Without having to hold the underlying asset, you can often trade thousands of financial instruments on CFD trading platforms. Instead, you’ll be trying to forecast whether the asset’s price will increase or decrease, whether it be for stocks, commodities, cryptocurrencies, or foreign exchange.

In this article, we examine the top CFD trading platforms to take into account in 2022.

Best CFD Trading Platforms 2022

There are countless CFD trading platforms available that let you purchase and sell financial instruments with a single click.

You should consider the markets the CFD platform offers, the costs and commissions it levies, and other factors related to regulation, payments, and trading tools in order to choose one that matches your demands.

The top CFD trading platforms for 2022 and beyond are highlighted below to help clear up any confusion. We provide what you need whether you’re looking for CFD forex trading platforms or CFD stock trading platforms.

1. eToro

eToro, which currently has over 17 million users, is a master of all CFD trading platforms in the realm of online trading. This is due to the provider’s extensive selection of CFD markets in addition to regular shares and ETFs.

This covers everything, including equities, cryptocurrency, foreign exchange, and commodities. No matter whatever CFD trading tool you choose to use, eToro doesn’t impose any commission fees.

In actuality, spreads are frequently extremely tight and there are no continuing maintenance fees. While gold has a spread of about 0.05 percent, popular currency pairs have spreads as low as 0.008 percent. You have access to leverage with eToro, as with all of the top CFD trading platforms available online. But depending on your location, you can get different amounts of leverage.

If you are a beginner, eToro is a fantastic CFD trading site to take into account. The trading platform was created from the bottom up with the goal of luring amateur traders. The smallest stake level for traders on a restricted budget starts at just $25.

We particularly appreciate eToro’s Imitate Trading tool, which enables you to “copy” a seasoned CFD trader. By doing this, your personal eToro portfolio will reflect each and every buy/sell position that the trader makes. Each trader is required to make a minimum investment of $200 even though there is no additional expense for this.

Opening an account, submitting identification, and making a deposit often take less than 10 minutes to complete. You can select from a number of well-liked payment options, including bank transfers, debit/credit cards, and e-wallets like Paypal and Skrill. Ultimately, the FCA of UK, ASIC of Australia, and CySEC of Cyprus all regulate eToro.

2. Libertex

Libertex is an online trading platform that only offers CFD trading markets. There are several other asset classes available, including a full-featured stock trading facility.

Libertex offers the ability to buy and sell FX pairs, commodities like gold and oil, as well as digital currencies like Bitcoin and Ethereum, in addition to its stock trading platform. Whatever CFD asset class you like, Libertex is a broker with tight spreads.

Forex pairs like USD/CAD and NZD/USD, for instance, can be traded at just 0.011 percent and 0.012 percent per slide, respectively, in terms of commission. Prices for commodities are even more competitive thanks to the 0% commission on Brent Crude Oil CFD trading.

Libertex lets you trade using MetaTrader 4 as the available trading platform. Due to the fact that Libertex has its own native trading platform, you can also trade there. This is also accessible through a mobile app, which works with both iOS and Android devices.

Similar to eToro, Libertex offers leverage and lets you go long or short on all CFD markets. With just a $100 initial investment, you can simply start an account with this premier CFD trading platform. Following that, Libertex enables you to top off your account with merely $10 for each transaction as a minimum.

The service provider accepts e-wallets in addition to debit and credit cards. Last but not least, CySEC, situated in the EU, regulates Libertex, which has been operating in the internet trading industry since the late 1990s. It has an excellent popularity as an outcome that has endured for more than 20 years.

3. Skilling

Skilling is a simple online trading platform with over 800+ CFD instruments. A wide range of of currency pairings, as well as cryptocurrencies, are included.

Additionally, you are able to trade stocks, indices, and commodities listed in the UK, such as gold, silver, oil, and natural gas. Overall, Skilling most certainly supports any well-known financial market that you are interested in.

Because this top-rated CFD trading platform was only started in 2019, it has chosen to entice new users by offering industry-leading costs and commissions. In addition to not offering a 100% commission-free option across all of its marketplaces, its spreads are also rather narrow.

Skilling actually provides spreads starting at just 0.1 pip, which is fantastic for those of you who enjoy day trading or scalping. This relatively new CFD trading platform called Skilling is well known for its top-notch client support. There is also a quick and welcoming live chat option available on the main Skilling website.

Features that stand out, we appreciate that Skilling is compatible with a variety of outside trading platforms. This applies to both MT4 and cTrader, so you may use automated forex EAs and CFD trading robots with ease. You can also choose to trade through Skilling Trader if you don’t have much expertise with these well-known third-party sites.

The web trading platform was created by Skilling itself and is user-friendly for beginners. If you like the idea of Skilling but are worried about safety, you may rest easy knowing that this CFD platform is governed by the FSA and CySEC. Additionally, the Financial Conduct Authority has permitted it (FCA).

4. Plus500

/plus500_source-5c5b58f746e0fb0001ca8550.png)

Plus500 is a global CFD trading platform licensed, authorized, and/or regulated by numerous jurisdictions. This covers the UK, Australia, Cyprus, New Zealand, Singapore, and some other countries.

One of the primary benefits of using Plus500 as your primary CFD trading platform is its vast asset library. For example, you can trade not only all main and minor forex pairings but also a plethora of unusual currencies.

If you are really interested in commodities, Plus500 offers CFD markets for energy, agricultural commodities, and hard metals. Included are things like wheat, gasoline, gold, silver, and oil. Numerous CFD stock trading venues are offered by Plus500.

Markets for ETFs, cryptocurrency (access subject to regulation), and indexes are also available. In addition to providing a vast selection of CFD instruments, Plus500 is well-known for not levying trading charges.

Major asset spreads are frequently extremely competitive as well. Despite not supporting external trading platforms like MT4 or cTrader, Plus500’s in-house platform has all the functionality and tools you require. This features several order types, leverage, buy/sell positions, and completely customizable real-time charting tools.

In terms of the fundamentals, Plus500 requires a minimum deposit of $100. PayPal, bank transfers, debit and credit cards, and PayPal are all accepted. There are no fees for making deposits or withdrawals, though Plus500 reserves the right to charge you if you withdraw more than once per month or less than the minimum withdrawal amount.

5. IG

/IG-ef2684aaa37d4d218af819f98d676d02.png)

IG was established in 1974 and is a reputable, licensed broker. More than 239,000 clients actively use the trading platform because it is permitted to offer CFD trading accounts to more than 100 countries. In approximately, IG provides more than 17,000 markets, which is a significant number.

With the platform supporting more than 80 currency pairings, the CFD forex trading division stands out for us. IG is excellent, especially if you want to trade less liquid forex markets like the Mexican peso or the South African rand.

Fees & spreads at this CFD trading platform are exceptionally low. For instance, spreads on popular pairs of forex can start at just 0.6 pips and trading is commission-free. Even smaller pairs are competitive, with the EUR/JPY pair offering a spread of as little as 1.5 pip on average.

On its CFD forex trading marketplaces, IG also provides leverage, allowing users to trade major pairs with just a 0.5 percent margin. This suggests that with a $100 investment, you might have exposure to trading capital of more than $20,000. It is important to recognise that IG is more than just a forex broker.

Additionally, there are CFD markets available on the this trading platform for stocks, indexes, cryptocurrencies, bonds, commodities, and more. Once more, these marketplaces cover rising economies in addition to major exchanges. In terms of accessible platforms, IG provides its own native web trading platform, which may be accessed through the internet or via a mobile app.

MT4 and IG are compatible. You can quickly create an account if you want to start using IG right now. Having said that, IG also provides a demo account function without a deposit requirement. Bank transfers and debit/credit cards are accepted forms of payment.

Factors to consider while choosing the best CFD Trading Platforms

When searching for an appropriate CFD trading platform, keep these things in mind:

Trading Costs

The more capital you have in your brokerage account, the less money you will have to pay out to your CFD broker in trading expenses. Dealing spreads, account management fees, and trading commissions and fees are some examples of trading expenses.

Tradable Assets

The CFD trading partner you choose should provide CFDs on all of the underlying assets you intend to trade.

Customer Service

Your success as a CFD trader may much depend on how quickly and easily you can contact your broker in the event that a problem happens, as well as how efficiently they reply to questions and handle problems. Along with that, while they are learning the ins and outs of CFD trading, new traders could need extra customer support and educational resources.

Mobile Application

When away from their desktops, numerous CFD traders want to be allowed to use their smartphones to monitor asset markets, check the performance of their CFD trades, execute trades, and do market analysis. Therefore, having a mobile app that works with your device can be a crucial element of a CFD broker.

Trading from Charts

Direct trading from price charts is perhaps the best option if you intend to conduct technical analysis first and then rapidly place a trade when an opportunity presents itself. Most respectable CFD trading platforms will include this crucial function.

Fast Execution

Transactions must be completed swiftly because CFD trading possibilities are frequently transient. Make sure the broker you are thinking about offers speedy transaction times to local clients and that order slippage and requotes are not a common occurrence. By conducting a few minor transactions in a live account, you may assess execution speeds.

How to Start CFD Trading?

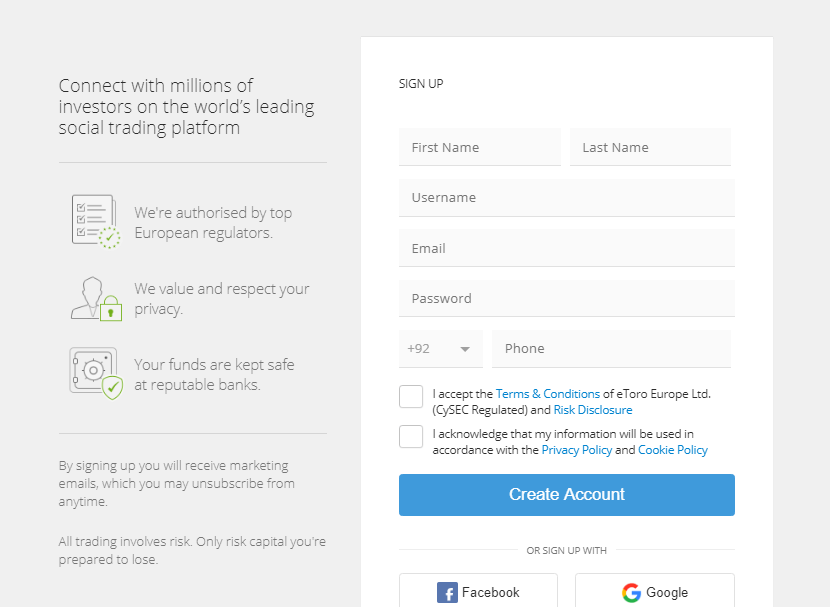

If you are brand-new to the universe of CFD trading, we will now walk you through the procedure of starting up. You can learn how to trade CFDs at the commission-free platform eToro by following the instructions below.

Step 1: Open an Account

Before you can begin trading on eToro, you must complete a brief registration and verification process.

To get things started, visit eToro and click “Join Now.”

Following that, the CFD trading platform will request some details from you, including your Personal Information, your contact details, your National Tax Number, and also your Prior Trading Experience.

Step 2: Confirm Identity

Following the creation of your eToro account, the provider will request that you provide several forms of identification.

The documents comprises of a:

- Passport or driving license

- Bank account statement or Utility bill

Step 3: Deposit Funds

Now that you can start trading CFDs with actual money, you must make a deposit.

You have a selection of the following payment options on eToro:

- Bank Transfer

- Paypal

- MasterCard

- Visa

- Maestro

- Neteller

- Skrill

Step 4: Search the CFD Market you want to invest

Finding the CFD trading markets of your choice is simple with eToro. In actuality, if you already know what the financial asset you’re looking in is, you don’t even need to search for it.

As in the example below, we type “gold” into the search box and select “Trade” since we want to trade gold CFDs.

Alternatively, you can access all of the assets offered by eToro by clicking the “Trade Markets” icon on the dashboard’s left side. You can categorize this according to the relevant asset class, such as indexes or commodities.

Step 5: Place a CFD Trade

Lastly, select “Open Trade” to commence your commission-free CFD transaction on eToro.

Conclusion

The market for CFD trading platforms has become oversaturated. With so many firms to choose from, choose which platform to join may be a time-consuming and challenging process. For this reason, we have put together this list of the top CFD trading platforms in the UK as of 2022.

Having said that, we found that eToro had by far the best CFD trading platform out of all the providers we tested. This is due to the platform’s small spreads, commission-free trading, and thousands of tradeable markets. Additionally, eToro is easy to use, strictly regulated, and even provides free CFD Copy Trading services.

Frequently Asked Questions

What is CFD?

Contracts for Differences or CFDs were developed by licensed internet brokers and will monitor an asset’s real-time pricing. This enables you to make predictions about the asset’s worth without having to assume ownership.

Which CFD trading sites have the lowest fees?

When looking for the finest low-cost CFD trading platform, there are a lot of expenses to consider. This covers spreads, commissions, and overnight credit. Because it is commission-free, provides tight spreads, and costs affordable overnight financing fees, we discovered that eToro excelled in all three categories.

Which CFD trading platform is the best?

Following a thorough evaluation of numerous vendors, we determined that eToro is the top CFD trading platform for 2022. Importantly, this highly regulated platform allows you to trade thousands of CFDs without paying a commission.

What CFD trading platforms are used by experienced traders?

The majority of CFD trading platforms provide accounts specifically for professional traders. To gain access to considerably larger leverage levels, for instance, many seasoned traders will register a professional account with the commission-free platform eToro.

What CFDs are offered for online trading?

Almost every asset class value can be tracked with CFDs. As a result, you can trade stocks, indices, bonds, ETFs, commodities, forex, cryptocurrencies, and more on the finest CFD trading platforms.