Trading can be thrilling for newcomers to the sector, but after a while, as they gain experience, they frequently discover that they are ready to take things a step further and attempt something riskier. They often find larger profits when they take on more risk, which is a wonderful combination to reintroduce excitement into trading for them. As a result, trading with leverage is an excellent option.

Leveraged trading is when you trade with borrowed money from your broker to improve your purchasing power. Brokers impose a fee for leverage based on the amount of borrowed cash you use, as well as for each day you keep a leveraged position open.

To get started with leverage trading, you must first understand how it works. We will go through how to trade efficiently with leverage by referring to a few key concepts in this article. We’ve also compiled a list of the best online brokers with high leverage and a thorough demonstration of how to trade with leverage.

What is Leverage Trading?

Trading leverage enables you to invest a higher amount than your initial investment. The leverage allows for larger holdings to be taken without placing one’s capital. To put it another way, when you use leverage to invest, you can trade in higher volumes. Leverage is a term that refers to a multiple of your invested capital.

While the tool can help you make more money when the markets move in your favor, it can also cause you to lose a lot more money if the market moves in the opposite way of your predictions. As a result, leverage should be used with prudence, especially by new investors.

The leverage will vary significantly, according to brokerage firms. For retail consumers, leverage of up to 30 is usual, and for professional users, leverage of up to 1,000 is not unusual. For each dollar deposited, a trader with a leverage of 1000 is committed up to £1000.

What is Leverage?

To better acknowledge leverage trading, we must first learn the fundamentals.

Leverage is an investment technique that entails borrowing money to increase the return on investment. To put it another way, you borrow money or take on debt in order to make an investment.

Traders typically employ leverage to boost their market buying power.

What is Margin?

The investments borrowed from a third party to undertake an investment are referred to as margin. Buying on margin entails borrowing money to purchase assets.

To clear up any misunderstandings, leverage refers to borrowing money, whereas margin refers to borrowing money to invest in other financial products like cryptocurrency. The two terms are fairly similar, yet they are not the same. Margin is determined as a percent of the required deposit, while leverage is determined as a ratio.

If you put £1,000 into a trade with a leverage of 20 (or 1:20), your investment will be £20,000. As a result, the margin, or your personal capital, will be £1,000 out of a total of £20,000.

The relationship between leverage and the concept of margin is shown in the table below:

| Leverage | Margin |

| 1:20 | 5% |

| 1:5 | 20% |

| 1:2 | 50% |

What markets are there where leverage can be traded?

Leverage can be applied to every asset type, including stocks, currencies, stock indices, and even cryptocurrencies. Each instrument will have its own set of limitations.

The leverage threshold limitations are determined by three factors:

- Regulatory restraints ( in particular those formulated by ESMA)

- Specific criteria are set by the broker to encourage less hazardous trading, particularly among retail consumers.

- The client’s current position (individual or professional)

Leverage will always act in the same way from one market to the next. The only thing that will change is the thresholds.

Leverage in Forex Trading

- Leverage maximum on major currency pairs: 1:30

- Leverage maximum on minor and exotic currency pairs: 1:20

Among the major currency pairs are the EUR/USD, USD/JPY, GBP/USD, and even USD/CHF.

Leverage in Stocks

- Leverage maximum for retail traders: 1:5.

- Leverage maximum for professional traders: 1:20

Leverage in Stocks indices

- The maximum regulatory leverage on stock indexes is 1:20.

- In contrast, several less popular indices, such as the Chinese or Spanish benchmark, are available with a maximum leverage of 1:10 or a 10% margin.

Leverage in Cryptocurrencies

The leverage effect available on cryptocurrencies is 2. This is also the most that regulated brokers are legally allowed to provide.

Leverage in Commodities

Here are the maximum leverage levels that you can have on eToro, based on the commodity:

| Raw material | Leverage |

| Oil | 1:10 |

| Gold | 1:20 |

| Money | 1:10 |

| Copper | 1:10 |

| Natural gas | 1:10 |

| Platinum | 1:10 |

| Palladium | 1:10 |

| Sugar | 1:10 |

| Cotton | 1:10 |

| Cocoa | 1:10 |

| Wheat | 1:10 |

| Aluminum | 1:10 |

| Nickel | 1:10 |

If you are trading using a professional account, these levels will clearly be different. For specific commodities, such as gold or silver, they can go up to 1:500.

How to calculate Leverage?

Leverage always works in the same manner regardless of the asset under consideration. The only variable that will change is the maximum amount of leverage that can be applied.

Calculating Forex Leverage

The following parameters are used to calculate the leverage effect on Forex:

- Size of the market’s open position

- Your capital invested in the position

The formula is:

Leverage = Open Market Position Size / Invested Equity

If you have a fund of £1,000 to invest and a stake in the markets worth £5,000, you have invested with leverage = 5.

Similarly, if your capital is £200 and you have a leverage of 10, your open position in the markets is 200 × 10 = £2,000.

The table below will help you comprehend the relationship between these three parameters:

| Market position size | Own funds invested | Leverage |

| £1,000 | £100 | 1:10 |

| £200 | £100 | 1:2 |

| £10,000 | £500 | 1:20 |

| £500 | £100 | 1:5 |

Some currency combinations in Forex, such as EUR/USD, even provide leverage of up to 30. With this leverage effect, if you invest £100 out of pocket, your total commitment to the markets will be 100 x 30 = £3,000.

Calculating Stocks Leverage

Leverage in the stock market works in the same way. The maximum leverage impact permitted by the broker may differ depending on the products to be traded. For cryptocurrency, for example, there is a maximum of 2, although certain commodities, such as gold, might profit from a leverage effect of 20.

| Market position size | Own funds invested | Leverage |

| £100 | £50 | 1:2 |

| £1,000 | £100 | 1:10 |

| £10,000 | £500 | 1:20 |

| £10,000 | £2,000 | 1:5 |

How to start Leverage trading?

We’ve outlined the entire process of getting started with leverage trading below.

Step 1: Choose an Online Broker

To trade with leverage, you must first select a reputable broker. Choosing from the hundreds of options available on the internet nowadays, however, might be difficult, so we’ve made it simple for you. The following are our top 5 online brokers for leverage trading:

1. eToro

eToro is widely regarded as the best high-leverage brokerage firm for both trading and social trading. For years, the company has been enhancing its service, expanding to other countries, acquiring new assets, and accumulating a growing number of customers.

It has licenses from several regulators, including CySEC, the FCA, and Australia’s ASIC, to mention a few. It has grown to over 20 million members who have access to over 2,400 financial marketplaces through eToro.

eToro offers a leverage ratio of 30:1 when it comes to Forex, with approximately 50 pairs available. This is only true for large currency pairs like EUR/USD, GBP/USD, AUD/USD, and USD/JPY. Smaller, less popular pairs, on the other hand, have a 20:1 leverage ratio.

It’s worth mentioning that this is only true for ordinary accounts, which are open to everyone. Experienced traders can open professional accounts with a 400:1 leverage ratio, though eToro will ask you to take a test before allowing you to do so.

It also offers assets other than forex, many of which may be traded with leverage, including stocks (x10), exchange-traded funds (x5), and even several cryptocurrencies.

And, if you’re new to trading but want to increase your profits right away by using leveraged trading, you can always use eToro’s social trading tool to imitate the trades of pros who use leverage and get comparable results.

Pros

- Leverage of 30:1 is available

- Fully regulated and licensed

- There are 2,400 markets available

- There are no fees for trading or management

- Trade like a pro

- User-friendly

- Only $50 is required as a minimum deposit

Cons

- There is a withdrawal cost

- It has a cost for inactivity

2. Capital.com

Capital.com is a CFD brokerage firm that also offers retail accounts x30 leverage. It is based in the United Kingdom, but it also has branches in Belarus and Cyprus. Even though traders can join Metatrader 4 and trade using it if they wish, the company has its own trading platform.

Users can choose from over 140 distinct pairs. It’s also worth noting that the platform has a very low minimum deposit requirement of only 20 GBP, which is even lower than our prior entry.

Pros

- There is a lot of educational stuff, such as manuals, FAQs, and other materials

- When buying and selling, there are no fees

- Spreads that are too narrow

- Minimum deposits are low

- x30 leverage

- Platform that is simple to use

- The ability to link MT4

- Tools for analysis

Cons

- Only CFDs are available

- Options trading isn’t available

3. Libertex

Libertex is one of the sector’s earliest high-leverage brokerage firms, offering retail clients x30 leverage on FX pairs and up to x600 leverage for professional accounts.

It is governed by CySEC, which requires it to limit its leverage for retail consumers, despite the fact that x30 leverage is not particularly high.

It’s also worth noting that the corporation offers three different trading platforms, featuring MT4, MT5, with its own. Customers will have access to 51 trading pairs, that can all be traded with x30 leverage, regardless of whatever option they choose. Another advantage worth mentioning is that the minimum deposit is exceptionally low, requiring only a $10 initial deposit.

Pros

- Only a $10 deposit is required

- Ordinary accounts get a 30x leverage, whereas professional clients get a 600x leverage

- Regulated by CySEC

- Three trading platforms are available

Cons

- Offers a limited selection of items

4. AvaTrade

AvaTrade is an excellent choice for expert traders looking for a high leverage broker because it offers a variety of advanced trading tools, a variety of platforms, and it operates in many countries across the world. The maximum leverage ratio for forex, commodities, ETFs, and stocks varies by nation. AvaTrade allows maximum leverage ratio for forex 1:400, 1:200 for commodities, 1:20 for ETFs, and 1:10 for stocks.

Apart from that, AvaTrade also offers currency trading, making it one of the few brokers that do so. Forex has a leverage of x400, while forex options only have leverage of x100.

Pros

- Leverage of up to 400:1

- Spreads are low

- Strictly regulated

- Allows you to trade forex options with leverage

- There are numerous trading systems available

Cons

- A margin fee is charged

5. Plus500

Plus500 offers a leverage of x30 for retail accounts and x300 for professional accounts when trading FX. The broker is likewise regulated by top-tier regulators, and it provides access to more than 70 forex currency pairs, as well as other markets such as stocks, commodities, options, indices, ETFs, and cryptocurrencies.

Users can also trade CFD options with the broker, however only at a leverage of x5. While it may not be the most advanced of the top accessible platforms, it is surely worthy of consideration. It’s also quite simple to use, making it a good starting point for inexperienced traders looking to get engaged in leveraged trading.

Pros

- Offers FX options

- Offers FX options

- Top-tier regulators are in charge of regulation

- Professional accounts have up to x300 leverage, while retail accounts get up to x30

- Excellent mobile app

- A wide range of assets are available

Cons

- The platform isn’t the most advanced

- Overnight fees are extremely high

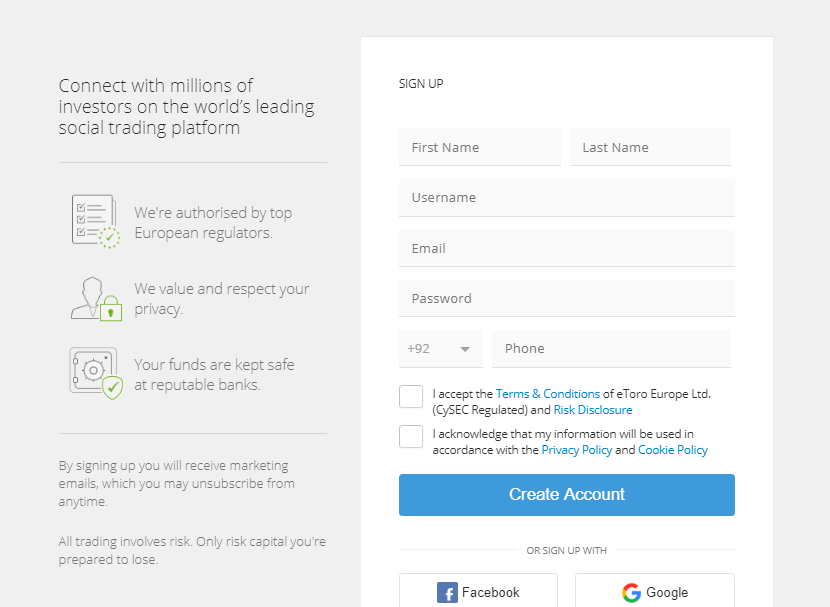

Step 2: Open A Trading Account

We will use the eToro platform to register accounts and start leverage trading, as it is one of the best brokers on the market.

For this step, you must create an account on the eToro website and provide your personal information, such as:

- First name

- name

- username

- E-mail address

- Password

- Phone number

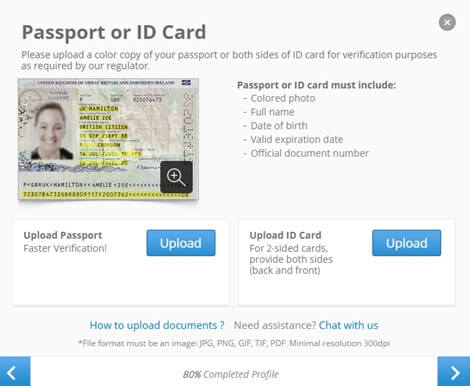

After registration, you will be required to validate your account by submitting the following documents:

- An identity document (passport, driving license)

- Address proof (all bills except mobile phone bills)

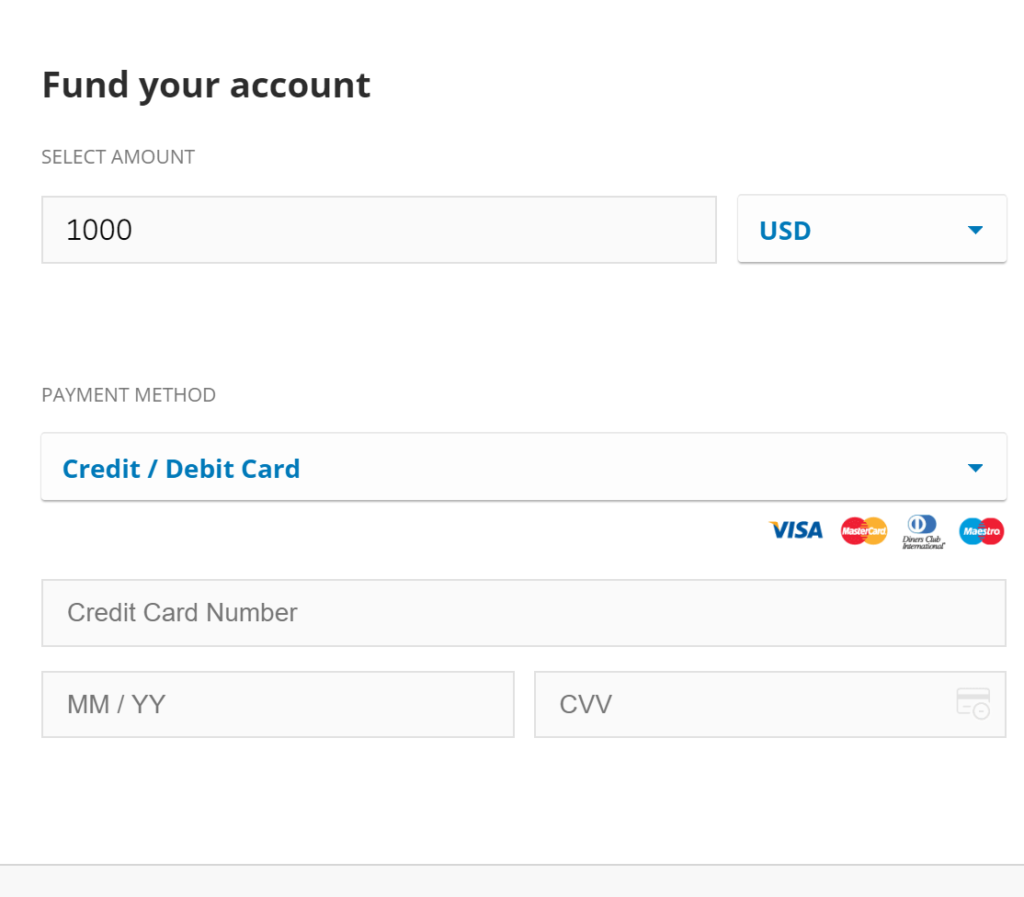

Step 3: Deposit funds

To begin trading after registering, you must make an initial deposit. Simply click the ” Deposit funds ” icon at the bottom left of the home page from your account.

You will then be required to select a sum and one of the numerous payment options available (credit card, debit card, Neteller, Paypal, Skrill, bank transfer, Rapid Transfer). All that remains is for you to click the blue “Submit” button to authenticate your monetary deposit.

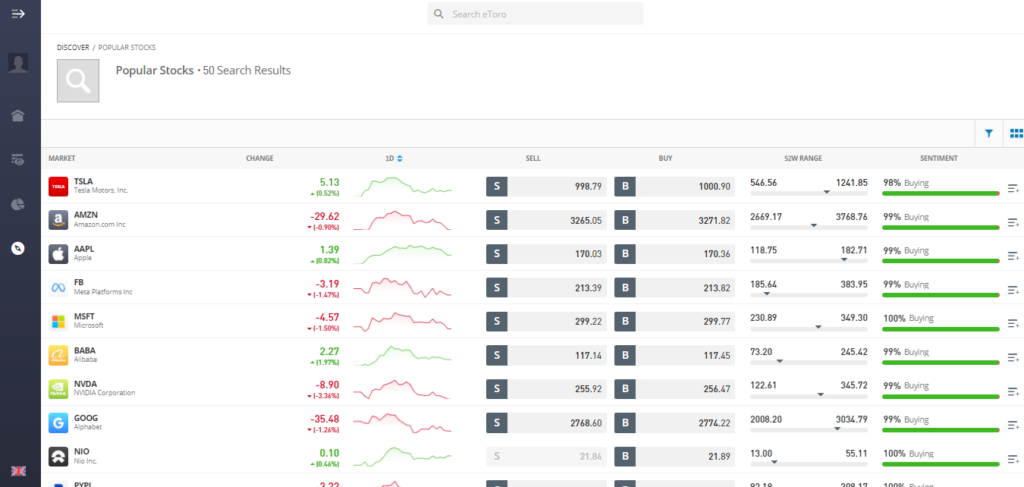

Step 4: Choose an asset to trade

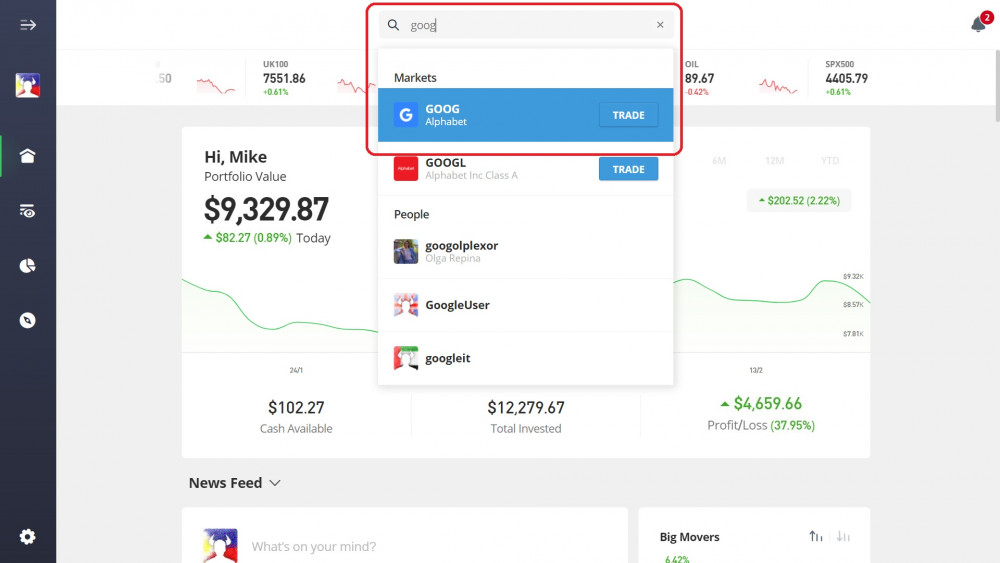

To select an asset, you have two alternatives. The first is to click on the “Markets” option to see a selection of financial instruments offered by eToro.

The second step is to utilize the search box at the top of the website to enter the name of the asset in which you want to invest.

Step 5: Open a leveraged trade

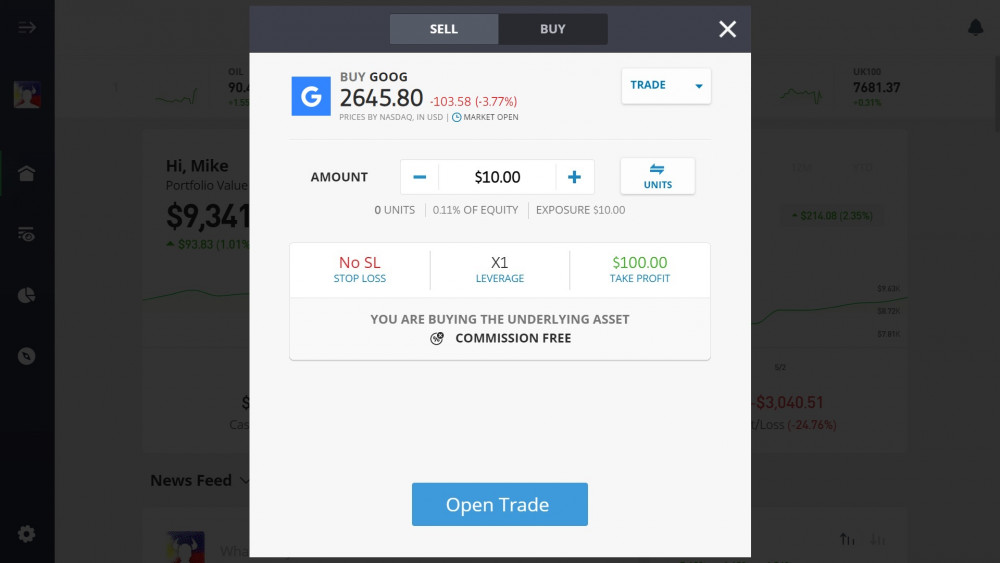

We took Google stock as an example for this step.

The Google stock trade without leverage is depicted in the image below. The next one is a trade of the action, but through its CFD, with a leverage impact.

Indeed, the leverage is equal to the one in the illustration below. In other words, there is no leverage, and you are trading Google stock. As indicated by the phrase “You are purchasing the underlying asset.”

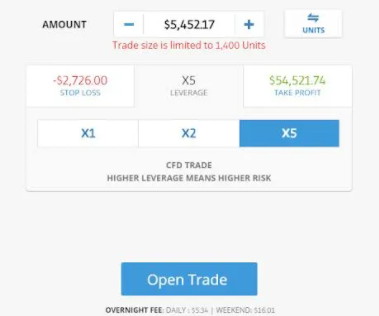

The leverage is shown in the example below. With the leverage effect, you no longer purchase the real asset, but rather the Google stock CFD. The eToro platform allows for maximum leverage of 5 on stocks.

By using leverage to trade CFDs, you are investing more capital than your initial deposit. For example, if you invest £100 and have a leverage of 2, you are actually investing £200.

Parameters to be configured

Before you can open a position, you must first set the following parameters, regardless of whether you are trading with or without leverage:

- The amount to be invested

- Stop Loss and Take Profit levels

Both are automatic resale limits. It is your job to modify them.

For example, if you buy a stock for £1000 and set the “Stop Loss” level to £900. If the price drops below £900, your stake will be instantly resold to reduce your losses. The automatic “Take Profit” barrier operates in the same way, but only when you’re in a winning position. Using the same example, if you set your “Take Profit” threshold at £1,200, the action will be resold automatically if it reaches this level.

Once you’ve set your investment amount, stop loss and take profit levels, and chosen leverage, all you have to do is click the “Place an order ” button.

Why should you trade with leverage trading?

Trading using leverage can help you make more money

Remember that when you invest using leverage, you are only investing a portion of your personal capital. The remainder, depending on leverage, might be compared to borrowing from the broker on which you are trading.

When the markets move in your favor, the leverage effect allows you to realize considerably more interesting capital gains.

Invest in a variety of assets

Leverage allows you to invest a smaller portion of your capital. You can then multiply your investments by doing multiple actions or investing in different assets.

To develop discipline

To be successful in trading, you must be extremely disciplined. This is especially true if you are trading with leverage. As a result, we propose that you chart a clear plan and stick to it. Discipline is the polar opposite of emotion in trading.

It is critical to have a level head, which leveraged trading allows you to achieve. Nonetheless, prior to engaging in leveraged trading, it is critical to exercise discipline.

Risk of trading with leverage trading

While leverage might increase your chances of winning, it can also increase your chances of losing. Here are the main disadvantages of leverage.

Greater possibility of capital loss

This is the inverse. If leverage allows you to profit more when the markets move in your favor, it will also cause you to lose more when they move in the opposite direction. In exactly the same proportions. When the market goes against your projection, a leverage of 2 will cause you to lose twice as much.

Leverage puts your emotions to the test

Because the stakes are larger, it is natural for leverage to exert greater pressure on you. This, however, should be avoided as much as possible.

You won’t invest more than you can afford to lose, and you’ll be less likely to make emotional blunders if you only invest what you can afford to lose. Certain approaches, such as “Money Management,” will assist you to lessen the unpleasant emotional impact of leverage.

Risk management through money management

Money management is a risk management strategy. This entails enforcing a strict management approach on your portfolio. Some money management guidelines are simple to implement and can help limit trading risks, especially when trading with leverage.

Here are certain ground rules to observe:

- Always calculate risk by determining the maximum acceptable loss. It will be crucial to consider the swap, spread, and even the broker’s probable commissions.

- Make use of money management software.

- Follow the plan you’ve developed upstream and resist the temptation to give in to your emotions.

- Keep an eye on the surroundings of the assets you trade.

Trading leverage: limits for individuals

Here is a table that summarises the maximum leverage allowed for individual customers based on the type of assets.

| Asset type | Maximum leverage allowed | Associated margin |

| Stock indices | 20 | 5% |

| Currency pairs | 30 | 3.33% |

| Commodities (except gold) | 10 | 10% |

| Cryptocurrencies | 2 | 50% |

| Individual Stock CFDs | 5 | 20% |

| Gold | 20 | 5% |

Trading leverage: limits for professionals

Here is a table that summarises the maximum leverage allowed for professional traders based on the type of assets:

| Asset type | Maximum leverage allowed | Associated margin |

| Major and Minor Forex Pairs | 1:500 | 0.2% |

| Exotic Forex Pairs | 1:25 | 4% |

| Main stock indices | 1:500 | 0.2% |

| Other stock indices | 1:100 | 1% |

| Commodities (Gold, Silver, WTI, Brent) | 1:500 | 0.2% |

| Other raw materials | 1:100 | 20% |

| Individual Stock CFDs | 1:20 | 5% |

| Cryptocurrencies CFDs | 1:20 | 5% |

Which level is ideal for Leverage Trading?

The progressiveness rule should be followed. We do not recommend using high leverage as a beginner trader. If you are new to trading with leverage, we recommend that you use the smallest amount of leverage available. When the maximum leverage for stocks, indices, or commodities is 5, 10, or 20, it could be wise to consistently choose the smallest leverage effect.

If you begin by trading stocks, for example, you can utilize a leverage effect of 2. That is, you directly invest half of the investment that you make.

For more experienced traders, you can progressively increase your investment by selecting larger leverage. If you achieve certain requirements, particularly in terms of expertise, you may eventually be able to register a professional account. According to the brokers, the access conditions vary, but they are all quite severe.

Is Leverage Trading right for me?

Although it can be fitted to any portfolio, some features can drive a trader to use leverage. These features are related to the investor’s profile, as well as his situation and investing capital. Leveraged trading is right for you if:

- You do not have a strong fear of risk. This is especially the case if you are trading with the highest possible leverage.

- Your initial capital is limited; but, the leverage effect will allow you to participate in positions larger than your initial capital. As a result, even if you have small funds, you will be able to diversify your investment.

- Forex is a particular asset in which you are particularly interested.

- You desire faster results: if your trading technique is already yielding results, it may be a smart idea to trade with leverage to multiply your profits.

A clear example of leverage trade

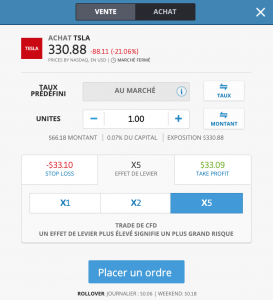

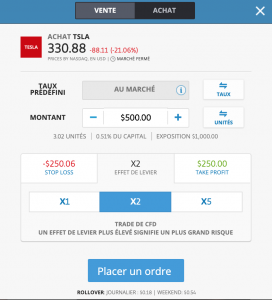

Let’s use the Tesla stock as an example to better grasp the leverage effect. The stock price in this example is $330.88. The margin is 20% when using one unit of stock and a leverage of 5. That means, you directly invest $66.18, as shown in the figure below “Units.”

Taking into account the leverage effect, the stake is $330.88, which is the share price since we have chosen 1 unit of Tesla stock.

In other words, if you invest $66.18 of your capital, your risk exposure is $330.88. Thus, by purchasing the value of 20% of Tesla stock through CFD, you expose yourself to 5 times greater risk, provided that the leverage impact is 5.

Consider the same case but with a monetary investment (rather than a unit of action) and a leverage effect = 2.

This time, the $500 figure represents your personal investment. As a result of selecting leverage = 2, your risk exposure is as follows:

500 × 2 = $1,000

Tips to consider when using leverage while trading

Some tips for inexperienced investors may be beneficial. Here’s a list of five tips to help you improve your leveraged trading technique.

Consider the volatility

This is a crucial rule to remember. It is advisable to employ a low leverage effect while trading risky assets such as cryptocurrencies. You amplify market movements by employing too much leverage on risky assets.

While the profits can be substantial, the losses can be devastating. However, as we have seen, regulatory authorities are now requiring brokers to give lower leverage on the most volatile items. Technical analysis methods like Bollinger bands can be beneficial for determining an asset’s volatility.

Use a well-defined strategy

This is sound advice that can be applied to practically any trading strategy. With leveraged trading, being disciplined and having a plan ahead of time is much more vital.

When you place an order, you must carefully define your “Stop Loss” and “Take Profit” levels. When you make trades with leverage, you should use money management strategies to acquire this consistency.

Begin with a demo account

The usage of a demo account to test your strategies can be an interesting approach. It will not only allow you to test your strategic plan but will also help you to become familiar with the platform’s features before plunging into the deep end.

Select a platform on which you are most at ease

While the platform’s usability is important to some, others will appreciate the ability to access a wide range of features. The best thing to do is test things out before making a decision.

Only invest your funds where you can afford to lose it

Trading using leverage has the potential to both save and lose a lot of money. Even if the markets don’t go your way, it’s critical to maintain taking positions that you can hold.

Furthermore, holding positions that are excessively large in comparison to your budget exposes you to the risk of trading with your emotions, which should be avoided at all times.

Conclusion

When the markets are trending in your favor, leveraged trading can help you achieve more appealing capital gains. Trading with leverage can be incredibly advantageous and profitable when it comes to forex, but it can also be extremely risky, therefore it is recommended that you proceed with caution. Be patient, take your time, and test things out first in a demo account before moving on to genuine markets.

When it comes to deciding which broker to use, we’ve compiled a list of the top 5 brokers that traders all around the world trust and have had excellent results with. But, in the end, it’s all about your own abilities, while the qualities of your chosen broker can only assist you to increase your profits significantly.

eToro provides an easy-to-use tool for creating a successful leverage trading strategy. In addition, a demo account allows you to test your strategies.

Frequently Asked Questions

Is it worthwhile to register a professional account in order to maximize leverage?

Professional accounts are only offered to traders with a lot of experience in the market. To be able to open such an account, you will need to demonstrate your previous experience with the broker you desire to use. The leverage effect is substantially higher when the account is opened, up to 1:600 for some asset classes.

Why is there a difference in leverage based on the assets?

The European Securities and Markets Authority regulates the maximum leverage for each product. The level of leverage is limited by the volatility of the assets. Due to the high volatility of cryptocurrencies, the leverage effect is limited to 2.

What is the difference between leverage and margin?

The two factors are closely entwined. A 5 percent margin, for example, means that you only invest 5 percent of your cash on a certain position, with the remainder (95 percent) coming from the broker. On a 5 percent margin, the leverage effect will be 20.

Is one trading strategy better than another for leveraged trading?

Day trading and scalping are two short-term trading tactics that are well-suited to leveraged trading. The leverage impact will be just as beneficial if you invest for the long run.

What does the term “knock-on effect” mean?

A knock-on effect occurs when leverage has a negative influence on your portfolio and the markets do not go your way. This illustration depicts the primary risk posed by the leverage effect.