Margin trading makes your experience more enjoyable while diversifying your holdings. The top Margin Trading Platforms can help you overcome these obstacles because this trading strategy is not as simple as it may seem.

We have discussed the best margin trading platforms in this article. This article will explain how to use a margin trading platform and how to find the best platform for margin trading.

What is Margin Trading?

Margin trading is a productive strategy for raising returns and expanding your portfolio. You can borrow money from your broker to raise the dollar worth of your holdings whether you trade equities, commodities, ETFs, cryptocurrencies, or currencies. For instance, you can start a $10,000 trading position with only $5,000 of your own money while employing 2:1 leverage (50 percent margin).

How Does Margin Trading Work?

Open a margin-eligible account first in order to take advantage of the perks. After that, you can use financing to buy almost any asset by borrowing money from your broker (which is simple to do using any of the aforementioned brokers’ online platforms).

However, please remember that if your investment grows in value, the return is significantly greater than an all-cash purchase. However, if your equity value drops below the maintenance margin required by the broker (often 25% to 35%), the broker may issue a margin call and require you to make a larger deposit. If you don’t follow through, the margin broker has the ability to liquidate the whole of your assets.

Best Margin Trading Platforms 2022

Leverage is available in a controlled environment on the top platforms for margin trading that we have found.

Unregulated exchanges can typically offer far greater limits, but security and safety are dubious. It is a good idea to research the margin exchange’s accepted coins and their costs.

Below is an analysis of the best margin trading platforms in UK 2022:

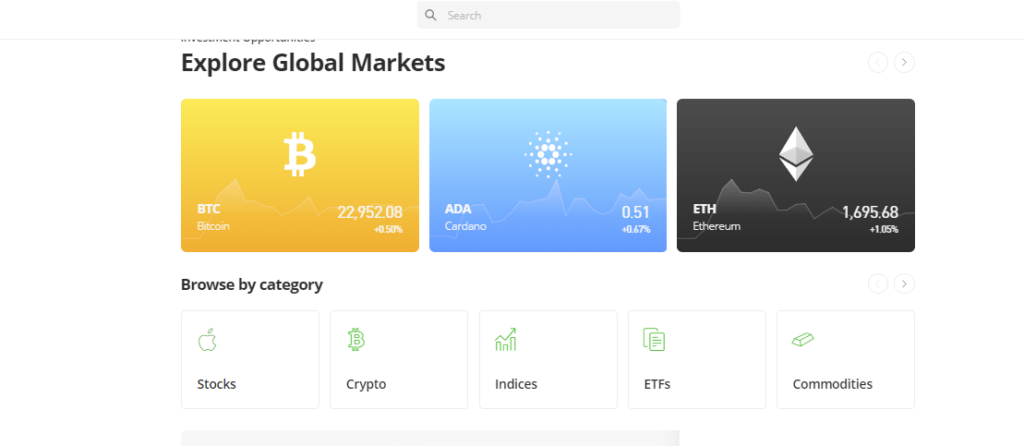

1. eToro

With the highest amount of accessible leverage, eToro can finance your positions in any asset class, including currencies, commodities, ETFs, and cryptocurrencies. The best margin broker is unquestionably eToro because of its exceptional margin limits and rigorous adherence to the ESMA’s regulations.

Additionally, not only does eToro offer access to more than 2,400 equities and 17 international markets but overnight loan fees are also determined by a defined algorithm. eToro openly reveals all fees before you complete your trade rather than shocking you with unforeseen expenses and hidden costs.

2. Capital.com

One of the greatest margin trading platforms for CFDs is provided by Capital.com, a U.K.-based broker with a broad selection of assets and competitive spreads. The 50 percent margin offered by Capital.com is by far more enticing than that offered by the other brokers on our list:

Even better, you can open long and short trades at the lowest costs possible because CFDs are exempt from stamp duty charges.

Furthermore, Capital.com supports zero commissions on over 3,000 tradeable instruments, notably forex trading, and its platform is fully interoperable with mostly all devices. Capital.com is competing for the title of best margin trading broker. The same goes for customer service, which is accessible via live chat, email, and phone 24 hours a day, 7 days a week (24/7).

3. Libertex

Libertex, which is undoubtedly a contender for the title of top online broker for margin trading, makes sure that all of its active clients have access to the highest possible level of leverage. The broker offers exposure to international stocks, ETFs, commodities, fx, CFDs, and digital currencies, simplifying margin trading.

Furthermore, you have direct exposure to leverage of up to 600:1 (0.167 percent margin) if you meet the requirements to become a Professional User, which include making an average of 10 trades per quarter, having an investment portfolio of more than €500,000, and having a minimum of one year of expert expertise in the financial services industry.

4. Robinhood

Robinhood offers the best security practices, transparent pricing, and superior execution with no account minimum and 0% commissions which makes it one of the best free trading platform. As an example, even if the broker is a signatory of the Securities Investor Protection Corporation, that safeguards accounts up to $500,000 (including $250,000 for claims for cash), Robinhood guarantees 100% of economic damage carried on by unauthorised account activity.

In addition, managing your money on Robinhood has never felt better when you register a brokerage account with them since best-in-class security is integrated on one of the top margin trading platforms.

Regarding margin requirements, Robinhood abides by Regulation T of the U.S. Federal Reserve Board, which mandates a $2,000 minimum account balance and permits a leverage ratio of 2:1. (50 percent margin). The capital value of your investment that must be kept at all times according to Robinhood’s servicing margin varies based on market unpredictability and liquidity, but average percentages range from 25 to 35 percent.

5. TD Ameritrade

/td_ameritrade_productcard-5c61ed44c9e77c000159c8f6.png)

TD Ameritrade is among the leading margin trading platforms in the UK and offers higher leverage than a conventional margin account.

For its portfolio margin, TD Ameritrade uses risk bands of -12 and +10 percent for large and small-cap indexes and -15 and +15 percent for shares and options. The outcomes of some fast calculation are 6.7x leverage trading for equities and options and 8.33x to 10x for large and small-cap indexes. However, in order to be eligible for portfolio margin, your account must always have a minimum balance of $125,000 and a maintenance margin of 30%.

For accounts with less than $125,000, TD Ameritrade adheres to Compliance T of the U.S. Federal Reserve Board, which once more requires a minimum account balance of $2,000 and authorises leverage of up to 2:1. (Mean Margin: 50%).

On the TD Ameritrade platform, you can purchase shares, exchange-traded funds, bonds, CDs, options, non-proprietary mutual funds, futures, and currency markets. TD Ameritrade also provides cost-free accessibility to online interactive classes, webcasts, and the most cutting-edge technical analysis instruments. Trades execute with zero commissions for the great majority of instruments.

6. Fidelity

Fidelity is undoubtedly one of the top online brokers in the industry and one of the best margin trading brokers in the USA (for account balances of $100,000 to $150,000). It provides portfolio margin (for account balances between $100,000 and $150,000) in addition to conventional margin. Fidelity complies with Regulation T of the U.S. Federal Reserve Board, just like Robinhood and TD Ameritrade. As a result, a minimum account balance of $2,000 allows access to leverage of up to 2:1. (50 percent margin). Portfolio margin accounts, however, have far larger leverage than TD Ameritrade.

Fidelity, however, offers a ‘restricted margin’ for retirement funds in a distinctive way. To qualify, your Fidelity account must have a minimum balance of $25,000. Additionally, the broker permits you to use funds from unresolved transactions to finance future trades rather than borrowing directly from Fidelity (which would otherwise trigger a good faith violation).

7. Interactive Brokers

/interactive_brokers_productcard-5c61eec746e0fb0001f25462.png)

Interactive Brokers offers both traditional margin and portfolio margin trading accounts. Clients are bound by the Regulation T margin requirements of the U.S. Federal Reserve Board ($2,000 account minimum, 2:1 leverage, and 50% margin) within a typical margin account. Similar requirements apply for portfolio margin accounts: you need to have a minimum balance of $110,000.

However, Interactive Brokers offers commission-free trading of UK-listed stocks and ETFs, as well as access to tradable assets on 28 exchanges in 14 different nations. Additionally, even with incredibly competitive commissions on options ($0.15 to $0.65 per contract) and futures ($0.25 to $0.85 per contract), Interactive Brokers is the greatest margin trading platform for investors on a budget thanks to significantly lower margin rates.

8. Plus500

/plus500_source-5c5b58f746e0fb0001ca8550.png)

Plus500 is the best margin trading platform for CFDs since it fills a niche and prioritizes specialization. On almost all of its tradable instruments, Plus500 provides 30:1 leverage (3.33 percent margin), with a $100 account requirement and also zero withdrawal charges. Additionally, by upgrading to Professional Client status, you can boost your maximum leverage to a maximum of 300:1 (0.33 percent margin).

Plus500 is dedicated for Leveraged CFDs and has made a name for itself as one of the best margin trading brokers. Additionally, Plus500’s platform functions flawlessly on Apple iOS and Android phones and tablets, and the broker accepts deposits in 16 different currencies, including those made through an e-wallet.

Factors for selecting the Best Margin Trading Platforms

Due to the extensive research processes and demanding testing required, selecting the finest margin trading platforms in the UK is not a simple undertaking. The good news is that the best margin brokers have been selected above after extensive investigation by our qualified specialists. Here are some of the criteria we used to determine the top margin brokers in the UK, and you should use them as well if you must perform the research on your own.

Security

Because it ensures the safety of your cash regardless of a broker’s financial situation, security in a margin broker is essential. Consider a UK-based margin broker that is FCA-licensed as a result. Trading with unregulated brokers is dangerous, and there’s a chance you might run across one of the UK market’s money-hungry crooks.

Charges

We usually suggest setting aside money for your trading activity so you can find a margin broker that is reasonably priced. Remember that a broker’s fees don’t just refer to commissions and spreads. Additional fees, such as financing costs, inactivity fees, transaction fees, and exchange rate costs, are to be anticipated. Additionally, look for a margin broker with a reasonable minimum deposit amount.

Assets Available

If you ignore this factor, you can end up with a margin broker that offers a limited selection of trading securities. A margin broker’s trading asset availability varies. Therefore, make sure the assets are being given to your satisfaction whether you are trading stocks, forex, commodities, or any other asset. For portfolio diversification, another broker with other securities outside your favorite choice should be taken into account.

Margin Requirements

Brokers are free to change margin requirements as they see fit, even though there are rules governing the number of margin traders in the UK must take out. Therefore, before making a choice of the best platform, be sure to review this feature and the limitations on margin trading.

Platform

No investor or trader wants to use a platform that is too slow for their operations. So, especially if you are trading in unpredictable markets, make sure the margin broker’s interface is quick. You can also download its mobile app to stay current on industry trends and act quickly when an opportunity presents itself.

The platform of the finest margin broker should have trading resources, including learning and research tools. Before you start trading with real money, look for a demo account that will let you practice margin trading.

Customer Service

Customer service is an important component of a margin broker. Make sure it fits into your schedule and is reachable via suitable channels, regardless of whether it is available 24/7 or 24/5. Responding quickly is another crucial component of staying one step ahead of the competition.

How to begin with a Margin Trading platform?

Margin trading on eToro is as simple as 1.2.3, giving it a clear advantage in platform warfare. Simply do the following actions to begin:

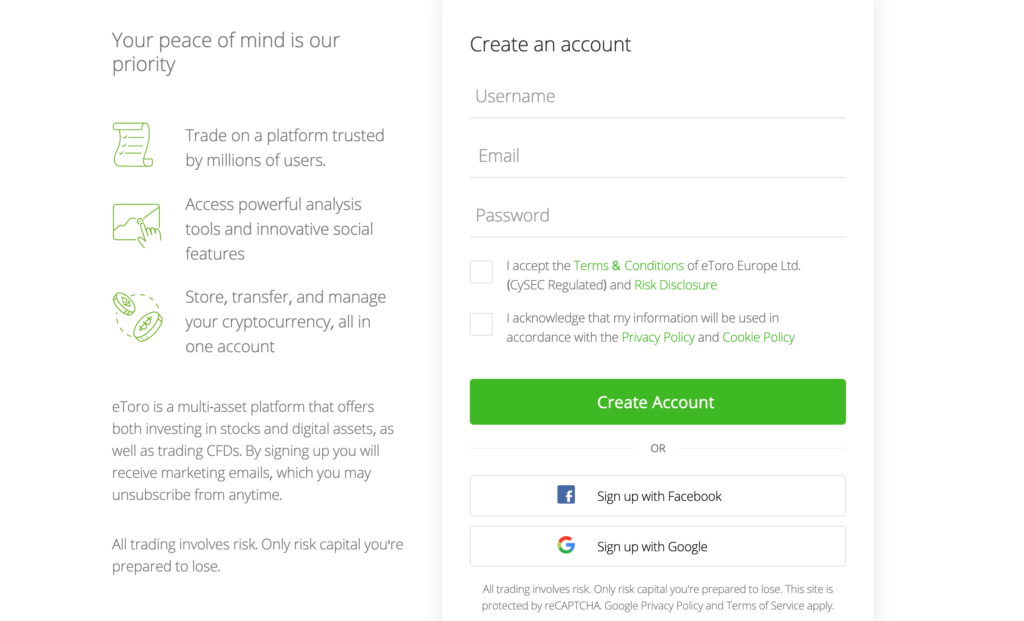

Step 1: Create an Account

By clicking the “Join Now” button at the top of eToro’s website, you may quickly access the best margin trading platform.

The next step requires entering a username, password, and email address. Additionally, eToro texts you to verify your mobile number for security reasons.

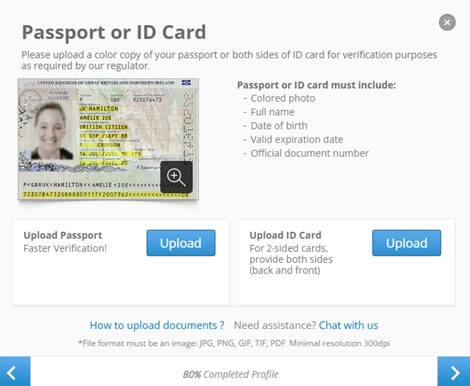

Step 2: Verify Your Identity

You must provide a copy of a current driver’s license or passport, as well as a utility bill or recent bank statement, in order to prove your identity.

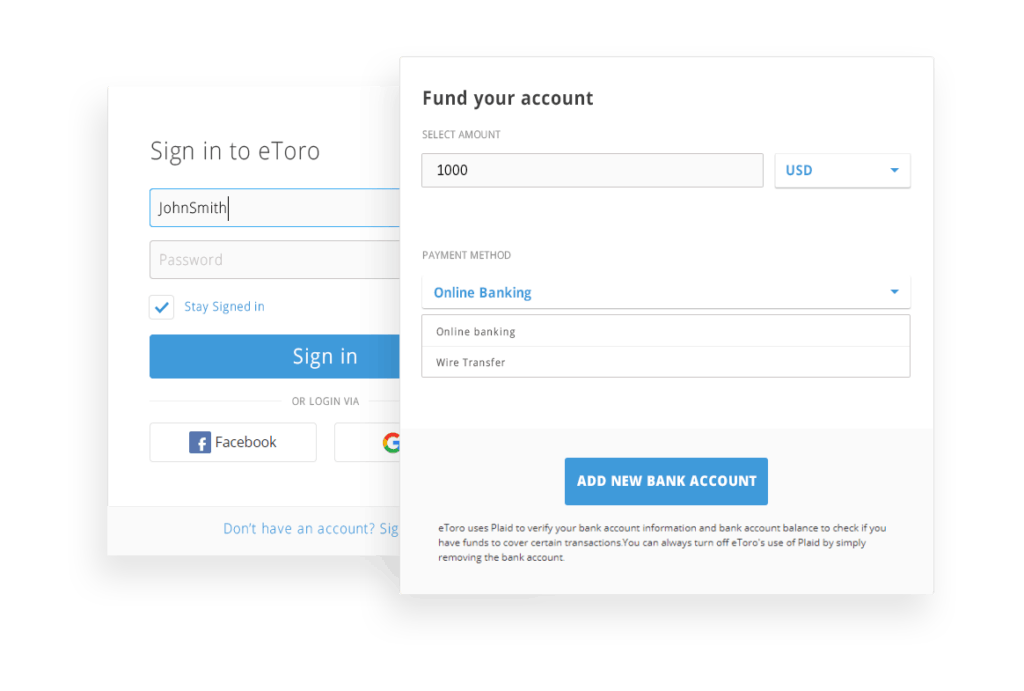

Step 3: Deposit Funds

You can select from a number of U.K. payment options, including debit/credit cards, PayPal, UK bank transfers, and more, all of which require a minimum deposit of $200.

Step 4: Select the Asset and place your order

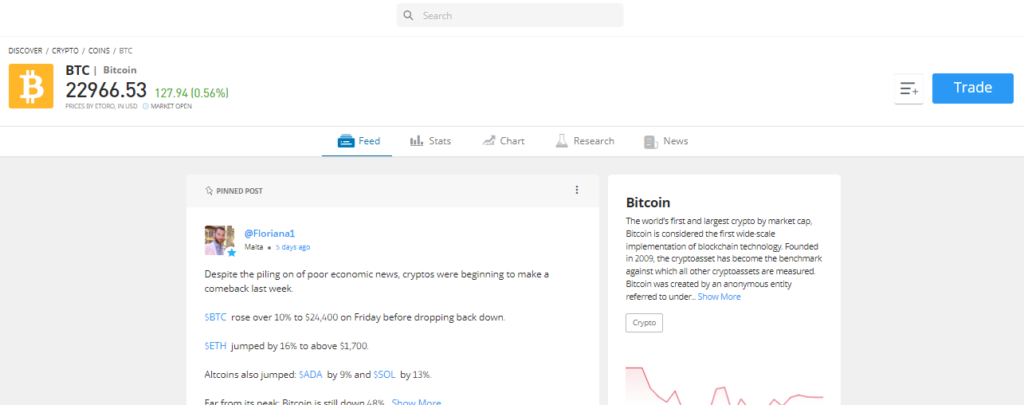

Following the methods below will let you quickly finance your position, whether your desired aim is the currency, crypto, or stock:

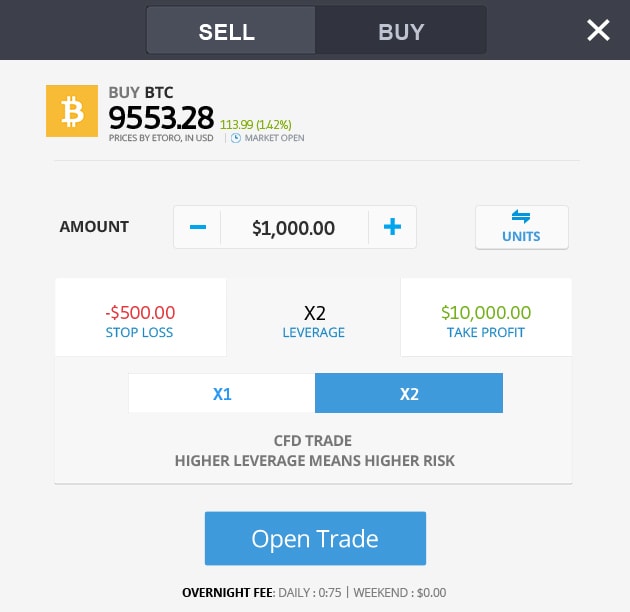

A popup box displaying the transaction specifications will show when you click the asset’s logo for example bitcoin.

For your trade, choose the relevant option at the top: Sell (short) or Buy (long).

Decide how much money you want to invest and your leverage ratio. A 2:1 leverage multiplier, for instance, suggests a 50% margin.

Set your stop loss and take profit levels. Risk reduction necessitates a Stop Loss limitation.

To place your trade, click Open Trade. When the market is open, trades are instantly put into effect.

Be advised that leveraged trades are handled as CFDs as well.

Conclusion

Margin trading is the complete antithesis of the marginal buyer, who is frequently seen as the victim in the financial markets. Margin trading can open the door to a more profitable future because it enables you to raise your exposure with no initial outlay.

However, it’s crucial to hitch your wagon to the correct platform before making the jump. If it wasn’t already obvious, eToro is the greatest margin trading platform for 2022 thanks to its unrivaled combination of 0 percent commissions, maximum leverage, low financing rates, and best-in-class support. Additionally, it’s simple to sign up and you may start trading with as little as $200.

Frequently Asked Questions

Can you use leverage to trade on margin?

Yes. Leverage and margin trading are comparable. Trading on margin enables you to buy more of an asset than you could with simply cash, much like taking out a mortgage loan on your home.

How does margin trading work?

Margin trading is equivalent to regular equities trading in terms of mechanics. Positions have a higher potential for gain or loss because they are partially financed with debt as opposed to an all-equity investment.

What is a margin call?

Your broker may require you to make additional deposits of money if the equity balance of your position drops below a particular level. Additionally, if you don’t, the trading platform has the authority to sell all of your shares.

Is trading on margin effective?

Absolutely. Margin loans are now more accessible to consumers than ever thanks to historically low-interest rates. The net cost of financing is really lower than it seems because the interest you pay is tax deductible.