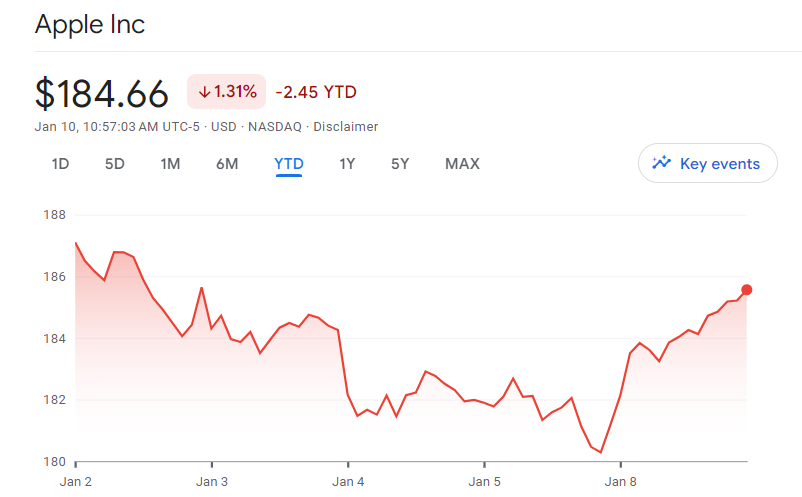

Apple stock appears to be facing headwinds, with shares falling in the first week of the year.

After a stellar 2023 in which the apple stock price rose 48%, concerns about the company’s growth rate and economic uncertainty have led some analysts to downgrade their outlook but investors should treat the situation with a measured approach, considering the tech giant’s challenges and constant strength.

Analysts immediately lowered their valuation of Apple’s stock, citing weak demand in China, a licensing dispute over Apple Watches, and concerns about the company’s valuation.

The potential economic slowdown further heightens fears about domestic demand for Apple products. The company’s growth has long been a concern, exacerbated by high-interest rates and tight consumer budgets.

AI and Next-Gen Technologies Focus

A key contributor to the cautious sentiment is Apple’s focus on artificial intelligence (AI) and next-gen technologies, including the affordable Vision Pro headset At $3,499, the mixed reality headset marks Apple’s foray into 3D camera technology, gaming, entertainment industry, and targeting opportunities.

Possible improvements to the chatbot called “Apple GPT,” add another layer to the company’s ambitions in the AI space. However, this focus on cutting-edge technology raises questions about costs and potential risks, especially given the competitive landscape and experiences companies like Meta Platforms have had in similar industries.

Despite these challenges, it is important for investors to take a long-term view. Apple has a strong brand, loyal customers, and a strong economy. While the growth hasn’t been spectacular in recent years, the company’s fundamentals remain strong.

Apple stock could face a headwind in 2024, and concerns about higher valuations and more investment in AI and headsets are justified. But selling Apple stock early may not be the wisest move.

Opportunities Amidst Challenges

Buying Apple stock in weakness in 2024 could be an attractive opportunity for investors who understand the true value of the company. The staying power of the Apple business, and its ability to innovate and change, makes it stand out in the long run. Investors should look closely at the company’s efforts in AI and next-gen technologies but also recognize that these projects could pay off in the future.

While 2024 could present challenges for Apple stock, the knee-jerk reaction to sales may not match the company’s long-term prospects. Smart investors should weigh short-term concerns against Apple’s underlying strengths and see it as an opportunity to rally in a tech giant with sustainable potential.

Also read: How To Buy Apple Shares