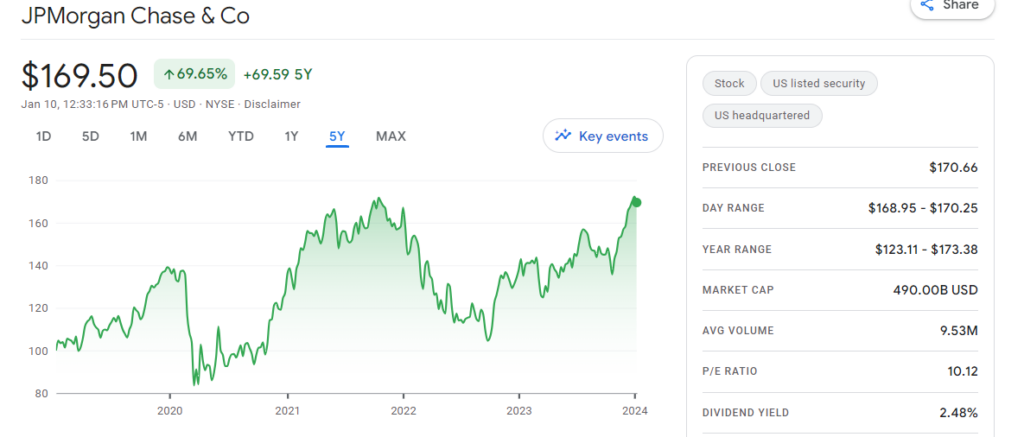

Investors seeking a steady income stream often turn to dividend-paying stocks, and JPMorgan stock is no exception. With the upcoming fourth-quarter earnings report generating buzz, some investors are eyeing the potential for monthly income through JPMorgan stocks’s dividends. In this post, we explore a strategic approach to earning $500 a month from JPMorgan stock dividends.

JPMorgan is expected to release its Q4 earnings results on Jan. 12, 2023, with analysts forecasting quarterly earnings at $3.40 per share and revenue of $39.77 billion. The recent upgrade by Deutsche Bank analyst Matt O’Connor, raising the price target to $190, adds to the positive sentiment around the stock.

To achieve a monthly income goal of $500, we start with the current annual dividend yield of 2.48%, translating to a quarterly dividend of $1.05 per share or $4.20 annually. Setting a yearly target of $6,000 ($500 x 12 months), we calculate the number of shares needed by dividing the target income by the annual dividend: $6,000 / $4.20 = 1,429 shares. Therefore, an investor would need to own approximately $243,873 worth of JPMorgan stock, or 1,429 shares, to generate a monthly dividend income of $500.

For those with a more conservative goal of $100 monthly ($1,200 annually), the calculation is adjusted accordingly: $1,200 / $4.20 = 286 shares or $48,809 to generate a monthly dividend income of $100.

It’s crucial to note that the dividend yield is subject to change based on the fluctuating stock price and dividend payments. As the stock price changes, the dividend yield will also vary. For instance, if a stock pays an annual dividend of $2 and the current price is $50, the dividend yield would be 4%. However, if the stock price increases to $60, the yield would decrease to 3.33%, and if it decreases to $40, the yield would increase to 5%.

Furthermore, changes in the dividend payment itself can impact the yield. If a company raises its dividend, the yield increases, even if the stock price remains constant. Conversely, a reduction in the dividend payment leads to a lower yield.

In conclusion, building a consistent monthly income through JPMorgan stock dividends requires strategic planning and consideration of the dynamic nature of both stock prices and dividend payments. Investors should stay informed about market trends, JPMorgan’s financial performance, and any potential changes in dividend policies to make informed decisions about their investment strategy.

Also read: 5 Best Dividend Stocks to Buy in 2024 for Passive Income

Leave a Reply