As oil prices surge, investors are eyeing BP shares for potential gains.

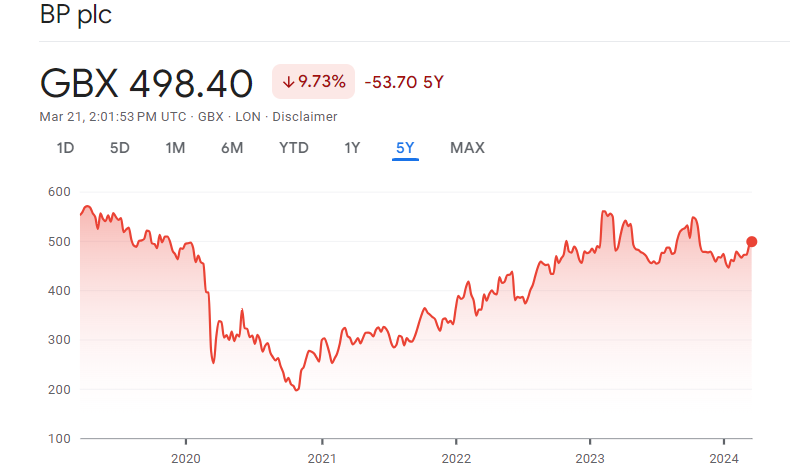

Despite a 10% decline in BP share price, the company appears undervalued compared to its peers. With a price-to-earnings (P/E) ratio of just 6.9, significantly lower than the industry average of 13.6, BP shares present a compelling investment opportunity.

A discounted cash flow analysis suggests the stock is approximately 44% undervalued at its current price of £4.98, indicating a fair value of around £8.89. Furthermore, BP’s planned $3.5 billion share buybacks in the first half of the year could provide additional support for share price appreciation over time.

Strength in the Oil Market

The recent surge in BP’s share price aligns with the upward trajectory of oil prices, particularly Brent crude, which has risen to around $86 per barrel and continues to trend higher. Supply-side disruptions, including ongoing tensions in the Middle East affecting oil shipments and production cuts by the OPEC+ cartel, have contributed to this bullish outlook. The company’s Q4 underlying replacement cost profit of $2.99 billion, surpassing analysts’ expectations, further underscores its resilience in navigating market dynamics.

While BP is committed to reducing oil production by 25% from 2019 levels by 2030 as part of its energy transition strategy, CEO Murray Auchinloss has indicated potential flexibility in oil output targets for the 2022-2027 period. This balanced approach to energy transition, coupled with a 17% increase in dividend to 28 cents per share, positions BP as an attractive investment opportunity. With a dividend yield of 4.5%, surpassing the FTSE 100 average yield of 3.9%, BP offers investors both potential price gains and a solid income stream.

Should you invest in BP shares?

Investors who want to start Oil trading and eyeing BP shares should carefully consider the company’s performance against its undervaluation, the strength of the oil market, and its strategic initiatives for a sustainable energy transition. While risks such as potential oil price volatility and the need for expedited transition efforts exist, BP’s current valuation, dividend yield, and balanced approach to energy transition present a compelling case for investment.

As oil prices continue to rise and BP demonstrates resilience and adaptability, acquiring more BP shares may prove to be a prudent long-term investment decision.