Capital.com offers a friendly atmosphere for both novice and experienced traders seeking a new MT4 broker with one of the lowest-cost trading environments in the business and a wide variety of tradable assets.

The broker is well-known throughout the world and mostly focuses on trading stocks and CFDs. To completely comprehend Capital.com’s features and determine whether it meets your trading needs, continue reading our comprehensive review.

What is Capital.com?

Founded in 2016, Capital.com is a fintech service with a license. On the broker’s multiple platforms, which include MT4, TradingView, and the Web Platform, there are more than 700,000 registered users. Capital.com also offers the best trading app that works flawlessly on all mobile platforms. To continue trading while on the go, feel free to download the broker’s app from Google Play and the App Store.

This broker offers a wide variety of CFD products on numerous marketplaces, all of which can be traded without paying any commissions. Additionally, there are no fees for idleness and all transactions are free. It should be noted that Capital.com has fantastic learning resources for traders who are just starting out or those looking to increase their knowledge. Additionally, you are exposed to study materials that will aid in the creation of your ideal trading approach.

Globally, Capital.com is regarded as one of the top online brokers. Its main office is in the UK, and it also has offices in Australia, Cyprus, and Belarus. 24 more world languages are also available.

Assets offered by Capital.com

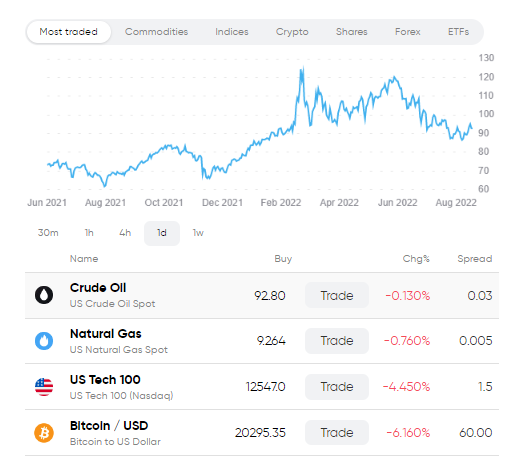

As previously noted, Capital.com provides a selection of more than 6,400 assets, all of which can be traded as stocks and CFDs. To make the finest investment choice, it is crucial that you fully comprehend the range of instruments that this broker provides. Look down below.

- Shares: At Capital.com, you can examine 5,900 shares commission-free while using more than 79 technical indicators and drawing tools to spot chances. The finest part of trading stocks on Capital.com is getting to know some of the biggest corporations, like Tesla, Alphabet, Amazon, Apple, etc.

- Cryptocurrencies: You can explore all 380 cryptocurrencies that Capital.com introduces to you commission-free.

- Forex: One of the most popular financial activities among traders is forex trading, and Capital.com exposes you to over 120 currencies for trading. This includes big, minor, and exotic issues.

- Indices: Capital.com offers the chance to trade 24 indices, including the Dow Jones, FTSE 100, S&P 500, and DAX 30, for index traders who enjoy combining many stocks in a single transaction.

- Commodities: On Capital.com, 22 hard and soft cryptocurrencies are also featured. You may freely trade them as CFDs and use them as a hedge against current investments.

Capital.com Fees

Capital.com charges its own fees for investing in the many financial assets it hosts, much like other brokers. The majority of the broker’s services, such as deposits and withdrawals, real-time quotations, opening, and closing trades, learning resources, and research tools, are provided without charge.

Since Capital.com does not charge commissions, its trading fees are based on spreads. Additionally, based on your trading preferences, it assesses an overnight cost. Only the leverage offered when trading shares, cryptocurrency, and thematic investments are subject to this overnight fee. The overnight charge will, however, be calculated depending on the total value of the trade for trading in currencies, commodities, and indices.

Overall, Capital.com is a cheap broker that gives you access to a wide range of assets for investing with just a £20 minimum deposit. Additionally, investing simply needs a minimum of £1. Additionally, Capital.com offers a sample account with £10,000 already loaded so that users may test it out and practice trading before entering the actual markets.

Deposit Methods

Capital.com does not collect fees for deposits or withdrawals, as was already mentioned. To make the greatest trading judgments, it is essential that you thoroughly comprehend the accepted currencies and payment methods.

The funding sources that are accessible in Great Britain are listed below since this information concentrates on the UK market. You can still consult the website of Capital.com to learn about additional regional choices. The only other minor currency listed on this broker’s website is the PLN. The other available currencies are GBP, USD, EUR, AUD, and GBP.

- Credit/Debit Cards: You can transfer money between your trading account and other accounts using bank cards like Visa, MasterCard, and Maestro. When contemplating Capital.com, make sure to check if your nation accepts this payment method as it is only available in the UK and a few other places.

- Bank Transfers: Although they can be time-consuming, wire transfers have been effective in every country that Capital.com serves.

- E-Wallets: Due to their efficiency and speed, this payment method has become the most common among traders. You can deposit and withdraw money from Capital.com using PayPal, ApplePay, Qiwi, Trustly, and other services within 24 hours.

POLi in Australia and GiroPay in the EU are a couple of the payment options that Capital.com accepts from customers in different nations.

Market research features

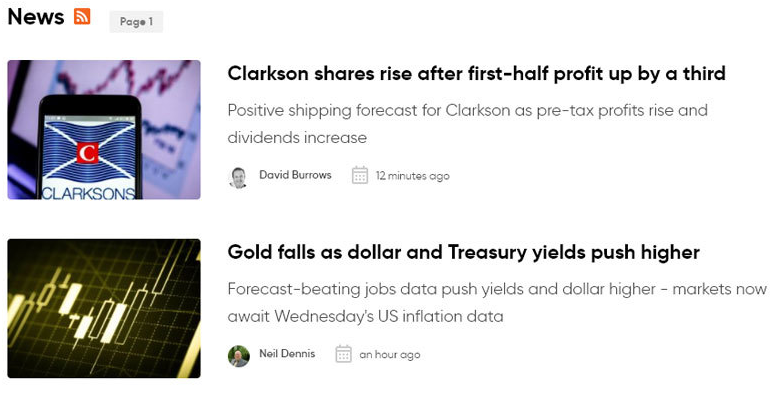

The polished research information on Capital.com is well-written, organized, and frequently contains charts and analyses.

The market commentary on Capital.com is well-organized, with a variety of theme-specific playlists available on YouTube and the company’s website. Under its news and analysis part, it also provides in-depth pieces, which We found to be really informative. Capital.com’s comprehensive research offering goes above and beyond what we’d anticipate from the typical broker, including commentary on economic basic data points and technical analysis of market data points.

Research overview: Within the Capital.com TV section of its website, which has playlists of videos, Capital.com provides research in addition to its educational content.

Market news and analysis: The research clips, which include the weekly outlook and information for particular symbols, may be found in the Market Outlooks area and are of high quality. The articles that Capital.com posts on its blog are quite well, link to resources, and frequently include charts and analysis, comparable to what you could see in a journalistic magazine. We were impressed overall.

Trading Central: The whole range of modules from Trading Central have been integrated into Capital.com’s web platform, which helps to further enhance its overall research offering.

Education resources

The Investmate app from Capital.com is solely devoted to investor education, and traders have access to a thorough training program that includes quizzes to assess their financial acumen.

This instructional program consists of five courses with a total of 28 lessons, and it concludes with a test meant to evaluate your learning and financial literacy. Even more impressive to me was its Investmate app. It employs a gaming-inspired approach that enables you to learn at your own pace while keeping track of your progress.

Learning center: At least 72 instructive videos, some of which are embedded in Capital.com’s web platform, are available on Capital.com’s YouTube account. It also includes eleven written guides, some of which, like CFD trading and trading psychology, we found to be interesting and detailed. A few of these guides feature additional articles that go into even more depth and go beyond what is provided in an investor glossary to clarify various phrases and topics. Overall, Capital.com’s robust educational selection is on par with the industry’s top brokers.

Investmate: A number of brokers have developed solely educational trading-related apps, and Investmate is Capital.com’s response to this market trend. A wonderful example of a mobile app that prioritizes teaching while also receiving good marks for usability and a pleasant user experience is Investmate.

Room for improvement: An increase in Capital.com’s lesson program would boost its instructional material. This outstanding educational tool might be improved even further by adding more content and enabling the organization of that content by experience level.

Capital.com platforms

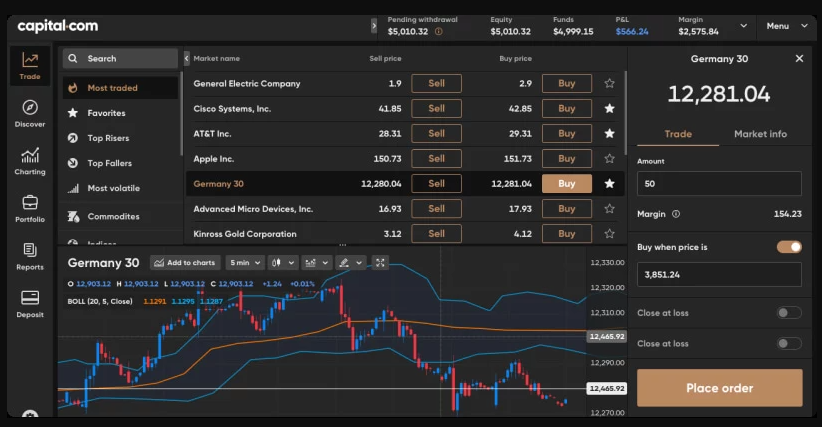

The user-friendly web platform from Capital.com is packed with a wealth of useful features, making it an excellent option. TradingView or MetaTrader are still options for those that choose external platforms.

Three trading platform packages are available through Capital.com: the TradingView web platform, which is renowned for its robust charting, and MetaTrader 4 for desktop and mobile. Without any notable add-ons that would make Capital.com stand out from the finest MetaTrader brokers, it provides the no-frills MT4 experience direct from the developer.

Platforms overview: Along with the web version that can be accessed using any current browser, the MT4 package is offered at Capital.com. The proprietary trading platform from Capital.com is simple to use and packed with a wonderful mix of features.

The Capital.com web platform, which balances user-friendliness with a number of rich features, is a fantastic option for almost all sorts of traders. It falls short of the platform choices made by the top forex brokers in this category.

Charting: The MetaTrader platform family is renowned for its powerful yet user-friendly charting. On MT4, it’s simple to zoom in and out and rearrange windows and tabs. Additionally, it permits dragging and dropping items from the nearly 50 indications on the default list. The Capital.com web platform is unique in that it offers a plethora of functionality and a variety of tools, such as pre-defined watchlists that act as screeners to keep track of markets and trend data and incorporated research from Trading Central.

Mobile trading apps

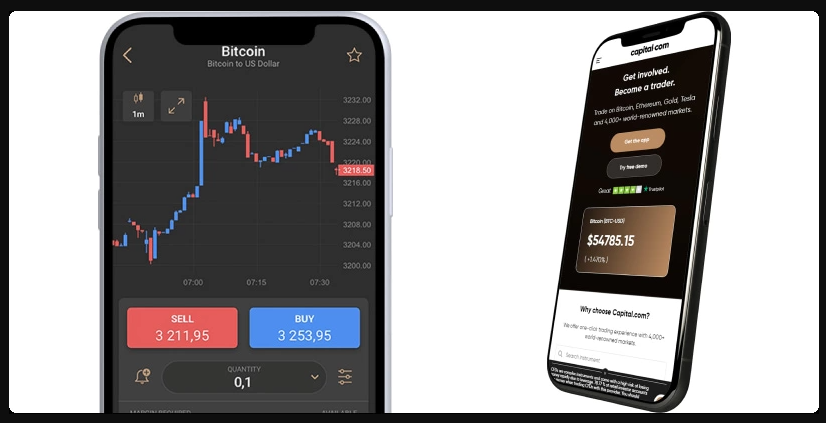

Capital.com offers distinct mobile applications for trade and learning, so you’re served regardless of whether you’re beginner or an experienced trader. The MT4 app is also available to MetaTrader devotees.

Overview of apps: The Investmate app for training, the MT4 app, and Capital.com’s own Trading app are the three mobile trading applications offered by the company. All of them are accessible to users via the Google Play store and the Apple App Store, respectively.

Easy to use: Nearly all brokers provide the MT4 mobile application due to its user-friendly layout and the plethora of functions that come equipped with MetaTrader. Although the MT4 mobile app makes seeing and maintaining positions quick and straightforward, algorithmic trading is not supported—you must use the desktop version instead.

Charting: The MT4 smartphone charts are user-friendly and include a variety of indicators. Simple tasks like drawing trend lines and altering the time range are available, and opening the quick pie menu on a chart is as simple as tapping and holding the chart.

Trading tools: The Tradays app, which needs to be installed separately and is launched from within the MetaTrader app, powers the economic calendar on MT4. Accessing the MetaTrader social features in the application requires registration into the MQL5 group.

Additional Features of capital.com

Demo Account: Capital.com offers a demo account, and as a beginner, we suggest using it to get started with your trading. Test the broker’s operations and the availability of supported tools for your trade since it is a risk-free account. However, keep in mind that you shouldn’t expect to make money with this account either as you won’t be investing real money in it.

Spread Betting: Users of Capital.com can take advantage of a variety of spread betting and CFD options with zero costs, narrow spreads, and no commissions. Additionally, the retail CFD accounts web trading platform gives customers access to tens of thousands of various forex trading markets at continuously low prices with excellent order execution and low spreads.

Customer Service: Capital.com is one of the top in the business and offers excellent customer service. Since they are open 24/7, you can get in touch with them by phone, email, or live chat at any time. Most essential, the client service for this broker provides timely, pertinent solutions.

Capital.com Licences and Security

More than 180 nations are represented among the customers of Capital.com. This indicates that highly regarded financial regulators have granted it licenses. Additionally, Capital.com has insurance agreements in accordance with regional rules, showing that you can trade with the broker in confidence.

Following are the well-known figures who are in charge of Capital.com’s operations.

- Capital.Com SV Investments Limited: under license number 319/17, is authorized and governed in Cyprus by CySEC.

- Capital.Com (UK) Limited: Licensed with registration number 793714 in the UK. The Financial Conduct Authority oversees trading in the nation.

- Capital.Com Australia Limited: under license number 513393, is authorized and governed in Australia by ASIC.

- CJSC “Capital.Com Bel”: with registration number 193225654, is authorized and governed in Belarus by NBRB.

How to begin with Capital.com?

With Capital.com, creating a trading account is a rather simple procedure. For retail traders, the broker offers a normal account, and for enterprises, a corporate account. Advanced traders may also open a professional account, but only if they executed at least 10 deals in the previous quarter. Additionally, you should have a portfolio worth more than £500,000 and at least one year of job experience in the financial industry.

The steps for opening a retail trading account, whether it’s a demo or a genuine account, are outlined here.

- To open a trading account, use the links on this page to navigate to the Capital.com website.

- Sharing your personal information, such as names, email addresses, phone numbers, dates of birth, employment information, etc., will finish the account registration process.

- You will share a copy of your ID card and, as is customary for all regulated brokers, a utility bill to prove your identity and address.

- Capital.com’s verification process can take up to 24 hours. Once you receive notification, you must deposit at least £20 in order to access the assets offered and engage in trading.

- Start exploring several markets with your new trading account. Always keep a budget in mind and choose the appropriate number of assets to meet it.

Conclusion

For traders looking for the best brokers for trading stocks and CFDs, Capital.com is a great option. This is based on our thorough investigation and user evaluations from up to Capital.com. For instance, the broker is secure because reputable financial regulators like the FCA, ASIC, and others regulate its operations.

We expect that Capital.com will continue to expand its services throughout other global regions, like the US, in addition to the hundreds of nations that it now serves. To ensure that no trader or investor is constrained, we also wish to see trading of actual assets included.

In general, we advise any CFD traders looking for exceptional features to choose this broker. However, if you want to have a productive experience, make sure it satisfies your trading needs. Make the best trading decision by using Capital.com’s sample account to test it out.

Frequently Asked Questions

Do they offer copy trading on Capital.com?

No. Unfortunately, Capital.com does not offer copy trading. To maximize your profit potential, you can still take advantage of the broker’s excellent learning and research resources.

Can I purchase stocks using Capital.com?

Yes. You can purchase stocks in a number of prestigious firms, including Meta, Tesla, Amazon, etc., through Capital.com. To determine the ideal entry and exit points, you just need to comprehend what motivates a company’s shares.

Can I trade at Capital.com for £10?

Yes. Although this broker has a £20 minimum deposit requirement, you can begin investing with as little as £1. For a better experience, make sure you comprehend the market in which you wish to invest.

Does Capital.com allow day trading?

Absolutely. At Capital.com, you can start day trading utilizing many different CFD assets, such as shares, currencies, cryptocurrencies, commodities, etc. However, as CFDs entail margin trading, be sure you are completely aware of the markets you wish to trade and any associated dangers before attempting to engage in CFD trading.