Particularly when engaging in short-term trading, such as scalping and day trading, low spread brokers are frequently essential to lowering trading expenses. Spreads are the value gap between the purchase and sale orders, therefore whether you’re trading currencies, commodities, or cryptocurrencies, high volume trading with huge spreads can ultimately exhaust your trading funds.

In this guide, we review the best low-spread brokers that you can use in the UK during 2022.

Best Low Spread Brokers 2022

For busy traders, low-spread brokers are best because numerous trades per day can quickly add up in fees. There are fortunately several low-spread brokers available, each with a somewhat distinct cost schedule and feature set. In light of this, let’s study the Best Low Spread Brokers listed below:

1. Capital.com

Capital.com is our top choice for the best low-spread brokers. This well-known CFD trading platform, which offers minimal fees and a large selection of tradeable assets, is the finest high leverage broker.

138 currency pairings are available for trading on Capital.com, making it simple to locate trading opportunities every day. Since these pairs are traded through CFDs, all of Capital.com’s fees are included in the spread. For EUR/USD at the busiest trading times, fees for FX trading average just 0.6 pip.

Capital.com does not charge any non-trading costs in addition to trading fees, thus deposits and withdrawals are free to make. Users can load their accounts with as little as a $20 minimum deposit using a credit/debit card, bank transfer, or PayPal.

Users of Capital.com can trade on the online portal, MT4, or the company’s exclusive mobile app, one of the top investment apps available, streamlining the trading process. Customers have access to a wide range of order types, including the uncommon “trailing stop” order, which is useful in the FX market. Capital.com even lets users create price alerts and offers a wealth of introductory educational materials.

2. eToro

eToro is yet another excellent choice among the finest low-spread brokers. eToro, which serves more than 26 million clients in 190 countries, has an outstanding reputation in the trading community.

49 currency pairings, including majors, minors, and a number of exotics, are presently available to trade on eToro. Users don’t have to pay any commissions to open or close trades because all of eToro’s FX pairings are available to trade using CFDs. The fees charged by eToro are instead included in the bid/ask spread, starting at just one pip for liquid pairs like EUR/USD and USD/JPY.

Banking deposits, credit/debit card payments, and electronic-wallets like PayPal, Skrill, and Neteller are all accepted for deposits on eToro. When financing with a credit card or an electronic wallet, the minimum deposit amount is also simply $10 and is received right away. Because the basic currency of eToro is the US dollar, US-based traders can fund their accounts without paying any deposit fees.

Additionally, eToro offers a number of useful services, such as the well-liked “CopyTrader” option. Users can automatically copy the transactions made by other eToro users in this way without paying any extra costs. This function assists in automating the trading process, much like the finest forex signals, and is perfect for newbies seeking to generate profits while still studying the market.

3. Libertex

Investors need to go no further than Libertex for the broker with the lowest spread. Because the platform doesn’t charge spreads on FX trades and is regarded as one of the top MT5 brokers, Libertex holds a unique position in the market. Instead, Libertex levies a commission—which varies according to the asset—when trades are made.

However, some pairs, including EUR/USD and GBP/USD, do not charge a commission. When the position is opened, a multiplier will be used to determine a tiny commission of about 0.0003% for other pairs.

CySEC, one of the top regulatory organizations in the world, oversees Libertex. Libertex provides complete support for MT4 and MT5, as well as the choice of trading via a browser-based platform or a mobile app. The free demo account option from Libertex additionally comes with €50,000 in fictitious currency.

4. AvaTrade

AvaTrade is one of the top low spread brokers to take into account when it comes to stringent regulatory requirements. This broker is a CFD trading platform with up to 30:1 leverage and 55 currency pairs available for trading. AvaTrade is supervised by the Central Bank of Ireland, ASIC, FSA, and FSCA, all of which provide strong investor protection.

There are no commission fees assessed when a trade is opened because AvaTrade’s currency pairings are exchanged using CFDs. Since spreads begin at 0.9 pips for highly liquid pairs, AvaTrade isn’t the broker with the lowest spreads on our list, but the platform does include a wide range of other trading instruments.

AvaTrade also provides a free demo account option and full support for MT4 and MT5. A bank transfer, credit/debit card, Skrill, or Neteller are all acceptable methods of payment for the $100 initial investment at AvaTrade.

5. Interactive Brokers

/interactive_brokers_productcard-5c61eec746e0fb0001f25462.png)

Interactive Brokers is one of the best trading platforms with reasonable spreads. This low spread broker is overseen by a number of powerful agencies, including the SEC and the FCA. Users of this platform get access to 105 different currency pairs, making it one of the platforms with the most options on our list.

The commission that Interactive Brokers charges are determined by the monthly trading volume of each user. A 0.20 basis point (BPS) commission is assessed for volumes under $1,000,000, with a $2 minimum fee. In addition, Interactive Brokers does not tack on any extra fees for placing FX trades.

Although credit/debit cards are not yet supported, UK-based traders can fund their accounts by ACH transfers, checks, or online bill payments. The last point is that each user’s first withdrawal each month is free, however, withdrawals after that may incur fees depending on the payment method.

6. TD Ameritrade

/td_ameritrade_productcard-5c61ed44c9e77c000159c8f6.png)

Since there are no commission fees when a trade is opened or closed, TD Ameritrade is one of the finest low-spread brokers for traders in the UK. All 70 trading pairs that TD Ameritrade offers—including exotic pairs like ZAR/JPY and NOK/SEK—are in this situation.

The spread, which changes based on the pair but is still comparable with the other services on this list, includes all of TD Ameritrade’s expenses. Although there is no minimum deposit required for account opening, users who want to trade on leverage must deposit at least $2,000 into their account.

The ‘thinkorswim’ platform, which is regarded as the best in the business, is one of TD Ameritrade’s most alluring features. This software provides a variety of capabilities, including backtesting, hundreds of technical indicators, and real-time data. Users can also trade using the thinkorswim interface and the TD Ameritrade smartphone app.

7. Skilling

Skilling is another of the top brokers with a minimal spread to take into account. Over 70 different currency pairs are available on the relatively new trading platform Skilling, which provides a wide choice of asset classes. Skilling’s commissions as a CFD broker are included in the spread, which for EUR/USD can be as little as 0.3 pip.

Due to the fact that users can trade on “Skilling Trader,” “cTrader,” or “MT4”, Skilling also makes trading incredibly simple. The latter two, which provide automated trading and sophisticated risk management features, are best suited for seasoned traders.

Users can select from the Standard, Premium, MT4, or MT4 Premium accounts, each of which has a different set of features and requirements for minimum deposits. Spreads on the Premium account, which fully supports trading with micro lots, can be as low as 0.1 pip.

8. CMC Markets

/cmc_productcard-5c61eb07c9e77c0001d93109.png)

Since the platform has been in use since 1989, CMC Markets is regarded as one of the top low spread brokers. The platform’s main firm is listed on the London Stock Exchange, which lends it further legitimacy. It is also subject to FCA regulation.

As users can trade over 330 currency pairings, CMC Markets offers a wide variety of assets. Additionally, this tool uses “precise pricing,” which compares prices from several banks to provide users with the best deal. Additionally, CMC Markets boasts extremely quick execution, assuring little to no slippage.

With CMC Markets, spreads are exceptionally minimal, averaging about 0.7 pip for EUR/USD during the busiest trading times. Additionally, CMC Markets does not impose fees for deposits, withdrawals, or monthly accounts; however, there is an inactivity fee that is applied after a year of no trading.

9. Forex.com

Over 90 FX pairs are available to trade on Forex.com, with a maximum leverage of 30:1 for main pairings. Leverage of 20:1 is available for trading minors and exotics, and all commissions are included in the spread. However, average spreads for EUR/USD typically exceed one pip, making them significantly more expensive than other options on our list.

A commission-based account, which has lower spreads but charges $5 for every $100,000 moved, is another option available to users. Last but not least, Forex.com provides a straight-through processing (STP) option, which lowers spreads for EUR/USD to as little as 0.1 pip, albeit commissions may be hefty for investors who don’t trade frequently.

10. E*TRADE

/etrade_core_portfolios_productcard-171c577c476c4b3dbe080a008f0cb033.png)

E*TRADE completes our ranking of the top low spread brokers. ETRADE is a well-known trading platform in the financial sector and is currently a Morgan Stanley affiliate.

Users can trade currency futures contracts as an alternative, which will be more appealing to experienced investors. Nine futures contracts are available for trading, and they include popular currencies including the EUR, GBP, and JPY.

Investors can trade both sides of the market thanks to E*TRADE’s lack of short-selling limitations and the low fee per contract of just $1.50. Additionally, E*TRADE does not have a minimum deposit requirement, despite the fact that users can only fund their accounts with checks, ACH transfers, or wire transfers.

Factors for selecting Low spread brokers

You still need to know how to choose an appropriate low spread broker even though we have chosen the best in the UK. Think about the following elements in this regard.

Licenses

The Financial Conduct Authority should regulate the top low spread brokers in the UK just like it does with all other brokers. Avoid putting your trading cash in danger by using a broker that isn’t fully licensed and regulated because they can’t ensure the security of your money.

Fees

Consider your budget while choosing a low-spread broker since you’re searching for one in the UK. Verify the minimum deposit amount, trading costs, and additional fees, among others. In order to avoid unpleasant shocks after committing fully, you should also confirm that there are no hidden fees.

Assets Available

Select a low-spread broker who will provide you with a trading platform and tools to enhance your experience. The majority of the brokers we’ve mentioned above offer a variety of tradeable assets, allowing you a selection to test out before deciding which ones are best.

Trading Platform

A reliable trading platform won’t cause your actions to slow. Instead, you’ll have a seamless experience that will let you concentrate more on your trading tactics. Examine its usability, availability of sufficient research and instructional resources, availability of a demo account, and other factors.

Payment Method

You should also think about how you will conduct payments with a broker. Therefore, make sure the payment options are practical for you or they’ll make things difficult for you.

Customer Service

According to our investigation, the majority of customer services can be reached through phone, email, and live chat. Select a low-spread broker who has accessible communication lines. Customer service accessibility is also crucial. As a result, be careful to verify this feature as well.

How to begin with Low Spread Brokers?

We will now lead you through the setup procedure after explaining what you need to do to select a low-spread broker that suits your needs.

By doing the following actions, you can begin working with an appropriate stockbroker of your selection:

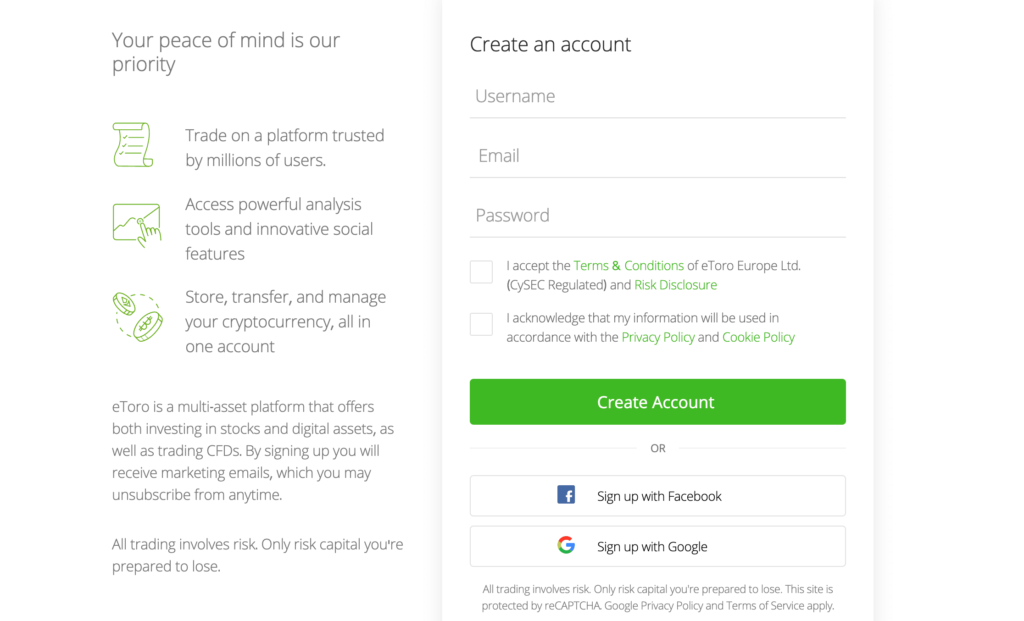

Step 1: Open an account

Starting up only takes a few minutes. Go to your brokerage’s website and start the sign-up procedure there. Following your click, a registration form requesting your name, email address, username, and password for your new brokerage account will show up.

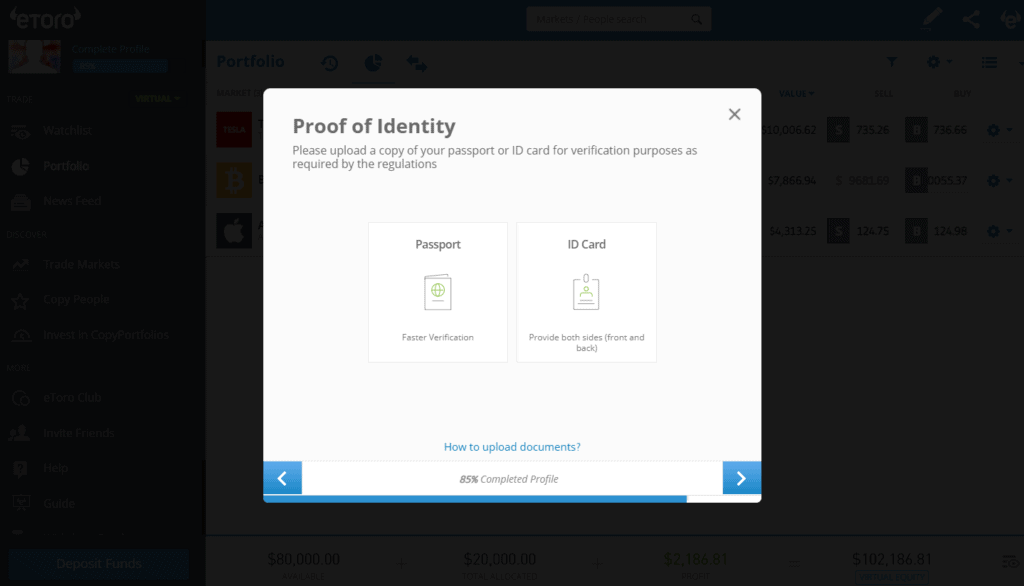

Step 2: Verification

If users invest with a licensed broker, they might need to go through a quick KYC process. A document of your passport or driver’s licence should be uploaded as evidence of your identification, and a current utility bill or bank statement should be uploaded as evidence of address.

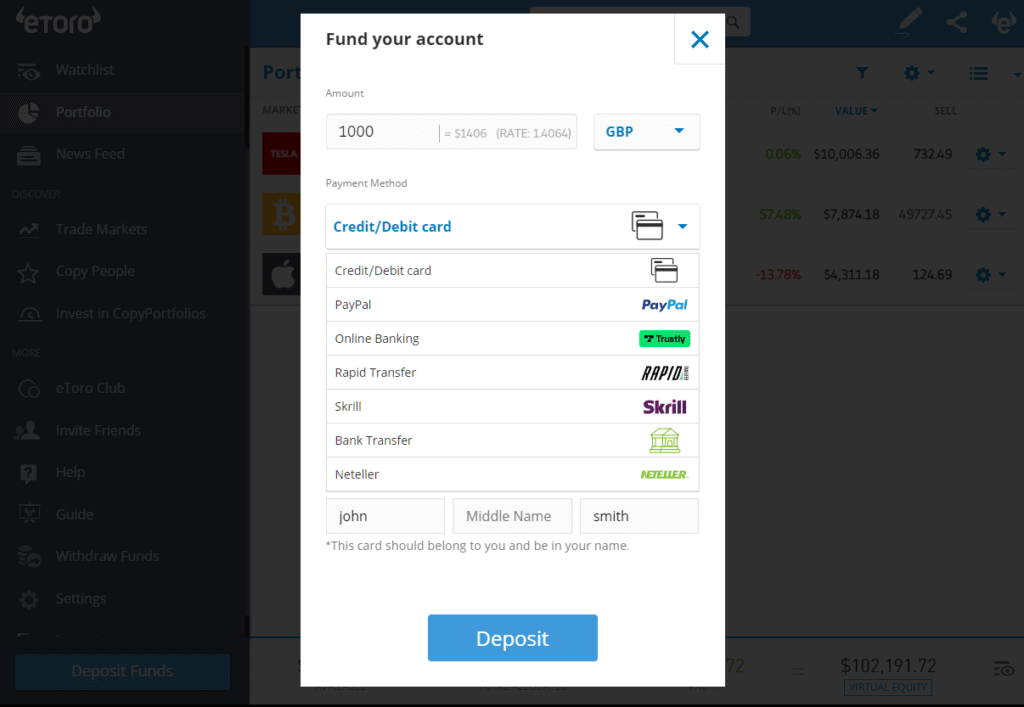

Step 3: Deposit Funds

You’re one step closer to being able to trade a variety of assets at the press of a button once you have a fully confirmed account. Based on the broker you choose, you can deposit funds through the payment methods supported by the broker.

Select your desired payment option and add money to the account.

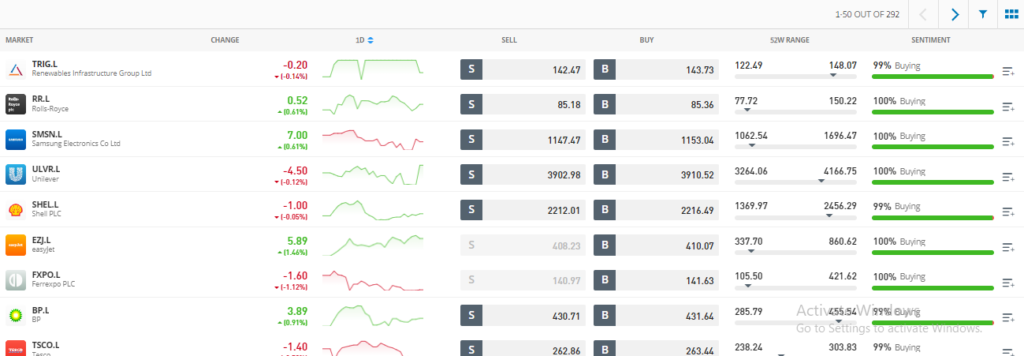

Step 4: Select a Low Spread Market

As quick as your money is deposited into your trading account, you can start trading. The simplest approach to achieve this is to use your platform’s navigation/search bar to look up the name of your low-spread trade. Enter to continue by clicking.

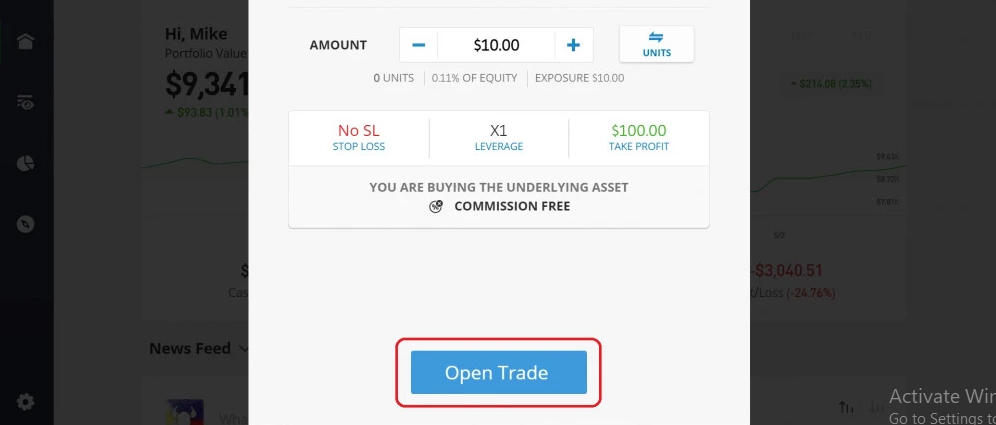

Step 5: Place an Order

You must create an order after choosing the financial instrument you wish to trade.

This process is not too difficult. You must enter the trade’s amount and may choose to use limit, stop-loss, and take-profit orders.

Conclusion

Low spread brokers help keep trading funds from being drained by costs. While many reputable brokers offer competitive spreads on a variety of instruments, keep in mind whether or not they are fixed or variable as well as any potential additional commission charges. The best broker will be determined by the type of trade being made, its frequency, and timing.

Consider eToro for low spread trading even though there are many low spread brokers in the UK and different brokers are good for different purposes.

Frequently Asked Questions

What is a spread?

The spread at the broker of your choice is the distinction between an item’s buy and sell prices. The differential among the two rates, which can be expressed in “pips” or %, is how the broker always gets money.

Which broker in the UK has the lowest spreads?

Our research reveals that the best low-spread broker in the UK is eToro. This FCA broker offers a wide range of markets and spreads, as well as affordable spreads and no fees.

Which brokers provide accounts with no spread?

One of the few zero spread brokers is Libertex. The platform does, however, impose trading commissions.