At the moment, renewable energy is a trendy topic. Due to the ongoing importance of sustainability and the current oil and gas crisis, many businesses and individuals are turning to renewable energy stocks.

The use of cleaner alternative energy sources is replacing carbon-based fossil fuels around the world. According to analysts, it will cost more than $100 trillion to decarbonize the world economy over the next three decades.

Is it wise to buy shares of renewable energy companies now that the industry is gaining popularity? Let’s dissect it.

In this guide, we will discuss the best UK renewable energy stocks for 2022, along with information on how to invest in them.

Best Renewable Energy Stocks 2022

Here is a list of the best renewable energy stocks for 2022:

- Scottish and Southern Energy (LON: SSE)

- Greencoat UK Wind (LON: UKW)

- ITM Power (LON: ITM)

- Ceres Power Holdings (LON: CWR)

- AFC Energy Plc (LON: AFC)

- Tesla (NASDAQ: TSLA)

- SolarEdge Technologies (NASDAQ: SEDG)

- Plug Power (NASDAQ: PLUG)

- NextEra Energy Partners (NYSE: NEP)

- First Solar (NASDAQ: FSLR)

Best Renewable Energy Stocks Analysis

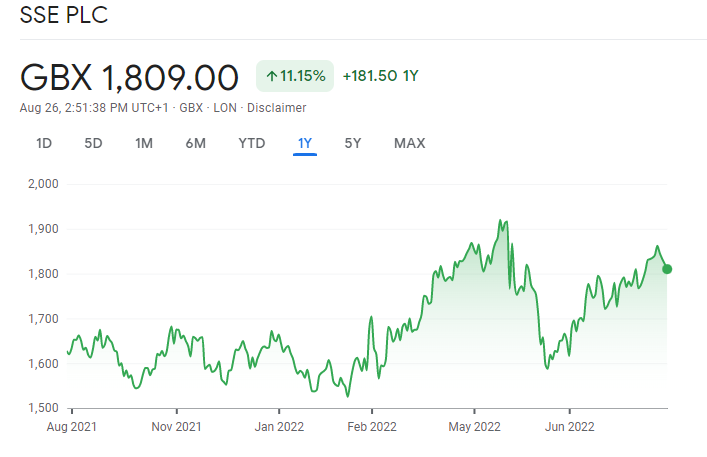

Scottish and Southern Energy (LON: SSE)

SSE, which is a component of the FTSE 100, was once known as Scottish and Southern Energy. It is a global energy corporation with operations in the UK and Ireland and its headquarters in Perth, Scotland.

According to SSE, its mission is to deliver the energy required now while creating a better world of energy for the future.

The company is one of the biggest power network providers in the UK and a significant generator of renewable electricity.

SSE creates, acquires, and manages a low-carbon infrastructure that is intended to aid in the transition to a carbon-free economy. Onshore and offshore wind, hydropower, grids for the transmission and distribution of electricity, and effective gas-fired generating are examples of this.

SSE is a sizable renewable energy corporation with 10,000 or so employees.

Greencoat UK Wind (LON: UKW)

A publicly traded renewable infrastructure company called Greencoat UK Wind has investments in profitable UK wind farms that are now in operation. The vehicle is a part of the FTSE 250.

It asserts to provide a compelling, long-term dividend that rises in accordance with RPI and effectively preserves capital.

43 onshore and offshore wind projects are now the subjects of investments from Greencoat UK Wind. Its assets have generated more than 14.4TWh of electricity since the company’s initial public offering (IPO) in March 2013. Its net generating capacity is 1,442MW.

ITM Power (LON: ITM)

ITM Power wants to use the power of green hydrogen to accelerate the global transition to net-zero emissions. Being listed on the LSE, the company is the first one connected to hydrogen.

ITM Power has been developing and producing electrolyzer systems based on proton exchange membrane (PEM) technology for more than 20 years. Only water and renewable energy are used in its systems, and the only byproducts are oxygen and water vapor.

In recent years, ITM has experienced substantial growth. It started a new Gigafactory in Bessemer Park, Sheffield, in 2021, which is now the biggest factory producing electrolyzers in the entire globe.

Because of greater automation and the benefits of scale, ITM Power should be able to reduce the cost of electrolyzers by roughly 40% over the next three years.

Ceres Power Holdings (LON: CWR)

The major goal of Ceres Power Holdings is to maintain a clean, green planet by making sure that clean energy is available everywhere.

The SteelCell was created by Professor Brian Steele at Imperial College in London, where the firm was founded. Since then, Ceres has spent over 20 years perfecting this technology and establishing itself as a world authority on fuel cells and electrochemistry.

A fuel cell is a machine that uses chemical reactions to produce electricity devoid of combustion. Fuel cell energy generation produces energy with little to no CO2 emissions and clean air with no emissions of SOx, NOx, or particulates.

Ceres aspires to provide homes, businesses, and automobiles with greener, more affordable energy. To accomplish this, the business collaborates with international partners to integrate its technology into popular energy products.

AFC Energy Plc (LON: AFC)

Surrey-based Alkaline fuel cells, which use hydrogen to generate energy, are being developed by AFC Energy. It does this as part of the global push to decarbonize industry, producing clean energy that has great performance and low operating costs.

Its Hydrogen Power (H-Power) systems make use of a proprietary design to guarantee effectiveness, dependable quality, and cost-effective operation. Additionally, it is free of greenhouse emissions and contaminants.

Through ongoing product development and enhancement, the company hopes to assist all of its clients in moving toward a net zero carbon future.

It has experienced a transformation over the last two years that will come to a head in December 2020 with the start of a strategic partnership with ABB. The goal of this was to develop the next generation of high-power electric vehicle (EV) charging options for places with limited grid infrastructure worldwide.

This was subsequently expanded in April 2021 after ABB committed a strategic investment in AFC Energy and negotiated a further growth contract.

Tesla (NASDAQ: TSLA)

Tesla, a US-based maker of sustainable energy and electric vehicles, has enjoyed a strong 2022; its stock is up 27% so far this year. Elon Musk’s business produces top-notch electric vehicles and related software, including that for completely autonomous vehicles. Additionally, EVs are the future because governments all over the world want to phase out fossil-fuel-powered vehicles over the ensuing years.

The firm listed on Nasdaq noted its record-breaking month of production in its second-quarter results published in July 2022, producing 258,000 automobiles. Despite coping with supply chain problems, a labor shortage, and manufacturing closures in Shanghai as a result of Covid lockdowns, this was the case.

The company’s new Berlin “gigafactory” is currently producing 1,000 cars per week, and it anticipates a “record” second half of 2022. With $18 billion in cash on hand, it is well-funded and anticipates increasing car deliveries by 50% annually in the long run.

Tesla shares have been affected by Musk’s recently failed bid to acquire Twitter, a social media platform. Investors expressed concerns that the controversial businessman has been diverted from concentrating on Tesla as a business and plans to use Tesla shares as collateral, in addition to being distracted.

A price-earnings ratio of above 50 indicates that the shares are costly, but they are still below their year high of $1,243, which was reached in November 2021. Investors now have a good entry point thanks to the recent downturn.

Learn more: How to Buy Tesla Shares UK- Complete Guide 2022

SolarEdge Technologies (NASDAQ: SEDG)

One of the most enduring brands in the solar energy sector that is still successful today was founded in 2006, SolarEdge. Even if the global pandemic reduced demand for its medicines, the company’s stock has undoubtedly remained steady, rising by around 400% in 2020. The company is currently less enticing than Enphase due to an anticipated first-quarter revenue decline of -8%, as well as lower profitability and sales estimates.

According to several market researchers, SolarEdge plans to broaden its core business to the European Electric vehicle industry in 2022 as the supplier of powertrain elements and batteries for Fiat e-Ducato van model. This is expected to generate an additional $100-120 million in revenue to the company’s financial statements.

Plug Power (NASDAQ: PLUG)

There is unquestionably tremendous potential for the supplier of hydrogen fuel cell systems utilized in the stationary power and electric mobility markets. After focusing mostly on the American and European markets, a partnership with the South Korean corporation SK Group was announced in January 2021 to bring Plug’s goods and services to Asian markets.

A memorandum of agreement for the beginning of the joint venture with French automaker Renault was signed in the same month. Management increased its forecast for 2021 from $450 million to $475 million in the previous report, and it increased its aim for 2024’s gross billings by up to 40% from its previous forecast.

Investors can consider the hydrogen stock as a high-quality contender for this year since it has corrected by about 50% in the past month.

NextEra Energy Partners (NYSE: NEP)

NextEra Energy, a member of the exclusive Fortune 500 list, is the largest private producer of wind and solar renewable energy in the world through a variety of operations including project development, building, and operation, as well as energy storage services. The corporation’s division, Nextera Energy Partners, is in charge of overseeing a network of solar and wind generation projects in addition to pipelines for natural gas across the United States and Canada.

Along with the positive estimate revisions and seven quarters of increasing fund ownership of its shares, the company’s sales increased from -5% to 3%, and its earnings-per-share increased from 0% to 70%.

First Solar (NASDAQ: FSLR)

Although the fundamental ratios of the FSLR stock don’t seem as compelling as those of the other stocks in this group, that could soon change as the American company, the company offered Q1 2022 report that was above analyst expectations as the profits trend is improving and points to a clear change from the largely negative trend of the preceding five years

The fact that more renewable energy investment funds now own FSLR shares than they did in the prior reported quarter demonstrates that institutions have taken notice of this.

Due to its manufacturing and industrial plants being headquartered in the United States and South Asia, First Solar might be in a role to benefit from prospective restrictions that might be implanted on Chinese solar content, amidst some looming worries from third-party market researchers regarding forced-labor programmes in China. First Solar also has a strong cash reserve.

How to buy Renewable Energy Stocks?

In the sections below, we’ll show you how to invest in Renewable Energy Stocks.

Step 1: Choose a broker

You’ll need a reliable brokerage if you want to buy Renewable Energy stocks in the UK. Which renewable energy you can trade will depend on your broker. Furthermore, the trading fees, platforms, and services offered by various brokers vary.

In light of this, let’s examine the best stock brokers for fee-free investments in renewable energy firms.

1. eToro

eToro is the most effective site in the UK for purchasing renewable energy stocks. The best alternative is eToro because it provides CFDs on a variety of renewable energy companies on the NYSE, NASDAQ, and the UK markets, as well as the best UK ETFs for gaining exposure to space.

Another important selling point of eToro is its distinctive features, such as its social and copy trading capabilities. The social trading industry’s first broker, eToro, allows its more than 12 million users to participate in a range of financial discussions. For rookie investors, having a strong peer network is an essential asset since it gives them another way to learn the ropes.

With a minimum investment of $50 (about £36) for each stock trade, the broker enables you to trade fractional shares, giving you the opportunity to invest in the best renewable energy firms without having to initially invest a lot of money.

Learn more: eToro Broker Review UK- Complete Guide 2022

2. Libertex

Like eToro, Libertex is not a conventional brokerage. This is because only CFDs, which are tradeable products provided by brokers and monitor the real-time price of the underlying asset, are the main emphasis of this trading platform. If the underlying asset increases or falls by 1%, the CFD that is following it will also increase or decrease by 1%.

Leverage and short selling are nevertheless offered by CFD brokers like Libertex, which are not always available on regular share trading platforms.

Leverage allows you to trade stocks with funds that are greater than those in your Libertex account. FCA guidelines limit this to a 1:5 ratio, thus a £100 balance would permit a £500 trading position.

Libertex accepts deposits made through e-wallets, bank wires, and debit/credit cards. Additionally, the £10 minimum deposit is perfect for people who are new to stocking CFDs. Since the late 1990s, Libertex has offered CFD trading services and takes pride in its security. It is useless to worry about security because Libertex is under the control of CySEC.

Learn more: Libertex Broker Review UK- Complete Guide 2022

Step 2: Create an Account

We’ll go over how to use eToro, a platform that offers access to global markets and commission-free trading, to purchase renewable energy stocks in the UK.

Visit the eToro homepage to begin started, then click the “Join Now” option to make a new account. You can sign in with your Facebook or Google accounts, or you can use your email address to create a new account.

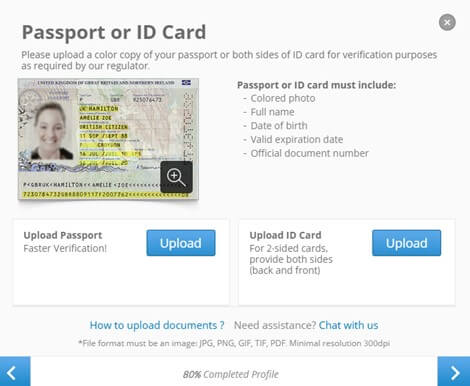

Regardless of the method you choose, eToro requires you to prove your identity in order to adhere to UK anti-money laundering regulations. To complete this step, upload a copy of your passport or driver’s license along with a copy of a recent utility bill or bank statement that displays your residence.

Step 3: Deposit Funds

You’ll then need to finance your brand-new eToro account. eToro accepts a variety of payment methods, including bank transfers, credit or debit cards, e-wallets like Neteller, and Skrill.

Step 4: Buy Shares

Renewable energy stocks can now be purchased using your eToro account. Search for the stock you want to purchase on your dashboard, then click “Trade” when it pops up in the drop-down menu. After that, you will be taken to an order form where you can purchase the renewable energy stocks.

Your desired investment amount in the renewable energy stock should be entered on the order form. You can select stop loss and take profit levels if they are included in your plan. Additionally, eToro gives you the option to trade CFDs with up to a 5:1 leverage ratio.

When your trade is prepared, click “Open Position” to buy your first renewable energy stock.

Conclusion

Even though the renewable energy industry is still in its infancy, several of the major players are already well on their road to becoming prosperous companies. Even with the predicted 62% rise in worldwide electricity demand by 2050, there is still room for expansion.

Since utility stocks can generate significant amounts of revenue, which means they pay out big dividends, they have long been popular among investors. They also provide some stability because governments support efforts to decarbonize their economies and energy consumption is largely guaranteed.

Some of the businesses in the list gain from having various revenue sources. Others focus exclusively on one type of energy, like solar or wind.

If you do choose to invest, you can buy all of the best renewable energy stocks right now on eToro.

Frequently Asked Questions

What is renewable energy?

Examples of renewable energy sources include wind, sun, hydro, biomass, geothermal, ocean waves and currents, and green hydrogen.

Are these businesses traded on any big stock exchanges?

They are indeed traded on significant stock exchanges including the NASDAQ, LSE, and NYSE.

Is it possible to make a wager that stocks of renewable energy will decline in price?

Investors have the option of shorting individual companies or one of the ETFs that invest in this market at any moment. On eToro and Libertex, investors can short-sell equities using CFDs.

What is the best stock in renewable energy?

The top renewable energy stocks to buy in the UK in 2022 are the ten companies listed in this guide.

Is making investments in renewable energy wise?

The market for renewable energy holds enormous potential for investors. However, because not all stocks can fully profit from this opportunity, investors must pick their stocks wisely.