Boohoo is a group of fashion and cosmetics companies that was established in the UK and launched in 2006. Its market value actually recently surpassed £6 billion. Not bad for a company that is listed on the secondary AIM exchange in the UK.

If you’re looking for information on how to purchase Boohoo shares using an online broker in the UK, our detailed guide outlines the steps in detail.

How to Buy boohoo Shares : A Step-by-Step Guide 2022

Even for a novice investor, getting started is not difficult. We have divided the procedure into the simple steps you must do in order to make an investment.

- Step 1: Open a Trading Account – Simply visit the broker’s website after choosing one and register for an account there. The procedures required to do this will vary from broker to broker, but overall, you can anticipate having to give your name, email, contact details, and some kind of proof of identity.

- Step 2: Make a Deposit – Enter your broker account credentials, then choose the option to deposit money. You’ll have a range of payment alternatives depending on your broker; most brokers accept bank transfers and debit card payments, but not all do so for e-wallets like PayPal. Select your desired method of payment and deposit the desired amount for BOOshares.

- Step 3: Place your order – Look up the ticker symbol for boohoo (BOO) to check the stock’s current trading price. If the price is acceptable to you, enter the number of shares you desire and submit your order.

- Step 4: Execute your order – Your broker will automatically execute your order when you place it, resulting in the listing of your boohoo shares in your account. Congratulations, you’ve just purchased BOO shares!

Examine Boohoo stock

Boohoo has performed extremely well since its IPO in 2014, and early investors have profited greatly. This is not mean that you need to buy something right away. Instead, take a step back and conduct your own research.

To guide you in the right direction, we’ve created a list of the most important criteria you should take into account before purchasing Boohoo shares.

Boohoo Overview

With a focus on both teens and young adults,, the UK-based fashion retailer boohoo was established in 2006. It provides apparel, footwear, accessories, and cosmetic products. Along with its primary website, boohoo also runs a number of brands aimed at a similar market, including boohooMAN, PrettyLittleThing, Nasty Gal, and MissPap.

Customers and revenue for the company have grown dramatically since its £300 million IPO in March 2014. Because it mass-produces high-fashion looks and catwalk trends at a low price, boohoo is best characterized as a fast-fashion company. Unquestionably, that strategy has been incredibly popular and successful; in 2021, boohoo reported having almost 18 million active consumers, up from 1.5 million in 2013.

boohoo has routinely run advertisements using past reality TV competitors in an effort to appeal to a younger demographic. Additionally, it has begun a number of partnerships with famous people, including Jennifer Lopez, Jon Jones, Tyla Yaweh, Lil Durk, and Eddie Hall, a former World’s Strongest Man. As a fashion growth business, Boohoo offers the best active investment opportunity due to its rapid expansion.

Boohoo Share Price History

Boohoo is a fashion retailer that primarily targets consumers between the ages of 16 and 30. The company, which is based in the UK and was just established in 2006, went public in 2014. Boohoo chose the AIM, the UK’s secondary exchange, as is frequently the case with emerging businesses. You could have purchased Boohoo shares back when they went public for just 70p.

In 2020, the shares will be significantly more valuable. Boohoo stock reached all-time highs in June at 433p per share. This represents a rise of more than 500 percent since its IPO in 2014. Not bad for a business with only six years of public trading.

Boohoo Share Price 2022

For a while, boohoo’s performance was excellent, but recently, things have gotten more challenging. Up until the beginning of 2021, it experienced a sharp increase in revenue and share price, but since then, it has been under intense pressure.

The pandemic initially benefited online-only businesses like boohoo. The downside was a shortage in the supply chain and rising prices once the first influx of new clients subsided. By the beginning of 2022, boohoo had issued two profit warnings and was trading at its lowest level in more than five years.

There have been other controversies as well, however, the company anticipates those effects to fade and feels the fundamental business is still robust. The company’s own auditor, PricewaterhouseCoopers (PwC), resigned in October 2020 expressing worries over boohoo’s reputation, among other notable instances, including allegations that boohoo has been exploiting workers at its suppliers’ plant in Leicester.

Dividends

A corporation with a market valuation of multiple billion pounds and three-digit percentage growth since its IPO in 2014 might be expected to pay dividends. However, as the company is very young, dividends have not yet been paid to shareholders. It is typical to practice for firms in their early phases of development to reinvest profits back into the company. Even delivering a dividend in the upcoming 12 months is not something we expect from boohoo.

However you can read our alternative guide to the Best Dividend Stocks You Should Buy in UK 2022 to find the best dividend paying stocks in UK.

Best trading platform to Buy Boohoo Shares

Find a UK stock broker that enables you to purchase Boohoo shares online. Meanwhile, the brokers given below are unquestionably the best in the financial industry to trade or purchase Boohoo stocks in the UK. Let’s look more closely at our top two options:

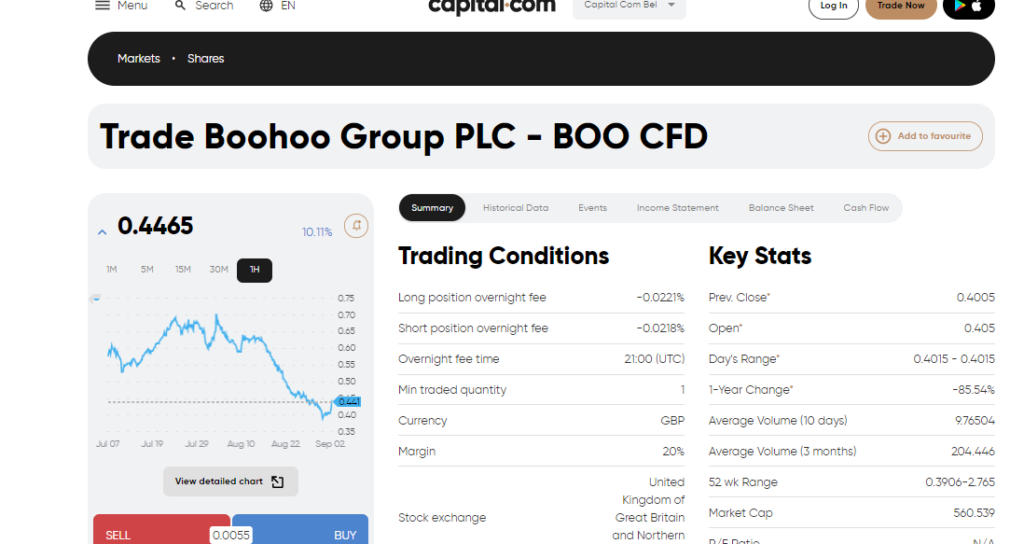

1. Capital.com

You would be trading Boohoo stocks with Capital.com, a reputable CFD trading platform. As an outcome, you won’t possess the investment product. In contrast, CFD trading gives you the option to open a trade that best suits your needs. You could, for instance, make a buy or sell order.

If you’re not aware, this suggests that you stand to gain irrespective of whether the value of Boohoo stocks rises. Standard stock trading platforms do not let you conduct business in this manner. You can choose to use leverage while purchasing Boohoo stock CFDs.

In a few crucial areas, this brokerage application is exceptional. To start, it provides some of the tightest spreads in the UK along with 100% commission-free trading. Both the Cyprus CySec and the UK FCA have jurisdiction over Capital.com. Leveraging your investment is a benefit of trading Boohoo stock CFDs as well. As a result, a £50 investment in Boohoo stock CFDs would result in a £250 transaction value.

Registering with Capital.com only takes a few minutes, and the required minimum deposit is just £20. This gives you the opportunity to experience trading Boohoo CFDs with a small sum of money. At Capital.com, a demo account offers a risk-free trading environment. Your investment is safe and secure since Capital.com is authorized and governed by the FCA.

Learn more: Capital.com Broker Review UK 2022 – Complete Guide

2. IG

/IG-ef2684aaa37d4d218af819f98d676d02.png)

IG is a well-known online brokerage firm with a history dating back to 1974. Its primary firm is listed on the LSE, in contrast to having licenses from the FCA and ASIC. Spread betting, CFD trading, and traditional stocks are a few of the financial products offered by IG. This provides you with several opportunities to make money off the growth and decline of stocks including Boohoo.

On its share trading platform, there are about 10,000 stocks, representing hundreds of UK companies. In the UK, you can buy shares in global corporations other than on the LSE and AIM.

It’s also crucial to remember that IG provides really affordable spreads. At this time, the share prices for Boohoo are 276.10 pence and 275.80 pence, respectively. For IG trading to start, you must put up a £250 investment.

How to buy Boohoo Shares?

We’ll now demonstrate how to invest in boohoo shares right away. Although there are various brokers to choose from, we’ll walk you through the process using the best platform, Capital.com.

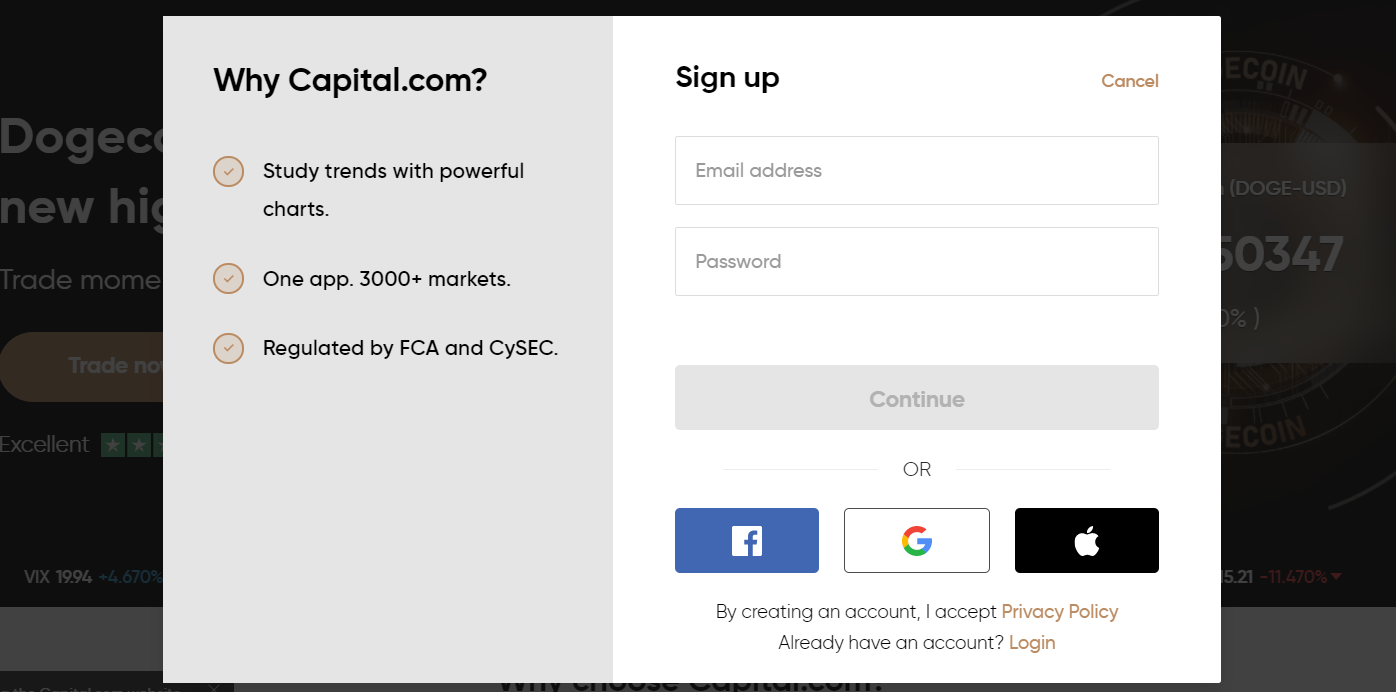

Step 1: Open an account

Go to Capital.com and select “Trade Now” to get started. The registration process, which involves giving your email address and creating a password, will then be explained to you.

Step 2: Verification

As a result of capital.com becoming subject to FCA regulation, you will now be asked for specific papers. The following is included in this:

- Driving License or Passport

- a utility bill or bank statement

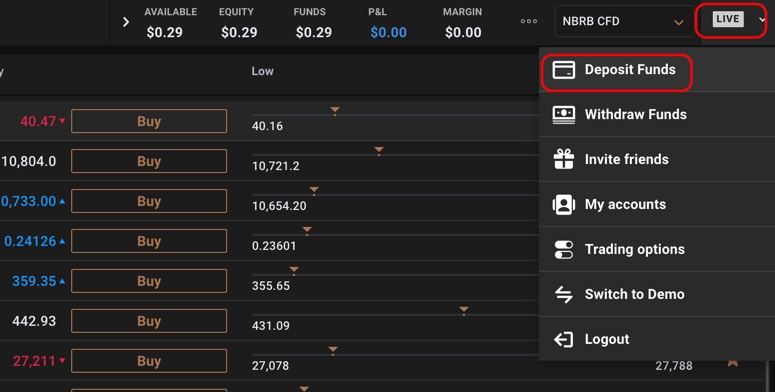

Step 3: Deposit Funds

In order to resume trading, you should deposit the necessary minimum deposit . At capital.com, you can make an immediate deposit using a debit/credit cards, Skrill, Paypal, or Neteller. Additionally accepted are bank transfers.

The minimum deposit required by Capital.com is £15.

Step 4: Buy Boohoo shares

You are now prepared to purchase Boohoo shares in the UK after funding your capital.com account.

Look for Boohoo using the magnifier while navigating to your account dashboard. When it does, press it and then tap “Trade” to bring up a new order page.

In the section that will appear ahead, enter the sum you wish to invest in a Boohoo share. When trading CFDs, you have the choice of using leverage of up to 5:1. You can also set a limit loss or take a profit position in order to lessen the risk associated with your investing.

You just need to give the order your approval at this point.

Conclusion

Investors who want to “buy the dip” and take advantage of short-term pressures to locate market value may find it appealing. boohoo just purchased the high street company Debenhams and routinely launches new apparel lines. It also spends £100 million annually on marketing.

All of those details hint at a business that has no plans to slow down. Its recent revenue downgrades were made from a position of strength, and it’s possible that they were only the product of short-term issues that won’t have a significant impact on its performance in the years to come.

But before making an investment, it’s important to think about the sector. Fast fashion is just that, and fashion trends can shift quickly. Up until now, boohoo has done a terrific job of luring young folks, but it is difficult to make too many predictions about the future.

If you believe this to be the case, you may quickly buy Boohoo shares on Capital.com. Spreads are incredibly narrow, commissions are not required, and you may make a quick deposit with a UK debit or credit card.

Also read: Best AIM Shares You Should Buy In UK 2022

Frequently Asked Questions

Where is Boohoo listed on the stock market?

Boohoo is traded on AIM.

Are Boohoo’s dividends distributed?

Boohoo is still a young company, therefore it doesn’t pay any dividends and instead reinvests its earnings to fuel its expansion.

Who is Boohoo’s founder?

Carol Kane and Mahmud Kamani are the creators of Boohoo.

How much did Boohoo shares cost at the time of their IPO?

Prior to the 2014 AIM Initial Public Offering, you would have just paid 70p per share.