Despite the recent volatility and skepticism surrounding tech stocks, Amazon stock is emerging as a top pick for the year among analysts.

Last week, major brokerages including Piper Sandler, Bank of America, D.A. Davidson, Wolfe, and Wells Fargo unanimously named Amazon stock as their top choice for 2024, echoing a sentiment shared by others such as JPMorgan, Evercore ISI, Citi, TD Cowen, and Bernstein.

Wall Street’s optimism is reflected in the consensus rating of “Strong Buy” for Amazon stock. Out of the 43 analysts covering the stock, an overwhelming 39 rate it as a “Strong Buy,” with three suggesting a “Moderate Buy.” Only one analyst has a “Hold” rating, and the mean target price of $177.97 indicates a 20% upside from current levels.

Compared to its FAANG peers, analysts are most bullish on Amazon stock for 2024, while Netflix (NFLX) faces a more bearish outlook. The reasons behind this bullish sentiment are diverse and highlight various aspects of Amazon’s business.

Bank of America’s Justin Post anticipates a significant boost to Amazon’s North American margins through the growth in advertising revenues. The introduction of an ad-supported Prime plan and increased digital ad spending during the U.S. Presidential elections and the Paris Olympics are expected to contribute to this growth.

D.A. Davidson’s Gil Luria emphasizes the potential of Amazon Web Services (AWS), particularly in the enterprise sector. While Microsoft’s Azure may see higher percentage growth, Luria believes AWS will make substantial gains in absolute dollar terms.

Wells Fargo’s Ken Gawrelski is optimistic about Amazon’s artificial intelligence (AI) pivot, predicting that enterprise AI could account for 7% of AWS revenues in 2024. He also forecasts a reacceleration in AWS revenues with a 17% YoY increase.

Piper Sandler points out that Amazon’s 2024 earnings estimates are conservative, highlighting strong retail margins and potential for further expansion. Wolfe’s Deepak Mathivanan sees room for additional margin expansion.

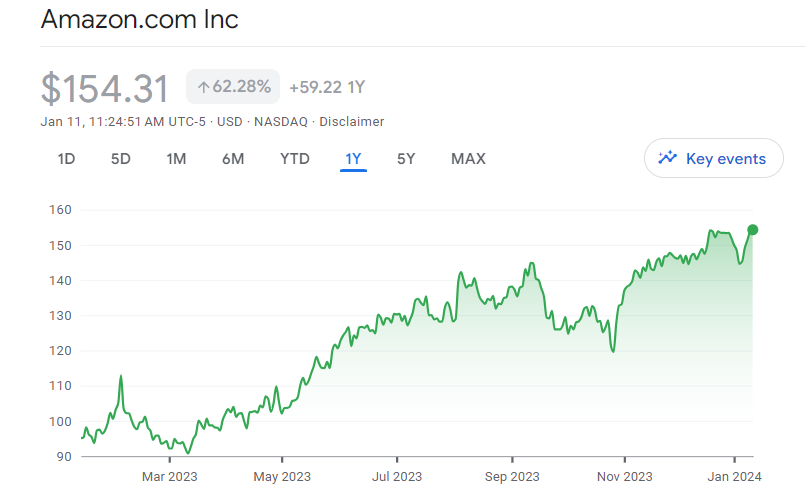

Despite Amazon’s impressive 81% gains in 2023, analysts believe there’s still room for growth. The company’s advertising business is on a rapid growth trajectory, with an annualized run rate of $50 billion. Additionally, Amazon Business, the B2B platform, presents another avenue for growth, boasting annualized gross revenues of $35 billion.

With a focus on cost cuts, increased efficiency, and improved margins, Amazon appears well-positioned for sustained growth in 2024. The company’s commitment to leveraging its infrastructure and CEO Andy Jassy’s emphasis on ongoing improvements further contribute to the positive outlook.

In conclusion, the combination of growth prospects, margin expansion, and reasonable valuation multiples make Amazon stock an attractive investment choice with the potential for further upside in the coming year.

Also read: Amazon Share Price Prediction: What Lies Ahead for AMZN Stock?