We believe that now is a fantastic time to look for high dividend companies to purchase due to market weakness.

Market conditions have been poor. As a result, there are more businesses that qualify as good dividend-paying companies.

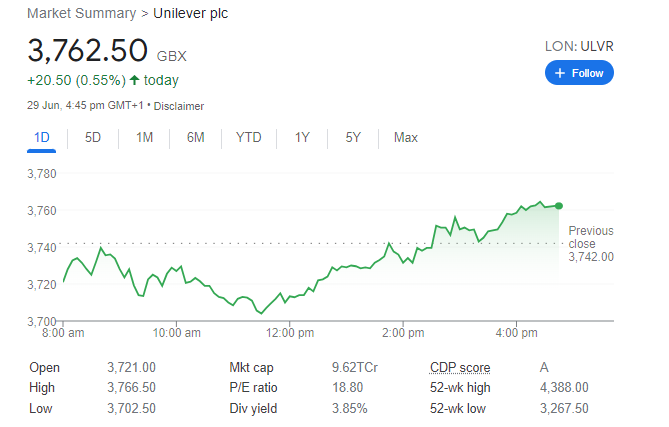

Unilever (LON: ULVR)

- Sector: consumer goods

- Price: 3762.50 GBX

- Current Dividend yield: 3.85%

Unilever, a manufacturer of high-volume consumer goods, appears to be more affordable than ever. The forward-looking dividend yield for 2023 is slightly over 4% with the share price hovering around 3,762p.

And we consider that price to be valuable. Unilever’s dividend has a compound annual growth rate that is now over 6%. We would also be content to hold onto the shares for at least ten years.

Inflation and its potential impact on the industry are one source of worry. However, the business claimed at the end of April that it was doing fine. And it is succeeding in increasing sales prices to counteract rising input costs.

This year’s earnings are predicted to drop. The business is making investments to strengthen the power of its brands. However, it is not subject to decreasing global economic conditions. Unilever, however, has a successful business and a track record of effective execution.

Future-looking City experts predict that earnings will increase in 2023. However, any corporation could miss its projections. However, despite the dangers, the stock is attracting us right now.

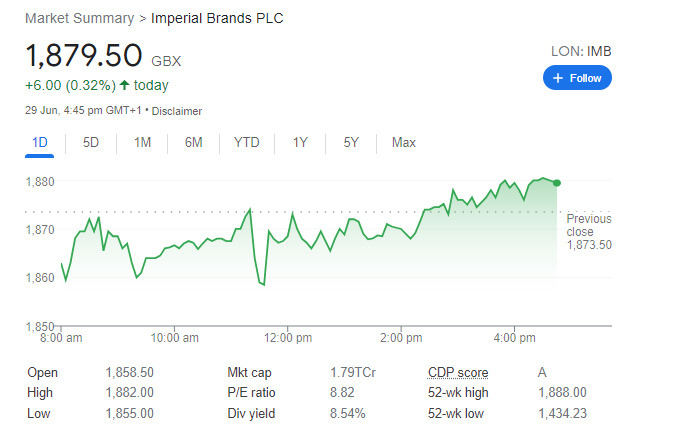

Imperial Brands (LSE: IMB)

- Sector: smoking products

- Price: 1879.50 GBX

- Current Dividend yield: 8.54%

Next, we are interested in Imperial Brands, a manufacturer of smoking products. With a share price of roughly 1,879p, the dividend yield is expected to be around 7.7 percent for the fiscal year to September 2023.

The business has been able to conduct a controlled exit from the modest portion of its operations in Russia. Additionally, the May half-year report gave a positive outlook for the company’s future. The first half of 2022 has seen almost no change in trading. However, the business anticipates that the recent price hikes will enable a higher revenue performance in the second half.

Of course, considering the risks associated with the products, this industry is not suitable for everyone. Additionally, the business is heavily in debt. However, cash flow is still strong and a dividend cut is not in the near future.

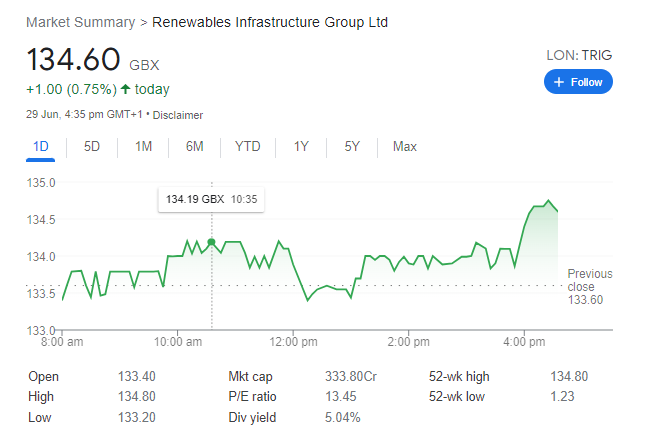

The Renewables Infrastructure Group (LON: TRIG)

- Sector: Renewable Energy

- Price: 134.60 GBX

- Current Dividend yield: 5.04%

Energy company Renewables Infrastructure is our third dividend pick. The business finances active initiatives for the production of renewable energy. And that includes solar photovoltaic, wind, and onshore wind resources in the UK and Northern Europe.

We appreciate the company’s stable multi-year trade and financial history. Additionally, the forward-looking dividend yield for 2023 is a little over 5% with the share price hovering around 134p. However, dividend growth has been modest, with a compound annual growth rate that is currently hovering around 2%.

There is a clear danger that if the wind doesn’t blow or the sun doesn’t shine, cash flow and profitability could fall. However, the business claimed to have produced a “strong” financial performance in 2021 in its full-year report released in February. And that was despite fluctuating commodity prices and the company’s lowest wind resource in its history.

In today’s energy environment, We believe that making a long-term investment in renewable infrastructure is worthwhile.

Leave a Reply