Two of the biggest, most established, and well-known online brokers in the trading market are eToro and Plus500. These brokers, who were both established more than ten years ago, in 2007 and 2008, respectively, have amassed devoted fan bases and untainted reputations. This eToro vs Plus500 review will help you decide which broker is better in UK.

Given that they provide retail investor accounts to individuals, most new investors seeking the best crypto trading apps will have come across both of these recognizable names. We have rigorously tested these two outstanding platforms because we understand how tough it may be to choose between them in order to discover which broker is the best.

eToro vs Plus500: Overview

Plus500 and eToro are online trading platforms that let you purchase and sell financial instruments at the press of a mouse. All you have to do is create an account on the platform of your choice, deposit money into it, and you’ll have unrestricted access to a number of trading markets.

As an illustration, both Plus500 and eToro offer coverage of stocks, indices, commodities, currency, and ETFs. While eToro also offers conventional assets, Plus500 only offers CFDs (contracts for differences).

This implies that you can purchase shares, ETFs, and even cryptocurrencies through eToro while still maintaining full ownership of the underlying asset. However, with Plus500, you are only gambling on the financial instrument’s potential value in the future. On the latter, more. However, both sites let you deposit money with a debit or credit card and are rather simple to use.

You are able to trade online or through a specific investment app with eToro and Plus500. Fundamentally speaking, the FCA regulates eToro and Plus500, therefore safety shouldn’t be an issue. While Plus500 is now a publicly-traded firm with its shares listed on the London Stock Exchange, eToro currently has an amazing 17 million clients.

eToro Vs Plus500: Assets Offered

Numerous investment options are available on eToro and Plus500, which can help you diversify your wealth. Here, we quickly review the trading options provided by both platforms.

Cryptocurrencies

Despite the fact that a lot of online brokers now provide cryptocurrency trading services, you must pick the best one for your needs. Do you want to trade less well-known alternative cryptocurrencies, also referred to as “altcoins,” or do you want exposure to the major players like Bitcoin or Ethereum?

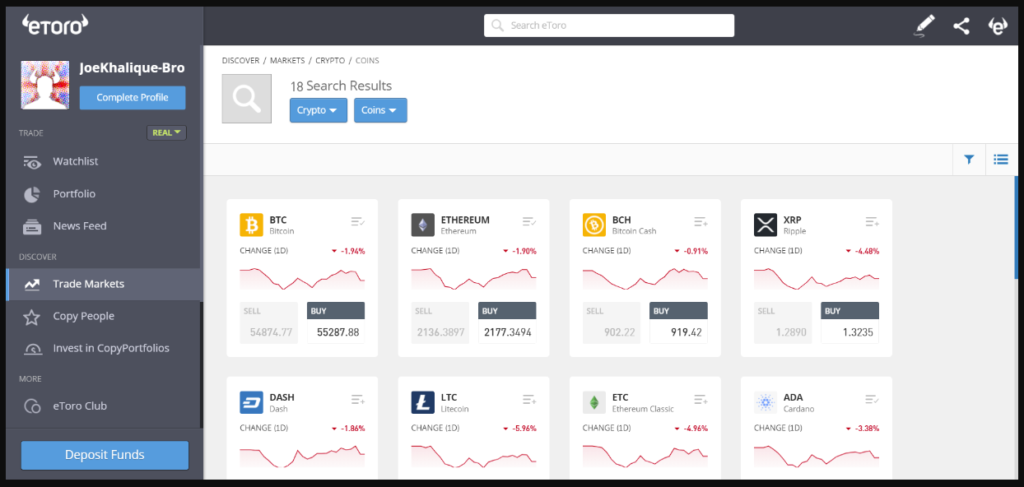

18 cryptocurrencies with medium to big market capitalizations are available on eToro. In addition to an index, Plus500 gives 6, which are only available for the largest coins. Both also provide a range of coin trading pairs.

Forex

The term “foreign exchange,” or “forex,” refers to the act of exchanging one fiat currency for another. This is accomplished using trading forex pairings, so if you chose GBP/EUR, you would be exchanging your Euro for the British pound. The objective is to sell a currency that is now weak and acquire one that is strong in order to profit by doing so.

People can participate in forex trading by purchasing and selling a variety of foreign currencies on eToro and Plus500 hundred, respectively. At the moment, Plus500 offers a lot more trading pairs than eToro.

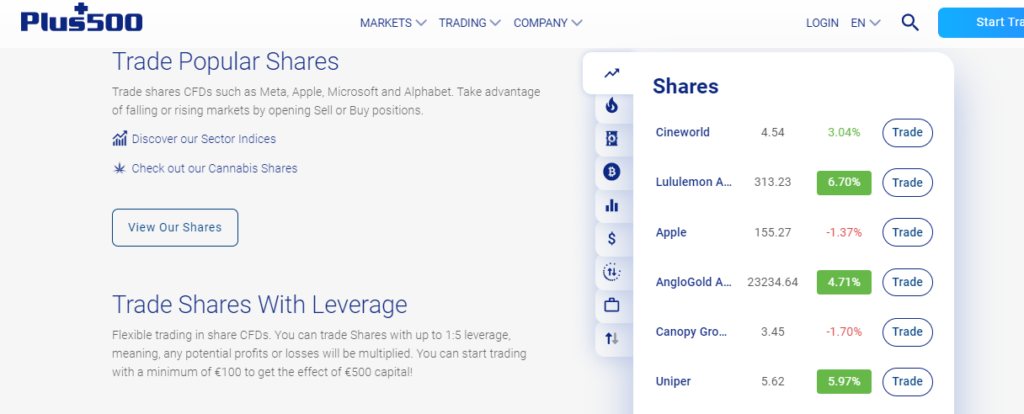

Stocks

The possibility for the user to purchase shares in an extensive list of firms from exchanges across the world makes up a significant portion of the offerings from both eToro and Plus500. Depending on where you are, not every platform makes trading stocks possible. As of this writing, Plus500 offers more firms than eToro does for stock purchases.

Investors should trade stocks at the best pricing to maximize gains, just like with cryptocurrencies. In addition to the purchase high and sell low strategy, a successful business may provide dividends to its shareholders.

Trading CFDs

Contracts for Difference, or CFD trading, are agreements between traders and brokers like eToro and Plus500. It’s a unique type of trading strategy because an asset (stocks, cryptocurrencies, or fiat money) is not bought directly. A CFD’s ability to give you better exposure for less money is a benefit.

The differential seen between open and closing rates, that could be greater or lesser than the investment’s present price, will be paid by the broker and the customer. Gains come from correctly forecasting the price’s movement, whereas losses result from incorrect predictions.

Contract lengths can differ significantly depending on the type of asset being traded; for instance, a stock CFD may finish when the market closes, whereas a cryptocurrency CFD is more likely to have a specified end time.

eToro Vs Plus500: Fees

Trading fees

All brokers will impose some form of fee because this is how they ultimately generate money. Even while these fees are considerably less than what traditional stockbrokers charge, it’s still crucial to research several price schedules in order to choose the best one for you.

Flat fee

Inactivity fees on Plus500 and eToro are $10 per month. If you don’t access your account for several months, you’ll be charged for it. Network costs will arise anytime you transfer coins into or out of your wallet because eToro offers you access to the genuine tokens.

You can reduce fees by making fewer large withdrawals rather than numerous little ones as eToro charges a fixed $5 fee for withdrawals.

Deposit and withdrawal fee

For deposits, neither broker levies a fee; however, eToro does charge $5 for withdrawals.

Broker trading fee

Neither platform levies a commission fee for trades you execute through them, but they both employ a “bid/ask spread.” This is the variation in market prices between buying and selling. How brokers make money depends on the discrepancy between ask and bid rates.

Depending on the coin, eToro’s spreads for cryptocurrencies range from 0.75% to 4%, with larger coins that have more liquidity drawing a tighter spread. The spread offered by Plus500 for Bitcoin is a highly competitive 0.3%, while that for Bitcoin Cash is less than 2%. These spreads are quite narrow and are a huge draw for traders looking to reduce expenses in this region.

Learn more: eToro Broker Review UK 2022 – Complete Guide

eToro Vs Plus500: User Interface

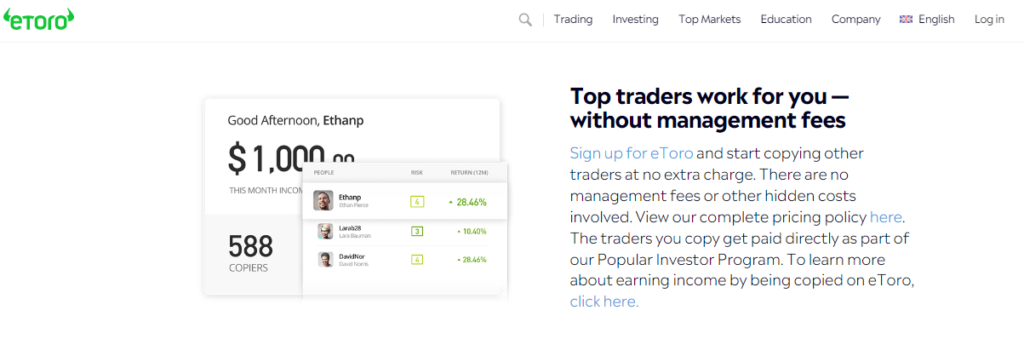

A complicated user interface can be frightening to inexperienced investors and frequently turns them away. Fortunately, eToro offers a lively, welcoming user experience that makes new traders feel comfortable. Additionally, it has a copy trading tool that lets you mimic the trades and portfolios of more experienced traders. This can aid in your initial understanding of how markets operate.

You can enjoy a slightly different user experience with Plus500 thanks to its sleeker, more advanced dashboard. However, its layout is still readable and user-friendly, and it exudes professionalism. Beginners will rapidly become accustomed to both systems, but it’s important to consider which user interface (UI) appeals to you the most.

eToro ease of use

eToro’s interface is minimalistic and simple. You may rapidly switch between your portfolio, news, and watchlist by using the various tabs on the left side of the screen. Under the markets tab, you can also access copy trading features. Your crypto trading pairings are prominently displayed, and each index is accompanied by a small graph and price.

This makes it incredibly simple to locate the coin you want to trade and enables you to gauge the market’s health right from the splash page. The blue buttons on the left allow you to simply access your profile and funds.

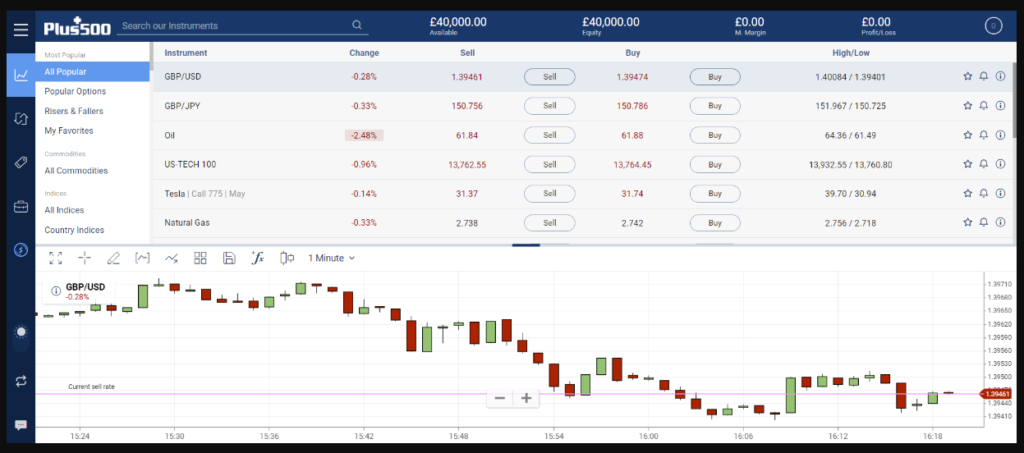

Plus500 ease of use

The trading pairs are displayed at the top of Plus500’s landing page, and your chosen pair will produce a price chart at the bottom of the page. Due to the chart’s high functionality and comprehensive feature set, traders can now perform technical analysis very quickly. Similar to eToro, you may trade right from this page by clicking the “Buy” and “Sell” buttons. The tabs on the left allow you to access settings and your account information.

eToro Vs Plus500: Trading features

These brokers’ attributes are extremely similar to one another. Indicators available on charts on Plus500 and eToro include Bollinger bands, Ichimoku clouds, strength indices, moving averages, and many more. This enables traders to carry out technical research and execute trades simultaneously.

You can execute leveraged transactions with Plus500. By doing this, you are using funds that you have borrowed from the broker to enhance your exposure. For instance, 10x (or 10:1) leverage enables you to multiply your position by ten. If you start a transaction with $500 and 1:10 leverage, this will act as if you have $5,000. With a small initial investment, this can be a great instrument for boosting your profits, but keep in mind that the same mechanism will also increase your losses.

eToro’s CopyPortfolio package and copy trading capabilities are perhaps its standout features. These alternatives let you mimic the trades and investments of more experienced investors, which can provide rookie investors with a significant competitive advantage.

Additionally, eToro provides what they refer to as social trading. These features, which are derived from copy trading, enable investors to connect and exchange trading tactics and investing guidance.

Learn more: Plus500 Broker Review UK 2022 – Complete Guide

eToro Vs Plus500: Liquidity and Volume

Liquidity relates to the total amount of an instrument accessible for trade on a broker, whilst volume relates to the particular value of the investment being exchanged. Generally speaking, more volume and liquidity result in tighter spreads and reduced user fees. A platform might not be able to complete trades during periods of heavy volume if liquidity runs out. On a broker with minimal trading activity, trades may complete slowly and values may deviate from the market rate.

eToro has encountered liquidity issues during periods of exceptionally high interest, for example in January 2021 during which they were obliged to stop purchase orders for Bitcoin. However, if a similar circumstance arises in the future, they might be better prepared to bootstrap liquidity. Since Plus500 trades in CFDs, which only monitor an asset’s price, it does not need the liquidity of the underlying asset. For bigger volume markets like BTCUSD on Plus500, spreads will be closer together.

eToro Vs Plus500: Customer Support

One of the factors contributing to the long-lasting success of Plus500 and eToro over the past ten years is the superb customer care services they both provide.

When you’re an eToro Club subscriber, you can text communicate with a customer service agent using the live chat tool. You must have a $5,000 overall balance in your account, divided between cash and investments, in order to do this. If not, you can submit a support ticket, and someone from their staff will reply to you via that ticket.

Additionally to its great live chat function, Plus500 offers a conventional ticketed support system. This tool is accessible to all users. As a result, traders may dependably access services around-the-clock, which is beneficial for the platform.

eToro Vs Plus500: Supporting Nations

Financial products are governed by various laws around the world, and brokers notably eToro and Plus500 are not an exception. The services that a broker offers are influenced by the investor’s country as well as the jurisdiction in which the broker is located.

Because eToro has offices in the United Kingdom, United States, Europe, and Australia, you can use their services from the majority of nations in the world. The UK, Cyprus, Seychelles, Singapore, and Australia are where Plus500 has offices.

eToro Vs Plus500: Security

When trading or making investments, the security of your investment is of the utmost significance. Malicious actors, scammers, and hackers will do whatever to steal your hard-earned money. Since cryptocurrencies are currently among the most expensive assets, you need to pay extra attention to the security of your broker of choice.

You can feel secure knowing that your money is secure in your brokerage account because neither eToro nor Plus500 has had a significant security breach. The implication is that you are in charge of safeguarding your investments, nevertheless.

Both Plus500 and eToro provide two-factor authentication or 2FA. 2FA requires you to authenticate your email address, phone number, or Google Verification application when you sign in from a different device. This implies that even if your password is stolen, unscrupulous users will need your phone number or email address in order to log in.

PayPal, bank transfer, and credit/debit card withdrawals are all supported by eToro. The withdrawal process is quite secure, and they have a helpful customer care service if you run into any problems. Through these routes, withdrawals are also permitted by Plus500.

KYC/AML

Although KYC and AML standards may seem burdensome, they are an indication of a reliable broker. To stop unlawful behavior, they demand platforms to authenticate your identity.

eToro requires you to upload proof of your identity and address as part of the registration process. Once you have been verified, deposit and withdrawal restrictions will be removed, allowing you to take advantage of all of eToro’s trading opportunities.

A similar proof is required by Plus500, and it also recognizes government-issued identification like passports and licenses. You might also use a bank statement or another similar document as confirmation of your address.

Regulation

The FCA in the UK, CySEC in the EU, FinCEN in the US, and ASIC in Australia have all granted licenses to eToro, making it a fully regulated broker. As a result of being examined by the strictest regulatory agencies in the globe, the platform could be regarded as an authorized provider of financial services. This is one of the characteristics that has helped it become an industry leader for the past 14 years. The fact that eToro complied is evidence of their validity because American authorities are generally hostile to this type of financial business, particularly when it comes to cryptocurrency.

Even though Plus500 does not have a licence in the United States, it is fully regulated and regulated in the United Kingdom, Europe, Australia, Singapore, and Israel. Because of this, Plus500 is a fantastic choice for traders in Asia. This is a good option for cautious investors because your investments are also subject to close inspection. CFD trading is available through Plus500, although cryptocurrency CFDs may be governed by regional laws, such as the FCA’s restriction on bitcoin derivatives in the UK. When selecting a trading platform, make sure to always examine the local laws that apply to you.

Both eToro and Plus500 are covered by government initiatives like the UK’s FSCS, which protects consumers’ funds in the event of bankruptcy or other catastrophes. This increases your level of confidence when using these platforms for trading.

eToro Vs Plus500: Conclusion

This is a tough one to pick a winner in. Since it offers a more straightforward, brighter UI, eToro is arguably more appropriate for novices. Through its copy trading tools, it also enables users to quickly expose themselves to profitable trades. It charges extremely few fees, with the exception of a $5 withdrawal charges. A much greater variety of coins are available for trading on eToro, and you can keep the tokens yourself.

However, Plus500 might be slightly more appropriate for experienced, advanced traders. For new investors, the interface’s more technical focus may be intimidating, but it allows seasoned users additional freedom. Additionally, it has exceptionally tight spreads on cryptocurrencies, like 0.3% on Bitcoin, and doesn’t charge for deposits or withdrawals, which may result in lower expenses for those who trade continuously. Because Plus500 uses CFDs, you don’t have custody of any actual currency when using it. For individuals accustomed to traditional markets, this may be more convenient, but it may also provide regulatory challenges in areas where bitcoin CFDs are prohibited.

In the end, no clear winner can be declared. Although both platforms offer slightly different feature sets and cost structures that are tailored to certain user categories, they both offer high levels of functionality and security.

Frequently Asked Questions

Between Plus500 and eToro, which is superior?

The first minimum deposit is smaller and the range of investments is greater on eToro. CFDs are available in a wider range at Plus500, and commission costs are reduced. In the end, eToro is best suited for seasoned investors and novice investors seeking to play a more passive role in their investments. Plus500 is better suited for traders with experience and those seeking a reduced-charge choice.

What happens if Plus500 or eToro fail?

Because eToro and Plus500 are regulated, they are required to provide their customers with a particular level of financial security as part of their regulatory responsibilities. By virtue of the law, eToro and Plus500 are required to safeguard customer funds apart from their own. They shouldn’t have access to your money in the event that either Plus500 or eToro file for bankruptcy. Accounts for customers ought to be kept apart. Check this on the eToro and Plus500 websites and regulators as financial services compensation schemes vary by country.

Are Plus500 or eToro suitable for beginners?

Beginners shouldn’t use Plus500 unless they are trading with a demo account, which is not recommended. CFDs are risky, sophisticated financial instruments that should only be used by more seasoned traders.

Low deposit requirements and access to a variety of market information and news sources are available via eToro and Plus500. Both Plus500 and eToro provide sample accounts. This is great for eToro and Plus500 since it demonstrates that they care about their clients.