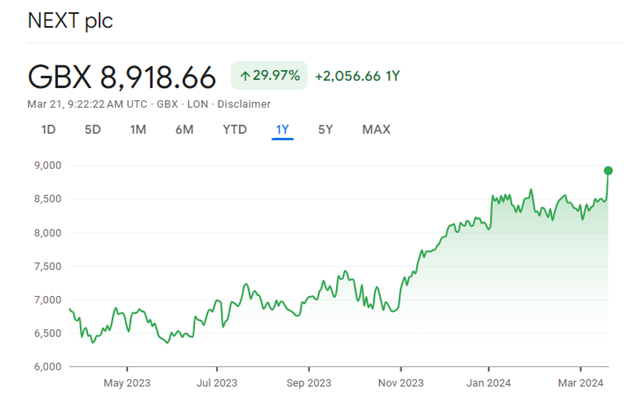

The Next stock price has soared by an impressive 29% over the past year, defying the turbulent economic landscape plaguing the retail sector. As competitors falter and high streets witness waves of closures, Next stock has distinguished itself as a stalwart performer, delighting investors with its resilience and strategic prowess.

In a time when many UK high streets resemble desolate landscapes due to store closures, Next has stood out as a beacon of success. While prominent clothing companies such as Hunter, Matches, FarFetch, and Ted Baker succumb to financial pressures, Next continues to thrive, capitalizing on its robust business model and astute management strategies.

The rise of online shopping has further exacerbated challenges for traditional retailers, yet Next has managed to navigate this shift with finesse. Despite the travails faced by industry giants like ASOS and boohoo, Next has remained resilient, leveraging its online presence and enhancing customer engagement to drive sales growth.

Record-Breaking Financial Performance

Next’s remarkable performance is underscored by its recent full-year results, which exceeded market expectations. With a 4% rise in full-price sales and a 5.9% increase in total group sales, the company has achieved record-high profits before tax, reaching £918 million. Chairman Michael Roney has lauded the company’s success, highlighting its ability to outperform amid challenging economic conditions.

Moreover, Next’s strategic initiatives, including the expansion of its Total Platform venture and acquisitions such as FatFace and Cath Kidston, have bolstered its revenue streams and positioned it for sustained growth.

Should you buy Next stock?

Despite its impressive growth trajectory, Next stock remains attractively priced, trading at 14.4 times 2024 earnings. While the company presents itself as a growth stock, it also offers investors a modest dividend yield, underscoring its commitment to shareholder value.

As the company continues to outperform expectations and navigate potential challenges, investor sentiment remains positive. While uncertainties persist, Next’s strong performance and strategic positioning make it an enticing investment opportunity for those seeking long-term growth potential in the retail sector.

Leave a Reply