In the UK, CFD trading is a common and sought-after investment. Before you make a move as a newbie, you need to know what trading CFDs is all about. You might as well settle in now that your search has brought you here since this guide will fill you in on all there is to know about CFD trading.

After reading this article, we hope you will have a better understanding of CFD trading as well as the meanings of the key phrases that are used when trading CFDs.

What is CFD trading?

Even if some of you might be familiar with contracts for difference (CFD) trading, let’s refresh our recollections or, even better, get the new traders up to speed. Trading CFDs allows traders to bet on the shifting financial markets without really owning any underlying assets.

CFDs are highly well-liked derivatives that follow the fluctuations of the assets on the financial markets. The people involved are often a buyer and a seller, and their main goal is to profit when the shifting markets are in their favor. Only only as a middleman, the broker determines the values of the CFD assets based on current market conditions.

Simply expressed, the buyer’s intention is to profit if the value of an investment following the derivative trade is greater than the purchase price.. On the other side, if the selling price of the CFD asset is greater than the price at the conclusion of the derivative trade, the seller also anticipates making some money.

What are Contracts for Difference (CFD)?

Contracts for difference, or CFDs, are agreements between two parties involving a kind of derivative assets. You won’t actually own an asset while using CFDs; instead, you’ll bet on how it will move.

It should be noted that with CFDs, all parties involved consent to exchange the difference in the value of an asset between the start and termination of the derivative contract. Forex, stocks, commodities, and indices are the main financial instruments available for CFD trading.

How CFD trading works?

CFD trading is a perfect substitute if you don’t want to trade by purchasing and holding an asset in a conventional manner. It is very adaptable because you are only allowed to concentrate on winning strategy.

You will always require a broker if you want to trade CFDs. This is true because brokers are skilled at controlling market supply and demand, which allows them to set fair rates. Brokers serve as middlemen in CFD trading, which involves two parties.

When trading CFDs, traders have the option of going long or short. When you start a buy position on an asset after making a prediction that its price will rise, you are said to be going long. This implies that the more prices rise, the more money you make.

In order to go short, traders must first speculate on the asset’s price falling before opening a sell position. To make money in this situation, you merely need the prices to keep going down.

How do you trade CFDs?

There is no ideal moment to begin trading with CFDs, and getting started is incredibly simple. We advise novice traders to give this style of trading a try, despite the fact that many may advocate it to experienced traders. After all, how can you learn to trade CFDs without giving them a shot?

1. Find a CFD broker

You are most likely a rookie trader with no prior knowledge of CFD trading. So before you start investing your money, you need a good CFD trading broker who will let you practice trading.

Traders used to invest money in demo accounts before trading regulations were made up on the spot. The majority of traders were dubious before opening a live trading account because of concern for their financial security.

Since paid demos are no longer available, traders have responded incredibly well to brokers, making CFD trading one of the most well-liked types of trading.

Finding the right broker is a challenge for many traders, which has an impact on their entire CFD trading activity. You may read our prior advice on the best CFD trading broker, which will save you time looking for brokers, so do not worry.

2. Understand the fundamentals of CFD trading

You must comprehend your trading tools better if you want to trade CFDs properly. Since CFD trading is a type of contract derivative, it has an expiration date. You must therefore use extreme caution when engaging in CFD trading.

Having said that, the key components that you should be aware of before starting to trade CFDs are listed below.

Contract specification: Every broker will have their own requirements, so you must research and select the ones that are most beneficial to you. These parameters could cover the quantity of CFDs, stop-out threshold, trading costs or commissions, leverage, and other information.

Fundamental analysis: This entails researching the elements of the financial market that influence how much the underlying financial assets’ prices change. To determine the value of the assets, you will analyze economic and financial data from notable incidents or businesses.

Technical analysis: Utilizing graphical tools, reports, and indicators, technical analysis allows you to examine the behavior of the financial markets. You can also use these methods to predict an asset’s long-term price movement.

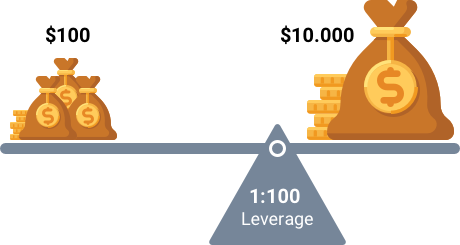

Leverage: You’ve probably heard that CFDs are a leveraged product. This means that when you use leverage to trade, a broker will loan you money, which you must of course pay back with interest.

3. Choose a strategy

In order to speculate on the changing markets and attempt to outperform them, CFD trading tactics necessitate total focus, dedication, and time. To efficiently handle your capital investment, stay updated with the most recent financial market trends.

Most seasoned traders prefer creating their own CFD trading techniques. As a result, we urge you to start acting similarly once you feel sure in your abilities.

Considering that you can only purchase or sell CFDs, picking the optimal technique will have a significant impact on your operations. Trading CFDs is typically done using intra-day, day trade, swing trade, leverage trade, or scalping strategies in order to avoid financing fees for overnight positions. Let’s examine these CFD trading strategies in more detail.

Intra-day

You can trade CFDs quickly using intra-trading, typically in a matter of seconds, minutes, or hours. It’s the kind of agreement that needs to be completed by the deadline.

The key reason to trade CFDs with this style of trading is that it enables you to benefit from quick price changes and determine whether you can make any money. This type of trading can be lucrative if you have a sharp eye for the markets.

Because the profits from utilizing this approach are so little, you must trade frequently to obtain a sizable profit.

Day trading

The majority of traders think day trading is an expensive investment because it necessitates making several trades in a single day. However, any CFD trader in the UK may afford day trading with the right budget and approach.

As the name suggests, day trading involves starting and terminating positions on the same day. Forex and equities are the two main markets for CFD day trading, and CFD traders who have mastered the procedures have made money on both markets.

Day trading CFDs involves a number of different procedures, therefore you need to be knowledgeable about them to be successful. This indicates that some traders’ lack of consistency and impatience prevent them from succeeding in day trading.

Swing trading

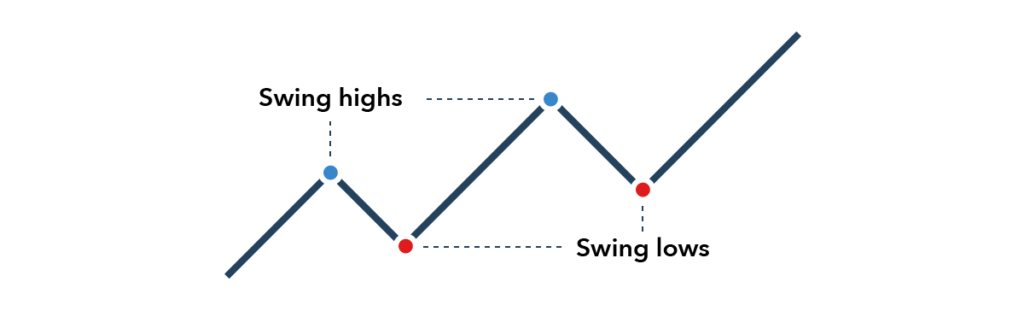

Swing trading also entails making predictions about daily changes in the prices of CFD assets. The ability to open a position for a longer time frame, typically days or weeks, distinguishes it from day trading.

You can maximize your profits by swing trading. It is widely acknowledged that learning is less difficult than day trading. As a result, it is a secure decision for a newbie.

Leverage

Another popular method for trading CFDs is leverage, sometimes known as margin trading. Leverage involves your broker lending you trading money, which you must repay with interest.

Your exposure is increased, as are your prospects of making more money. Keep in mind that even while you have a high chance of making more money, you also have a big risk of losing it all. Simply said, when you succeed, you make a lot of money, and when you fail, you suffer greatly.

Due to the risks that this technique entails, Europe, which includes the UK, has strict regulations on leverage. Since equities and currencies are the two most common CFD trading instruments, the leverage limit has been set at 20x for CFD forex trading and 10x for CFD stocks.

Negative balance protection is not supported by existing leverage trading legislation. Therefore, while using leverage in trading, remember that you have no protection against losing more money than you have.

Scalping

Scalping involves taking modest profits, much like intra-trading. You get to make quick predictions about short-term, rapidly changing pricing. If you are not persistent and patient with your CFD trading, it is a difficult method to perfect.

The best part of scalping is how quickly you can enter and leave the financial markets. However, this method requires constant awareness and a reliable internet connection that won’t interfere with your tasks.

4. Start trading

You can now establish a position and try your luck in CFD trading with your favorite market assets once you have determined your best strategies.

How to start CFD trading?

Naturally, before you can begin trading, you will need to choose a CFD broker. This is due to the fact that CFDs are formed by brokers based on the price fluctuations of financial instruments rather than being listed on exchanges.

We haven’t included recommendations on the top brokers to use because this article is all about how to trade CFDs. Our comprehensive guide includes a top ranking of the UK’s best CFD brokers.

Additionally, because the FCA regulates all CFD brokers in the UK, they all go through identical registration procedures. This means that regardless of the broker you choose to use, you can open an account and begin trading CFDs by using the procedures below.

Step 1: Visit the Broker

Finding a broker you wish to use is the first step. As said earlier, our article of the top UK CFD brokers includes all the leading providers. You can access the broker in question by clicking on the links we offer in that guide.

Step 2: Registration

The following step is similar to opening an account with a financial institution, site, or social networking platform. It will be necessary for you to provide personal information, such as your name, address, contact details, and email.

A basic financial markets knowledge test will be required of you. Your leverage limits, which will shield you from needless losses and risk, will be determined using the test results.

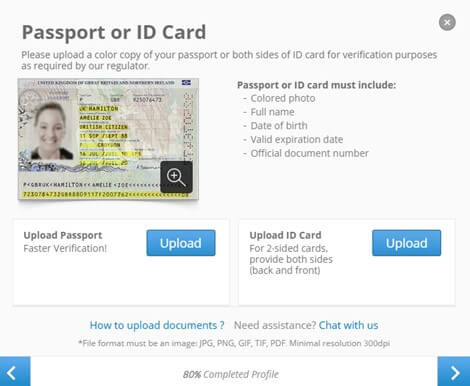

Step 3: Verify Your Account

The FCA in the UK oversees and issues licenses to all CFD brokers. This indicates that, like other financial institutions in the area, they adhere to a strict system for customer registration and Know Your Customer (KYC).

All traders must therefore provide identification (ID, a driver’s license, or passport), as well as documentation of their place of residence, to prove their identity (utility bill or bank statement, no older than 3 months).

Step 4: Fund Your Account

Once your identity has been confirmed, you have complete access to your account and may begin exploring all the tools, services, and marketplaces that are accessible. Additionally, you can use the demo account provided by the broker.

The minimal deposit requirements for all brokers range from £0 to £300+.

Step 5: Start CFD Trading

Now that your CFD account has been registered, you may begin trading.

Pros and cons of CFD trading

You can gain from CFD trading in a variety of ways, but it also has disadvantages. Let’s examine the advantages and risks in greater detail.

Pros

- Based on whether you are going long or short when trading CFDs, you can profit from the growing and decreasing values of CFD assets on the financial markets.

- If a trader knows when to use CFD trading’s high leverage, it can be advantageous. Leverage is a two-edged sword that comes with significant risks for both gains and losses, but if you follow the broker’s guidelines, it can help you make big money.

- These days, trading CFDs does not restrict your market access. All you need to do is choose a broker who offers the CFD trading options you’re interested in, whether you want to trade FX, stocks, or commodities.

- When you anticipate a declining price in the near future, CFD trading gives you the option to short sell the investments and profit from the difference between the selling and purchasing cost.

- The majority of CFD trading platforms provide reduced fees or charges, allowing you to open more positions per day.

Cons

- You could lose a significant portion of your investment cash due to excessive leverage.

- On CFD leveraged positions that are held overnight, the majority of CFD brokers will charge you financing fees.

- Trading CFDs is all about speculation on the values of financial assets, thus you will never actually own any shares or commodities.

How to reduce CFD trading risks?

Many traders claim that CFDs are a dangerous investment. One method of managing CFD trading risks is to sign up with a reputable and helpful broker so your money is safe. You can also obtain negative balance protection, narrow spreads, and crucial risk control features for CFD trading with such firms.

The following details how to manage CFD trading risks using such tools:

Regular Stop-Loss order

Your predictions may be considerably impacted by market volatility. Your open trade will automatically close if this occurs while you have a stop-loss order in place when it hits a particular price level.

Close Open Position

By defining the profit threshold at which your position should close, you can restrict your orders. Whether market prices continue to rise or fall, this feature will remain in place. Although it is one of the safest ways to trade CFDs, keep in mind that your order may also slip below the designated profit threshold and result in losses.

Trailing Stop-Loss order

With this order, you can increase the maximum price of your profitable position or specify a percentage loss. The stop price increases if the price of your security increases or decreases in a way that benefits your activity. However, the stop price still stands if the shifting prices do not work in your favor.

Guaranteed Stop-Loss order

If you employ these type of orders, you may be certain that your positions will be closed when they reach the specified value. This stop-loss order will be in force even if the markets are volatile or if you are not there to oversee your operations.

Conclusion

CFDs Trading in the UK is dangerous, but if you are savvy enough to use the appropriate tactics, you might potentially make money. Additionally, it is quite advantageous that CFDs allow for indirect ownership, which allows you to possess an asset without also owning the underlying item.

So, if you want to start trading CFDs in the UK, do it right away. Before you spend real money, however, you are again urged to test the market by using the free demo account features offered by the top CFD brokers to determine whether it is suited for you.

Frequently Asked Questions

What Does CFD Trading Mean for Novices?

It is a deal in which two sides agree to split the price difference between opening and closing a position on an investment. Because CFDs are a type of derivative, traders never actually possess the underlying asset, such as gold, for instance.

Is CFD Trading A Good Idea For Newcomers?

Because of the low margin costs and the reality that investors never hold the underlying asset, it can be tempting to new investors. CFD trading is risky since you can lose more than your initial investment. Before making a real-money investment as a newbie, think about testing your techniques on a demo account.

Should I Begin Trading CFDs?

If you wish to know about the money markets, you can benefit from CFD trading if you can regulate your emotions well and manage risk responsibly. Never before have there been as many materials, instruments, and online tutorials accessible to aid beginners in CFD trading.