One of the earliest coronavirus vaccines was created by Moderna after it made its debut with the largest biotech offering in history. Shares of Moderna are traded internationally. As a result, numerous traders and investors worldwide are interested in the US healthcare company.

This guide may teach you everything there is to know about Moderna. We briefly discuss pricing history, market performance, and the top online brokers for purchasing shares.

How to Buy Moderna Shares – An Overview

Don’t be concerned if this is your first time investing; it’s easy to do so. To begin your investment adventure, adhere to this simple five-step procedure.

- Step 1: Choose a broker – A trading platform online is the first item you must locate. There are numerous solutions available, each with special advantages and disadvantages. If you’re still unsure, read our comprehensive guide to the top online brokers.

- Step 2: Open a Trading Account – Simply visit their website after choosing your broker to register for an account.

- Step 3: Make a Deposit – Enter your broker account credentials, then choose the option to deposit money. Your deposit for Moderna shares should be made using your selected method of payment.

- Step 4: Buy Moderna Shares – Search for the ticker symbol (MRNA) for Moderna to discover the stock’s current price. If the price is acceptable to you, enter the number of shares you want to purchase and submit your order.

Examine Moderna Stock

Obviously, before making any form of investment, you should conduct a study. As a result, you must perform a thorough study to see whether buying Moderna stocks would be a sensible investment for you.

To save you time looking online, we’ve provided more information for you to read below. This contains some significant financial data, such as the Moderna stock price, among other things.

Moderna Overview

Moderna is a biotech business with a focus on vaccine technology and research & development. In the pharmaceutical industry, Moderna is a relatively new company; it was founded in 2010 and went public in 2018. Moderna’s first public offering (IPO) garnered $621 million, making it the largest biotech IPO in history.

Compared to its competitors in the biotech and pharmaceutical industries, Moderna is unusual in the manner it has tackled vaccine development. Prior to 2020, there had never been a prescription approved for it. It has gathered enormous sums of money to invest in a variety of different research topics instead of picking one or two, with the goal of scaling up as soon as feasible.

The US government approved its coronavirus vaccine in 2020, and other governments all around the world quickly followed. The genetic code known as mRNA, the subject of all of Moderna’s research but never used successfully in a cure before COVID-19, is used in the vaccination to teach the body how to heal itself.

Moderna and Pfizer’s vaccines are both using mRNA, which could serve as a proof of concept for future study in the field. Investors should take into account that Moderna might continue to be a risky investment until it is able to manufacture further vaccines. Particularly because it has few approved treatments other than the COVID-19 vaccine and because its enormous gains in 2020 may be fragile given the large number of rival treatments that are currently in development.

Moderna Share Price History

Before it spiked in 2020, Moderna’s share price had been flat for a few years. Moderna stayed close to its IPO price of $23 after going public in 2018 before the epidemic struck. Moderna’s stock soared to $156 in December after the US government authorized the vaccine, an increase of over 700% from the beginning of the year.

Moderna’s early investors were aware that they would probably have to wait a long for the company to start showing returns. Even though it briefly traded below its IPO price after 2018, its value remained remarkably stable. The potential for vaccine development in 2020 is what gave rise to the price increase for Moderna.

Moderna didn’t encounter any price pressure from a halt in treatments, unlike many of its big pharma rivals because it had nothing on the market when the epidemic struck. Moderna then jumped into coronavirus research like every other business in the sector. Its worth increased twofold in a month after the favorable outcomes of its initial study were made public in November 2020.

Moderna Share Price 2022

The shares have been on a steady ascent since 2020. In fact, they reached highs of $449 in September 2021, which is a 700% YTD increase. Moderna shares are currently trading at $138.57, though this still represents gains of over 280% in comparison to the 2020 prices.

Dividend

Moderna is not for you if you’re wanting to expand your portfolio of dividend-paying stocks. There are no immediate intentions for it to start paying dividends, and it has not yet done so. Considering that Moderna is a young firm, it makes sense that it would devote the majority of its incoming cash flows to R&D.

Visit our article on the top dividend stocks of 2022 if you’re interested in making investments in some dividend paying businesses.

Best trading platform to Buy Moderna Shares

American business Moderna is publicly traded on the NASDAQ. It’s wonderful that there are countless UK-based brokers who provide unrestricted access to this stock exchange.

However, you must also take into account other aspects of your selected platform, such as the cost of purchasing US-based stocks and the accepted payment options. Of course, the broker you choose must be licensed by the FCA.

Below you will find a brief list of stock brokers that let you purchase Moderna shares online in the UK, pointing you in the correct way.

1. eToro

Since its first inception in 2007, eToro’s growth has been exponential. Over 13 million active traders use the site now, many of whom are situated in the UK. It takes only a few seconds to deposit and withdraw money from your trading account with this online broker.

Not only will you not incur any share dealing expenses as a result of this, but there will also be no monthly or annual fee. There are 17 stock markets available for you to pick from on eToro in terms of supported markets. This covers the NASDAQ as well as more than 1,700 other stocks. Because of this, purchasing Moderna shares online from the UK is simple. You don’t even have to purchase a full share because the minimum investment is only $50 (about £40).

For instance, Moderna stocks are now trading above $137 each, so if you want to start off with little bets, you have the opportunity to hold a “fraction” of a share. In addition to its stock division, eToro now provides conventional ETFs and even cryptocurrencies. For those of you who want to trade on a short-term basis, it also provides CFDs, which is fantastic. It’s also worthwhile to take a look at the eToro Copy Trading tool, which enables passive investing. This is so that you can replicate a seasoned investor’s portfolio.

You have the choice to purchase and sell shares using eToro either online or through a mobile device. It only takes a few minutes to create an account at eToro if you want to purchase Moderna shares right away.Lastly, eToro is affiliated with the FSCS and has licenses from the FCA, ASIC, and CySEC. To learn more about what this brokerage app has to offer, read our in-depth eToro Broker Review UK 2022 – Complete Guide.

2. Capital.com

If you’re looking for a little more flexibility in the way you invest, this UK trading platform is ideal for you. This is due to the fact that Capital.com specializes in CFDs, which allows you to employ leverage and even engage in short-selling. For the former, the trading platform just requires a 20% “margin” to trade Moderna share CFDs.

Simply put, this indicates that a £20 account balance would be sufficient for a £100 trade. This is excellent for targeting modest margins or using your trading funds. Capital.com gives you the choice of a “buy” or “sell” position for market orders. The former indicates that you anticipate a growth in the price of Moderna shares, whereas the latter indicates that you anticipate a decrease.

Our list includes Capital.com as well because it is a low-cost trading platform. It offers extremely narrow spreads, and best of all, there are no commissions to pay. For example, the spread on Moderna stock CFDs is only $0.17 at the moment. Even while stock CFD trading is best suited for those of you who have some background in the industry, Capital.com wants to make the phenomenon accessible to beginners.

This is clear from the abundance of instructional resources it provides, including a learning-focused mobile app. When you load your account with a debit/credit card or an e-wallet, the platform also permits you to deposit as little as £20. Capital.com also offers the option to trade using a risk-free demo account. This enables you to learn about short-term CFD trading without putting your own money at risk. This reputable trading platform is completely regulated, including having an FCA license. To learn more about what this brokerage app has to offer, read our in-depth capital.com Broker Review UK 2022 – Complete Guide.

How to buy Moderna Shares?

You must now open an account with a broker who allows you access to the NASDAQ if you want to move on with investing in Moderna. We will guide you through the process using your top-rated trading platform, eToro, as the broker enables commission-free purchases of Moderna shares.

Step 1: Open an account

To get started, create an account on the eToro website. You must submit your name, residence address, contact information, among other personal information.

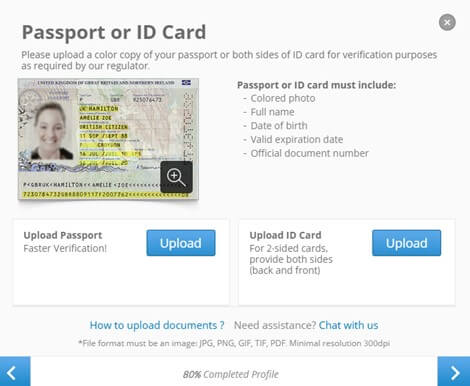

Step 2: Verification

After you complete the registration process, eToro will request identification proof from you. You may finish this in a few minutes by quickly submitting a copy of your passport. It is also necessary to attach a copy of a recent utility bill.

Step 3: Deposit Funds

You will be required to make a deposit at this point, which must be at least $200 (or roughly £160).

Payment options accepted include e-wallets, bank transfers, and debit/credit cards.

Step 4: Buy Moderna shares

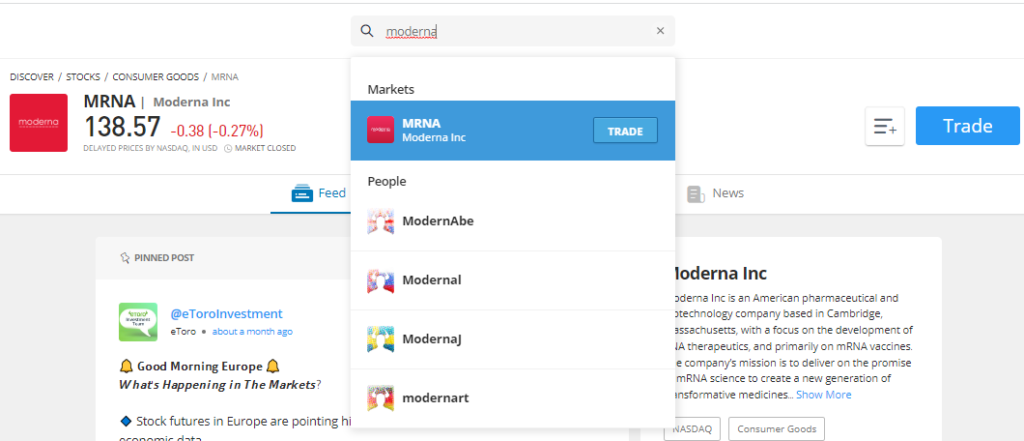

Type “Moderna” into the search bar and select the first result that appears, as shown below.

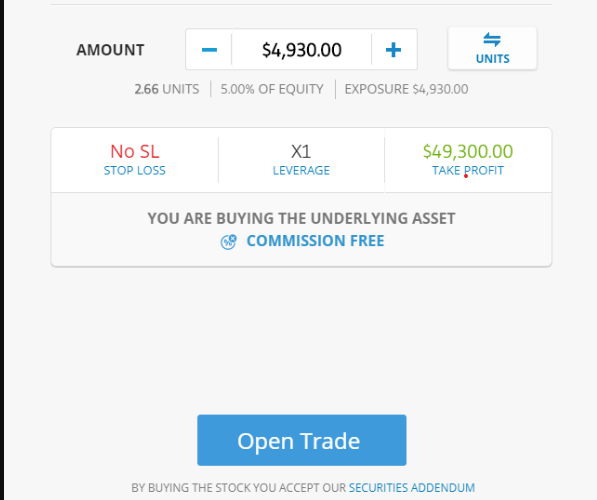

Lastly, specify your desired investment in US dollars ($50 minimum). Your Moderna share investment will be carried out immediately as you click the “Open Trade” button.

Conclusion

Following the development of the coronavirus vaccine, Moderna is pricy. Before making an investment, you should consider whether you believe in its fundamental business concept. For its novel method of vaccine development, the COVID-19 vaccine might serve as a “proof of concept.” A personalized cancer vaccine, for example, would be a good follow-up result that would help verify the strategy. Until then, investing in Moderna carries a higher risk due to the possibility that the coronavirus’s boost will be transitory and the lack of a track record of success.

It’s important to consider why Moderna poses a greater risk than some of its rivals. Moderna operates in a more siloed manner while smaller biotech businesses frequently collaborate with major pharmaceutical companies to create vaccines. The market is congested because there are numerous more coronavirus vaccines available now or in development. Finally, due to its secrecy, its price may be highly sensitive to any treatment-related news that does surface.

It is dangerous to rely solely on the coronavirus vaccine, but Moderna has already provided opportunities for short-term traders who want to utilize technical indicators to profit from its price increase in 2020. In the long run, it’s critical to bear in mind the fundamentals, notably the fact that Moderna is a vaccine development firm with few results, and to closely monitor the results of its trials to determine whether it can expand on its coronavirus success.

If you’ve made up your mind to purchase Moderna shares, do it now using eToro, our top-rated trading platform recommendation.

Also read: Best Healthcare Stocks You Should Buy In UK 2022

Frequently Asked Questions

What is Moderna used for?

A biotechnology business called Moderna is dedicated to developing virus vaccines. It has been in existence since 2010 and is situated in the US.

Is Moderna a corporation that pays dividends?

No, Moderna has never paid a dividend and never will. Don’t anticipate a dividend from this stock anytime soon because it is a loss-making firm that has been publicly traded for less than two years.

How do you purchase Moderna shares in the UK?

Simply create an account with an online broker that enables you to purchase shares of firms listed on the NASDAQ.