Social trading platforms have grown to be quite popular and in great demand by both novice and experienced traders. Finding the best social trading platforms might be difficult, despite the fact that there are hundreds to choose from.

The best social trading platforms in the UK are mentioned in this guide. We can assure you that they will make your trading experience rewarding because they have all been put through hours of extensive testing.

Best Social trading Platforms 2022

1. eToro

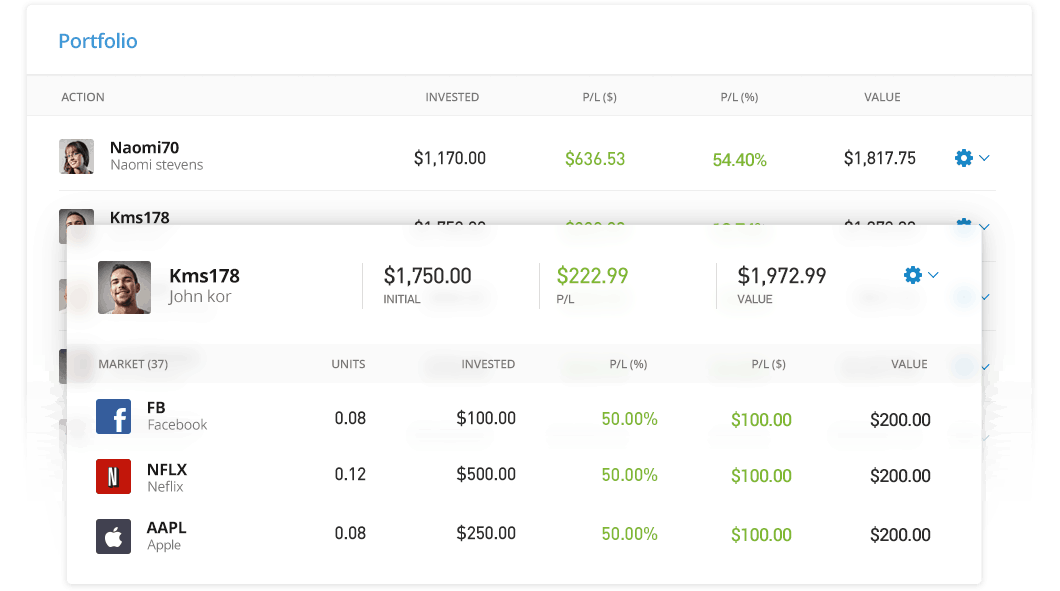

The ability of eToro to provide a top-notch social trading platform is one of the factors contributing to its popularity in the UK. Upwards of 10 million users have successfully joined with eToro since it was the first brokerage service to provide the social trading feature.

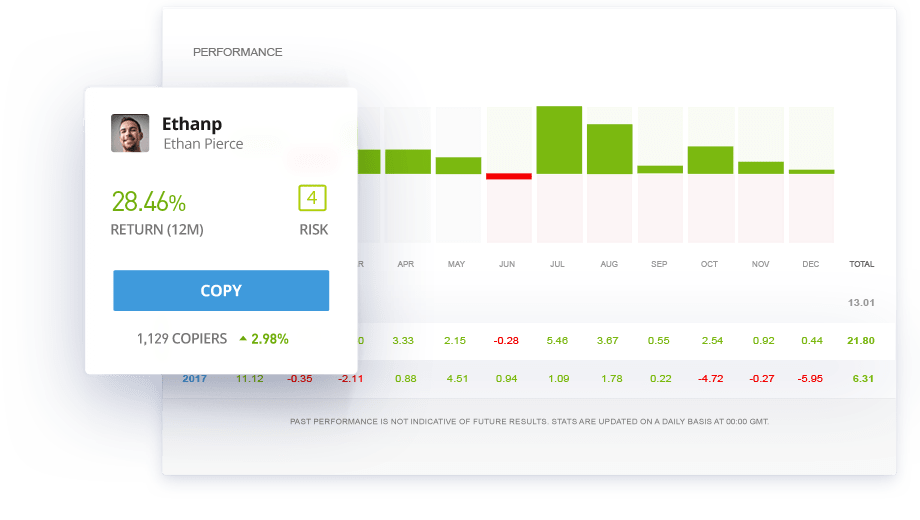

Since its 2007 introduction, eToro has continued to offer its CopyTrader tool, which enables you to find knowledgeable traders that meet your trading needs and imitate their trades. Because of the CopyTrader’s adaptability, you can maintain control over your portfolio.

If you are a skilled trader, eToro will pay you for each transaction you copy using its well-known investor program. Since eToro offers the CopyTrader tool without charging a fee, this does not imply that beginners will incur additional costs.

The social news feed function on eToro allows you to be notified of new transactions made by experienced traders. You can use it to share your trading concepts, give feedback on other traders’ posts, and pick up trading tips from them to enhance your own trading abilities.

Finally, eToro requires a minimum commitment of about £150 before you can begin investing. Given that this broker is under the FCA’s regulation in the UK, you can trust them with your investment funds.

2. Pepperstone

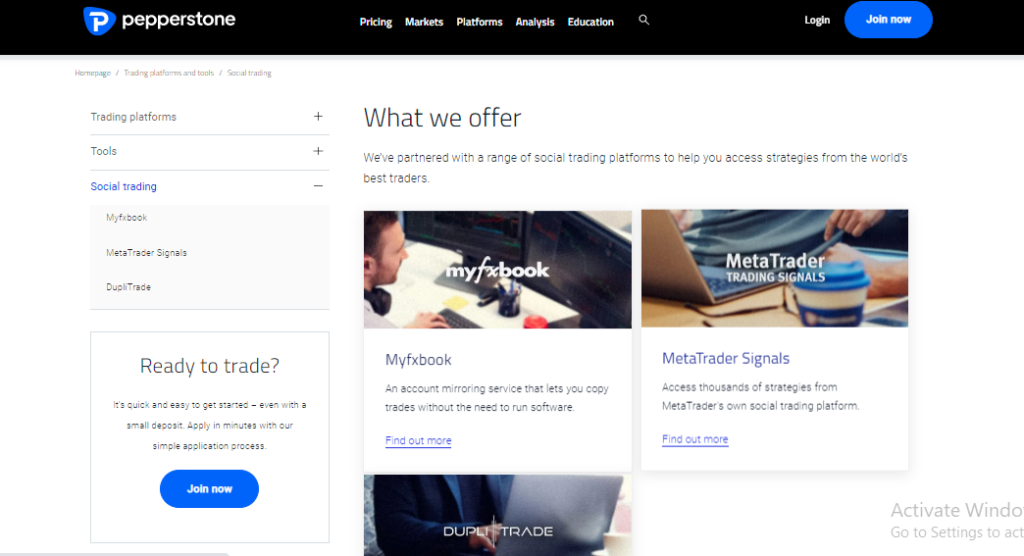

The best social trading platform in the UK for newbie traders is Pepperstone, which is simple to use and explore. Its trading platform works flawlessly on all gadgets, and for desktop access, you may also download the WebTrader software.

The fact that Pepperstone uses third-party social trading systems like myfxbook, MetaTrader Signals, and DupliTrade makes it one of the finest social trading brokers. These platforms allow you to exchange trading concepts and methods. In order to improve your chances of making good profits, Pepperstone also allows you to mirror the trades of experienced Traders.

Pepperstone provides the user-friendly and highly customisable cTrader, MT4, and MT5 platforms in addition to the social trading platforms. They include a number of technical indicators, expert advisers, and charting tools that you may use to effectively analyze the markets and manage your trade.

These platforms also offer a wealth of instructional resources, such as webinars, articles, and tutorial videos. These can be a huge help in getting you up to speed on the trading industry. A risk-free demo profile is also offered on Pepperstone. You can use it to explore how this social trading platform works before you start depositing money.

3. IG Markets

/IG-ef2684aaa37d4d218af819f98d676d02.png)

Access to the IG Social trading platform is provided without fee by IG Markets. Through an online forum, you can communicate with other traders from across the world using this platform. You can learn from and refine your technique more quickly if you replicate the positions of experienced traders.

Other trading platforms, such as ProRealTime, MetaTrader 4, and L-2 Dealer, are also supported by IG Markets. They are simple to use and customizable with cutting-edge market analysis graphing software. Additionally, the L-2 Dealer provides the Direct Market Access capability, which enables you to transact directly in the order books of the markets.

This broker’s trading platform offers over 17,000 markets for you to trade on. Trust and think that your investment capital is safe with IG Markets because of its extensive history dating back to 1974. In order to provide its services to clients in the UK, it is also subject to Financial Conduct Authority regulation.

Many traders prefer IG Markets despite its hefty trading fees because of its extensive research resources, which include access to an excellent charting program and news feed for efficient market analysis. To assist you in swiftly advancing your trading abilities, IG Markets also offers a wealth of instructional resources.

4. ZuluTrade

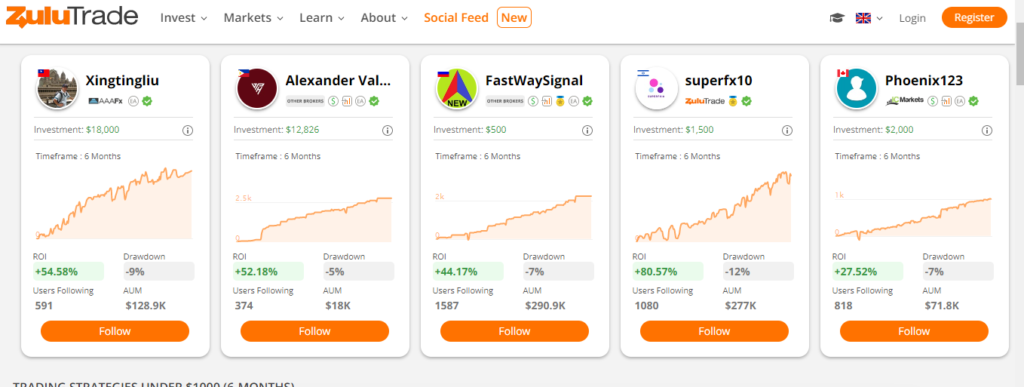

A social trading broker with a solid reputation in this field is ZuluTrade. It has an intuitive user interface that ought to suit the majority of investor profiles. ZuluTrade customers that engage in copy trading will have accessibility to a plethora of knowledge.

This gives enough details on each trader’s performance since joining ZuluTrade, as well as the assets they seem to favor. We appreciate that ZuluTrade gives its users access to a variety of adaptable tools. For instance, users of the Automated tool can place take-profit and stop-loss orders on the traders they are copying.

This makes sure that the user’s personal objectives and risk tolerance are satisfied. Users can test a copy trader’s effectiveness using a social trading network and a simulation tool. On this platform, markets such as cryptocurrency, equities, indices, commodities, and forex are supported.

There are two possibilities for opening an account, and the choice will determine the fees. First, using the traditional account entitles the user to commission-free participation in social trading. However, there will be broader spreads to cover. Second, the monthly fee for the profit-sharing account is $30.

No higher spreads or commissions are required, but a portion of the copy trader’s lucrative trades will be required. We also appreciate ZuluTrade’s social feed. This functions similarly to a social media site in that ZuluTrade members can publish, like, and leave comments in public. To see which assets and markets are popular, one can view and look up trending hashtags.

5. AvaTrade

With the help of the broker Avatrade, you can commission-free trade on a number of financial markets using a variety of trading platforms. The most important currency pairs, such as USD/GBP and EUR/GBP, as well as the most important commodities, like gold, have relatively thin spreads.

The minimum deposit required after creating and verifying your account is £500. Next, select a trading platform, look for a trader to duplicate, and then simply relax. The proceeds from the asset purchases and sales made by your chosen trader will subsequently be reflected in your own account.

ZuluTrade is the primary trading platform that may be used with Avatrade. It is particularly appropriate for beginners and is fairly comparable to eToro. You must pick a trader to replicate from a pre-selected list of traders, which is another identical aspect of the process. They offer a wealth of details that will help you choose a trader whose trading habits align with your financial objectives. You can pick from more than 10,000 copy traders.

Because ZuluTrade is an unregulated trading platform, using Avatrade through it carries a number of risks to your capital.

AvaTrade also charges a commission that is profit-based, so if you lose money, you won’t be responsible for paying any costs. Without particular mitigating circumstances, this often amounts to 20% of the revenue generated. For instance, if you spend £1000 and receive a 10% return, your profit would be £100. Therefore, you would have net gains of £80 after deducting 20% of this, or £20.

What is Social Trading?

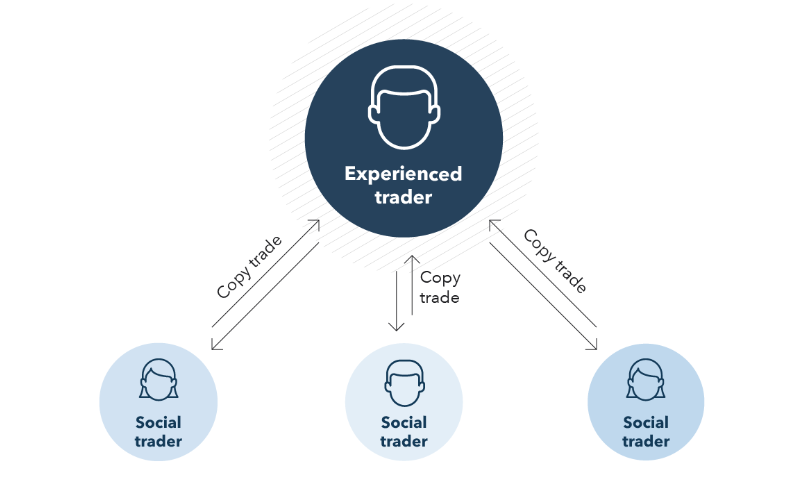

Social trading is a type of trading that brings together traders with varying degrees of expertise to engage with one another, access market data, closely monitor the professional traders’ trading patterns, and even duplicate or mimic their trading techniques.

Since the social trading platform brings together a community of investors and traders and enables them to mimic the trading tactics of other successful traders, social trading frequently doesn’t require a great deal of market expertise.

Types of social trading platforms

When comparing social trading platforms to stock trade applications, traders and investors can choose from a variety of instrument categories and options on a social trading platform. The most common forms of social trade include, although their decision would typically rely on their needs:

1. Signals or Tips

In the financial market, traders frequently make significant trading decisions by attentively examining market signals and putting advice from seasoned traders into practice.

A trader can use signals and recommendations to understand market conditions and what to do at a given time. These alerts and suggestions may originate from relatively straightforward sources, such as a mood indicator posted on a broker’s site.

Very sophisticated computer-generated systems that read the market and provide signals and advice to traders are another source for the signals and advice.

Because there is no space for investors to ask inquiries, this kind of social trading does not encourage contact with other traders. Particularly for novice traders who have little to no knowledge of how the financial market operates, the signals and advice may be challenging to comprehend.

For seasoned traders who are already familiar with market conditions and can provide them with direct market positions to follow, it will be advantageous.

2. Copy trading

The most common form of social trading is this one. As the term implies, copy trading is following the trading tactics of experienced traders in an effort to duplicate their performance.

For beginner traders who have not yet mastered the basics of trading, this is best suited. However, it is crucial to pick a trading platform that is specially made for copy trading.

Copy trading is a quicker technique to trade since it reduces the trouble of having to make selections; a trader only requires to choose the trader who seems to be the best and emulate them.

Although copy trading gives investors a competitive edge because they are essentially duplicating the trades of profitable investors, it does not ensure success. Because market conditions and activities might change, what worked for one individual may not always work for another.

3. Forums and Profiles

This kind of social trading is especially intended for people who are more committed to making profitable trades and becoming as knowledgeable about the financial market as they can.

In forums, traders can converse with one another and learn a lot about the market from the discussions. Trading successfully can be figured out by using the knowledge gained from other forum members’ comments.

The purpose of the profiles is to aid traders in developing a closer relationships. The finest platform for this type of social trading is one that offers thorough biographical information on each trader on its site, including information about their trading approaches, a list of open and closed trades, and even details about the forums they frequently visit, which gives other traders an understanding of how successful they are in the market.

Numerous parts of a reputable forum, including those devoted to trading methods, tools, predictions, and tips, are home to thousands of active traders.

4. Mirror Trading

Although copy trading and this kind of social trading are quite similar, there is a small distinction between the two. With mirror trading, participants effectively duplicate an expert’s actions.

Included are the precise positions determined by algorithmic trading techniques, the identical opening and closing timings, and an automated system set up to respond in a specific manner.

5. Auto-Bots

Since there is no social connection present in this sort of trading, it is technically not social trading. As an alternative, a trader designs trading bots to carry out certain transactions when a number of criteria are met.

In traditional social trading, traders must engage with one another in order to decide when to execute particular trades. The auto-bots in this instance don’t require any human supervision, though.

On the flip side, since the human error was the primary cause of bad trades, the likelihood of a human error occurring is greatly diminished. However, despite the fact that experienced traders could prefer to disregard a trade proposal, these auto-bots always carry out the preprogrammed trades.

How to begin with Social Trading Platforms?

The following steps can be used to open an account with any social trading broker in the UK if you wish to start social trading.

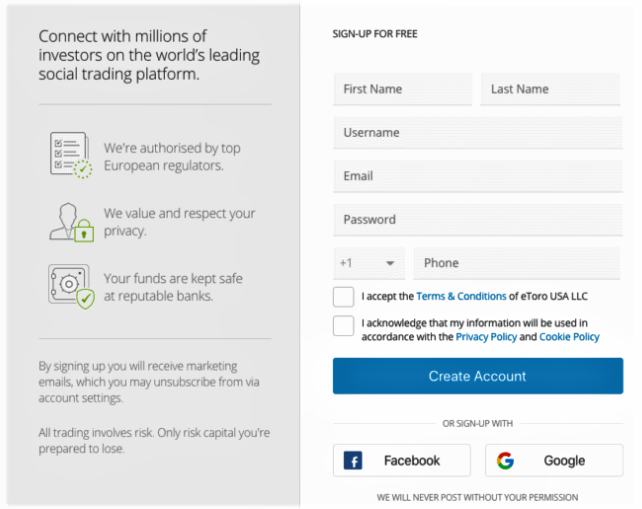

Step 1: Create an account

To begin with, you use the buttons below every broker listed on this page to get to the broker of your choice. Brokers let you open an account on any internet-enabled device of your choice, including a laptop or smartphone.

For registering for a social media platform, you will be asked for information that will serve as the foundation for your account. Your entire name, birthdate, address, email, and phone number are among the details that you must submit.

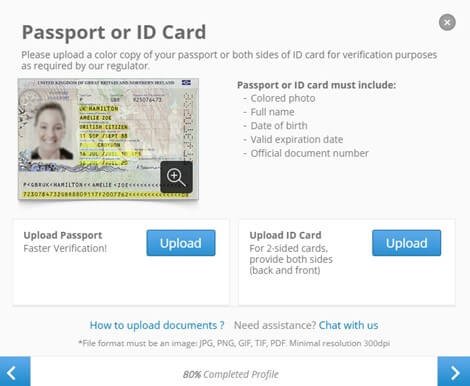

Step 2: Verify Your Identity

You will now confirm your identity and demonstrate to the broker that you are who you say you are. Two distinct documents must be submitted to do this. To establish your identity, you must first provide a copy of your identification, such as a passport, ID, or driver’s license. A current utility bill or bank statement with your address on it should be used as the next proof-of-address document.

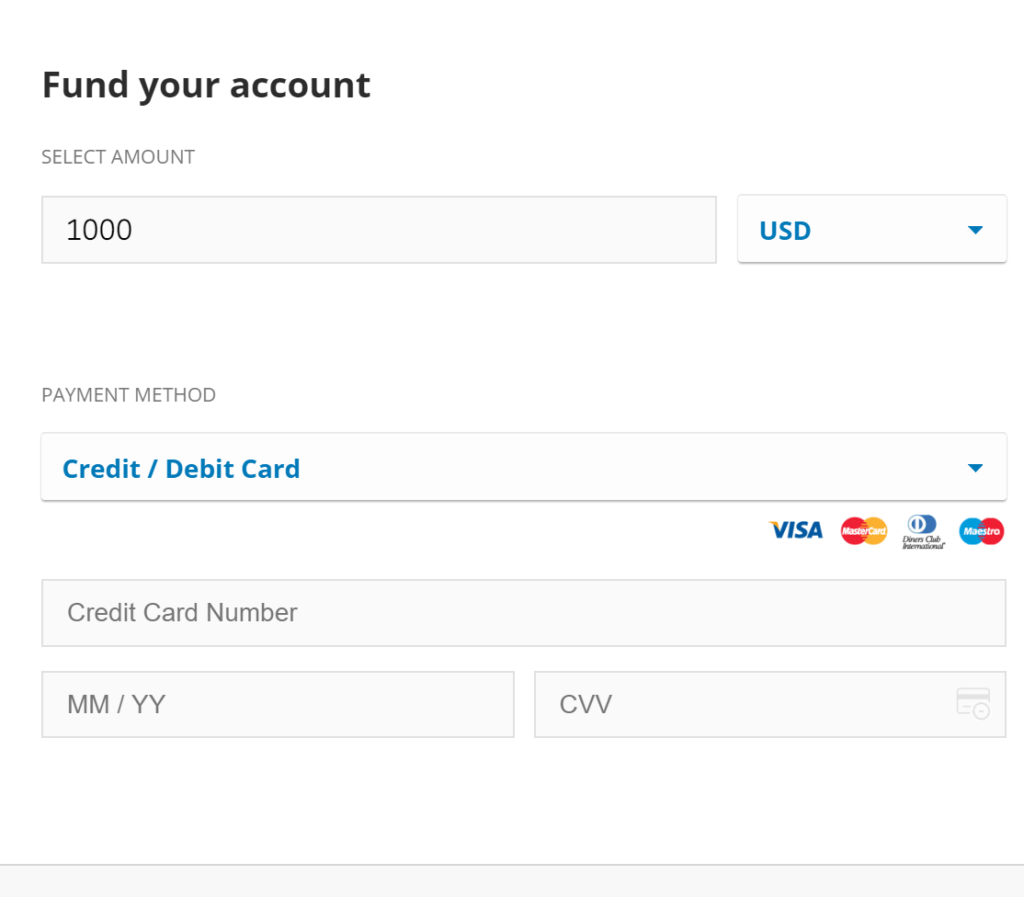

Step 3: Make a Deposit

Making an initial deposit is the next step needed before your account is fully opened. The minimum deposit amount required by the broker, which can range from zero to a few hundred pounds, must be met with your initial deposit.

After your initial deposit, you may make additional deposits of any size.

Step 4: Start social trading

All that is left for you to do is begin social trading now that you have money in your account. Before choosing which or whom to mimic, try to take some time to research and evaluate various traders.

Planning ahead might increase your chances of becoming a profitable copy trader.

Conclusion

Overall, social trading is a tremendously popular subset of the market, and it can be a very helpful technique for all traders whether they trade on the best social trading platforms available or use any social trading software.

As a novice trader, social trading may be a fantastic opportunity to exchange knowledge with top-tier experienced traders and can truly aid you in gaining insightful market knowledge.

Both individual investors and signal producers can have a great experience utilizing a social trading platform like eToro.

Frequently Asked Questions

What types of assets can be traded on social trading platforms?

You can trade a variety of the most popular assets on the majority of social trading platforms, including stocks, FX, indices, commodities, and cryptocurrencies.

Which social trading platform is the best?

Overall, eToro provides the greatest social trading services. We have outlined what distinguishes eToro’s platform from the competition further on this page.

Can I copy cryptocurrency investors?

Yes, it is feasible to emulate cryptocurrency traders who specialize in coins like bitcoin, Ethereum, litecoin, and many others using social trading platforms.