Traders utilize a number of strategies to profit from market movements one of which is Swing Trading. Swing trading is defined as a form of fundamental trading in which positions are held for more than one day. Traders try to make short-term profits by employing technical analysis to enter positions, hold them for a few days or weeks, and then leave.

Continue reading to learn more about swing trading and how to do swing trading. We’ll also look at some of the best brokers to start swing trading in 2022.

What is swing trading?

Swing trading is a useful trading strategy for people looking to buy and sell assets over a medium to a lengthy period of time. The swing traders profit from higher price changes than day traders, which appeals to many investors who don’t have a lot of time to spend.

Swing trading, in fact, allows you to profit from an asset’s evolution over a period of days, weeks, or months, depending on market conditions and the graphic numbers that appear. In general, technical indicators are used to evaluate whether assets have a bullish or bearish momentum, as well as the optimal time to buy or sell them.

Swing trading is offered across all markets and with a variety of instruments, including CFDs. So, depending on your knowledge, you can swing trade stocks, indices, Forex, commodities, or other financial markets.

How does Swing Trading work?

Swing trading requires holding a long or short position for more than one trading session, but hardly for more than a few weeks or even months. This is a broad time range because some deals can last for several months and yet be called swing trades by the dealer. Swing trades can develop during a trading session, however this is a rare occurrence due to extremely volatile market conditions.

Swing trading aims to profit on a portion of a potential price move. While some traders enjoy equities with a lot of fluctuation, others may choose stocks with less volatility. Swing trading, in either scenario, is the process of predicting where an asset’s price will move next, taking a position, and then profiting if the prediction comes true.

Swing Trades vs Day Trading

In some ways, swing trading and day trading appear to be comparable except the holding position time between the two procedures. Day trades close within minutes or before the market closes, although swing traders may keep stocks overnight or for several weeks.

Day traders do not keep their positions overnight. It usually indicates they don’t endanger themselves as a result of world events. Company increased trading frequency results in higher transaction costs, which can have a significant impact on their earnings. They frequently use leverage to increase profits from tiny pricing increases.

Swing traders are vulnerable to overnight risks’ volatility, which can lead to big price swings. Traders can monitor their positions on a regular basis and react when critical points are reached. Swing trading, unlike day trading, does not necessitate constant monitoring because the transactions take several days or weeks.

Best Swing Trading Platforms

To be profitable, trading, like any other activity, necessitates the use of the appropriate tools and supports. It will be tough for you to become a profitable swing trader without a dependable, efficient, and available broker. So, which broker should you take into account? We’ve included our top two picks for below:

1. eToro- Overall Best broker for Swing Trading

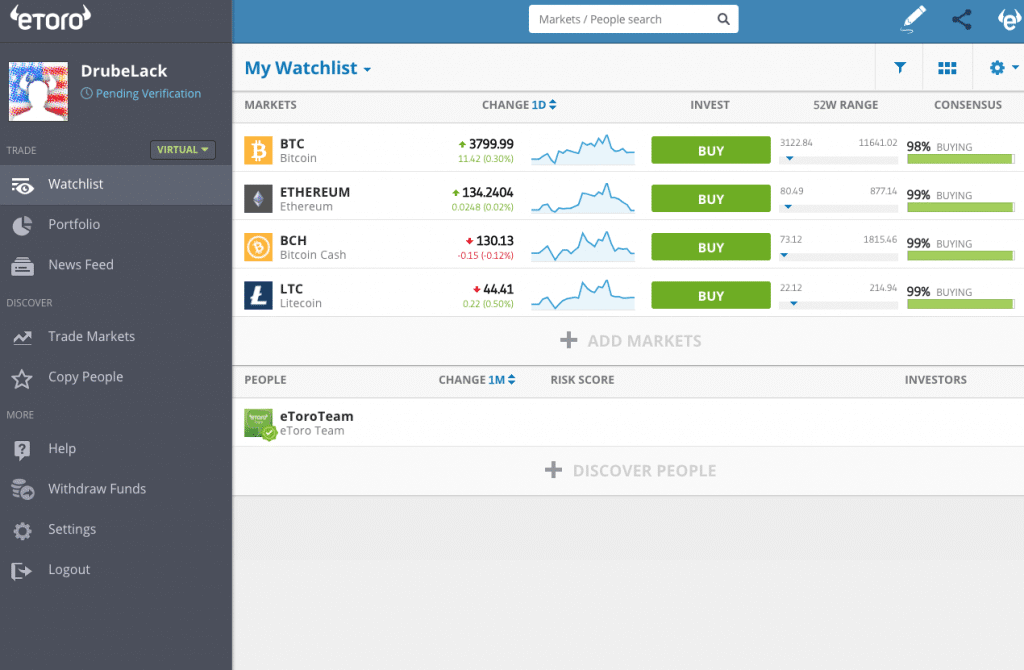

eToro is the best swing trading broker since it allows you to trade stocks, bonds, ETFs, FX, commodities, and cryptocurrencies. All stock trades with this swing trading broker are completely commission-free. You can also trade equities with a 5:1 leverage and currency with a 30:1 leverage.

One of the coolest features of eToro is its built-in social trading network. You can exchange ideas with other traders or start a conversation about day trading techniques. eToro also allows you to automate your portfolio using copy trading.

For swing trading, eToro’s trading platform is quite reliable. Although you cannot construct your own indicators, the charting interface includes approximately 100 research. eToro also has a useful mobile trading app and news feed.

Pros

- Commission-free stock and ETF trading

- Wide range of assets

- Supports copy trading

- Includes mobile trading app

- Fully regulated by FCA, CySEC, ASIC

Cons

- Charges withdrawal fees

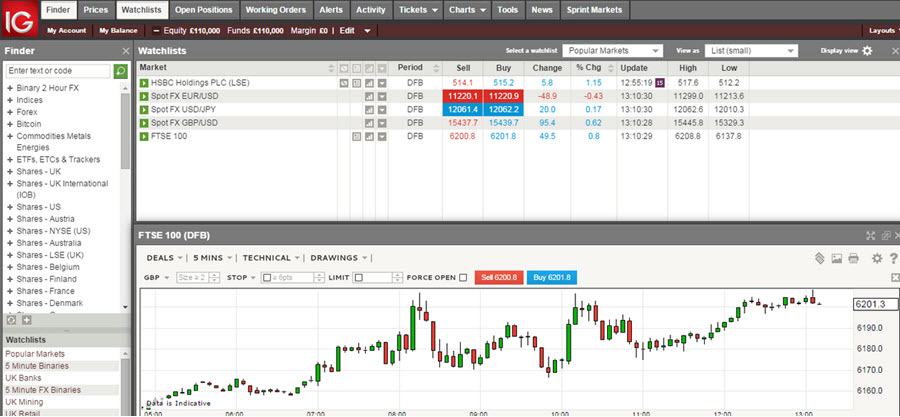

2. IG Markets- Established Swing Trading Platform

/IG-ef2684aaa37d4d218af819f98d676d02.png)

One of the major licensed CFD brokers is IG Markets. It provides a diverse choice of assets (over 17,000 securities) as well as the ability to use a variety of financial instruments (CFDs, vanilla options, barrier products).

You can use various trading platforms with a minimum investment of €300. MetaTrader 4 and ProRealTime are two of the most professional options available. Swing traders that require a large number of advanced trading tools are particularly fond of them. Day traders, on the other hand, prefer these platforms because of their immediacy and good execution quality.

The catch is that IG broker is not cheap. For most traders, the platform charges above-average spreads which makes it one of the top low spread broker, and you may even be charged a commission for stock trading. As a result, IG is perfect for skilled swing traders seeking top-tier trading tools.

Pros

- Includes ProRealTime and MetaTrader 4

- Supports forex signals and custom indicators

- Multi-leg options trades

- Heavily regulated

- Automated day trading

Cons

- Expensive spreads and commissions

How to do Swing Trading?

In this section, we’ll show you how to use swing trading tools using eToro, a platform with no commission trades, a social trading network, and complete charting and trading features.

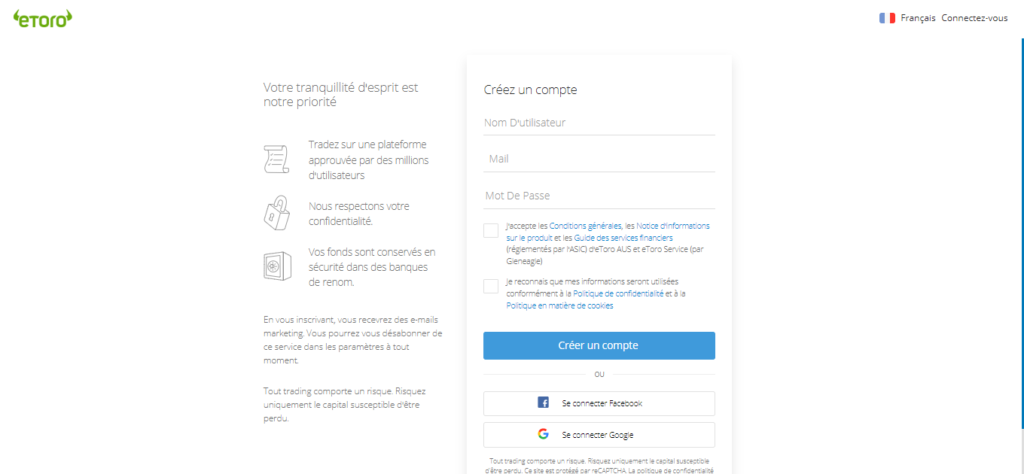

Step 1: Registration

Complete the eToro signup form and create your account in minutes by going to the eToro website. You will be taken immediately to the eToro platform after clicking “Create an account “.

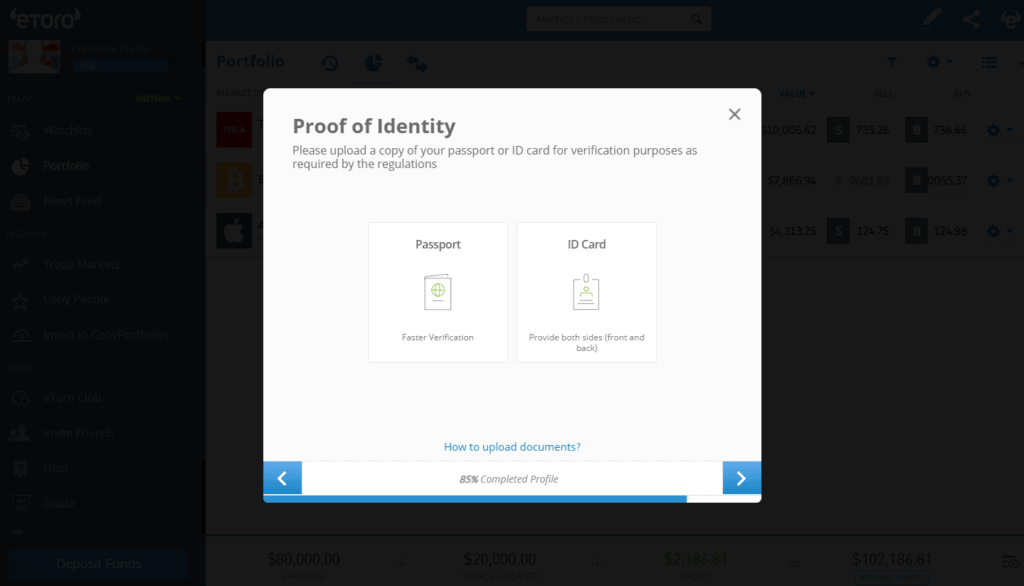

After then, you must verify your account by filling out a questionnaire and submitting a few papers, such as evidence of identity and address. To do so, go to “Complete profile” (under your name on the left) and go through the stages.

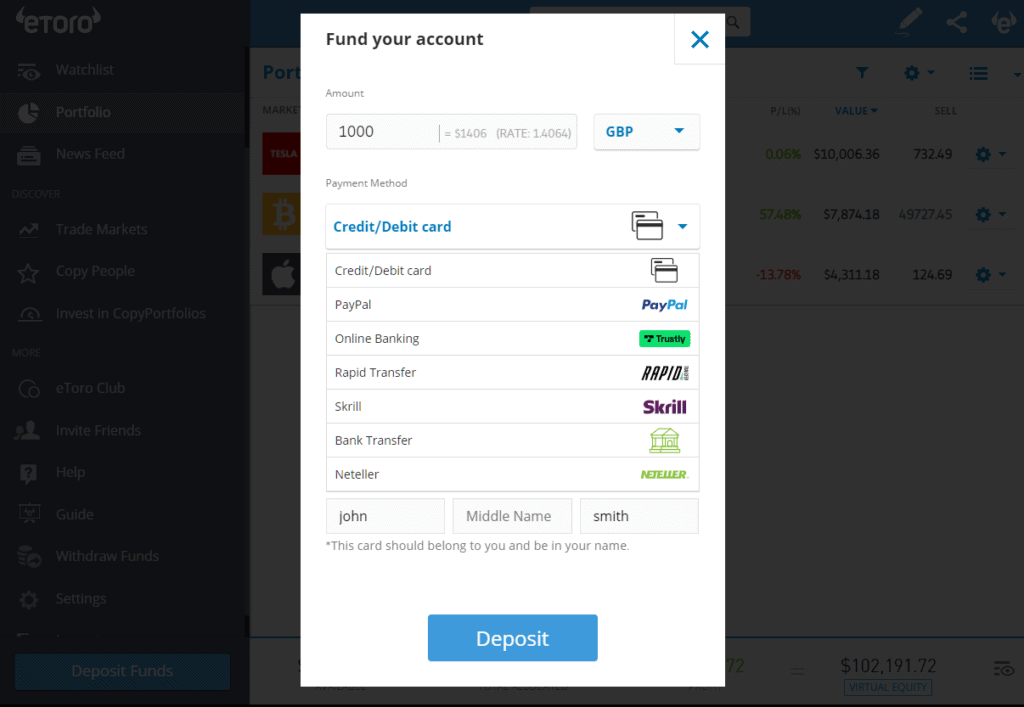

Step 2: Fund your account

To begin developing your swing trading strategy, you must first fund your trading account. Select your preferred payment option by pressing the blue “Deposit Funds” button.

Step 3: Learn to use the platform

Now is a good moment to look at the eToro marketplace because it has a lot of useful features.

By clicking on “Markets” in the left sidebar, for example, you can access all available assets. You may also use the “Newsfeed” button to get the most up-to-date market information. Click “People “if you wish to use eToro’s social trading platform.

You can also easily imitate the portfolios of other successful traders with eToro. Click on ” CopyPortfolios ” to see this option.

Step 4: Use advanced charts for better analysis

ProCharts offers powerful charting tools and technical indicators for swing trading strategies that rely on thorough technical analysis. This eToro platform has all of the top trading indicators.

Step 5: Track your positions

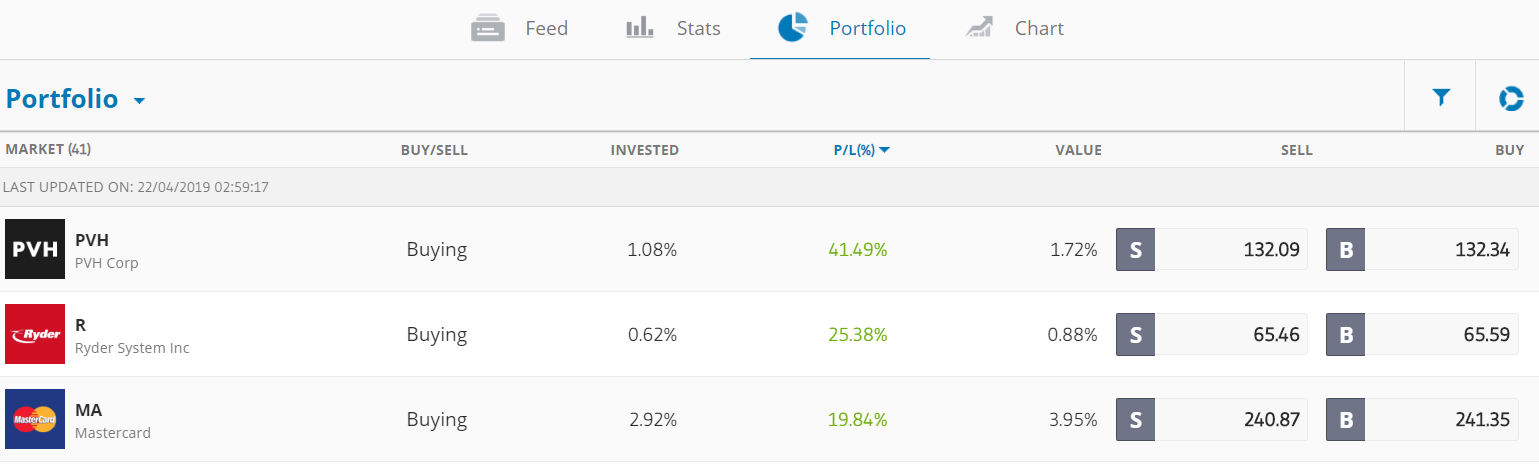

In the sense that your investment horizon is medium/long term, swing trading tactics do not require constant monitoring. To avoid any surprises, you should continuously monitor the progress of your portfolio.

On the eToro platform, this process is straightforward because you simply click “Portfolio “to see all of your open positions. To close your position, click on the wheel icon to the right of the line you want to close.

Best Trading Strategies for Swing trading

Because swing trading is all about benefitting from price changes inside a wider trend, it’s critical to employ strong forex swing trading tactics that help you figure out the direction an asset is traveling in and where prices might react.

The study and application of price charts, volume charts, and other technical indicators to make trading decisions are known as technical analyses. As a result, technical analysis uses price and volume data from the past to estimate future price fluctuations.

The most significant tools for swing traders are all of the techniques for determining the trend and breakouts, or periods when prices will accelerate. The following are some of the most well-known strategies:

1. Fibonacci retracements

Fibonacci retracement levels are horizontal lines that show price levels where an item will most likely react (level of support and resistance). These retracements are calculated using Fibonacci numbers, and each level corresponds to a percentage: 23.6 percent, 38.2 percent, 61.8 percent, and 78.6 percent.

2. Support and resistance triggers

There are swing highs (high points – short selling opportunity) and swing lows (low points – purchasing opportunity) in particular. Technical analysis is frequently used to detect swing highs/lows via support and resistance levels to take advantage of tiny trends inside a larger trend.

3. Channel trading

A price channel is made up of two trend lines that run above (resistance) and below (support) the price of an asset. As a result, the price movement is limited between these two parallel trend lines. You can buy at the support level and sell at the resistance level if you wish to trade with a channel.

4. Moving Averages

The moving average (MA) is an excellent technical indicator for determining an asset’s trend. In effect, the MA smooths an asset’s values by calculating an average price that is regularly updated based on new prices. The trend is considered good when prices climb above the moving average. Prices, on the other hand, fall below the moving average when the trend is negative.

5. Trend line

A trend line, in its most basic form, allows you to see the general direction in which an item is moving. Focus primarily on big swing levels while drawing a trendline, and connect at least two important points. Then all that’s left is to draw the line to collect as many contacts as feasible.

Pros of Swing Trading

- Allows you to profit from price fluctuations throughout the medium and long term

- To take advantage of trading chances, no screen time is required

- Built for busy investors

- Provides a lot of freedom

- Investing in the stock market is similar

- You can pay fewer fees and commissions

- It is more likely to avoid misleading signals than other trading strategies, such as day trading

- Profit from liquid markets like Forex

- Because of the leverage, it can be employed with a small starting trading stake

Cons of Swing Trading

- Gap risks, for example, can have a significant impact on pricing late at night or on weekends

- It can take a long time for a trading position to provide large profits

- You have the option of locking in your capital for a longer length of time

Is swing trading the right strategy for me?

Swing trading can be exhilarating or too complex and hard, depending on your personality. This trading strategy is a good option for traders who don’t want to use an aggressive trading technique or who only have a limited amount of time to trade. Swing trading does not require continual monitoring and might take significantly less time than other trading strategies.

If you swing trade on a daily chart, for example, you can locate new chances and update your trading orders in under an hour per day. Others just look at the markets on weekends to see what happened throughout the week and forecast their movements for the next week.

Tips for Novice traders to begin Swing Trading

- Invest funds that you are prepared to lose

- To define how you will approach the markets, work on your trading strategy

- Find a broker that meets your requirements

- Before spending real money, test your trading strategy with a demo account

- Always stick to your trading strategy and never take risks

- Always use prudent risk management to safeguard your assets

- To avoid harmful tendencies influencing your trade, control your emotions

- Learn from your mistakes

- Accept the possibility of being incorrect

- Continue to learn about how markets and trading operate

- To improve your trading, review your trades on a frequent basis

Conclusion

Swing trading is one of the best ways for new traders to get their feet wet in the market. Intermediate and skilled traders can still profit significantly from it. After a few days, swing traders have enough insights on their trades to keep them engaged, but their long and short positions are of a duration that does not distract them.

Day trading is for you if you can spend a lot of time in front of the markets during the trading day and appreciate demanding activities. Swing trading is for you if you have full-time work and can only evaluate the news and charts on weekends.

In any case, remember to stick to your trading plan as well as your money and risk management principles. As a result, you’ll lower your danger of losing money and have more control over your total trade.

If you want to get started with swing trading and advance quickly, we recommend eToro, an online broker that is reputable, easy to use, safe, and has a good reputation among traders.

Frequently asked Questions

What are the most important indicators for swing trading?

Moving averages, RSI, volumes, Fibonacci retracements, and candles on candlestick charts are the strongest indicators and tools for swing trading.

What are some of the finest swing trading strategies?

The most important advice for becoming a better swing trader is to utilize the money you don’t need, to always stick to your trading plan, limit your losses as much as possible, and always enhance your trading knowledge.

What Are “Swings referred to in Swing Trading?

Swing trading seeks to identify entry and exit points into a security based on its intra-week or intra-month swings, which fluctuate between periods of volatility.

What Are the Differences Between Swing and Day Trading?

Day trading, as the names suggest, requires employing technical analysis and advanced charting techniques to execute dozens of deals in a single day. The goal of day trading is to make small profits multiple times throughout the day, with no trades held overnight. Swing traders do not close their positions every day and may keep them open for weeks, months, or even years. Technical and fundamental analyses are more likely to be combined by swing traders.

Is day trading riskier than swing trading?

While day trading involves opening and closing multiple positions in order to profit from small market swings, swing trading involves holding assets for a longer length of time (a few days to a few weeks) in order to profit from greater moves, which is theoretically less risky.