Names like Netflix, Amazon, and Microsoft began their careers as small-cap stocks before becoming the global mega-corporations they are today. Their assets exploded as they achieved greater success, and as a result, they are now among the biggest businesses in the world.

Given this success, investors frequently search for the next big brand, or more specifically, for today’s winners of tomorrow. One strategy to accomplish this growth is to invest in small cap companies.

In this guide, the best ten small-cap stocks to purchase in 2022 will be discussed, along with information on where and how to do so.

What is a small-cap stock?

A small-cap stock is a publicly traded company with an overall market cap of $300 million to $2 billion. Anything below this is referred to as a micro-cap stock, which frequently consists of newly established companies, while anything above is referred to as a mid-cap or large-cap company.

Small caps may be chosen by investors to diversify their portfolios and find early-stage development companies. These stocks typically receive less analyst and media attention, making them a challenging but lucrative investment if successful. Determining whether they will be a wise investment, also takes more investigation, but nothing about stock market shares is guaranteed.

Best small-cap stocks 2022

The best small-cap stocks to acquire right now in the United Kingdom are listed below

- CarParts.com (NASDAQ: PRTS)

- ACM Research (NASDAQ: ACMR)

- Perion Network (NASDAQ: PERI)

- Tullow Oil (LON: TLW)

- Petrofac (LON: PFC)

- Allied Motion (NASDAQ: AMOT)

- KAR Auction Services Inc. (NYSE: KAR)

- Urban Outfitters Inc. (NASDAQ: URBN)

- Veritiv Corp. (NYSE: VRTV)

- Sonic Automotive Inc. (NYSE: SAH)

Best small-cap stocks analysis

CarParts.com (NASDAQ: PRTS)

U.S. Auto Parts, an online retailer of automotive parts, has changed its name to CarParts.com. Sales increased during the COVID-19 epidemic as a result of the company streamlining its operations by combining its web brands under the CarParts.com logo. CarParts.com is investing in marketing and technology, and the business is quickly expanding its distribution network. Now, it can deliver in two days to 80% of the nation.

The auto industry’s semiconductor scarcity, which is driving up the cost of new and used cars, also appears to be a positive factor for the e-commerce company’s future growth. The stock appears to be more than just a pandemic tale given the company’s long-term targets of 20 to 25 percent revenue growth and 8 to 10 percent adjusted EBITDA.

CarParts.com has a $456 million market cap. Its 52-week high is $20.74 and its low is $5.9.

ACM Research (NASDAQ: ACMR)

ACM Research is a “picks-and-shovels” player in the semiconductor business as a producer of cleaning tools for semiconductor wafers. The firm offers exposure to a sector with high growth potential without the worry of falling commodity chip prices.

ACM is a U.S. corporation that also does the majority of its business in China, providing investors with a relatively secure way to invest in order to access the Chinese market. One of the few small-cap firms, ACM has both strong profitability and tremendous growth potential.

ACM Research has a $1.03 billion market cap. Its 52-week high is $39.71 and its low is $11.23.

Perion Network (NASDAQ: PERI)

Along with more general advancements in connected TV and digital advertising, ad tech stocks have soared throughout the pandemic. One of the major beneficiaries is the Israeli company Perion Network, which uses its intelligent base to link publishers and advertisers. That makes it stand apart in a market where businesses normally serve brands or publications.

Microsoft is a key collaborator of the business as well; Perion is assisting Microsoft in making money off of their Bing search engine.

Perion has been expanding quickly through acquisitions and carving out a niche for itself in premium advertising by providing features like QR scanning, changeable backgrounds, and in-game advertisements during sporting events. The business was on target to increase revenue by 42% in 2021 and 29% in 2022. It’s profitable, much like ACM Research.

Perion Network has a $940 million market cap. Its 52-week high is $33.09 and its low is $16.40.

Tullow Oil (LON: TLW)

With an emphasis on Africa and South America, the British oil and gas business Tullow Oil has approximately 40 interests across 11 different nations. From oil discovery to oil manufacturing, the business operates throughout the whole oil lifecycle. Due to restrictions on oil supplies, the corporation has been able to lower its debt over the previous year, and this upward trend in the market may continue through 2022.

Tullow Oil has a $709 million market cap. Its 52-week high is 63.52 GBX and its low is 39.38 GBX.

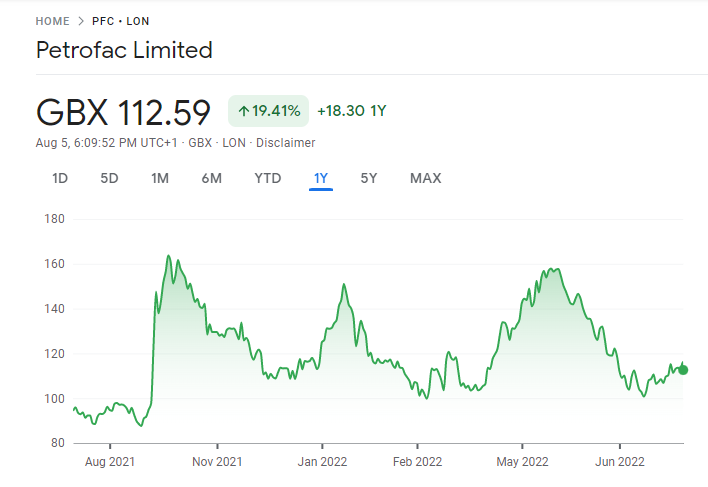

Petrofac (LON: PFC)

Petrofac is a British company that offers oilfield services to the oil and gas sector. The business creates, constructs, and manages top-notch energy facilities that guarantee zero emissions. Petrofac manages more than 200 engineering, procuring, and building projects, among them those in the North Sea. In October 2021, it issued new shares worth £275 million that will be used for “refinancing” in order to develop a longer-lasting and more sustainable business strategy.

Petrofac has a $597 million market cap. Its 52-week high is 203.34 GBX and its low is 95.45 GBX.

Allied Motion (NASDAQ: AMOT)

Precision and customized controlled motion products and solutions are designed, produced, and distributed by Allied Motion Technologies. The automotive, medical, aerospace, and defense industries are just a few that utilize these goods and solutions. With offices throughout the United States, Canada, South America, Europe, and Asia, Allied Motion Technologies is headquartered in Amherst, New York.

The manufacturing company’s stock has a $427 million market cap and an EPS of $1.52. Its 52-week high is $44.70 and low is $21.14, respectively. The yearly dividend yield for Allied Motion Technologies is $0.12 per share. And over 20,613 shares are traded there each day. In 2021, the business made $371 million in revenue.

KAR Auction Services Inc. (NYSE: KAR)

In the United States, Canada, Mexico, and the United Kingdom, KAR Auction Services offers services for salvage and used car auctions. According to an analyst, KAR’s first-quarter profits report was loud because it no longer operated its physical auction business, Adesa, which it had previously sold to Carvana Co. Analysts are still optimistic about the company’s turnaround strategy, particularly the switch from traditional auctions to online sales. The recent challenges in the auction industry, according to Murphy, are cyclical and should subside by 2023 and beyond. KAR stock, which ended at $16.91 on July 22, has a “buy” rating and a $28 price target from Bank of America.

KAR Auction Services has a $1.95 billion market cap. Its 52-week high is $22.10 and its low is $11.76.

Urban Outfitters Inc. (NASDAQ: URBN)

Urban Outfitters operates stores with the labels Urban Outfitters, Anthropologie, and Free People. According to an analyst, Urban Outfitters will reap the rewards of a recovery in occasion-wear sales in 2022 as event demand picks up again in the wake of the pandemic. According to an analyst, cost pressures will continue to affect Urban Outfitters in the short term, but they should start to lessen in the second half of the year. As of July 22, shares of Urban Outfitters had lost roughly 29 percent of their value year to date, the poorest performance of any stock on this list. But URBN stock, which ended at $20.86 on July 22, has a “buy” recommendation from Bank of America and a $26 price target.

Urban Outfitters has a $1.95 billion market cap. Its 52-week high is $41.03 and its low is $17.81.

Veritiv Corp. (NYSE: VRTV)

Packaging, printing, and facility management products are offered by Veritiv. According to one analyst, traders were sceptical of Veritiv’s Q1 earnings surprise and estimate increase because much of the unanticipated gain came from the company’s noncore printing services industry. But according to an analyst, Veritiv’s packaging business recorded double-digit revenue growth in the first quarter across all end-use industries and product categories, and its free cash flow is relatively resilient to a macroeconomic slowdown. Price rises should sustain packaging and print solution margins. When VRTV shares ended at $120.18 on July 22, Bank of America had a “buy” rating and a $131 price objective on the stock.

Veritiv Corp. has a $1.80 billion market cap. Its 52-week high is $161.10 and its low is $59.95.

Sonic Automotive Inc. (NYSE: SAH)

Sonic Automotive is a major car store in the United States. According to an analyst, supply disruptions have made life challenging for car dealerships. According to an analyst, Sonic’s EchoPark used-vehicle retail division has expanded to represent a larger portion of Sonic’s overall operation, which might eventually aid the company in gaining market share and enhancing profits. Analyst claims that EchoPark’s performance varies greatly from quarter to quarter though. In the first quarter, EchoPark’s sales increased by 23%, but it also had a $35 million pretax loss. SAH stock, which closed at $38.98 on July 22, has a “buy” rating and an $84 price target from Bank of America.

Sonic Automotive has a $1.65 billion market cap. Its 52-week high is $58.80 and its low is $34.17.

Why should you buy small-cap stocks?

The following are some benefits of investing in small-cap companies.

- If investors believe small-cap firms will eventually become growth stocks and reach large-cap status, they may decide to invest in them. They will be able to make investments while the company is still developing and watch as it establishes itself while earning earnings along the way. Keep in mind that a lot of blue-chip businesses began as tiny caps.

- Small-cap stocks are a useful tool for portfolio diversification. Depending on the market cap, sector, and industry, some investors like to hold a variety of companies.

- Small-cap stocks have historically outperformed large-cap stocks. Large-cap tech stocks dominated the stock market prior to the Dot Com bubble in 2000. Small-cap equities have, nevertheless, consistently outperformed their larger peers over the previous 20 years, albeit by a small margin. When the economy is doing well, they do extremely well, but significantly worse during a bad market.

Risks of buying small-cap stocks

Small-cap stocks have a history of outperforming their peers on the stock market, but they also carry unique dangers, which are described in more depth below.

- Because there are fewer investors interested in the market, small-cap companies typically have higher levels of volatility and less liquidity. This implies that it might be harder to locate willing buyers and sellers for a specific share, which may force investors to keep the asset for a longer period of time than they had intended.

- Despite having a higher potential for growth than large caps, small caps also carry a higher risk of failure. These businesses may not have the financial stability to support their operations, which makes it difficult for them to stay afloat.

- Small businesses are frequently not financially successful and cannot afford to spend a percentage of their cash flow to pay dividend payouts to shareholders. Despite this, internet behemoths like Alphabet and Meta Platforms have never paid out a dividend, demonstrating that even businesses with some of the biggest market capitalization in the world don’t reward shareholders.

- Small-cap stocks are typically more susceptible to stock market meltdowns and economic downturns. Small-cap stocks, for instance, declined more during the Covid-19 pandemic than large-cap companies, which may be related to the fact that there is less stability and investor interest surrounding them to maintain their stable standing in the market. Investors did, in fact, swarm to safe-haven assets like defensive stocks and blue-chip indices like the S&P 500.

How to invest in Small-cap Stocks?

After learning about the advantages and disadvantages of small-cap stocks, let’s have a look at the investment process.

Step 1: Choose a broker

You will need a reputed stockbroker to invest small-cap stocks in the United Kingdom. Let’s now take a glance at two of the best UK brokers for purchasing small-cap stocks:

1. eToro

Over 800 shares from the UK and several more from the other exchanges are among the numerous shares that are accessible for trading on eToro.

For the majority of UK stocks, eToro provides commission-free stock trading. On eToro, there are only two more costs to be aware of: a £4 withdrawal fee and a £15 inactivity fee that becomes effective after a year of inactivity.

There are many trading tools available on eToro that can help you find high-growth small-cap stocks. Each company has a page with comprehensive basic information, price targets from knowledgeable analysts, and extremely detailed technical charts.

A crucial component that this broker provides is a social trading network. You can also see on eToro whether a stock in a certain company is being bought or sold by investors. By replicating the portfolios of knowledgeable small cap traders, you may invest in a collection of businesses in a matter of seconds.

The Financial Conduct Authority oversees eToro, and the FSCS safeguards all trading accounts. 24/7, the broker provides customer service.

2. Fineco Bank

One of the biggest banks in Italy, this broker has a trading operation that targets British investors. Despite not having the greatest reputation among brokers in the UK, Fineco has a lot to offer.

The starting price for share trading for UK equities is just £2.95 per trade, and all stock CFD trades are commission-free. Hundreds of exchange-traded funds (ETFs), including a few small-cap ETFs, are also available from Fineco Bank. These cost 0.25 percent, which is preferable to a flat commission for many investors.

Given that it is an Italian publicly traded firm, Fineco Bank is regarded as being trustworthy. The Bank of Italy oversees the broker, and the FSCS protects every UK trading accounts.

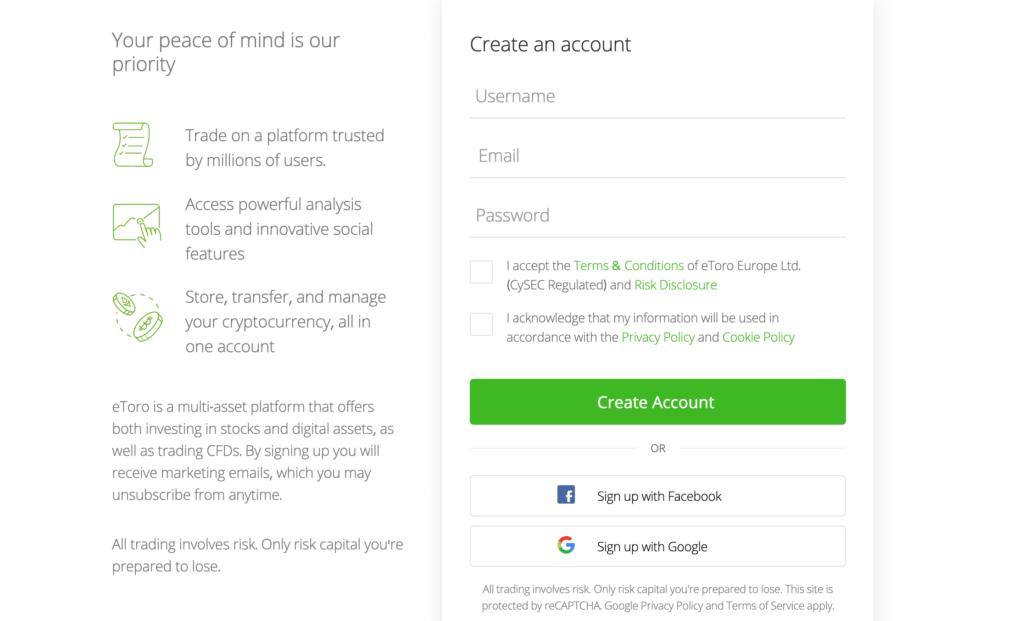

Step 2: Open an Account

We have selected eToro for this phase since it offers a wide selection of equities and has no commission fees.

To get started, go to the eToro website and click the “Join Now” option. Using your email address and login information from Google or Facebook, you can create a new account.

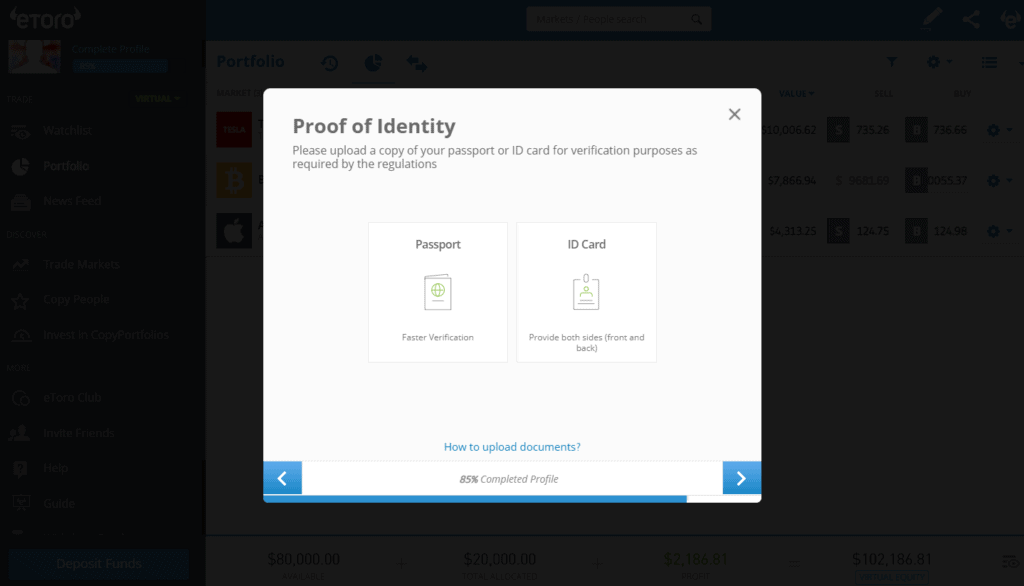

Step 2: Verify Your Identity

In order to adhere to UK AML regulations, eToro requests that you verify your identity. To finish this, upload a photocopy of your passport or license. Additional documentation proving your present residence is needed, such as a current utility bill or bank statement.

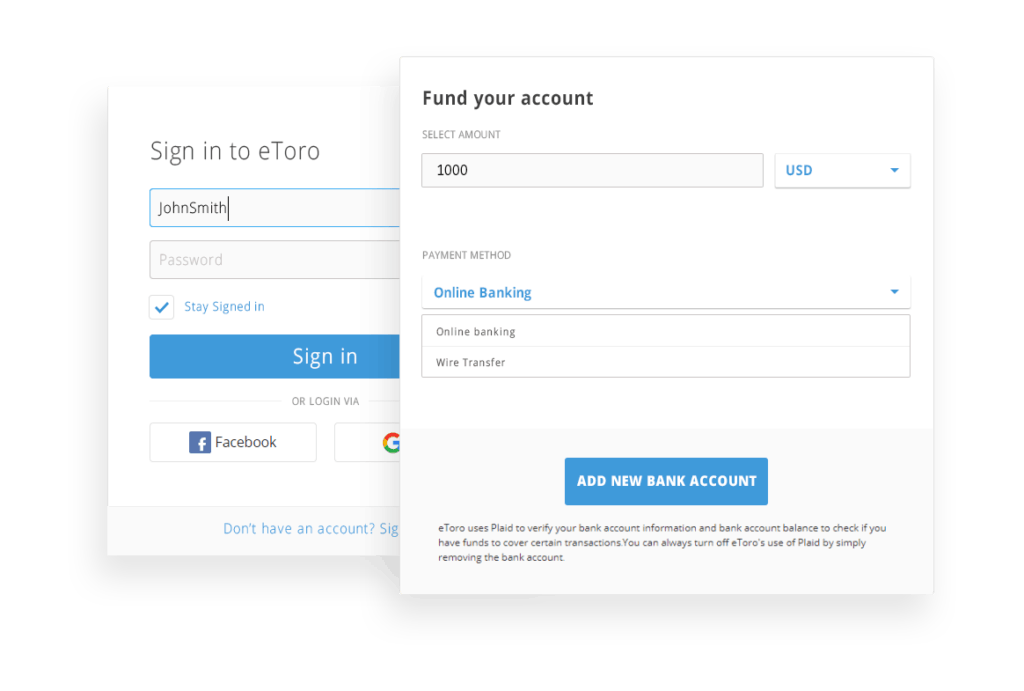

Step 3: Deposit Funds

You must deposit at least £140 into your new eToro account with your preferred payment methods.

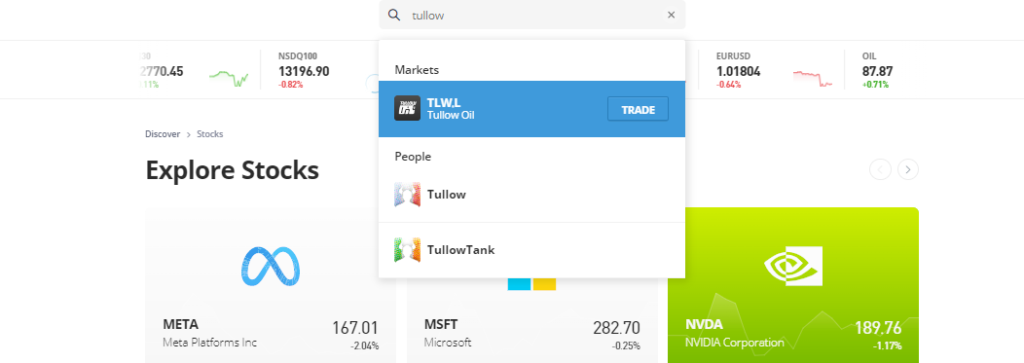

Step 4: Search your Small Cap Stock

To find the name of the small-cap company you wish to acquire, just use the account dashboard search feature. When “Trade” appears in the drop-down menu, click it to launch a new order form.

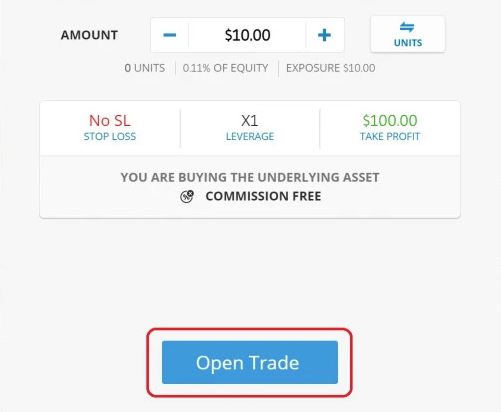

Step 5: Place your trade

Now you can put your desired investment amount in the small-cap stock in the order box that pops up. Since eToro accepts fractional shares, you can invest any amount above the minimum of £40. Although it is optional, you can use leverage, stop loss orders, take profit orders, or both to purchase small-cap stocks on eToro.

Choose “Open Position” to purchase your first small-cap stock in the UK once your trade is ready.

Conclusion

The tremendous upside growth potential of small-cap equities, which is unmatched by larger companies, is the main benefit of investing in them.

The tenets of wise investment should still be applied to tiny companies, though. It is imperative to diversify. This is because there are risks associated with these profitable prospects. Investors in small-cap companies give up stability for a promise. Exploring the world of small caps might be right for you if you can tolerate higher levels of risk.

You may now purchase all of the best small-cap stocks on eToro if you opt to invest. You can purchase small-cap stocks without paying any commissions by making an immediate payment using your UK debit or credit card.

Frequently Asked Question

What are small-cap stocks?

Companies classified as small-cap are those whose market worth is $300 million to $2 billion. Low stock prices are a characteristic of small-cap stocks, however, this does not necessarily mean that a stock is a small-cap.

How can I use a stock screener to find small-cap stocks?

In order to narrow your search results, you should also use other parameters, such as industry or most recent performance.

Do penny stocks and small-cap stocks have the same meaning?

Market capitalization for small-cap stocks ranges from $300 million to $2 billion. Stocks classified as penny stocks have a share price of under $5.