Your trading success will be influenced by a number of factors, with stock selection being a significant one. Since Netflix stock is very well-liked, it is a wise choice. As a result of its net subscriber growth, its stocks have been on the rise. As a result, it has attracted a lot of new investors, and the idea of investing in Netflix is just irresistible.

This article will walk you through the process of purchasing Netflix stock step-by-step.

How to Buy Netflix Shares – An Overview

You’ll be happy to know that you may finalize your purchase at a FCA-regulated broker if you’re certain that Netflix represents a sound investment for your stock portfolio.

Learn how to purchase Netflix stock in less than five minutes by following the straightforward instructions listed below.

- Open a Trading Account – You must first register for an account by supplying basic personal data. You must also submit a proof of your government-issued Documentation to have your account verified.

- Make a Deposit – If you are based in the UK, you can make a fee-free deposit using a debit/credit card, an e-wallet, or a bank transfer.

- Search for Netflix Shares – You may now search for Netflix and select “Trade” to open an order form.

- Buy Netflix Stock – Your desired investment in Netflix shares should be mentioned to the broker. Click “Open Trade” to complete your Netflix stock investment.

Examine Netflix Stock

Netflix has had dramatic peaks and lows in recent years. On the one hand, the stock responded to the worldwide lockdown measures by performing quite strongly in 2020. However, since then, the value of Netflix stocks has dramatically decreased.

While some market analysts contend that this is consistent with a larger sell-off in IT stocks, others point out that Netflix is up against stiff competition from services like Amazon Prime and Disney+.

As a reason, before choosing to buy Netflix stock, you should conduct your own research.

Netflix Overview

Reed Hasting and Marc Randolph, two businessmen from the United States, launched Netflix in 1997. The company’s main office is in Los Gatos, California. The business began as a subscription DVD by mail service and has since undergone a number of changes.

It currently controls a significant portion of the streaming video business. As a result, investors have started to bid up the stock. It still offers its original DVD postal services in addition to subscriptions for online streaming of movies and television shows. Domestic DVD, foreign streaming, and domestic streaming are the three operating segments.

The corporation promises a premium streaming membership of over 213 million subscribers. The subscription spans more than 190 nations and includes a variety of languages and genres.

Netflix share price history

Immediately following the dot-com bust in May 2002, Netflix stock began trading on the NASDAQ public market in the United States. Just $15 was the opening price for shares.

By 2004, shares had risen to almost $70 each, at which point Netflix declared a 2-for-1 stock split.

The turning point for Netflix occurred in 2007 when the firm simultaneously introduced a platform for streaming internet videos and DVD rentals. At the time, this was among the first membership streaming platforms in the entire globe.

Up until about 2017, when rivals like Amazon, HBO, Disney, and others started to enter the subscription streaming market, Netflix was essentially the only player in this space. With the 2015 stock split taken into account, Netflix shares increased by 5,700% between 2007 and 2017, going from slightly more than $3 per share to about $200 per share.

Shares of Netflix reached a high of $408 in 2018, but after that, the year was difficult due to the escalating streaming competition. When the coronavirus epidemic started, the stock price of Netflix fell to $380.

Investors immediately understood how the epidemic may affect Netflix shares. The shares rose to a high of $556 a share in September of last year rather than falling along with the rest of the market in March 2020. Shares of Netflix increased dramatically by 66% in 2020.

And as a result, this provides the company with an original listing price of $1.21 for the purpose of examining the rise of Netflix stock since its IPO. Netflix has developed into a large-cap stock since its IPO. In reality, Netflix stock reached a record high of $700 in late 2021. This represents gains from beginning to end of greater than 57,000% in comparison to its revised IPO price.

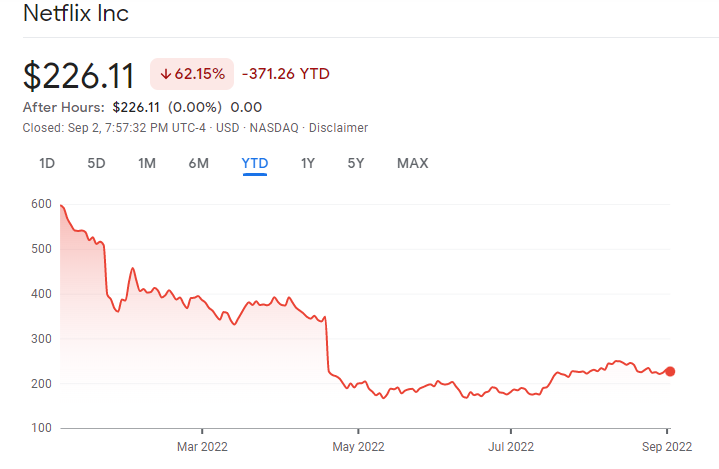

Netflix share price 2022

Ever since Netflix’s shares began trading in 2022, they have been falling. The price of the shares right now is $225 a share.

The market capitalization of Netflix is $231.7 billion at the current share price. The corporation ranks as the 22nd largest in the US.

Another example of how growth stock investments can be successful if you get in quickly. Having said that, Netflix stock has now fallen from its previous high of $700. In actuality, the company has fallen to $162 52-week lows. This is a decline of over 76 percent. Netflix stock has had a 62% decline in returns over the past year. Netflix stock has only increased 15% over the past five years.

The NASDAQ exchange, in contrast, is up 28% over the past five years and down 60% over the previous year. Therefore, Netflix stock is performing poorly in comparison to the whole market.

Dividend

Netflix does not and has never paid a dividend. A sizable amount of the company’s revenue is reinvested in production; in 2022, the firm expects to spend more than $19 billion on new motion pictures and television programs.

However you can read our alternative guide to the Best Dividend Stocks You Should Buy in UK 2022 to find the best dividend paying stocks in UK.

Best trading platform to Buy Netflix Shares

You can use any UK-based brokerage site that provides international equities because Netflix is a large-cap stock listed on the NASDAQ exchange.

Research is essential in this area, though, as a broker should support your preferred payment method and have cheap costs and low account minimums.

As a result, if you’re still looking for a reliable broker, we go through where to buy Netflix stock today in the parts that follow.

1. eToro

Anyone wishing to buy Netflix shares in the UK frequently chooses eToro. You can purchase thousands of well-known shares from the UK, US, Europe, Asia, and other places using this trading site.

The fact that all trades on eToro are completely commission-free is one of its benefits. The marketplace also enables you to purchase Netflix fractional shares for as little as £35. After a year, eToro charges a £10 inactivity fee, but you may easily avoid it by trading with your account.

Furthermore, eToro provides access to professional analysts’ research, including 12-month price forecasts to assist you in estimating what Netflix shares might be worth in the future.

You can watch and interact with millions of other investors on the social trading network that eToro offers. You can rapidly react when the market’s perception of Netflix shares changes by being able to notice it coming. Or you can save a section of your account to make deals that resemble those made by experienced day traders.

The FSCS, which is supervised by the UK’s FCA, covers all accounts at eToro. You may access eToro on iOS and Android devices, and you can use the app to contact customer care whenever you need it. To learn more about what this brokerage app has to offer, read our in-depth eToro Broker Review UK 2022 – Complete Guide.

2. Libertex

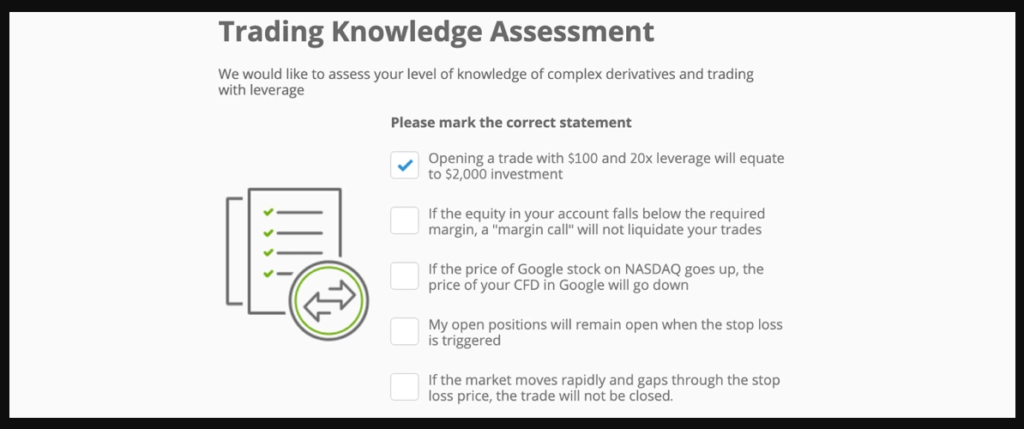

Numerous US companies, including Netflix, are available for trading on the CFD trading platform Libertex. You can easily place large bets on this streaming stock without making a significant initial capital investment because the broker provides leverage up to 5:1 for all stock CFD trades.

With only a few touches on your tablet, it offers more than 70 distinct technical studies and drawing tools that can all be changed smoothly. For your convenience, the platform also has a news feed and an economic calendar that can help you track developments in the market that could affect the price of Netflix stock.

Libertex approaches pricing differently than many other UK trading apps. The platform doesn’t have any changeable spreads, however, it does have a modest commission of about 0.1% for each stock trade.

Libertex is subject to regulation by the CySEC, a reputable financial watchdog in Europe. The broker offers round-the-clock email support, but you’ll need to leave the app to access it. To learn more about what this brokerage app has to offer, read our in-depth Libertex Broker Review UK 2022 – Complete Guide.

How to buy Netflix Shares?

It may seem simple to purchase Netflix shares or any other type of stock (and it can be). However, selecting the incorrect online broker could make things more difficult. The three internet brokers mentioned above all have rather simple purchase processes. We’ll show you how to use eToro to purchase Netflix shares in the UK in the sections below.

Step 1: Open an account

A trading account can be opened with eToro in a very straightforward manner. There is no extensive paperwork required. Instead, you only register by providing your contact information and selecting a username. For account security reasons, you also submit your phone number, email address, age, and other information. Upon finishing the process and completing your profile, the account will be available for real-time trading.

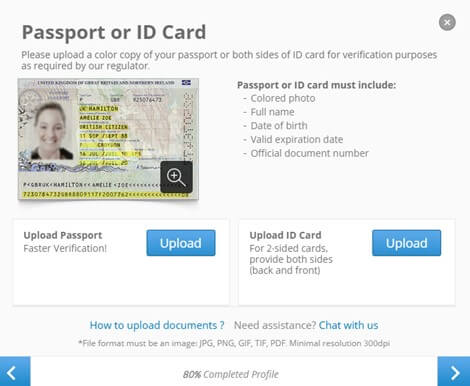

Step 2: Complete Profile

For the protection of your account, this step is crucial. It includes all of your necessary personal identification. You must upload and submit identification documentation. Examples include a current passport or any other type of official photo. Additionally, you must provide proof of your address, such as a current power bill or a bank statement from the previous three months.

After there, you respond to a questionnaire to help eToro create a service package just for you. When the account has been validated, which might take a few hours to a few days, eToro will let you know. The user’s username is shown with a green check to indicate a verified account. In the event that a document is denied, eToro sends a thorough email with explanations.

Step 3: Make an Initial Deposit

It is easy to fund your eToro account. Simply sign into your account, click “deposit funds,” input the desired amount, and then choose the appropriate currency. Finally, select your desired payment option.

For UK traders, the first deposit requirement on eToro is £50.

Step 4: Learn the Platform

You need to get comfortable using the eToro platform. Keep in mind that clicking an icon next to your profile name will allow you to change from the demo account to the genuine account. So, as previously indicated, utilize the £100,000 in fictitious funds provided on the sample account. Utilize it to test out the various trading methods you intend to employ when trading in real-time.

Step 5: Buy Netflix Shares

On eToro, you may trade Netflix shares in a variety of ways. This entails taking possession of the physical asset and trading it as a CFD or an index. Therefore, determine the number of shares you can afford and finalize your transaction. Last but not least, choose the appropriate order type and keep track of Netflix’s share price performance to know when to initiate and close positions.

Conclusion

In the online movie rental and home video market sectors of the business, Netflix Inc. has maintained a dominant lead. Being the top streaming service provider, its stock is frequently in the news. Investors are consequently always interested in any updates on the company’s development. Fortunately, the business recently announced its most recent quarterly results, showing that it is financially sound.

The company no longer needs outside money to maintain its daily operations, therefore the financials stand out. Additionally, the management thinks that starting in 2022, cash flow will be produced annually in a sustainable manner. This follows free cash flow’s break-even point in 2022. This is an obvious sign that the company’s finances are becoming better.

Now that you’ve decided to buy Netflix shares, go ahead and do it with eToro, our number-one trading platform recommendation.

Frequently Asked Questions

Does Netflix allow stock purchases?

Yes. All you have to do is look for an established online broker with NASDAQ access. Open a stock trading account, add money to it, and then purchase the shares.

Are there any subsidiaries of Netflix?

Yes. In addition to having numerous subsidiaries abroad, Netflix also operates in the Netherlands, Japan, the UK, France, and Germany.

Is the stock profitable?

Yes. The company’s profits from year to year have doubled. Furthermore, its first-quarter bottom line saw a 140% increase in net income.

Does the company offer dividends?

Netflix does not distribute dividends. One of the main causes of this is that a large portion of the company’s income is used to fund internal operations as well as the creation of new television programs and motion pictures. As a result, you shouldn’t anticipate Netflix to begin distributing earnings to shareholders very soon.