Despite the broader market driving many stocks to all-time highs, there remains a variety of undervalued stocks trading below their intrinsic worth. These securities, often trading at a discount to their true value, offer an attractive risk-reward profile for savvy investors.

Undervalued stocks typically possess solid fundamentals and growth prospects yet are overlooked or overshadowed by market sentiment. Investing in undervalued stocks can lead to significant returns as the market eventually recognizes their true potential, driving their prices higher.

In this article, we delve into a curated selection of undervalued stocks across various sectors, examining their compelling investment thesis and growth prospects for the discerning investor in 2024 and beyond.

10 Most Undervalued Stocks To Invest In 2024

Undervalued stocks present a compelling opportunity for investors seeking to capitalize on overlooked gems in the market. Below are the 10 Most Undervalued Stocks that you should invest in 2024.

1. PayPal (NASDAQ: PYPL)

PayPal emerges as a standout among undervalued stocks in 2024. Despite its robust revenue growth of 9% in the fourth quarter and a staggering 61% increase in earnings per share (EPS), PYPL trades at an enticingly low multiple of just 11.5 times forward earnings.

With a diverse range of payment solutions extending beyond traditional checkout experiences, PayPal continues to capture market share and drive innovation in the fintech sector. Its strong business fundamentals, coupled with its attractive valuation, make it an appealing investment opportunity for discerning investors.

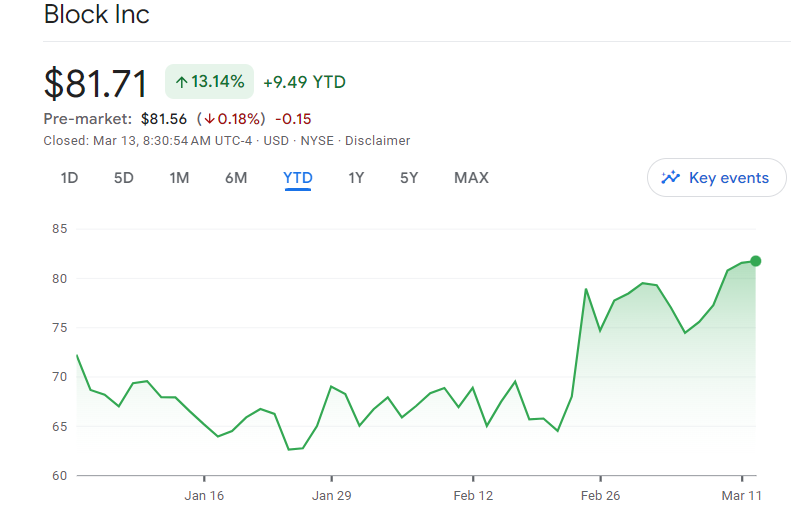

2. Block (NYSE:SQ)

As a profitable player in the digital payments space, Block has transitioned into a powerhouse, delivering solid revenue growth and profitability. With its diverse suite of products and services, including payment processing, Cash App, and cryptocurrency trading, Block is well-positioned to capitalize on the evolving needs of consumers and businesses alike.

With projected triple-digit growth in earnings per share (EPS) from 2024 to 2030 and substantial revenue growth on the horizon, Block offers investors the potential for multi-bagger returns over the long term. Furthermore, Block’s exposure to the booming cryptocurrency market and its strategic investments in blockchain technology further bolster its growth prospects, making it an undervalued stock with significant upside potential for investors seeking exposure to the fintech sector.

Also read: Best AI Stocks to Buy in 2024

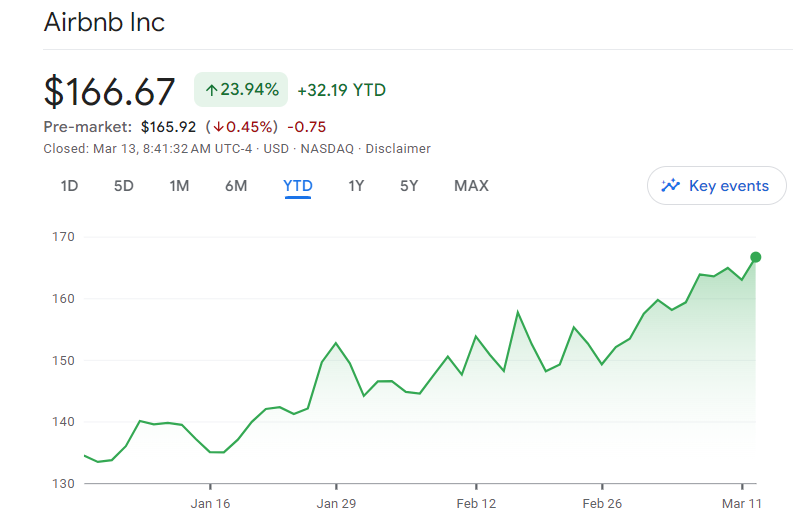

3. Airbnb (NASDAQ: ABNB)

Airbnb continues to defy expectations and emerge as a resilient player in the hospitality industry, making it an intriguing undervalued stock for investors in 2024. Despite facing challenges such as the COVID-19 pandemic and regulatory hurdles, Airbnb has exhibited impressive growth, with its fourth-quarter revenue rising by 17% year-over-year.

Additionally, the company’s decision to enact a substantial stock buyback program underscores management’s confidence in Airbnb’s future prospects and the belief that its stock is undervalued. With a forward-looking price-to-earnings ratio (P/E) of just 26 times free cash flow, Airbnb’s stock presents an attractive opportunity for investors seeking exposure to the travel and accommodation sector.

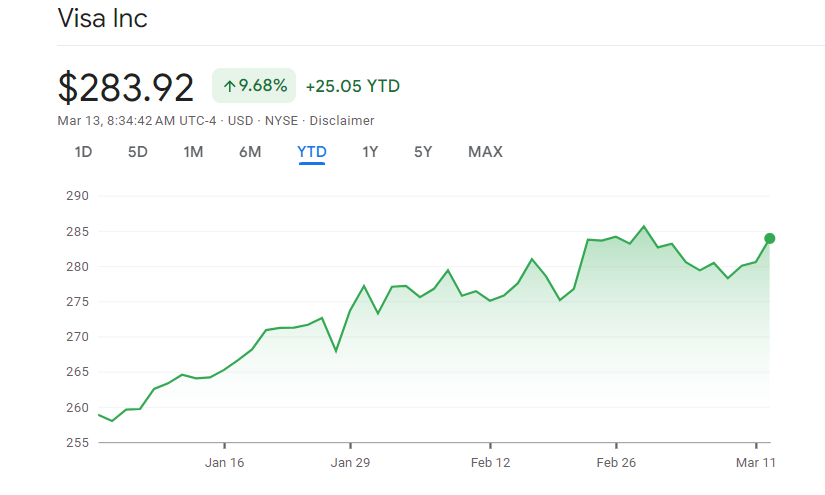

4. Visa (NYSE: V)

Visa stands out as an undervalued gem in the market for investors in 2024. Despite consistently beating the market with its steady growth, share buybacks, and improving profitability, Visa’s stock trades at a relatively low valuation point of 32 times earnings.

In its fiscal first quarter of 2024, Visa reported a robust revenue growth of 9% and an impressive 20% increase in earnings per share (EPS) year-over-year, demonstrating its resilience and ability to generate strong returns for shareholders.

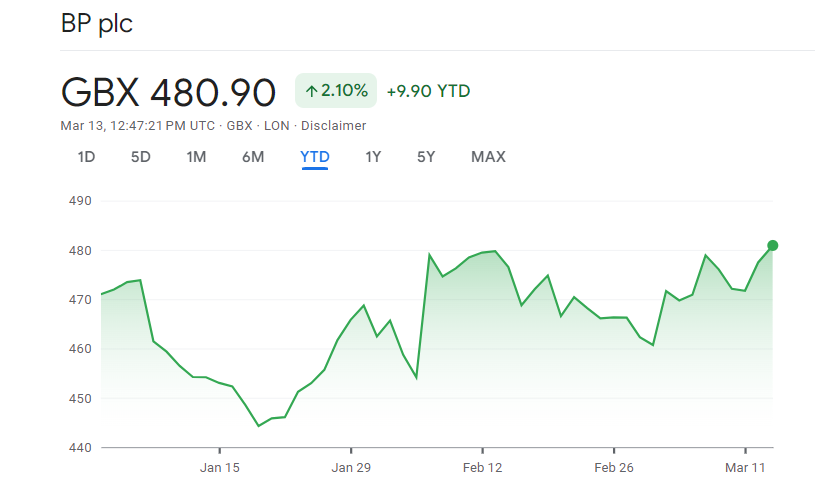

5. BP (LON: BP)

BP presents an enticing opportunity for investors in 2024 as a deeply undervalued stock in the energy sector. Despite facing challenges stemming from the transition to renewable energy sources, BP has renewed its focus on oil and gas exploration, demonstrating a commitment to its core business. This strategic shift, coupled with improved fundamentals, positions BP as one of the top undervalued stocks in the market.

In the third quarter, BP reported a 6% decrease in revenue year-over-year, yet net income surged by a remarkable 324% over the same period, reflecting the company’s efforts to enhance profitability. Moreover, BP’s dividend yield of around 4.67% and a sustainable payout ratio of 56.5% underscore its dedication to rewarding shareholders.

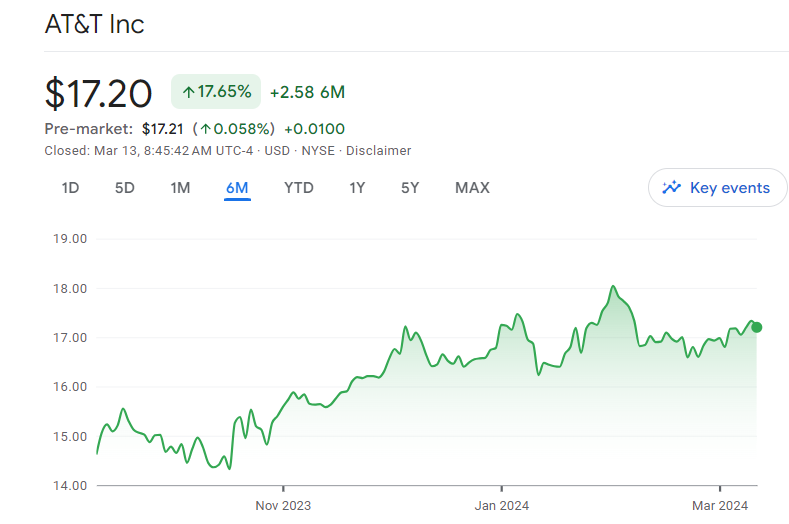

6. AT&T (NYSE: T)

AT&T emerges as a compelling undervalued stock choice for investors in 2024 despite recent challenges. The telecommunications giant, after a dividend cut in 2022, now trades at a significantly lower valuation compared to its peers. Despite this setback, AT&T is showing signs of a turnaround, with improved margins and potential top-line growth driven by subscriber gains in 5G and AT&T Fiber services.

In the fourth quarter, AT&T reported revenue growth of 2.2% year-over-year, with particularly strong performance in its Fiber segment, where revenue climbed 22%. Moreover, the company’s EPS rebounded from a loss per share in the previous year to positive earnings, signaling a positive trajectory.

7. Panasonic Holdings (PCRFY)

Panasonic Holdings represents a compelling undervalued stock option for investors in 2024, particularly within the electric vehicle (EV) battery industry. Despite broader industry sentiments weighing on its valuation, Panasonic offers an attractive forward price-earnings ratio of 7.3 and a dividend yield of 2.37%.

The company’s aggressive growth plans, including quadrupling its EV battery capacity to 200GWh by 2031, underscore its commitment to capturing a larger share of the burgeoning EV market. Additionally, Panasonic’s focus on innovation, with plans to boost battery energy density and produce solid-state batteries for various applications, positions it for long-term success in the evolving energy storage landscape.

8. UiPath Inc (NYSE: PATH)

UiPath Inc. emerges as an intriguing undervalued stock option for investors in 2024, particularly within the automation software sector. The company’s Software-as-a-Service (SaaS) platform offers a range of resources, catering to workforce and enterprise institutions across various industries. PATH’s impressive financial performance further bolsters its appeal, with a reported 24% year-over-year growth in revenue and Annual Recurring Revenue (ARR) reaching $1.38 billion in Q3’24.

Notably, the company has demonstrated consistent ARR growth, with an estimated 35% compound annual growth rate (CAGR) since 2022. With a growing customer base, including a significant increase in large customers spending $100k yearly, PATH’s guidance anticipates continued revenue growth and ARR expansion in the near term.

9. Tencent Holdings (0700)

Tencent Holdings remains a compelling undervalued stock option for investors in 2024, despite recent regulatory challenges in China. With a strong growth profile evidenced by a 22.3% increase in quarterly revenue over the past three years, Tencent continues to solidify its position as a leader in the global gaming and technology markets.

Furthermore, Tencent’s robust financial performance, highlighted by a 10% year-over-year revenue growth in the third quarter of 2024, underscores its ability to navigate challenges and deliver value to shareholders. With the video games market projected to reach $363.2 billion by 2027, Tencent’s dominance in this space positions it for long-term growth and profitability.

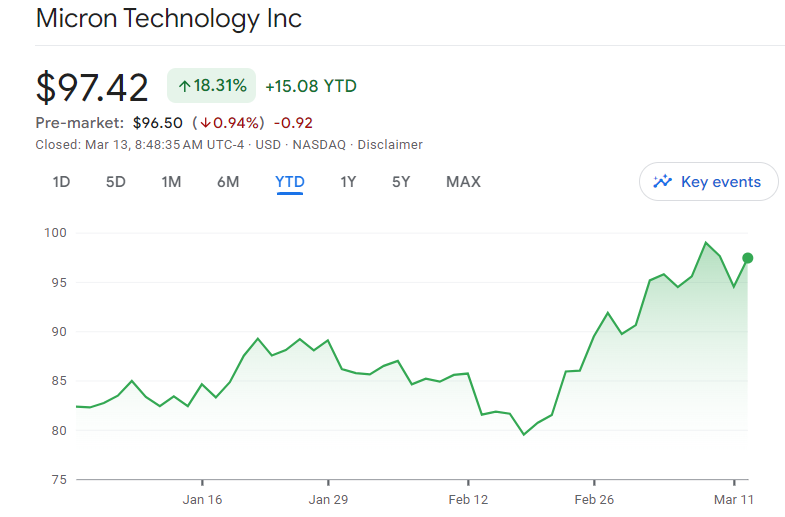

10. Micron (NASDAQ: MU)

Micron stands out as a top undervalued stock pick for investors in 2024, particularly within the semiconductor industry. Despite its critical role in advancing technology, Micron’s current market valuation fails to fully reflect its growth prospects. With trends such as cloud computing, 5G deployment, and the Internet of Things driving demand for memory and storage resources, Micron’s earnings potential remains substantial.

Furthermore, the company’s ongoing investments in advanced manufacturing technologies and focus on high-value memory solutions enhance its competitive edge and profitability. Despite the cyclical nature of the semiconductor industry, Micron has demonstrated resilience and maintained strong financial health, positioning it as an attractive undervalued stock with significant upside potential for investors seeking exposure to the technology sector’s continued growth.

Also read: 6 Best Cheap Stocks To Buy Under $5 With High Potential

Leave a Reply