Certain firms usually distribute a consistent portion of their earnings to devoted shareholders on a regular basis, so investing in dividend stocks can be a wonderful way to boost the income diversification of your portfolio.

In this guide, we’ve mentioned the best dividend stocks you should buy in UK 2022, a detailed analysis of each company, and a step-by-step tutorial on how to invest in them.

Best Dividend Stocks in 2022

The best dividend stocks to acquire right now in the United Kingdom are listed below:

- Persimmon (LON: PSN)

- BHP Group (LON: BHP)

- Rio Tinto (LON: RIO)

- Aviva (LON: AV)

- Imperial Brands (LON: IMB)

- Phoenix Group Holdings (LON: PHNX)

- British American Tobacco (LON: BATS)

- Anglo American (LON: AAL)

- Sage Group (LON: SGE)

- GlaxoSmithKline (LON: GSK)

Best Dividend Stocks Analysis

Persimmon (LON: PSN)

One of the largest companies in the UK that builds homes is Persimmon. After a difficult 2020, the company has improved and will distribute 235p in dividends in 2021. As a result, it is one of the select few companies that is expected to offer double-digit dividend yields. On 1 August 2022, Persimmon had one of the strongest dividend yields on the market at 10.7%.

Dividend payments from persimmon typically occur twice a year, first in July or August and secondly in March or April. The spring dividend in 2019 through 2021 and 2022 was always 125p, and the summer dividend was always 110p. The disruption caused by Covid-19, however, resulted in lower and later dividend payments for the 2020s, with 40p being paid in September and 70p in December.

While the pandemic’s effects cannot be disputed, it is important to note that Persimmon was still able to distribute dividends to its stockholders despite the fact that the bulk of UK construction sites was closed for several months of the year. This will reassure any investors who are concerned about how a major real estate developer handles unexpected circumstances.

BHP Group (LON: BHP)

BHP, an Anglo-Australian mining firm, paid the biggest dividend in 2021 due to higher metals prices, which increased its profitability.

The corporation is recognized for paying large dividends when metal prices are rising, but it also has no problem making reductions when commodities are performing less well. Given that past dividend payments have been impacted by macroeconomic conditions, shareholders will want to keep a careful eye on them to determine the worth of future payouts.

In 2022, BHP’s current dividend yield, which is 10.7 percent, can turn into double digits. This suggests that a sizable amount of BHP’s earnings were paid out as dividends to its shareholders.

BHP has consistently paid two dividends every year for many years. It’s crucial to keep in mind that they aren’t usually progressive, which means that each payout isn’t always more than the equivalent one from the prior year.

With a dividend payment ratio of 1.5 or higher on a regular basis, BHP can manage to pay its dividends with revenues that are 1.5 times higher than those payments. This is a crucial indicator to evaluate when evaluating dividend stocks since businesses with a high cover ratio are more likely to be able to stably pay dividends over an extended period of time, despite market volatility.

Based on final dividend amounts and the share price as of August 1, 2022, BHP’s dividend cover ratio is at 1.3 percent. Even while it is lower than the sector median of 3.6 percent, it is still close to BHP’s five-year average.

Rio Tinto (LON: RIO)

Pat yourself on the back for some incredibly lucky timing if you purchased Rio Tinto in anticipation of its dividend payments in 2021. The mining corporation Anglo-Australian was regarded as the FTSE 100 stock with the highest dividend yield early in 2021. This was partly due to the company reporting its greatest quarterly earnings ever in 2020 and 2021, which were fueled by an increase in iron ore prices following Covid-19 interruptions.

With a special dividend of 133.26p for 2021 and an interim dividend of 270.84p per share, Rio Tinto distributed a sizable portion of these profits as dividends. Over £6.5 billion was paid out in dividends, making it the miner’s greatest dividend payout in history.

Rio Tinto’s dividend is anticipated to be reduced this year, but even with the reduction, it will still be among the highest-yielding investments, with analysts projecting a full-year dividend yield of roughly 10.7 percent.

According to our most recent projections, Rio Tinto’s dividend yield for 2022 should be close to 9.1%. Although significantly lower than the yield from the previous year, which was over 10%, this is still a good dividend yield.

Rio Tinto distributes interim and final dividends twice a year in the form of dividends. The firm is renowned for adhering to the traditional payment dates of April and September each year, steadily increasing its dividends over the previous five years.

Rio Tinto’s dividend coverage ratio right now is about 1.2 percent. This indicates that the business is in a good position to be able to pay its dividends 1.2 times over from its profits coffers.

Aviva (LON: AV)

Following the release of Q1 earnings in May, Aviva shares plunged, already down 28% year to date. Despite this, they are still a well-liked option for dividend shares. Insurance provides a degree of consistent returns that are often less impacted by economic downturns than miners and housing equities.

Additionally, it now has a very strong 7.3 percent dividend yield, which is nearly double the average for the FTSE 100. The payout has been reduced numerous times over the past two decades, despite the 40 percent increase this year.

And things might be improving. The corporation has been strategically repositioned under CEO Amanda Blanc, who assumed leadership in 2020. She has sold certain international assets, paid off debt, and distributed nearly £5 billion to shareholders.

The new legislation intended to stop insurers from charging renewing customers more than new customers pose a significant danger. According to Aviva, the impact has been negligible thus far, with few customers switching and new ones just paying extra.

However, Aviva can run into problems as the cost-of-living crisis gets worse. Customers who are strapped for cash are more motivated than ever to find the best bargain, claim costs are rising owing to inflation, and there is limited opportunity for maneuvering in a highly competitive market. This can jeopardize the dividend security.

Additionally, Cevian, the second-largest shareholder after Blackrock, has been increasing its holdings in Aviva. The co-founder of Cevian contends, in opposition to Blanc’s assertion, that the insurer has been poorly managed for years and has been restrained by excessive expenses and a string of poor strategic decisions.

Cevian is pushing for higher shareholder returns, optimistically estimating that Aviva’s underlying value exceeds 800p per share.

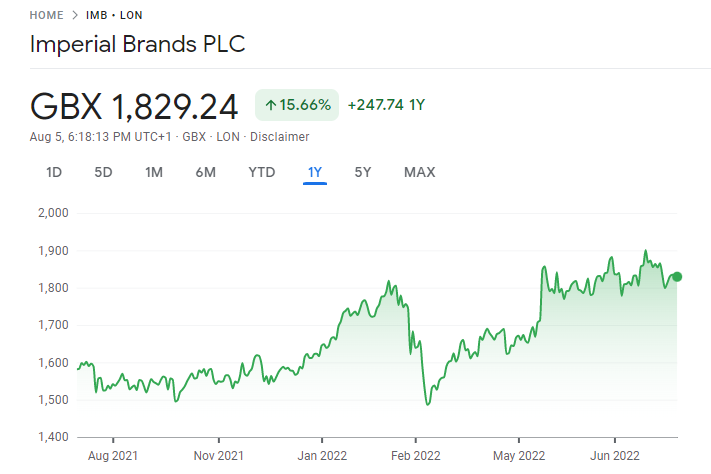

Imperial Brands (LON: IMB)

A UK tobacco company called Imperial Brands is well known for routinely distributing quarterly dividends for more than 20 years and for providing some of the best dividends in the stocks sector.

This indicates that Imperial Brands pays dividends four times per year. The first and fourth quarter payments of the year are often equal in size, whereas the second and third quarter payments are typically lesser but still equal in size.

Imperial Brands’ final November payment should be this amount as well, and its second and third payments should also be approximately 21p since the company’s first payment for 2022 has already been verified to be 48.48p. If this prediction turns out to be accurate, 2022 will see total dividend payments of 138.96p per share.

This would result in a projected dividend yield for Imperial Brands for 2022 of 7.7 percent, or around one percentage point less than its 2021 numbers.

As of 2020, the company would distribute 87 percent of its income in the form of dividends, which is a high dividend payout ratio. Its expected dividend cover ratio at the moment is a solid 1.7 percent, nevertheless. This number is unreasonably high.

Phoenix Group Holdings (LON: PHNX)

One of the larger insurers in the UK and a provider of long-term insurance is Phoenix Group Holdings, which bills itself as the nation’s top provider of retirement and long-term savings products.

It has been a consistent dividend producer for more than a decade, paying out two payments a year that typically increase little but consistently each year.

The company distributed a 23p interim dividend and a final dividend of 24p per common share in the financial year 2021. This resulted in a dividend yield for 2021 of about 6.4 percent. As of now, the dividends for 2022 have been growing slightly to 24.8p, giving them a dividend yield of almost 7.8% as of August 2022. For a firm that, unlike the miners on our list, didn’t have a revenue boom in 2021, this is a generous dividend yield level.

British American Tobacco (LON: BATS)

British American Tobacco, situated in the UK, had a successful year in 2021. The Covid-19 outbreak raised concerns in the tobacco industry that it would result in a major decline in cigarette sales, but the firm reported a surge in sales of glo-related and vaping products.

As a result, their full-year 2021 dividend, which was paid in four equal quarterly installments of 53.9p each, increased by 2.5 percent to 215.6p. It reflected a 65 percent dividend payout ratio.

The financial status of the corporation in 2022, however, has changed in light of Russia’s invasion of Ukraine. BAT made the decision to halt operations in Ukraine in March 2022 and stated that it was looking to sell its Russian business holdings. Despite the possibility that this could affect the company’s bottom line, BAT also plans to make investors four equal quarterly distributions of 54.45p per ordinary share in May, August and November 2022, and February 2023.

Any investment would benefit from BAT’s reputation for regular quarterly dividend payments. This would result in a dividend yield of about 6.2 percent for 2022 at the most recent share price from August. This is still a healthy number even though it is slightly lower than the dividend yield for 2021 of 8.2 percent.

Based on projected dividends through 2022, the company’s dividend coverage ratio is 1.2 percent, which is a respectable level for such a large dividend payout.

In the end, BAT is on the list due to its propensity to raise its dividend every quarter, year after year for more than ten years now. Investors can lock in substantial dividends for the foreseeable future, while market turmoil in the Ukraine and Russia may lead this to alter.

Anglo American (LON: AAL)

A mining business with its headquarters in London, Anglo American is well-known for its diamonds, platinum, iron ore, and other products.

In addition to any additional special dividends, Anglo American pays two payments each year. These are their September interim dividend and their April or May final dividend of the following year. It has adhered to this strategy for more than 25 years, demonstrating that it is a reliable dividend payer.

The corporation profited from a rise in commodity prices in 2021, especially for copper, iron ore, and platinum. Due to Anglo American’s objective of paying out at least 40% of company income in dividends, this constituted both an interim dividend of $2.1 billion and a $1 billion special dividend of 58p per share.

However, 2022 has not yet seen the price increases of 2021, which could mean reduced dividend payments in September 2022 and April 2023.

The company is somewhat insulated from Russian market volatility thanks to its mining operations in South Africa, Botswana, Zimbabwe, and Namibia, but in February it issued a warning to shareholders that it had lowered its copper price guidance due to supply risks brought on by the conflict between Russia and Ukraine.

Anglo American’s dividend yield is currently about 7.4%, which is nearly as high as the 8% seen in 2021 and 2020.

The company now has a 0.4 percent dividend coverage ratio, which is comfortable, and a 2021 payout ratio of about 59 percent, which is prudent. However, if dividends continue to be as high as they have been, some experts have cautioned that this payout ratio could increase to unsupportably high levels in 2022.

Sage Group (LON: SGE)

Sage, a provider of accounting software, is one of the FTSE 100’s prestigious dividend elites.

A corporation is considered a dividend aristocrat if it has paid dividends for the previous 25 years or more and has continually increased its dividend distribution. The term originated in America. It’s a significant accomplishment, therefore it seems to sense that the list is short. This is much more true now that Covid-19 has caused interruptions.

Sage distributes a final and an interim dividend each year. Dividend payments were more or less level from the 5.93p and 11.31p paid in the prior year, coming in at 6.05p for the first half of 2021 and 11.63p for the full 2021 dividend in February 2022.

It is planned to raise the dividend in 2022 to 6.3p, which is 4.1 percent more than it was the previous year. This results in a dividend yield of 2.7 percent, which is greater than the 2.4 percent dividend yield reported for 2021 and above the industry average.

The firm is currently being “digitalized” by the company, which has received a lot of media attention and may eventually result in higher returns and dividends.

Sage Group has a healthy dividend coverage ratio of roughly 2.1 percent, which indicates that it could easily pay out more than twice as much in dividends from earnings. This is a testament to the sustainability of a company with a long history of paying dividends.

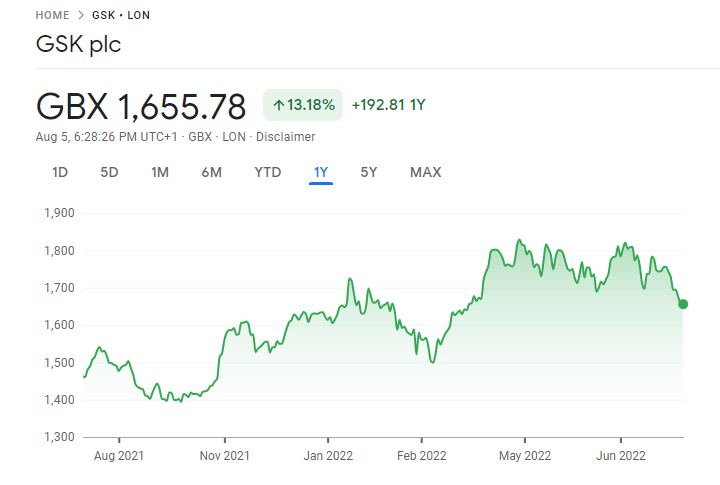

GlaxoSmithKline (LON: GSK)

It is simple to ignore the pharmaceutical business GlaxoSmithKline (GSK) in favor of its more prominent UK rival AstraZeneca because it is not a member of the Covid vaccine makers club.

However, GSK is renowned for paying out good dividends on a quarterly basis each year, and its dividend payout ratio has consistently been at or above 40% (and occasionally noticeably higher) for more than ten years. Investors frequently know the date and amount of the next dividend announcement up to a quarter in advance, which is uncommon for firms of its magnitude.

But GSK’s projected dividends maybe even more intriguing than those from the past. According to the company’s new progressive dividend policy, it would aim for a quarterly dividend payout ratio of between 40 and 60 percent starting in 2023.

This is consistent with the company’s announcement that between 2022 and 2023 it will split in order to create a distinct consumer health entity. This can entail a noticeably increased dividend from a business that is already well-known to them.

GSK stated in its Q1 2022 results that shareholders can anticipate 52p in total dividends per share for the entire 2022. This lowers the company’s dividend yield from the prior year to around 3.02 percent.

The dividend cover ratio for GSK is relatively strong at roughly 2.4 percent as a result of the company maintaining a payout ratio of about 45 percent. This indicates that the corporation has enough cash on hand to pay 2.4 times the cost of dividends.

How to invest in the best dividend Stocks in UK?

After talking about the top dividend Stocks in the UK, we’ll walk you through the investment process.

Step 1: Choose a broker

You must locate an online broker who can meet your wants if you want to purchase UK dividend stocks. The most popular sites for purchasing and trading the top UK dividend stocks are listed below:

1. eToro

With over 800 worldwide equities, many of which pay dividends, eToro is a well-known broker. This comprises equities listed both domestically and internationally, including those of US, Canadian, Japanese, German, and Swedish businesses.

You don’t pay any transaction fees while buying and selling stocks on eToro, which is a popular advantage. On the platform, you can trade without paying a commission. Spreads, a $5 withdrawal fee, and a minimal 0.5 percent conversion cost are the only fees to take into account.

To attract over 12 million other users, eToro first gained notoriety as a cutting-edge social trading broker that mixes conventional brokerage services and social networks. As well as copy trading tools, eToro provides. By pressing a button, you can instantly copy the complete portfolio of a top investor. You can read our comprehensive review of eToro to learn more about this stock trading app.

2. Plus500

A CFD provider, Plus500, offers dozens of different financial products. This contains more than 2000 stock CFDs in the stock section. You no longer own the underlying stock you are trading if you choose Plus500 and its CFD options. Instead, it predicts the asset’s future worth. The good news is that dividends are still represented in the stock CFDs’ underlying value.

As a rough illustration, if you assist in the sharing of 20 CFDs and a company provides a dividend return of 20p, a Plus500 cash account would theoretically deposit £4 into your account. It is significant to note that choosing the Plus500 CFD approach has a number of benefits. For instance, you can use a broker to enter buy and sell positions. The former enables you to estimate the company value loss. On Plus500, there are no commissions for any transactions.

For UK retailers, Plus500 additionally permits leverage up to 1:30. You can only utilize 1:5 CFDs on equities if you desire to do so. For the most part, Plus500 is subject to FCA regulation, and its parent company is traded on the London Stock Exchange. You can read our comprehensive guide of eToro vs Plus500 to make the best selection between these top online brokers.

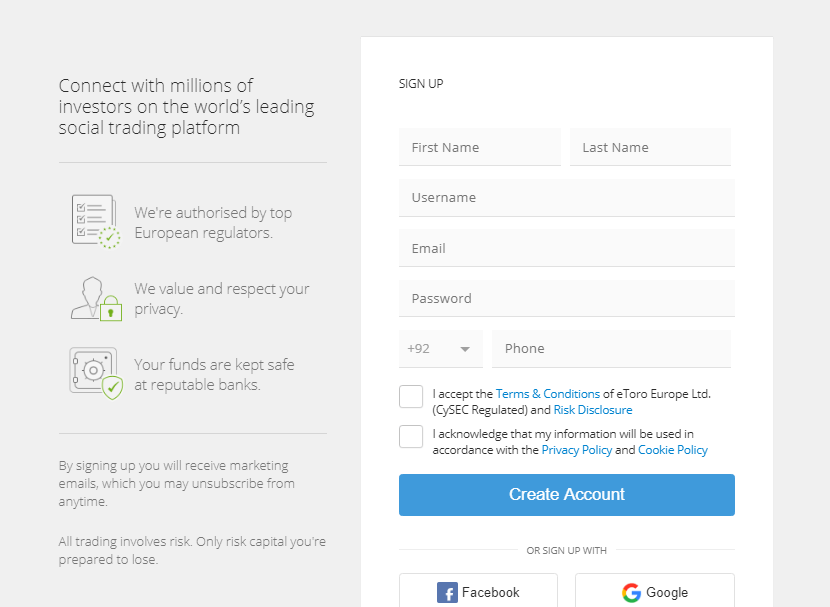

Step 2: Create an Account

For this illustration of purchasing dividend stocks, we have chosen eToro, a commission-free and FCA-regulated platform.

To begin, register for an account on the eToro website. Personal information is necessary, just like it is for any other share dealing platform governed by FCA regulations.

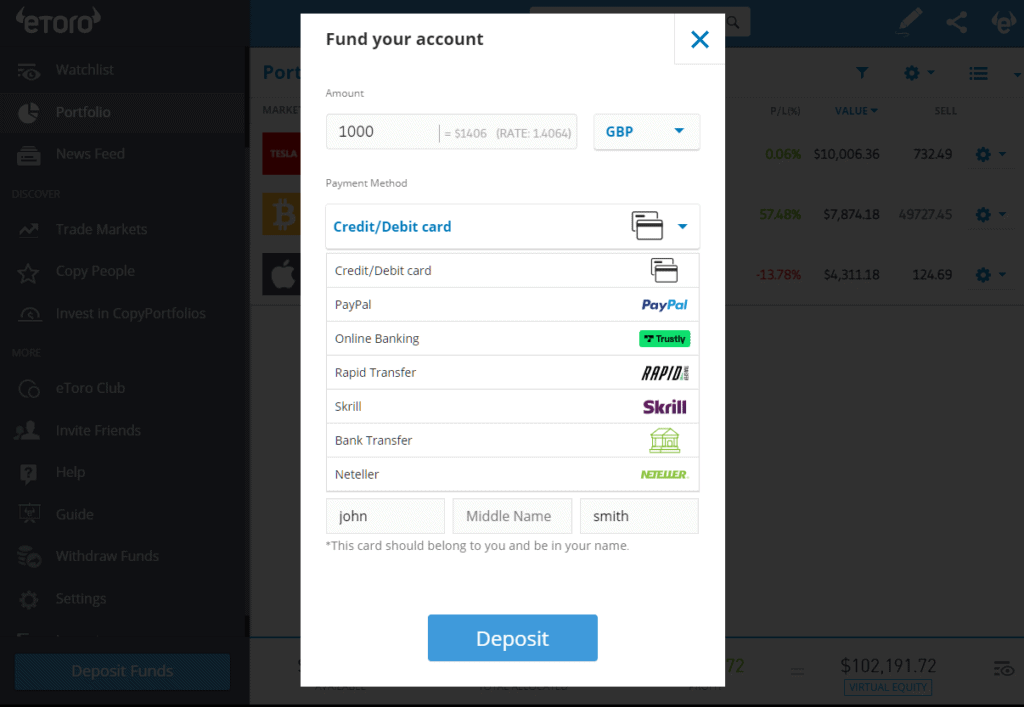

Step 3: Make a Deposit

At eToro, deposits are easy to make. By using your UK debit/credit card or an e-wallet, you can do this right away.

Step 4: Find your chosen dividend stocks

At the top of the screen, a search box will show up. You only need to type in the dividend stock’s name and select the corresponding result after. You are free to purchase shares of any corporation in this scenario, but we choose to buy British American Tobacco stock for this tutorial.

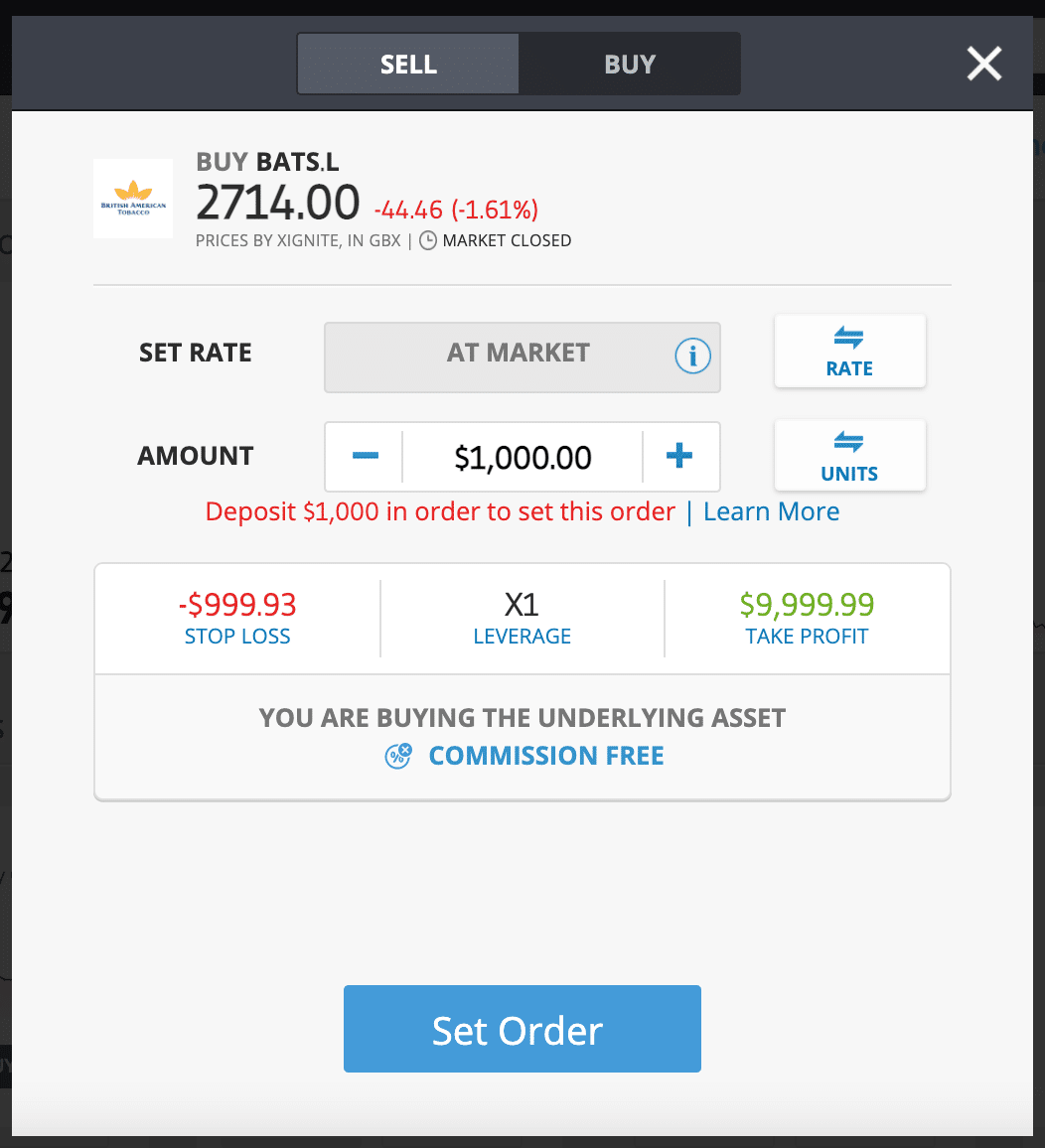

To access the trading page for British American Tobacco (or another stock of your choosing), click the blue “Trade” button.

Step 5: Finish your order

You must now enter the sum you wish to invest in the dividend stocks you have chosen. In this illustration, you are purchasing $100 worth of British American Tobacco stock. Finally, finish your investment by clicking the “Open Trade” option.

Conclusion

Traditional capital gains and periodic payouts are two ways that dividends might boost your money. Although not all UK businesses do so, many do. Because of this, seasoned investors frequently invest a portion of their portfolio in dividends.

But it’s crucial to keep in mind that you shouldn’t invest only because a business offers dividends. You must take into account a number of other aspects in order to choose the finest dividend stocks for your portfolio.

Consider using eToro if you want to start investing in dividend stocks right away. More than 800 stocks are available through FCA brokers, and you can use our cutting-edge copy trading tools to buy any of them without paying any stock trading commissions.

Frequently Asked Questions

How are dividend payments made?

Investors who have purchased stock in a firm are typically paid stock dividends twice a year, at a predetermined date after the company releases its half- and full-year results. The shareholder’s shareholding determines the dividend value. You can be eligible for dividend adjustments while trading on shares with us.

What benefits do dividend stocks offer?

Dividend stock investments provide low effort-to-reward income and can contribute to the development of a more balanced investment portfolio. With a few exceptions, companies that continuously pay dividends are often large-cap or blue-chip.

Do tech stock dividends exist?

The majority of the bigger, more well-known computer giants opt not to provide dividends to their shareholders, while some just allocate a tiny portion.