Healthcare companies that create medications produce medical equipment or offer healthcare services and insurance are represented by healthcare stocks. Numerous investors are drawn to the area by its robust numbers: For instance, at the end of 2021, health spending in the United States represented about 18% of GDP, and by 2028, it is projected to reach $6 trillion annually.

If such figures have you prepared to buy up healthcare stocks, you have a vast array of choices. In this guide, we’ve chosen the Best Healthcare Stocks to Buy in UK 2022 to help you cut through the research clutter.

Best Healthcare Stocks in 2022

The best healthcare stocks in terms of value, growth rate, and momentum are listed here:

- UnitedHealth Group Inc. (NYSE: UNH)

- Johnson & Johnson (NYSE: JNJ)

- AstraZeneca (LON: AZN)

- Pfizer Inc. (NYSE: PFE)

- AbbVie (NYSE: ABBV)

- Vertex Pharmaceuticals (NASDAQ: VRTX)

- Intuitive Surgical (NASDAQ: ISRG)

Best Healthcare Stocks Analysis

UnitedHealth Group Inc. (NYSE: UNH)

UnitedHealth Group Inc is a healthcare and insurer company that sells and services pharmaceutical products. UnitedHealthcare, Optum Insight, Optum Health, and Optum Rx are its four subsidiaries.

UnitedHealth Group just released its Q1 2022 Results:

- $80.1 billion in revenues were reported. This represents a double-digit rise within the Optum and UnitedHealthcare units, with a 14 percent year-over-year increase.

- Operations reported $7 billion in earnings.

- Operating cash flows totaled $5.3 billion.

- The earnings per share were $5.27.

The quarter saw significant growth for UnitedHealthcare. In this quarter, the corporation served 1.5 million more consumers than it did in the same period last year. The Medicaid market as a whole as well as Medicare Advantage and Dual Special Needs Plans continued to experience robust growth, which drove this expansion. For those covered by commercial benefits, UnitedHealthcare is always investing in and growing its range of cutting-edge, fresh products, including physician-led, consumer-tailored, and virtual-first options.

The market value of United Health Group is more than $480 billion. The price of its shares last closed at $519.62. Since the pandemic caused the market to crash, the company’s shares are on a bullish trajectory.

2020 saw the stock close off at $ 350.68 after rising 18.6% over the course of the year. The stock increased by 38% in 2021 and ended the year at a price of $502.14. The stock has increased by about 17 percent year-to-date this year.

Johnson & Johnson (NYSE: JNJ)

Johnson & Johnson develops, manufactures, and sells a wide range of healthcare goods around the world. This healthcare company operates in three segments: consumer health, medicines, and medical equipment. In recent years, global pharmaceutical stocks have grown significantly.

The firm claimed in its most recent full-year report for 2021 that:

- 93.8 billion dollars in total sales, up 13.6 percent over the previous year. High volume was a crucial factor in this rise in sales. J&J’s pharmaceutical division generated the most revenue, with sales of $52.1 billion.

- $20.88 billion in net income, up 42% from the previous year.

- The stated earnings per share were $7.93.

Over $447 billion is the market capitalization of Johnson and Johnson. Its stock is currently selling for $170 per share. The pandemic has been driving a bullish trend in the company’s shares for two years.

The stock increased by 8% in value during 2020, ending the year with a price of $157.38. Johnson & Johnson stock increased by 7% over the course of the year in 2021, from $160 at the beginning of the year to $171 at the end. The stock has increased in value this year by about 6.5 percent so far.

AstraZeneca (LON: AZN)

Pharmaceutical company AstraZeneca, which is listed on the LSE, focuses on oncology and respiratory-related therapies. It has gained notoriety more recently for being the world’s largest manufacturer of the Covid-19 vaccination.

Recently, AstraZeneca released First Quarter 2022 Results:

- The company’s total revenue climbed by 60% to $11,390 million, demonstrating growth throughout the organization, the contribution of Alexion pharmaceuticals, and other agreements with Vaxzevria, all of which are scheduled for delivery by the end of the first half of this year.

- Product sales from oncology climbed by 18%, while total revenue from oncology increased by 25%, including a milestone payment. R&I climbed 4%, Rare Disease increased 7%, and Total Revenue from CVRM8 increased by 18%.

- The quarter’s operating margin benefited from cost phasing.

- Core EPS grew by 20% to $1.89

The market value of AstraZeneca is more than $195 billion. The price of its shares last closed at 10,918 GBX. Impressive Q1 2022 statistics from AstraZeneca resulted in a 3.3 percent boost in the stock price on the day of the publication, but not for the reasons expected. Instead of the Covid vaccination, the company’s cancer medications saw a 15 percent increase in sales compared to Q1 2021, driving revenue growth for the period. Additionally, core earnings increased by 55% to $1.63. This indicates a turnaround in AstraZeneca’s financial situation in 2021 when more oncology facilities and therapies are used globally.

The business has claimed that it expects robust growth in its cancer treatments for the remainder of 2022, giving some investors hope that the company would continue to outperform once the Covid impact of a post-Covid-19 pandemic has worn off. It is noteworthy that new drugs accounted for 53% of revenue growth in Q1, opposed to 47% in the same period last year.

Pfizer Inc. (NYSE: PFE)

Pfizer Inc. develops, produces, sells, markets, and distributes biopharmaceutical products globally. It offers medications and vaccines in a variety of therapeutic categories, including cardiovascular, metabolism, and women’s health, under the Premarin group and Eliquis brands. It also offers biologics, small molecules, immunotherapeutic, biologic drugs, generic injectable and anti-infective medications, and COVID-19 oral medication. Furthermore, the company provides medications and vaccinations for diseases such as COVID-19, meningococcal infection, tick-borne disease, and pneumococcal disease.

The business disclosed the following in its most recent annual results report for 2021:

- Total revenues were $81.3 billion, up a staggering $95 percent from the previous year.

- EPS was $3.85, a 137 percent increase from 2020

- Distributed medications and vaccinations to an estimated 1.4 billion individuals.

- In 2021, 3 billion doses of the COVID-19 vaccine were produced by Pfizer BioNTech. Additionally, the business anticipates producing up to 4 billion vaccines in 2022.

Pfizer has an estimated market value of $282 billion. The price of its shares was $50.40. Since the epidemic hit, the company’s stock has been rising steadily. And the primary COVID-19 vaccine manufacturer doesn’t seem to be facing any hurdles.

The price of Pfizer’s stock increased from $ 36.94 at the beginning of the year to $ 36.81 during the course of that year. The stock performance significantly increased in 2021 as COVID-19 entered the market and received FDA approval. From $ 36.81 at the beginning of the year to $59.05 at the end of the year, the stock increased by a staggering 60 percent. The price of Pfizer stock has decreased by 10% so far this year.

AbbVie (NYSE: ABBV)

Pharmaceuticals are discovered, developed, produced, and sold globally by AbbVie Inc. Many of its well-known drugs are designed to address certain illnesses and diseases.

The business reported in its 2021 full-year report:

- Net revenues of $ 56 billion, up 23% from the previous year

- According to reports, net income reached $11.5 billion, a notable increase of 150 percent from the previous year.

- The reported earnings per share were $12.7.

Abbvie’s market capitalization is approximately $259 billion. Its shares were last valued at $147.69. The company’s stock had been flat for the previous two years, but it picked up steam in the fourth quarter of 2021 and has been on a bullish run since then.

In 2021, the share began the year at $ 107.15 and ended the year at $ 135.4, reflecting a 26 percent rise during the year. The stock has surged in the current year and has gained 20% year to date.

Vertex Pharmaceuticals (NASDAQ: VRTX)

Vertex Pharmaceuticals Incorporated is a multinational biotechnology firm. The healthcare company is dedicated to identifying drugs that address the main cause of cystic fibrosis (CF), and it currently has a number of clinical and research programmes in place to improve and broaden CF treatments.

The pharmaceutical business announced in its most recent full-year report for 2021 that:

- 7.57 billion dollars in revenue, a 22% increase from the prior year.

- 2.34 billion dollars in net profits, a 13.6% decrease from the prior year. A $ 900 million payment to Vertex’s partnership with CRISPR Therapeutics is what led to this decrease.

- EPS of $9.01 was reported. It fell by 12% in compared to the previous year.

A diverse pipeline of potentially game-changing small chemical, cell, and genetic medicines for critical diseases is being developed by Vertex. Numerous programs are also in the works. Additionally, the projection for product revenue for the entire 2022 fiscal year is $8.4 to $8.6 billion.

The market value of Vertex Pharmaceutical is approximately $73.2 billion. Its stock last traded for $ 285.50. Vertex’s share price has been fluctuating during the last two years. The stock began to trend downhill in the latter half of 2020 after beginning 2021 with a bullish trajectory. The stock movement reversed direction in the final month of 2021 and has since been accelerating upward.

The price of the share increased from $ 217.98 at the beginning of the year to $ 236.34 at the conclusion of the year in 2020. The share price in 2021 decreased from $ 236 at the beginning of the year to $ 219 at the conclusion of the year. The share skyrocketed this year, and it has increased by almost 32% year-to-date.

Intuitive Surgical (NASDAQ: ISRG)

Intuitive Surgical is a global pioneer in robotic-assisted minimally invasive surgery (MIS) methods and techniques. The Company’s da Vinci Surgical Solution gives surgeons with better visualisation, higher flexibility, higher accuracy, and ergonomic convenience for optimal MIS efficiency. The Da Vinci Surgical Solution has received international recognition as the first use of artificial intelligence (AI) in the healthcare industry. This device is intelligent enough to aid doctors during difficult open-heart procedures.

Intuitive Surgical just reported full-year earnings:

- $ 5.7 billion in revenue, a 31 percent increase from the prior year.

- Net profit was $1.7 billion, increasing 62 percent from the previous year, according to disclosures.

- The stated earnings per share were $4.66.

Intuitive Surgical is worth $79 billion. Its stock was recently trading at $222 per share. Since the pandemic-caused decline, the company’s stock has been rising. The share price began to fall in the last month of 2021 and has continued to fall in the present year.

Intuitive Surgical’s share price climbed from $ 197.78 at the start of 2020 to $ 272.7 by the end of 2020. The share price rose from $ 272 at the start of 2021 to $ 359.3 at the end of 2021. The share has depreciated by around 22 percent year to date in the current year.

Considerations when selecting the Best Healthcare Stocks

How can you locate the top healthcare stocks? Following are four essential to consider while choosing the best healthcare stocks:

Growth prospects

The company’s growth prospects are one of the most important aspects traders take into account when determining which company to invest in. This can be accomplished by determining how quickly their revenue has increased in recent years. While this alone cannot predict whether a firm will expand in the future, it could assist you in determining whether you are optimistic about the company’s prospects.

Financial strength

You can review the regulatory filings that businesses submit to the SEC. These documents contain financial statements that can be used to analyze and assess the financial health of a particular company. Many merchants look for already-profitable businesses. Some traders try to comprehend how a firm aims to become profitable and when that will happen if the company isn’t already.

Valuation

Before purchasing a firm’s shares, many traders want to know how much the company is worth. Knowing the stock’s valuation might help you decide whether you are paying a fair price.

You can utilize a variety of value metrics. The price-to-earnings (P/E) ratio is a popular tool among traders. This measures the price of a stock in relation to its EPS.

Some P/E ratios represent a company’s earnings over a prior time period by looking back in time (ie. the past 12 months). Earnings forecasts for the following year are used in a forward-looking P/E ratio. Traders can use P/E ratios to compare a stock to others in its sector and determine if it is costly or inexpensive.

Dividends

Some healthcare stocks, such as the ones we’ve just mentioned, will distribute dividends to their stockholders. These equities are commonly referred to as healthcare dividend stocks by traders. This is the amount of profit distributed to shareholders by the company. Sometimes dividends can increase a trader’s overall return from holding shares.

How to buy the best Healthcare Stocks in the UK?

After discussing the top UK healthcare stocks, we’ll walk you through the investment process.

Step 1: Choose a broker

If you want to invest in the best UK healthcare stocks, finding a trustworthy broker is crucial. The broker must not just offer the healthcare stocks you choose, but it must also have reasonable costs and charges.

We’ve done the homework and put together a list of two of the top UK stock brokers for 2022 healthcare stock investments:

1. eToro

With over 100 top healthcare stocks to pick from, eToro is a well regarded stock broker. This stock is one of 2,400 stocks from 17 distinct UK and international marketplaces that make up a larger stock collection. In reality, eToro makes it simple to purchase all of the top healthcare stocks that we have discussed in this article.

With this FCA-licensed broker, there are no commissions or ongoing account fees. As an extra incentive, you will also save the 0.5 percent stamp duty fee associated with transactions involving FTSE 100 shares. If you’ve never invested online before, eToro is a perfect place to start. This is due to the platform’s design with new users in mind.

Your eToro account can be funded with a UK debit card, credit card, bank transfer, or e-wallet. Once you’ve opened an account, which often takes less than 10 minutes, you can purchase your favourite healthcare stocks for about $50. eToro also offers a Copy Trading tool. This includes investing passively by imitating the trades of a knowledgeable stock trader. Finally, eToro’s FSCS safeguards your funds.

2. Fineco Bank

If you’re a UK investor looking for a regulated stockbroker to buy healthcare stocks in a user-friendly setting, go over to Fineco Bank. For a fixed fee of £2.95 per transaction, this Italian financial institution’s extensive selection of shares and assets are available for trading.

With over 50 currency pairs and CFDs accessible with spreads as low as 0.4 pips, Fineco Bank also serves the needs of Forex and CFD traders. This UK stockbroker allows futures traders to trade on CME Micro Futures for as little as $0.70 a contract. Overall, investors in UK stocks should expect to spend £0.00 per month in fees, with no initial deposit, no initial custody fee, no inactivity fee, and no market connectivity costs.

The Financial Conduct Authority (FCA), a renowned financial regulator in the industry known for its stricter licencing standards and regulations, is in charge of Fineco Bank.

Step 2: Open an Account

We have selected eToro, a commission-free and FCA-regulated website, for this example of how to buy Healthcare stocks.

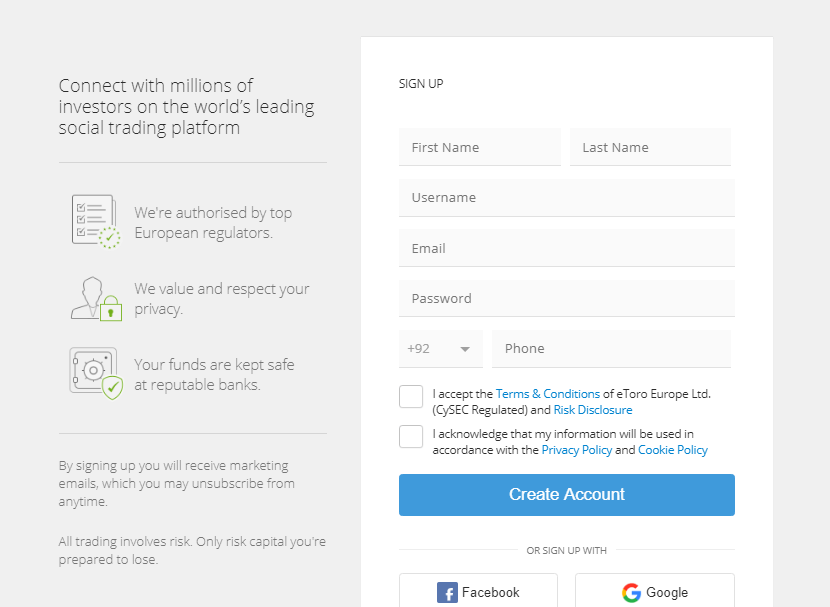

To begin, you must register for an eToro account. Visit eToro’s main page, click the “join now” button, and a new box will appear.

You must provide your contact information and some personal information on this form. You need to validate your cellphone number, create a username, and password.

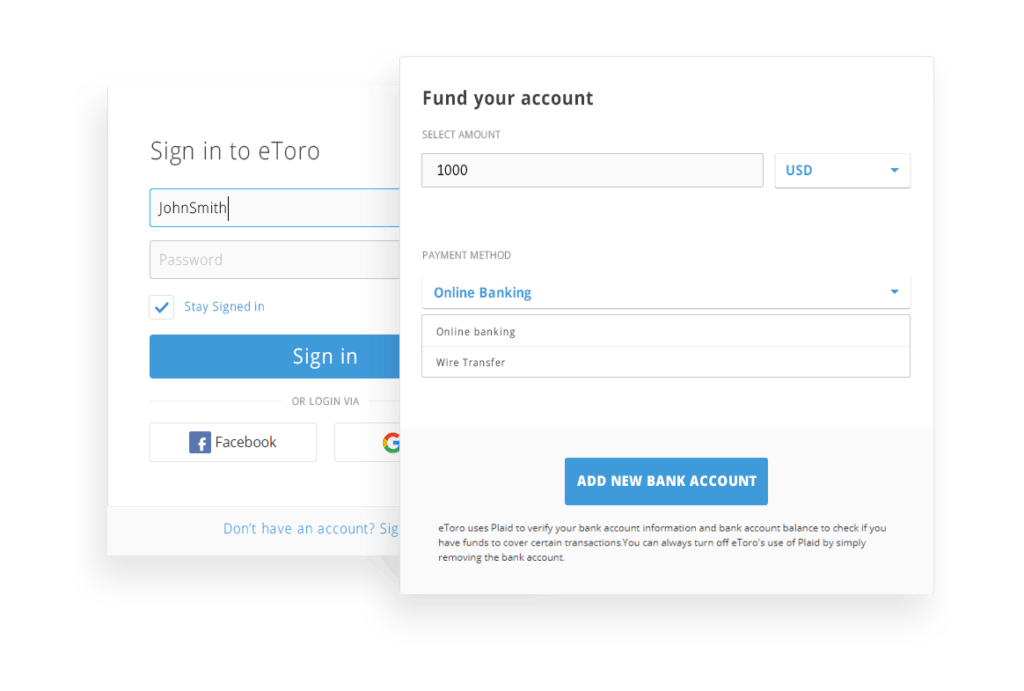

Step 3: Deposit Funds

You must make a deposit before you may buy your favourite healthcare stock.

Debit/Credit cards, e-wallets, bank transfers can be used to deposit funds in your eToro account.

Step 4: Select the healthcare stock you want to buy

Simply look for the business you wish to invest in. In this example, we’re looking at buying Pfizer stock.

Afterward, you must choose the “Trade” button.

Step 5: Buy healthcare Stocks

Click “Open Trade” after entering the amount you wish to invest in your selected healthcare stock.

Risks of buying Healthcare Stocks

Healthcare prices continue to rise at an unprecedented level. Although this situation is not new, there are growing requests for legislative and regulatory changes to address the rising expense of healthcare and health insurance. Patients and payers are clamoring for less expensive, better care.

Established healthcare stocks are constantly threatened by disruption from new companies. Tech businesses are expanding their reach into the healthcare industry. Companies like Amazon may dramatically upset established business practices. Slim biotech companies may outperform hefty, stodgy pharmaceutical companies.

It can be difficult for some healthcare stock categories to maintain growth. Drug and medical device manufacturers must persuade government organizations and health insurers to keep purchasing their goods. The chances for these players’ future growth may be limited if they refuse to approve reimbursements.

Conclusion

Despite these risks, the long-term outlook for healthcare stocks is very positive. A combination of aging demographic trends and technological advancements could create enormous potential for healthcare businesses and yield respectable returns for long-term investors.

If you use an FCA broker like eToro, you can purchase your chosen shares without paying any commission. You may also start investing in healthcare companies on the website for as little as $50, which is great for diversity. Simply click the button below to purchase healthcare stocks on eToro in less than 10 minutes.

Frequently Asked Questions

Which is the best healthcare stock to buy in UK 2022?

One of the top performing healthcare companies to buy in UK 2022 is AstraZeneca. The AstraZeneca stock has been rising for a while, providing investors with a large return.

How can I buy equities in the healthcare industry in the UK?

All you need to buy healthcare stocks is a broker account with a reputable company. On eToro, there are more than 2,400 commission-free stocks, many of which are in the healthcare industry.

What is the top healthcare stock for dividends?

Without a question, the best dividend-paying healthcare stock is Johnson & Johnson. After all, the company has consistently grown its dividend for more than 60 years!

How can you purchase shares in an international healthcare company?

In the UK, a lot of brokers now provide international stock trading. For example, eToro offers shares from 17 various markets.

Are healthcare stocks a smart investment during a recession?

Healthcare stocks may decline in value along with the rest of the market, but many of them are often resistant to downturns. This is due to the fact that they are products and services that will always be in demand.