Plus500 is a CFD broker that serves a growing global clientele with cutting-edge financial products. The company’s distinctive trading platform, especially the smartphone version, is well renowned.

Plus500 has led the way in the market for several years by, among many other things, producing the first Cryptocurrency CFD and offering a broad selection of CFDs on options. Additionally, this broker will undoubtedly continue to rank among the best online brokers for many years with the impending launch of Plus500 Invest.

Continue reading our in-depth analysis to fully understand Plus500’s features and assess whether it satisfies your trading requirements.

Plus500 Overview

/plus500_source-5c5b58f746e0fb0001ca8550.png)

Plus500 is an FTSE 250 firm listed on the London Stock Exchange and a global provider of CFD trading services (LSE). It has established itself as one of the biggest brokerage businesses in the world by fusing cutting-edge technology, a broad selection of financial instruments, and advanced trading tools.

A variety of online CFDs on currency, equities, commodities, indices, futures, and precious metals are available from Plus500. The company’s present headquarters are in Israel, where it was established in 2008.

The majority of CFD trading platforms are just too challenging to use. Fortunately, Plus500 is among the easiest-to-use brokers available right now. Its top-notch customer support, user-friendly platform, and adaptable trading opportunities have contributed to its recent exponential growth.

Assets Offered by Plus500

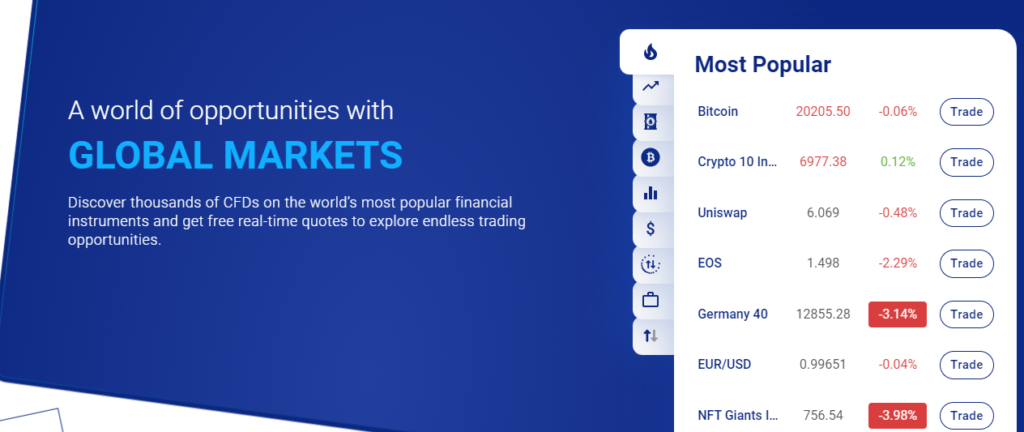

About 2,500 CFDs are available overall on the Plus500 platform. The fascinating markets covered by these CFDs include indices, equities, currency, and options. Naturally, the collection includes the most well-liked financial products available, such as the most significant indexes, American corporate equities, and commodities like gold and natural gas, to name a few.

- Indices: Almost 30 different index-based CFDs are available for trading. Germany 40, the US-TECH 100, and other important country indices are a few examples. Alternatively, you could try your hand with more specialised stock indexes.

- Forex: Plus500 is currently one of the best CFD forex brokerage firms in Europe. Profit from trading major, minor, and exotic currency pairings as CFDs on the largest financial market in the world.

- Commodities: You can trade a variety of well-known commodity futures as CFDs with Plus500. The spectrum includes natural gas, platinum, coffee, gold, and oil, the most commonly traded commodity asset in the globe.

- Stocks: Using CFDs to trade stocks on the stock market has numerous advantages. The ability to trade for a small portion of the stock’s true market value is one of the key benefits. Today, Plus500 offers a diverse range of CFDs based on foreign stocks traded on significant global exchanges.

- Options: Plus500 allows you to trade CFDs based on options, which is unusual in the market. In actuality, the majority of Plus500’s rivals don’t provide options.

- ETFs: Exchange-traded funds can also be traded using a Plus500 trading account. There is a wide range of options, including best ETFs like Global X Lithium & Battery Tech and a great deal more.

Plus500 also provides cryptocurrency trading outside of the UK, but due to existing UK regulations, these assets are not permitted there.

Plus500 Fees

You won’t ever pay a commission when trading with Plus500. Instead, Plus500 offers some of the industry’s smallest spreads, making it a cost-effective choice. There are no fees associated with using the tools or making deposits. However, there are a few non-trading costs associated with particular services, as shown in the breakdown below.

Overnight fees: Plus500 levies a small cost for positions that are held overnight, or after the exchange has closed, similar to how all CFD brokers do.

Conversion fees: If you invest in a currency that Plus500 does not offer, you will be charged a currency conversion fee. Create an account with a currency and payment method that suit for you to prevent additional cost. Currently, currency exchange fees can cost up to 0.7 percent.

Stop Order: If you want to place a confirmed stop-loss order on a transaction, you would be charge. This is a regular charge in the field, and it’s definitely worth the money to make sure that your losses don’t go over your spending limit.

Inactivity Fee: If an account is inactive for three months, there is also an inactivity fee of £10 per month. Only as long as there are funds in your account will this fee be applied.

Deposit Methods

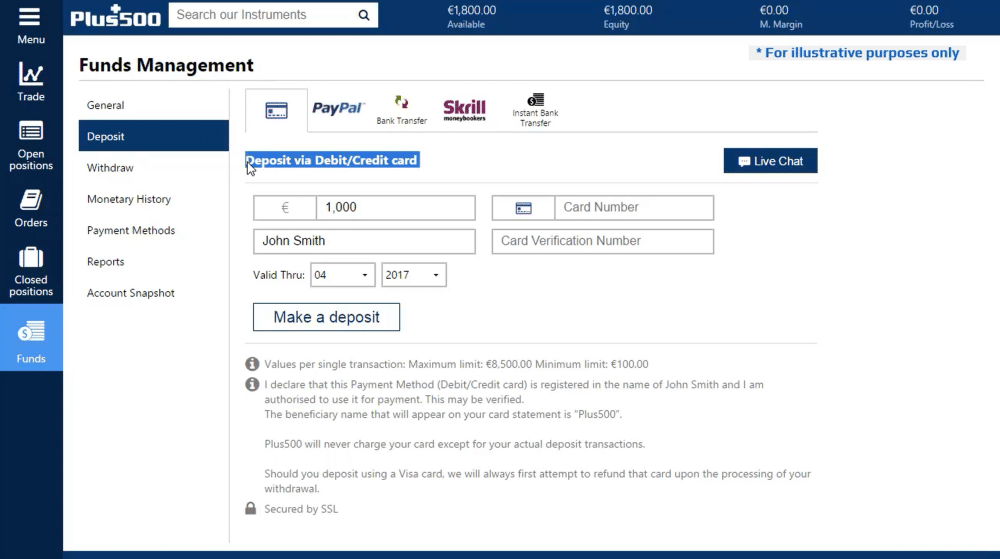

You have a lot of options when it comes to the methods of payment that Plus500 supports. Naturally, Plus500 offers commonly used payment methods being one of the more well-known online brokers in Europe.

- Credit cards: You can deposit money into your account and withdraw money with a Visa or Mastercard debit or credit card. Please make sure that your card issuer supports it because some banks and credit card providers have restrictions against transactions with internet brokers.

- Electronic payment methods: For all of your Plus500 transactions, you can also utilize Skrill or PayPal. Since Skrill and Paypal are two of the most popular online payment processors ever, many UK citizens are already accustomed to using this choice.

- Bank transfers: Traditional bank transfers are another method that can be used to deposit and receive money from Plus500. Just bear in mind that while the other options are fast, bank transfers typically take a few business days to process. Additionally, a larger minimum deposit is required for bank transfers.

Plus500 Platforms

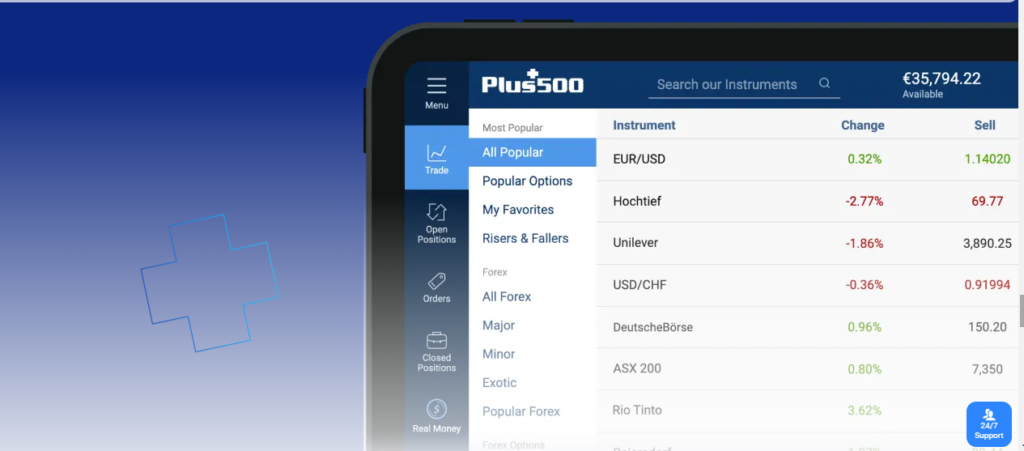

The fact that Plus500 solely offers custom trading software for desktop and mobile trading is one of its defining features. In other words, the broker is the only user of the platform. Additionally, Plus500 has created one of the greatest CFD platforms in the world, earning numerous accolades and having the highest user ratings in both app stores.

Plus500 WebTrader

The main platform is powerful web-based trading program with a comprehensive array of cutting-edge capabilities. The platform hosts more than 2,000 assets across seven markets and offers all the graphs, market updates, stop-loss services, and other features you could possibly require for asset analysis and opening profitable positions.

The risk management concept is important to Plus500, and it has built a number of risk management tools within its platform.

Trading App

As previously indicated, Plus500 is the top-rated trading app in both European app stores. Any broker would be proud of this accomplishment, but Plus500 is more so since it created the app in-house.

You get access to the same tools and cutting-edge analytical functions. Since you use the same account for all devices, switching between desktop trading and mobile trading is also quite simple.

Plus500 Invest

For many years, Plus500 only provided speculative trading using Contract for Differences as it was a CFD-only broker. Although there is nothing wrong with it, several traders found it to be restrictive, and many have hoped that Plus500 would obtain the necessary licenses to begin providing investments.

This was finally accomplished only a few months ago, and today Plus500 offers one of the top CFD platforms and a ground-breaking stock investment service.

You need to register an investment account in order to utilise Plus500 Invest platform, even if you have an existing trading account with the operator. Following that, you will have access to 2,700 unique equities from around the globe that you can buy for the long term.

The good news is that you can invest in stocks using Plus500’s award-winning platform, which includes a variety of cutting-edge tools to support your performance at the highest level.

Even better, Plus500 operates somewhat differently from more “conventional” stockbrokers in order to work to your advantage as an investor. For instance, there are no fees associated with using the platform, withdrawing or depositing money, or paying custodial costs. Despite not being commission-free, Plus500 boasts some of the cheapest commissions we’ve seen in years for stock investments.

In other words, Plus500 makes investing simple and affordable, which is why so many people choose it.

The broker only offers 2,700 stocks, but some other online brokers offer 15,000+, which is the only drawback we can come up with. So you have to determine if you want to choose one of the more traditional stockbrokers with a wide variety or whether you’d rather limit yourself to a chosen few stocks.

Plus500 Licences

If you ask any trading professional what to look for in an online broker, they would probably advise you to start by looking at the broker’s licenses. Every broker and bank in the UK is required to have approval from and a license from the Financial Conduct Authority (FCA). This guarantees the security and dependability of said broker.

There is an FCA counterpart in every country and jurisdiction, and the more licences a broker gets, the more reliable it is. Fortunately, Plus500 is governed in a number of international jurisdictions.

Plus500 is licensed and governed by:

- FCA: The UK (main license). The FCA has authorized and regulated Plus500UK Ltd. under license number #509909.

- CySEC: License No. 250/14 for the European Union. In the UK, cryptocurrency CFDs are not accessible.

- ASIC: Australia. The AFSL number is #417727.

- ISA: Israel

- FSCA: South Africa. License No. #47546

- FSA: Seychelles. License No. SD039

- FMA: New Zealand. License No. 486026

- MAS: Singapore. License No. CMS100648-1

How to begin with Plus500?

Plus500 account registration is simple, and because it is governed by the FCA, it adheres to the same general procedures as all other UK online brokers. In light of the foregoing, it is necessary that you supply accurate personal information and that you verify it all. You cannot, therefore, give inaccurate information or omit any of the process’s steps.

Step 1: Open an account

You can get to the registration page for Plus500 by clicking one of the website’s links. Personal information such your full name, address, phone number, and email must be entered here.

Additionally, the broker will ask you to respond to a brief questionnaire about trading with leverage and the financial markets. They do this to limit your leverage and margin levels and to make sure you are capable of trading safely.

Step 2: Verification

Every new customer is required by UK financial regulations to confirm their identity and address. In order to do this, you must present a copy of your identification as identification and a recent utility bill as proof of residence. Plus500 has the right to request additional identification to confirm that you are who you say you are.

The broker must then manually complete the verification, which can delay its implementation by a few hours.

Step 3: Deposit funds

Once you have been verified, you will have complete access to your trading account; but, before you can begin trading with actual funds, you must fund the account.

Currently, the broker requires a minimum deposit of £100 from all UK-based traders. You must deposit £500 if you use a bank transfer, though.

Conclusion

Plus500 is clearly the best alternative for novice and less experienced traders looking to try their hand at making money, excluding a lack of educational resources and a few other small hiccups. It is due to Plus500’s high level of simplicity and user-friendliness. In the year 2020 alone, the broker won the top spot as the Best in Class in three categories: Beginners, Trust Score, and Ease of Use.

On the other hand, Plus500 could use better instructional and research resources. Furthermore, Plus500 is woefully lacking in sophisticated tools. On Plus500, however, there are lots of opportunities for newcomers to profit thanks to the 2,000 CFDs and 70 Forex pairings.

/plus500_source-5c5b58f746e0fb0001ca8550.png)

Frequently Asked Questions

Is Plus500 appropriate for new users?

Yes, beginners are strongly advised to use Plus500. It is easy to use and features a user-friendly trading platform. 2020 saw Plus500 win the Best in Class award for brokers in the Beginners category. It has also received great marks in the Ease of Use and Trust Score category. 100 units of the selected currency must be deposited to start an account, which is a smart decision for newbies.

Can you profit with Plus500?

It is feasible to gain financial success using Plus500. According to a regulatory study, 23.36% of retail investor accounts on the broker were profitable when they traded CFDs and other products. The broker has been recognized first in its class, making it a fantastic opportunity for beginners to start trading.

Is Plus500 appropriate for day trading?

Plus500 is unquestionably a solid option for day trading. It’s because the broker is extremely user-friendly, has a large selection of trading alternatives, and operates with excellent operational efficiency. On the platform, there is a tonne of chances for trading CFDs and other instruments.

What is the minimum deposit amount?

Opening an account on Plus500 requires a deposit of 100 units of the connected currency, and the process is quick and easy.