By investing in an S&P 500 index, you can expose yourself to some of the biggest, highly profitable firms on the planet. This significant stock index can be purchased in a variety of ways, and we’re here to help you every step of the way.

In this guide, we’ll explain the various methods of investing in the S&P index as well as the best brokers for doing so.

How to invest in S&P 500 Index- An Overview

If you’re confused about how to invest in the UK’s S&P 500, you’ve come to the correct spot. We will outline how to invest in index funds in this section. Index fund investing is fairly simple. By following these instructions, you can invest in an index in about 10 minutes. –

- Step 1: Choose a broker – The first step is to invest in the S&P 500 Tracker with a broker you can rely on. Because eToro is governed by the FCA and makes investing in the S&P 500 simple and quick, we suggest it.

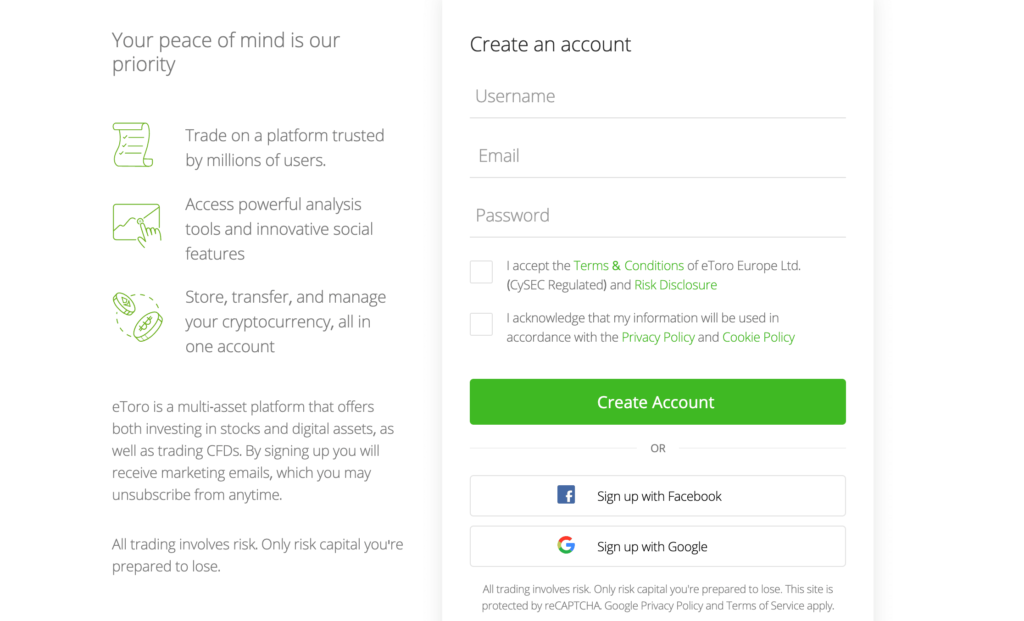

- Step 2: Open an account – Create an account by choosing a broker and opening a trading account. The process of opening an account is finished quite rapidly. Simply input your contact information and submit your ID and address proof to get started.

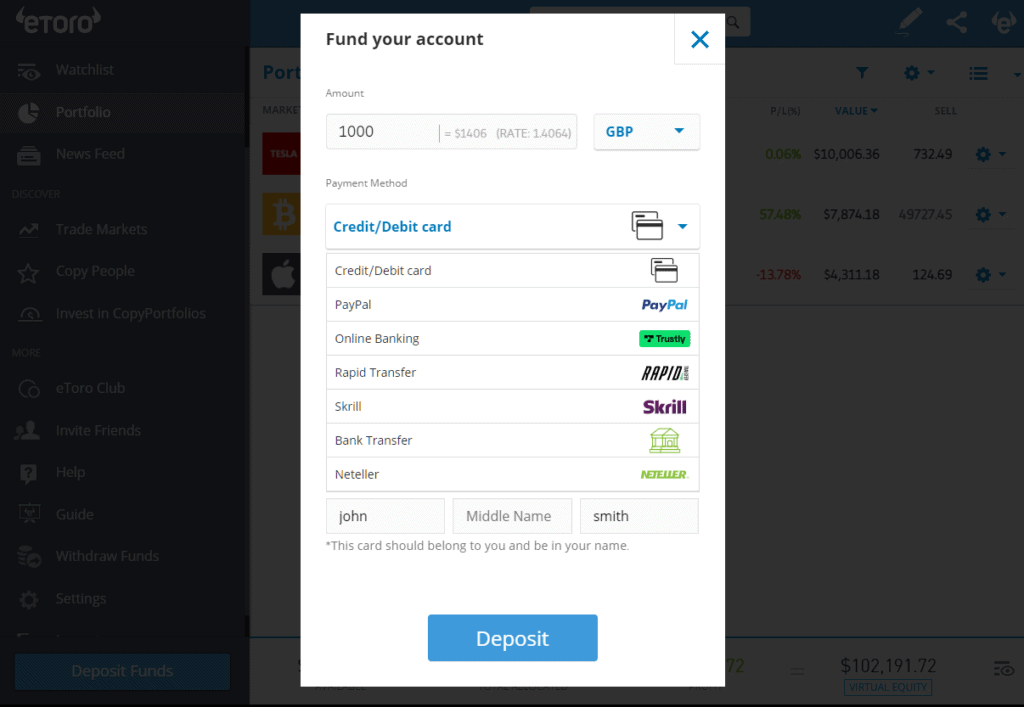

- Step 3: Fund your account – You need to deposit funds into your account before investing.

- Step 4: Invest in the S&P 500 index – After funding your account, you can quickly make investments in the market. Just enter the S&P 500 Index ETF in the search box and after finding it input the preferred purchase amount to finish purchase.

What is the S&P 500 index?

The S&P 500 Index, the first market capitalization-weighted equity index in the United States, was introduced in 1957 and is largely regarded as the finest single indicator of large-cap U.S. stocks. Trillions of dollars are indexed to or benchmarked to the index, which is the most important equity index in the world. 5

The index typically consists of 500 of the top U.S. corporations, though the exact number may change. Approximately 80% of the available U.S. market capitalization is represented by the S&P 500. The index’s stocks have a median market cap of $31.7 billion and a maximum market cap of $2.85 trillion.

The main growth drivers of the U.S. economy are largely reflected in S&P 500 stocks. For instance, the top 10 S&P 500 participants by index weight are:

- Apple

- Microsoft

- Amazon

- Tesla

- Alphabet (class A shares)

- Alphabet (class C shares)

- Nvidia

- Berkshire Hathaway

- Meta Platforms

- UnitedHealth Group Inc.

The U.S. and international markets are dominated by these mega-cap stocks, which are mostly focused on three industries:

Information technology is the S&P 500 index’s largest sector by weight, accounting for 28% of the index’s total weight. Consumer discretionary is the third-largest sector by weight, accounting for 12%.

The fact that these three industries together make up about 50% of the S&P 500 illustrates how important technology and related industries are to the American economy. Health care ranks second in the S&P 500 with a weight of 13.6%, and financials come in at number four with 11.1%.

Is S&P 500 index a good investment?

Diversification is the main benefit that purchasing an index has over buying a single stock. By distributing your risk among 500 equities rather than just one, indexes help to reduce the volatility of your investment’s price movements.

However, even if investing in this significant index is often a safer choice, it is not without drawbacks. For instance, index funds have a propensity to decline uniformly when a bear market begins. Similar to how your performance in various stocks is reflected when the US government takes specific actions or the US dollar depreciates.

Investment options for the S&P 500 index

You can invest in this index using a variety of techniques. Therefore, you need carefully consider each investment option before picking one, just as you would need to consider many banks before deciding where to create a savings account. Following are the investment options for the S&P 500 index:

ETFs

An ETF is an investing fund that is listed on a stock market exchange, much like a stock. ETFs can hold a variety of assets, such as specific stocks, bonds, or commodities, or act as a stand-in for an index of stocks. Due to the advantage of portfolio diversification and low expenses, investing in an index ETF can be a beneficial way to do so while still having the flexibility to trade your investment on a market. Still, during a bad market when market indices decline significantly, an ETF might become unstable and risky.

This method of investing is for you if you wish to gain from the S&P 500’s diversity, low fees, and ability to trade your asset on an exchange.

Individual stocks

Purchasing stock in each of the 500 stocks the index monitors is another method to invest. An internet broker can be used to do this. In contrast to investing in the index as a whole, this approach allows you to select which stocks you want to keep for a longer amount of time and which companies you want to sell. The drawback is that buying each stock in 500 separate transactions would quickly add up in transaction fees and take up a lot more of your time.

This method of investing is appropriate for you if you want to give each of the 500 stocks a test run before reducing your holdings to focus on a select few standout performers. This technique is typically advised for investors with bigger investment budgets and free time due to the high transaction fees involved.

Mutual funds

A mutual fund is a kind of well maintained investment vehicle that pools money from a number of various sorts of investors to invest in a range of assets, in this case the entire index. The ability to invest in all 500 companies is a feature that a fund and an ETF both offer. Mutual funds, in contrast to ETFs, cannot be exchanged freely and must be purchased through a stockbroker or directly from the fund.

The fact that mutual funds have greater fees than ETFs is a drawback. Additionally, while diversity in mutual funds reduces risk, it also means that you’ll be forced to own the best- and worst-performing equities within the larger index. An index fund is another name for a mutual fund.

Tips for investing in the S&P 500 index

Go over these key tips before investing in S&P 500 index.

Make research: Spend some time learning about the advantages and disadvantages of investing in this index as well as the various investment strategies. Your chances of success will increase if you have a plan in advance.

Make a budget: Decide on a spending plan that works with your lifestyle and risk tolerance. Avoid accumulating losses that are so significant that they undermine both your confidence and your capacity to execute future deals.

Pick the appropriate platform: The various trading platforms you can use to invest in the index were already covered in the section before this one. Think over all your possibilities and select the one that best suits your investing requirements.

Increase your investments slowly: It might make sense for beginners to start off with a modest investment. You can always raise your investment opportunities as your expertise and abilities advance.

Take a long view: Major index funds aim for regular stable growth over time, thus investing in them is frequently a long-term strategy that may be used to benefit from months or even years of gains.

Best trading platforms to invest in S&P 500 index

The most important step when thinking about how to invest in the S&P 500 index is finding and selecting a reliable stockbroker. These days, there are numerous brokers to pick from, making a decision difficult.

We detail each of these brokers and what you may anticipate if you use each of them below.

1. eToro

eToro, which is well-known for its vast portfolio and offers shares, stocks, commodities, and cryptocurrencies for purchase, lets users exchange assets with no commission. Thus, there are no commission costs associated with investing in the S&P 500 index.

Furthermore, eToro offers a safe and dependable option to invest your money because it is governed by the Financial Conduct Authority (FCA). Additionally, creating an account at eToro may typically be done in less than 10 minutes.

It’s easy to deposit money into your eToro account, so you may do it quickly and start investing in S&P 500 tracker.

As an alternative, you might use one of the S&P 500 ETFs that are provided by eToro and Vanguard. Even better, you can put money into actively managed funds that strive to outperform the S&P 500 index. You can even invest in the FTSE 100 if you want to get a taste of the UK market. There is an investment for everyone with such a vast range of alternatives.

2. Capital.com

Capital.com is a second brokerage to take into account. Because they are governed by CySec, they abide by all relevant European security regulations.

They provide a wide range of securities, including equities, ETFs, commodities, currency, and others. Additionally, Capital.com provides key indices with up to a 20:1 margin trading option.

Finally, Capital.com provides platform users with a ground-breaking “newsfeed” that is powered by AI. Videos and articles that can help you make better selections are automatically selected for you in this newsfeed based on your financial choices. These instructional resources are intended to assist you in honing your approach when trading stocks like S&P 500 CFDs.

How to invest in S&P 500 index?

We choose eToro for this because with it you can take advantage of the S&P 500’s $200 minimum investment requirement and 0% trade commission.

Step 1: Open an account

Just establish an account on the eToro website. Simply enter your social security number and the necessary personal details after that.

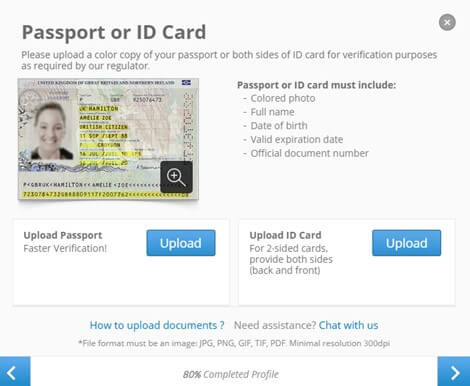

Step 2: Verification

You must provide the broker with proof of your identity and address because eToro is subject to FCA regulations. You can do this extremely rapidly thanks to the eToro digital trading platform. Just submit a copy of your ID and your utility bill or bank statement as evidence of your address. It normally takes a few minutes for eToro to verify your documents for verification after that.

Step 3: Deposit funds

You must fund your account before making an investment in the S&P 500 UK. The use of a credit card, debit card, or electronic wallet is the quickest way to complete this. This is due to the fact that the money will show up in your account right away.

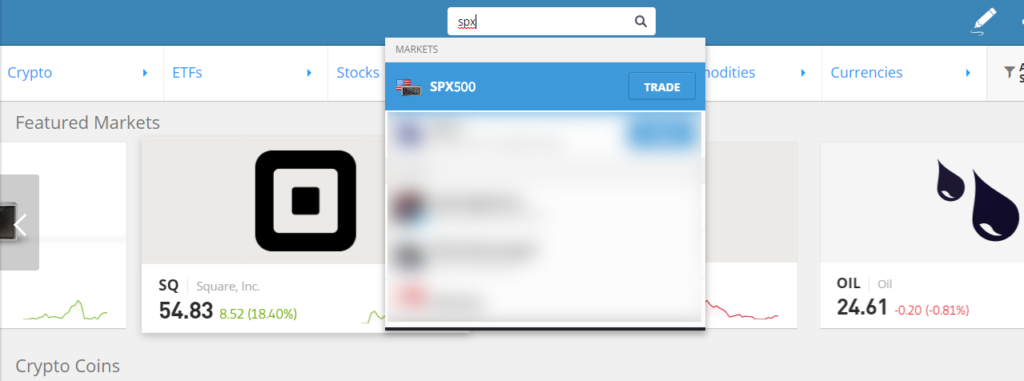

Step 4: Search the S&P 500 index

We’re getting close! Simply type “SPX500” into the search bar at the top of the screen and choose the first choice from the drop-down selection that appears. Alternatively, you might invest in the S&P 500 ETFs offered by Vanguard and eToro.

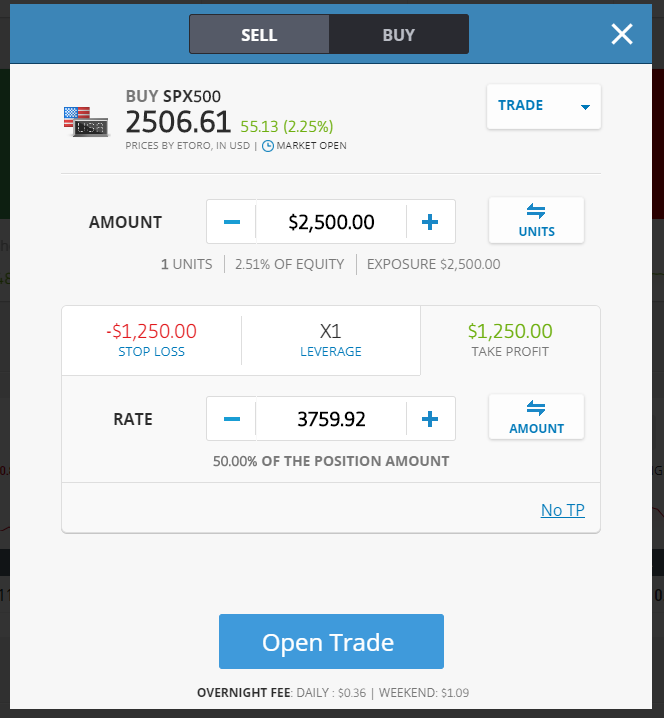

Step 5: Start trading

Make sure everything is right, enter the desired investment amount (minimum $200), and then click “Open Trade.”

Conclusion

The S&P 500 index is a superior source of passive returns. This index is a favorite among certain investors since it offers fantastic diversification advantages and an average annualized return of 10%.

It is simple, low-risk, and doesn’t involve any sort of active trading or rebalancing. Simply choose your investment amount, complete the transaction, and then sit back and watch the index work its magic.

Frequently Asked Questions

Is the S&P 500 a good investment?

The S&P 500 boasts a great level of diversification and therefore entails little risk. The S&P 500 is unquestionably worth investing in if that appeals to you. But bear in mind that only you have the authority to make this choice; if you are doubtful, consult a qualified financial counsel.

What are the S&P 500 day trading options?

You can day trade the S&P 500 by determining entrance and withdrawal points as well as carrying out fundamental and technical research that offers certain potential. Day trading chances are somewhat constrained due to a large number of passive investors in this index.