Since its foundation in 1997, when it first became a significant global retailer, Amazon has experienced tremendous development, making it one of the most alluring long-term investment options in the UK. Moreover, Amazon shares did not see any significant losses during the COVID-19 recession. On the other hand, for a while, Amazon shares were able to profit from the stock market’s turbulence.

This detailed guide’s goal is to clearly explain how to purchase Amazon shares. When it comes to buying Amazon shares in the UK, we also suggest a few brokers with a strong track record.

How to Buy Amazon Shares: A Step-by-Step Guide 2022

Follow the straightforward instructions below to purchase Amazon shares with 0% commission in an SEC-regulated market.

You can purchase fractional shares of Amazon stock at the top online broker eToro for $10 or more.

- Step 1 – Open a Trading Account: Users can start the registration procedure by going to the website of their favorite broker.

- Step 2 – Upload ID: Upload a copy of your ID to instantly have your newly formed account confirmed. Select a passport, state identification card, or driver’s license.

- Step 3 – Deposit Funds: By selecting a payment option, such as e-wallets, credit/debit cards, or ACH, users can deposit money.

- Step 4 – Buy Amazon Shares: Users can start the open order procedure by searching for Amazon shares in the platform’s search box. Enter your desired investment amount, then confirm the transaction.

Examine Amazon Shares

The choice of where to purchase Amazon stock is a step in the investing process. You must, however, thoroughly study Amazon before investing any money.

As a result, this stage will cover everything from the business operations to its stock’s historical performance.

Amazon Overview

Jeff Bezos established Amazon as a bookshop business in 1995. Since that time, the business has expanded significantly and is currently recognized for providing other services in e-commerce, digital streaming, cloud computing, and artificial intelligence. You might possibly make enormous profits by investing in Amazon’s shares, as evidenced by its impressive growth over the years and its present strategy to keep growing.

If you have any doubts about this and think that Amazon’s incredible bull run will eventually come to an end, think back to 2008 when it went through a recession. The business also made it through the dot-com boom of the 1990s, Jeff Bezos’ departure, and the COVID-19 epidemic.

Around 200 million people worldwide will have signed up for Amazon Prime by the year 2022. By 2026, there will have been more than 240 million members to Amazon Prime Video globally.

As more people than ever turn to streaming services for entertainment, younger demographics seem to be the ones who utilize Amazon’s video products the most frequently.

Amazon Share Price History

When Amazon originally went public in 1997, if you had shared Jeff Bezos’ vision, you could be looking at gains that are unheard-of today. The shares would have only cost you $18 each back then. To account for the numerous stock splits that Amazon has started, we must modify this scenario. As a result, the debut UK share price of Amazon was only $1.73.

In August 2022, the same Amazon shares will run you more than $2660 each. It amounts to gains from beginning to end of more than 166,000%. Simply put, if you had invested £1000 in Amazon in 1997, your money would be worth nearly £1.6 million now. But things haven’t always gone smoothly for Amazon shares.

On the contrary, the early 2000s Dot Com bubble had a significant negative influence on the shares. Indeed, it took more than ten years only for Amazon stock to recover to its pre-bubble levels. But as we already know, things have only gone up, up, and away since then. Amazon undoubtedly profited from the coronavirus epidemic in more recent years.

While the majority of its divisions and subsidiaries did well in 2020, the company’s primary retail platform exceeded market forecasts. In contrast, Amazon shares began the year at $1,900 per share, a 75% rise over the previous year. As a result, Amazon has grown to be a multi-trillion dollar business.

Since the epidemic, Amazon has grown steadily by diversifying into a number of fast-growing markets. The thriving cloud computing business, where Amazon owns the greatest market share thanks to the company’s Amazon Web Services (AWS) subsidiary, is one of the most intriguing aspects of Amazon’s ongoing strategy.

Amazon Share Price 2022

Amazon has performed better in the last five years of trade than the NASDAQ Composite. Nearly the past year, the value of Amazon equities has soared by over 280%, while the NASDAQ Composite has increased by 143%.

Early in 2022, Amazon stock fell precipitously, but it is now beginning to rebound. Stocks have gained 20 percent from $2,063 to $2,550 since May 8, the day before Amazon declared a 20-for-1 company split, for a profit of just over 24 percent in just over two weeks.

At the time that this article on how to acquire Amazon shares was being written, the business was trading for $2660, a 20% discount from its price from the previous year.

Amazon Stock Dividends

Amazon has never given its investors a dividend since it was founded.

Instead, profits are put to other uses by the business, which should be to your advantage if you purchase Amazon stock.

Also read: Best Dividend Stocks You Should Buy in UK 2022

Market Capitalization

As of this writing, the firm ranks among the top 5 corporations in terms of market valuation, along with Microsoft, Saudi Aramco, Google, and Apple. Amazon currently has a market valuation of more than $1.1 trillion.

Best trading platform to Buy Amazon Shares

Amazon’s stock is denoted by the ticker AMZN on the NASDAQ exchange. Finding the best online broker who has access to NASDAQ and meets your needs is necessary if you plan to trade the shares of this company. Simply put, you should feel at ease making investments through the broker to improve your chances of profiting. Additionally, look for a broker that hosts alternative assets for portfolio diversification and enables you to trade Amazon shares as CFDs or indices.

To make sure you have the best broker to launch your Amazon investing initiatives, we conducted research on hundreds of brokers in the UK. Here are the top three that we personally chose based on our research and user suggestions.

1. eToro

One of the user-friendly brokers for trading Amazon shares in the UK is eToro. Therefore, this broker is ideal for you if you are a beginner looking to reach the stock market. Get zero commission on shares, a low minimum deposit requirement of $50, copy and social trading, etc. Additionally, eToro offers top-notch educational tools like in-depth guides, webinars, and seminars.

Unfortunately, this broker has huge spreads for trading and investing in Amazon shares. You must make a minimum deposit of £200 in order to access the copy trading platform, and withdrawal fees apply. Additionally, in the broker’s Smart Portfolio, the minimum trade size is £500.

2. Plus500

/plus500_source-5c5b58f746e0fb0001ca8550.png)

Plus500 is a cheap broker that offers effective trading tools to aid you in successfully trading Amazon shares. Low spreads and no commissions will apply to you. Additionally, the minimum deposit amount is £100, which is made without cost. You may also test out additional CFD products at Plus500, including those for currency, commodities, cryptocurrencies, ETFs, and more. In order to provide you with the finest experience, suitable learning resources and research tools are also made available.

Since you can only trade Amazon shares as CFDs at this time, we hope Plus500 will one day permit purchasing and acquiring ownership of the company’s shares. Plus500 has a smaller selection of assets than some of its competitors. Additionally restricting and inconveniencing traders looking for advanced tools or capabilities is its sole proprietary platform.

3. Capital.com

Another reputable broker that enables you to invest in Amazon shares utilizing CFDs and indices is Capital.com. Since there are no commission fees with this investment, you will only pay tiny spreads. Additionally, there are no fees for deposits or withdrawals, and you can take advantage of your activities on top-notch platforms like the MT4. In addition, the broker only asks for a minimum deposit of £20 for card deposits.

On the other hand, Capital.com prohibits you from purchasing and claiming ownership of Amazon shares. Depending on your trading patterns, you may also have to pay overnight fees for positions that are left open.

How to buy Amazon Shares?

There are many obstacles in your path to becoming an Amazon shareholder now that you have made up your mind to acquire or sell stock in the company. However, you may thoroughly prepare yourself for a beneficial experience by following the below step-by-step instructions for first-time stock buyers and traders. Remember that the process for buying shares applies to any of the brokers we’ve listed above or those that are overseen by the Financial Conduct Authority (FCA). We merely use eToro as an illustration.

Step 1: Visit eToro

To purchase AMZN shares, you must first visit the eToro website and open a trading account. We provide links on this page that will lead you to the website for simpler access. Install the eToro trading app on your smartphone for a smooth and thrilling trading experience. Keep in mind that it can help you keep track of your activity while you’re on the road.

Step 2: Registration

We assume that by this time you are aware of how the stock market operates and are capable of conducting a thorough analysis to develop the most effective trading plan. Then, in accordance with eToro’s standards, you will complete the account registration by providing personal information. They consist of complete names, birth dates, phone numbers, email addresses, employment information, etc.

In order to identify the appropriate package for you, eToro will also ask you to take a short test to assess your familiarity with share investing. Additionally, you will have to pass a fundamental margin trading test so that the broker can choose an appropriate leverage limit.

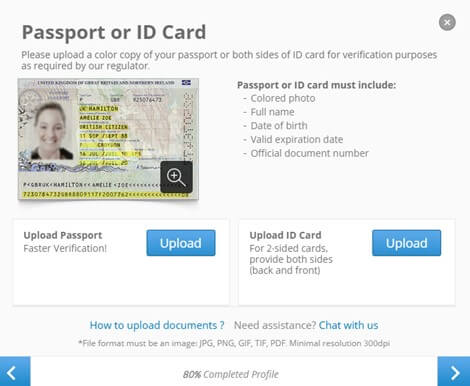

Step 3: Verification

To completely activate their clients’ investment accounts, all FCA-regulated brokers follow a standard method of verifying the clients’ locations and identities. In this regard, eToro will ask for copies of your driver’s license, passport, or ID card as well as a utility bill or bank statement, as appropriate.

Remember that eToro’s verification procedure could take up to two days to complete; as such, wait for the broker to send you an email before placing a deposit.

Step 4: Deposit Funds

eToro accepts a number of payment options for deposits, including debit/credit cards, bank transfers, and e-wallets. Select a payment option that won’t cause your actions to lag and deposit the minimum amount specified by the broker. The good news is that eToro deposits are cost-free.

Step 5: Buy Amazon Shares

Your deposit will be confirmed by eToro, who will then connect you to the NASDAQ exchange, where Amazon stock is traded under the ticker AMZN.

Select “Trade” by clicking the icon next to the AMZN stock.

This box needs to be filled out with the amount you want to invest in the shares. As long as the amount is larger than $50, you are free to invest as much or as little as you like.

When you’re ready to purchase AMZN shares, click “Open Trade.”

Conclusion

The first time you trade Amazon shares, it might seem difficult, but you should be prepared to put in the time and effort to get better. As long as it’s permitted, start with a broker’s demo account and practice investing in shares there. Derivatives trading can also be practiced to find a strategy that suits you.

Despite the chance that they may be overvalued, Amazon shares could increase in value in the years to come. We suggest you think about investing in fractional shares if you are hesitant to buy all of the Amazon stock. Do not enter this enterprise looking to earn additional money because the company does not offer dividends.

Frequently Asked Questions

What is the cost to purchase Amazon shares?

Even if one share costs more than £3,000, online stock brokers make it simple to buy a small portion of the corporation. Simply make sure the broker has access to NASDAQ, where AMZN stock is listed and is FCA-regulated.

Is buying Amazon shares profitable?

Yes. If you are committed to carrying out a study and market analysis before putting up your money, investing in Amazon shares might be rewarding. But most significantly, you require the greatest stock broker, such as the ones we’ve listed above, who can satisfy your investment needs.

Do dividends get paid by the company?

No. The firm regrettably does not distribute dividends to its stockholders. As a result, the business places a strong emphasis on expansion into new markets, potentially making it a profitable investment.

Can I purchase shares of Amazon in the UK?

Absolutely. Through FCA-licensed and -regulated brokers with access to NASDAQ, you can purchase shares in the UK. The good news is that most of these brokers offer additional financial assets to diversify your investment portfolio and let you trade AMZN shares as indices or CFDs.