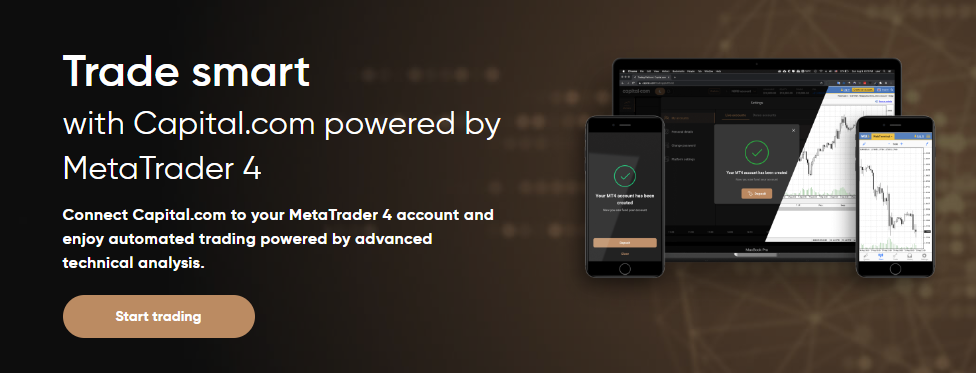

Over 12 million customers from around the world utilize the international brokerage eToro. It boasts one of the most varied portfolios on the market, with stock indexes, individual stocks, commodities, exchange-traded funds, as well as stocks from dozens of other exchanges and cryptocurrencies like Bitcoin (ETFs).

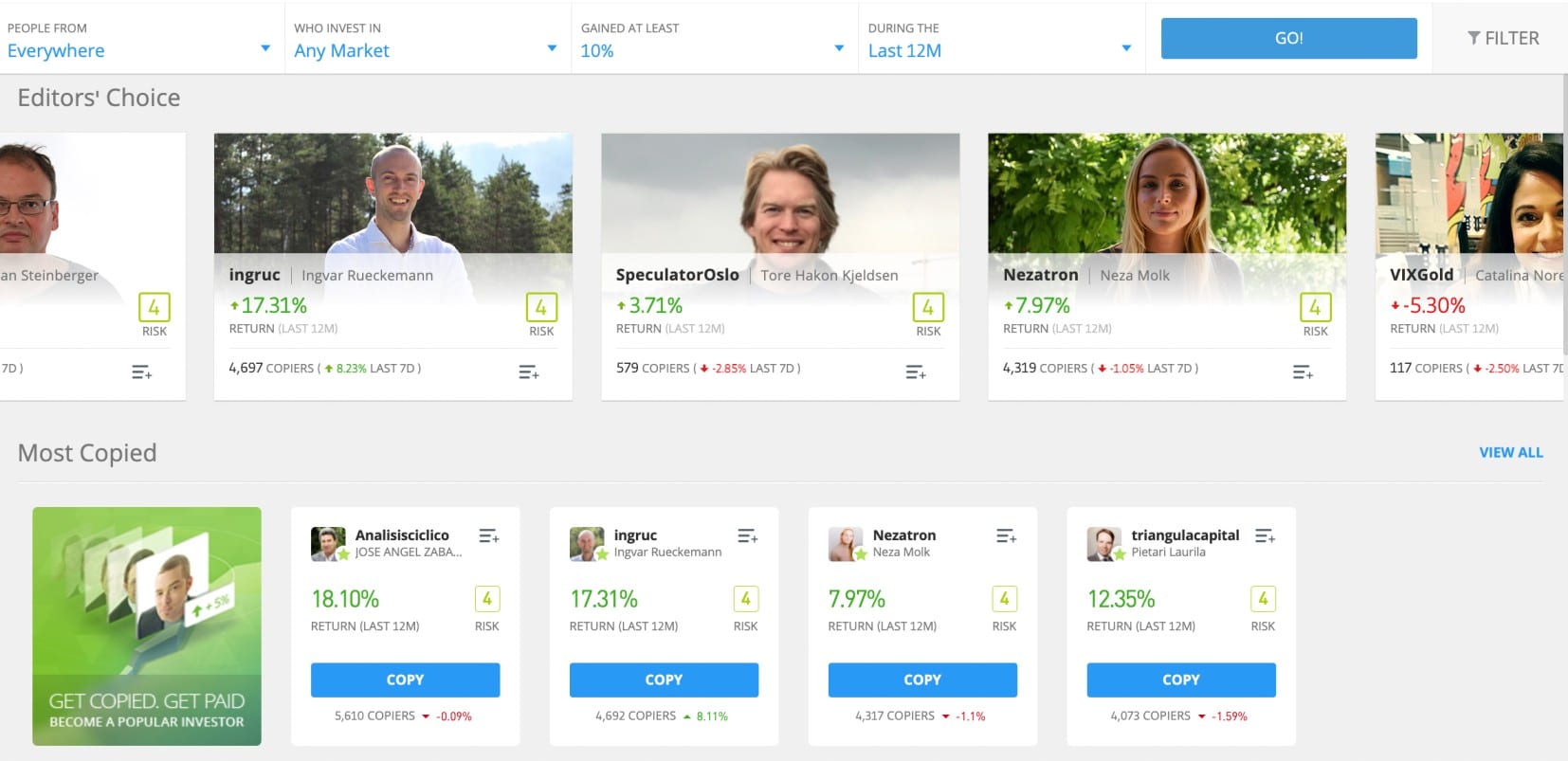

Despite not being a true algorithmic trading platform, eToro does provide a feature that serves as an autonomous trading service. Through copy trading and copy portfolios, eToro users can create a free portfolio that duplicates the assets of other members on the platform.

Copies of another user’s portfolio can be made in a matter of seconds and are quite easy to do. The system will execute the transactions necessary to construct that portfolio, much like an algorithmic trading system, and eToro users can choose how much of their account balance they wish to invest into that portfolio.

Investors have the choice of either copying the portfolio of another individual or investing in portfolios that reflect a certain trading strategy. Each of the choices will have a risk score shown, and visitors may learn more about the portfolio’s past performance, its structure, its approach, and the number of investors who have imitated it.

2. Capital.com

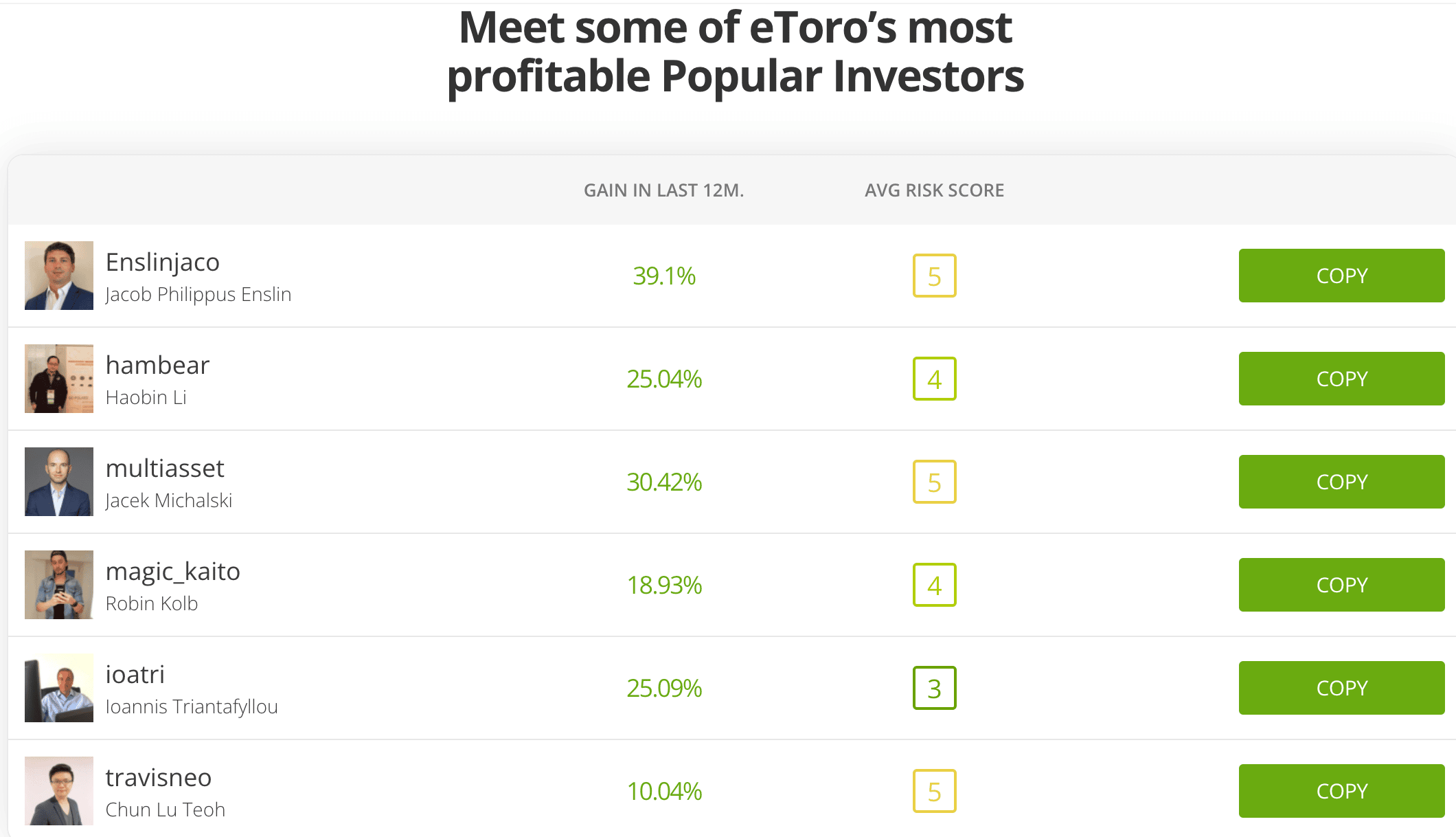

One of the best algorithmic trading platforms in the world, Meta Trader 4, is integrated into the Capital.com CFD trading platform for its users. MT4 offers desktop, mobile, and web-based versions of its systems that are easily downloadable and installable on a range of operating systems.

After logging into Capital.com, users can establish or register for an MT4 account. Once logged in, the MT4 interface will instantly establish a connection with Capital’s, enabling users to start trading.

The MT4 platform comes with numerous pre-installed indicators for identifying trading signals, and customers can use the Expert Advisors function to follow algorithmic trading techniques.

The platform also supports commodities, digital currencies (like Ethereum), and international stock indices, among other goods and financial asset classes. You need to fund your account with this supplier with a minimum deposit of $20.

3. Pionex

A Singapore-based algorithmic trading platform called Pionex has been in operation since 2019. The platform offers 16 cryptocurrency trading bots that work for you to create the most profitable trading strategies.

Since Pionex is a cryptocurrency-based network, trading fiat money is not possible. However, the network offers a wide variety of coins to trade, including some of the most well-known ones, such as Shiba Inu, Ether, and Dogecoin. Each cryptocurrency has a different minimum deposit and withdrawal value, and you may check the information on the Pionex website.

One of the most economical algo trading systems available is this one. To open an account, you don’t need to make any deposits, and Pionex charges just 0.05 percent for every trade, which is among the lowest trading fees in the business.

Pionex offers a mobile trading app for iOS and Android phones so you may trade wherever you are in addition to a PC version. You won’t have any trouble choosing a trading bot and opening an account because the UI is clear and easy to use. You can also choose to trade manually instead of using an algorithm.

Pionex is a secure algo trading program, to sum up. It shares the same MSB (Money Services Business) license as Binance and Huobi, two of the most well-known cryptocurrency exchanges. Pionex is also the only cryptocurrency trading platform with internal crypto trading bots that have been granted this US license. So it comes as no surprise that Pionex offers all of the best cryptocurrency trading bots available.

4. Interactive Brokers

/interactive_brokers_productcard-5c61eec746e0fb0001f25462.png)

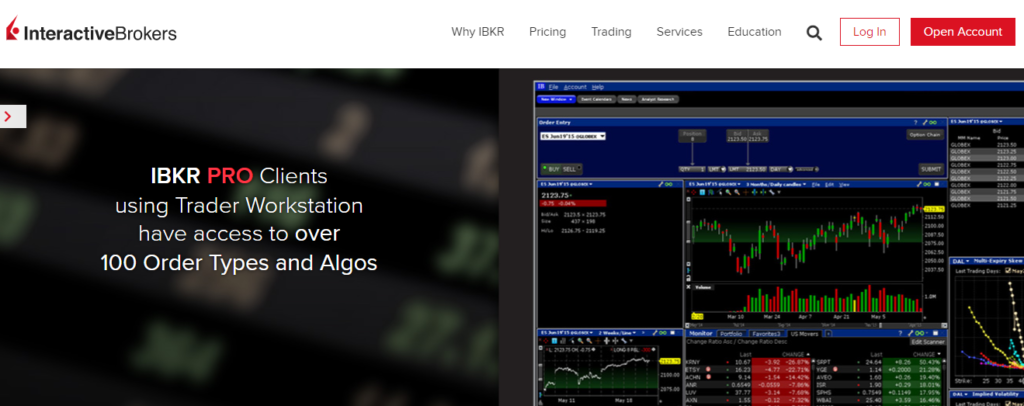

A respected brokerage firm with its headquarters in Connecticut, Interactive Brokers was established in 1977. With access to 150 marketplaces, it’s one of the most used platforms for paper trading. Additionally, it is among the least expensive brokers for algorithmic trading.

IBKR Lite and IBKR Pro are the two account types offered by Interactive Brokers and both support algo trading. IBKP Lite is a cost-free account that has no commission charges, a low minimum balance, or inactivity fees. However, there can be extra charges if you use an algorithm. IBKR Pro is only available to professional traders and has no minimum balance requirements or maintenance costs. The commission fee structure, which features tiered set pricing, is somewhat complex.

The large selection of assets that Interactive Brokers offers is one of the factors that make it the ideal brokerage for algo trading. Forex, stocks, options, futures, bonds, mutual funds, and a variety of other assets can all be traded.

You can choose the asset you want to trade using Interactive Brokers, then create a strategy. Accumulate/Distribute algo, Arrival price, Adaptive algo, Close price, and other algo strategies are only a few of the algo strategies offered by Interactive Brokers. Additionally, it offers algorithmic order types from outside vendors like Quantitative Brokers, Fox River, CSFB, Jefferies, and (QB).

Additionally, Interactive Brokers provides a variety of solutions for educating aspiring traders. You can view the Traders’ Academy and the IBKR Campus provided in addition to the usual classes and webinars.

5. Bitcoin Prime

Bitcoin Prime is promoted as cryptocurrency-specific trading software. This Algo trading software touts being entirely automated and uses cutting-edge AI to support passive trading.

Its in-house algorithm is able to scan the markets, compile useful information, and make trading decisions on your behalf. According to the Bitcoin Prime website, you don’t need to manually set any parameters. However, you will be able to alter the settings as necessary.

Bitcoin Prime might be among the greatest algorithmic trading platforms for novices if its claims are true. To check open positions, users only need to spend 20 minutes every day on the auto trading platform.

We were unable to backtest or verify this comparatively new algorithmic trading software, nevertheless. According to the Bitcoin Prime website, it works with margin trading, including CFDs and perpetual futures pairings, and supports more than 20 cryptocurrencies.

Additionally, the Algo trading platform makes the claim that it uses a number of brokers to carry out those trades. Bitcoin Prime requires a minimum investment of $250.

Advantages of Algorithmic Trading

Algorithmic trading has a number of benefits over regular trading techniques. Here are some benefits of algorithmic trading:

Increased Speed

One of the most significant advantages of algorithmic trading is the speed it offers. The algorithms have the ability to rapidly assess a variety of technical indicators and factors before executing the transaction. The increased speed becomes essential since it enables traders to respond swiftly to changes in the market.

More Accuracy

Algorithmic trading also has the enormous advantage of requiring little to no human participation. This suggests that the likelihood of errors has been significantly decreased. In order to ensure that human errors do not damage the algorithms, they are double-checked. Although it is conceivable for a trader to err and analyze the technical indicators inaccurately, under ideal conditions, computer systems do not. Thus, the trades are carried out with the highest level of accuracy.

Decreased Cost

Algorithmic trading makes it possible to complete a lot of transactions quickly. As a result, several trades are carried out, and the transaction costs are reduced.

Minimization of human emotions

The reduction of human emotions is the main benefit of algorithmic trading. Since the tactics have already been developed, there is no opportunity for the traders’ emotions to influence their decisions. When the pre-required objectives are achieved, the trade is instantly performed; the trader is not given the chance to reconsider or question the trade. Both undertrading and overtrading are controlled by algorithmic trading. The psychological components of the trade are eliminated, and any departure from the initial strategies is impossible.

Ability to Backtest

Using past data, the recently created algorithms are first backtested. This helps to ascertain whether or not the plan will succeed. Based on the results of the backtest, the strategy can be modified and improved to suit the demands of the trader.

Risks of Algorithmic Trading

Algorithmic trading has numerous advantages. However, there are several drawbacks that traders should be aware of. The trading process has become overly reliant on technology, and any failure in technology causes the wheels to screech to a halt. Some of the disadvantages of algorithmic trading are listed below.

Dependence on Technology

The biggest drawback of algo trading is how heavily it relies on technology. In many circumstances, rather than being stored on the server, the trading orders are kept on the computer. This implies that the order won’t be transmitted for execution if the internet connection is lost. This undermines the basic tenet of algo trading. In such circumstances, the traders can lose money since they miss out on the opportunity. Algorithmic trading has serious systemic vulnerabilities that could lead to huge flash crashes of the entire market.

Loss of Human Control

Algorithm trading is entirely automated. Humans are not given the option of making any discretionary decisions. Even if a trader recognizes before the order is executed that the technique would not work in the given scenario, he lacks the ability to cancel the program and halt the deal. Even if the program runs in an unfavorable direction for the trader, there is no way to stop it and manage the losses.

Constant Monitoring is required

Algo trading is regarded as having pre-set algorithms that allow traders to be away from their computers for extended periods of time. The truth, however, is different. The trader must continue to keep an eye on the system for any potential mechanical problems, such as connectivity problems, power outages, etc. The strategies are built into the servers, but they still need to be watched over to make sure they work as intended. Monitoring the algorithms is also necessary to make sure that there are no duplicate, incorrect, or missing commands.

How to Start Algorithmic Trading?

Are you prepared to begin using Algorithmic trading? If that’s the case, this section will walk you through the process of starting a copy trading account with eToro, one of the finest Algorithmic trading platforms for beginners.

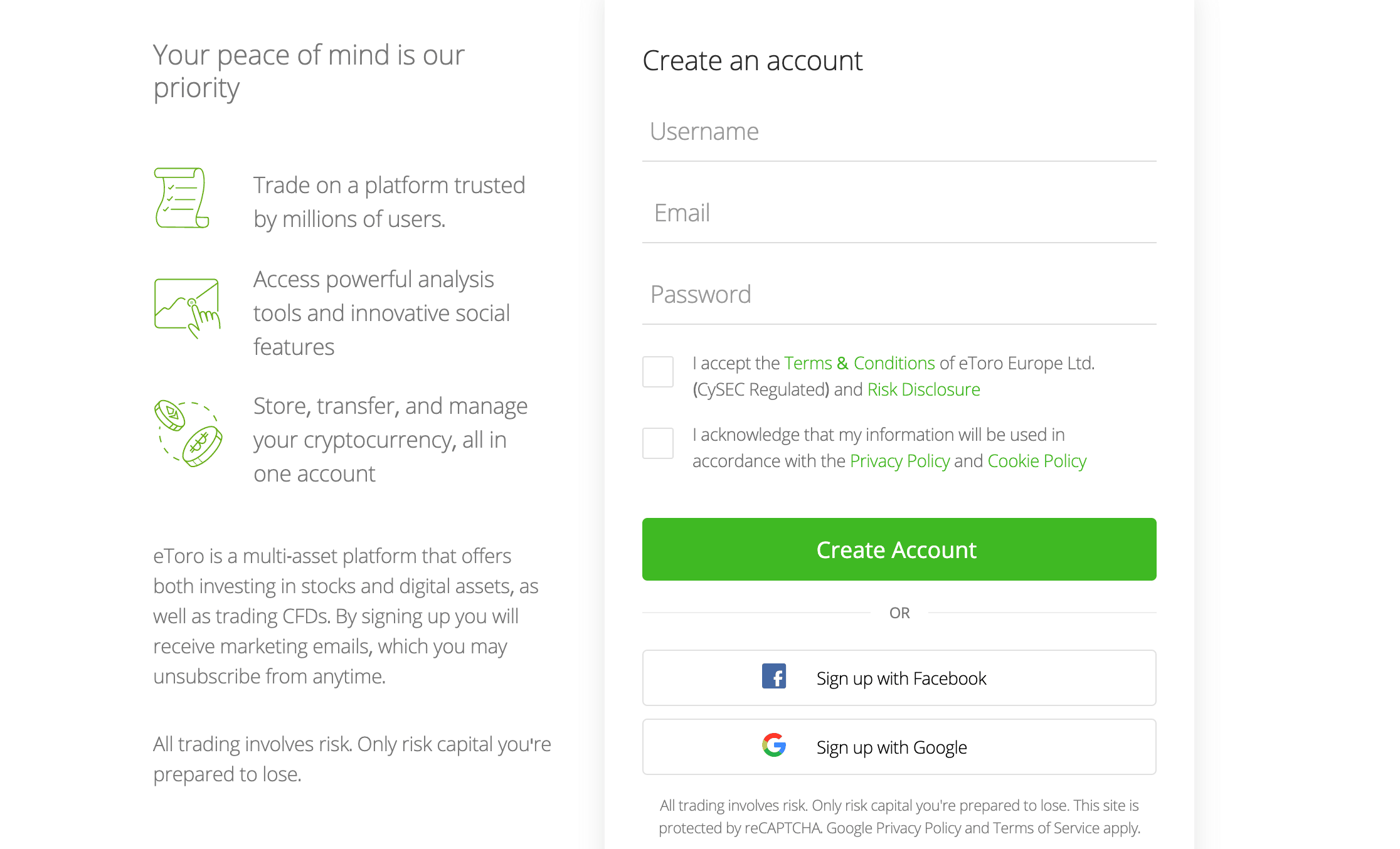

Step 1: Create an Account

To make an account, go to eToro and select the “Join Now” button. Along with submitting your email address, you must select a username and password for your account.

As a certified broker, eToro also requires some personal information from you. This includes your full name, address, and phone number.

You will additionally need to provide documentation that may support the information you have provided. It might be a passport or a license. You can affix a utility bill or bank statement as proof of address.

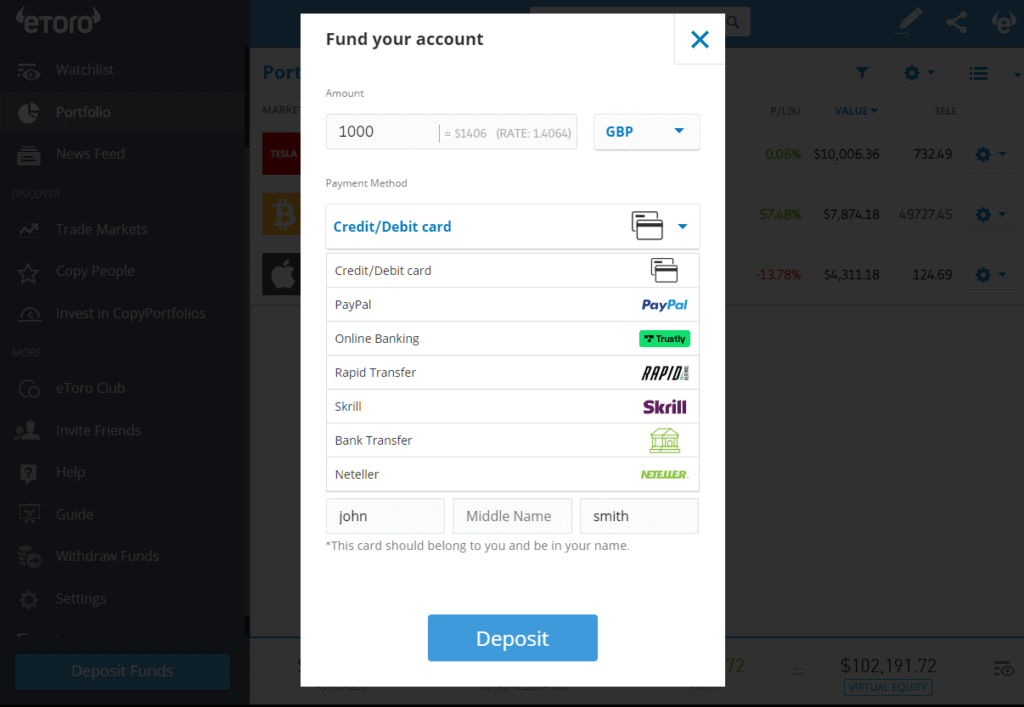

Step 2: Deposit Funds

Deposit money through a debit or credit card, or e-wallets like PayPal. Starting an eToro investment requires only a $10 deposit.

However, you must deposit at least $200 in order to use the copy trading feature.

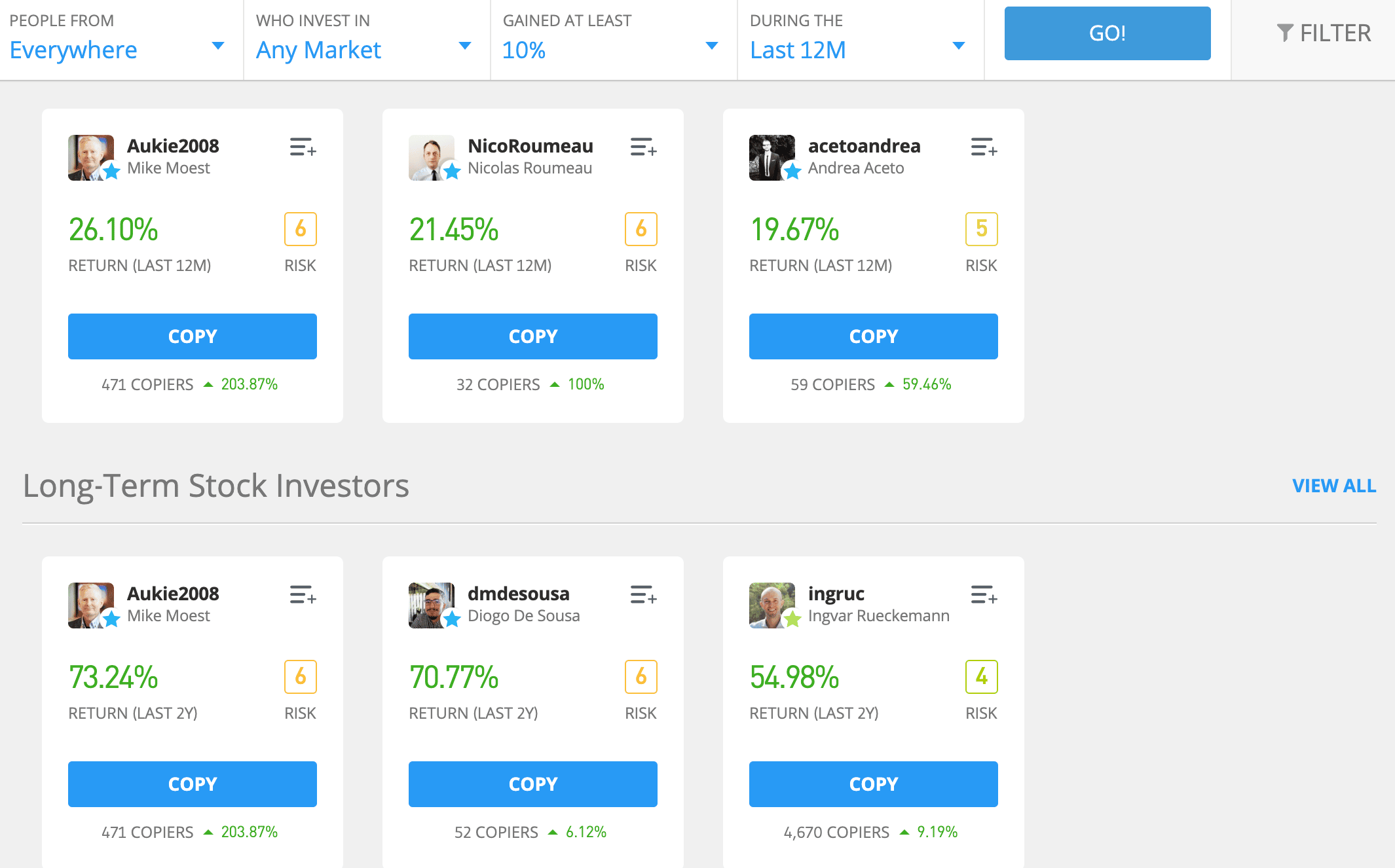

Step 3: Choose a Trader

Then, on eToro, select the “Discover” tab from the left side panel.

The many markets and portfolios that the broker offers can be found here. To see a list of experts whose techniques you can duplicate, click on “CopyTrader.”

Here, eToro shows information like the historical returns produced and the level of risk for each trader.

Additionally, you can sort traders by market and area. Select a trader and then click the “Copy” button.

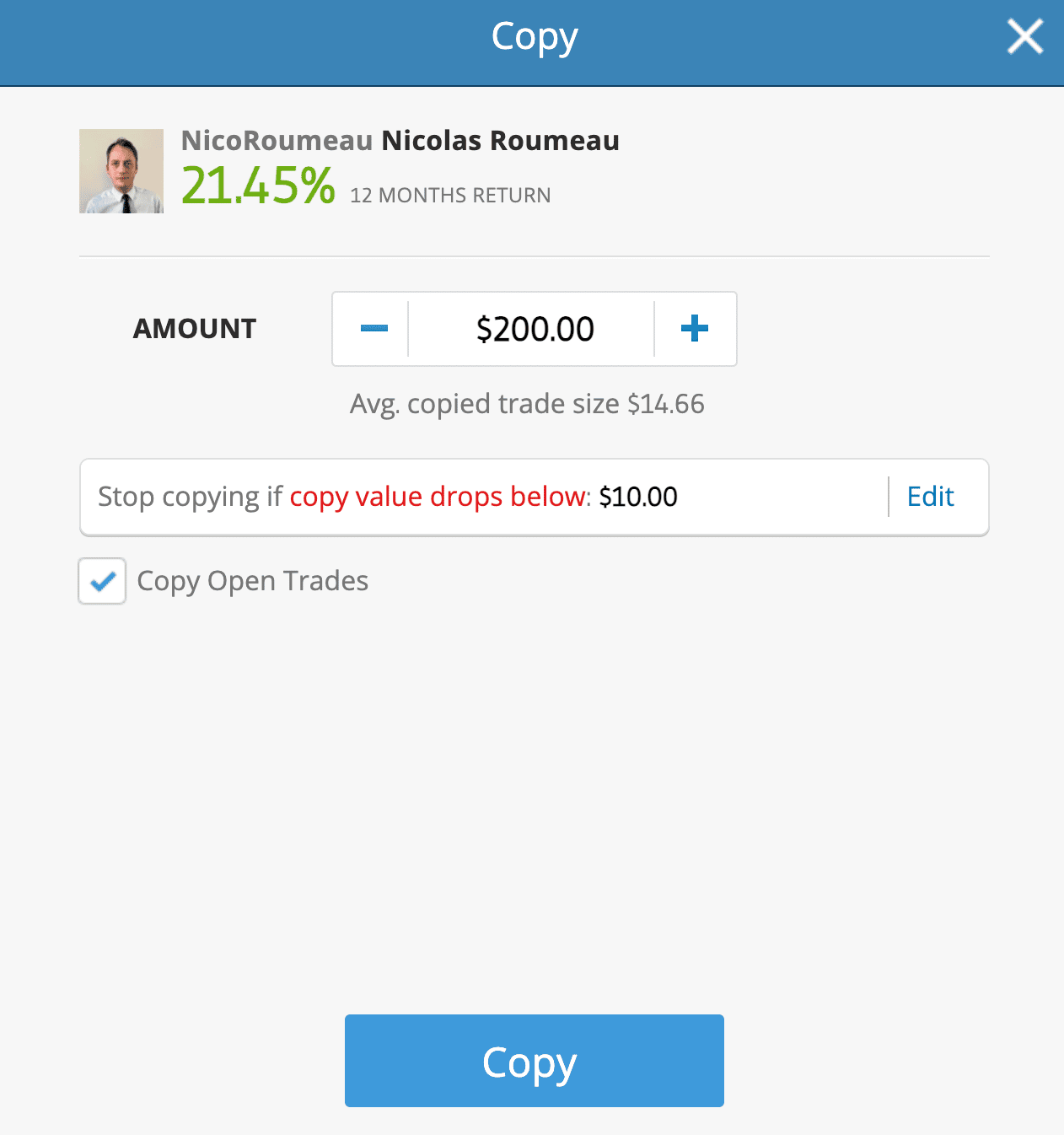

Step 4: Start Copying

Enter your desired investment amount on the next page.

You can choose to copy all open trades or just deals that will be placed in the future using eToro.

When finished, click the “Copy” button.

After that, you may check your eToro portfolio to see how the investment is doing. At any point, you can increase your investment, put the investment on hold, or stop copying.

Conclusion

A relatively new form of trading, algorithmic trading is quickly gaining popularity among investors. eToro is the best place to start if you want to use an algorithmic trading platform. It trades a wide range of financial assets and is one of the most trustworthy and safe trading platforms for traders of all skill levels. They have the industry’s lowest spreads and fees for trading equities and currencies, and their trading platform and features are practically unrivalled. Overall, eToro is a solid choice to consider if you need to trade algorithms.

Frequently Asked Questions

Is trading algorithms profitable?

Yes, trading algorithms can be profitable. An automated trading system trades securities using computer programs. These programs are made to make trades by taking into account a number of variables, including the state of the market and the volume of orders. This kind of trading has a higher level of risk even if it has the potential to be successful.

Which algorithmic trading platform is the best?

Although some platforms are better suited for various types of traders, eToro remains the greatest algorithmic trading platform overall.

What algorithmic trading platform offers cryptocurrency?

Cryptocurrencies are available on several algorithmic trading platforms, such as eToro and Capital.com.

Are platforms for algorithmic trading secure?

Different organizations around the world, including the FCA in the UK, govern the biggest algorithmic trading platforms.