The foreign exchange markets are the most active in the world because trillions of dollars are constantly circulating there. Many of the well-known companies in stock trading just don’t provide this function, so if you want to get in on the action, you’ll need to find the Best Forex Trading Platforms that deal in currency.

Based on our own research and a number of other factors, we will examine the Best Forex Trading Platforms in the UK in this guide.

Best Forex Trading Platforms 2022

The top Forex Trading Platforms in the UK are thoroughly analyzed below based on our extensive market research.

1. Capital.com

The best forex trading platform in the UK overall is capital.com. As of this writing, this day trading platform offers no fewer than 138 currency pairings, including all majors and minors as well as a large number of exotic currencies. At Capital.com, all supported currency pairs can be traded with a 0% commission.

Additionally, Capital.com offers its users the ability to trade popular forex pairs with leverage of up to 1:30 in accordance with UK rules. This indicates that a trading capital of £500 can be obtained for every £100 staked. Trading leverage of up to 1:20 will be made available to UK traders when trading minor and exotic pairings.

Capital.com is subject to numerous regulations regarding safety. This contains certifications from the NBRB, CySEC, ASIC, and FCA. Capital Com is an additional FSCS member.

2. eToro

The FCA, SEC, CySEC, and ASIC have all given their approval and licenses to the regulated forex trading platform known as eToro. The FSCS also provides coverage for the platform. We prefer eToro for a variety of reasons, one of which is that the system may be the finest for newcomers to forex trading in the UK.

Numerous currency pairings are available with eToro, with the majority coming from the major and minor categories. A few uncommon currencies are also supported. We also appreciate that eToro offers 0% commission on stock and ETF purchases for UK citizens.

Perhaps the main factor making eToro one of the top forex brokers in the UK is the fact that it provides a market-beating copy trading service. In a word, this enables eToro users to mimic the financial decisions of an established, successful FX trader. As a result, every single trading position that the investor enters will be copied over to the user’s eToro portfolio.

3. Libertex

Libertex’s combination of narrow spreads and low commissions earns them a spot on our list of the top Forex trading platforms in the UK. For the latter, commission-free trading is available on GBP/USD and EUR/USD, while all other supported pairings are charged a cost of just 0.0003 percent.

Even with uncommon pairs like USD/ZAR and USD/TRY, this is the case. Major pairs can be traded with spreads as little as 0.3 pips. Overall, Libertex makes it extremely affordable for UK traders to speculate on changes in currency prices. Libertex offers leverage of up to 1:30 when trading currency, just like Capital.com and eToro.

ETFs, options, commodities, indices, and stocks can all be traded by someone wishing to diversify their portfolio. Users of Libertex can trade using either their default web browser or MT4 or MT5. When opening an account with Libertex in the UK, the initial deposit requirement is a mere £10. This broker accepts a variety of e-wallets, debit/credit cards, and bank transfers.

4. XTB

Commodities, indexes, and stocks are just a few of the instruments available to be accessed through the CFD trading platform XTB. Additionally, UK citizens have access to a forex trading platform with 48 currency pairs. Because micro-lot trading is allowed, speculators can speculate on the currency markets with little initial investment.

When trading forex, spreads start at just 0.1 pip, according to XTB, and there are no commission fees. On major pairs, leverage up to 1:30 is available; on minor/exotic pairs, leverage up to 1:20. Everyone who uses XTB will have access to a unique account manager. There are several helpful tools for forex traders on the market analysis section of the XTB website.

Among them is a financial news website that informs XTB subscribers of significant market developments. Numerous trading tools, technical indicators, and real-time charting are available on the xStation 5 platform, which is proprietary to XTB. Deposits conducted using a bank account or debit/credit card are completely free of charge. On the other hand, Skrill charges a 2 percent fee.

5. AvaTrade

For individuals wishing to trade currencies tax-free, AvaTrade is among the top Forex trading apps in the UK. This is possible because AvaTrade provides a spread betting option. In a nutshell, AvaTrade’s spread betting markets follow the value of currency pairings in real time.

Gains from a position in forex spread betting are not subject to taxation in the UK. Additionally, AvaTrade supports both long and short positions in its spread betting facility and offers leverage of up to 1:30. The fact that AvaTrade doesn’t charge commissions is yet another significant advantage.

However, spreads on EUR/USD are slightly greater than the market average, costing a minimum of 0.9 pip. However, we also appreciate AvaTrade’s fee-free deposits, which accept debit and credit cards. Additionally, AvaTrade provides traders with a variety of platforms to choose from, including MT4 and MT5.

6. Pepperstone

For accounts with raw spreads, Pepperstone is the top Forex trading platform in the UK. Regular forex traders will benefit from this account type because they can access major currency pairs at 0 pip rates. For each traded lot, the raw spread account charges a commission of $3.50.

Pepperstone also offers standard accounts. Spreads start at 0.6 pip on the EUR/USD currency pair, and all trades can be entered with a 0% commission rate. Pepperstone provides quick deposits through Paypal and debit/credit cards for funding.

Although bank transfers are also accepted, it may take up to three business days to get your transaction. In addition to providing more than 60 different currency pairs, Pepperstone also offers stocks, ETFs, commodities, and indexes in under-supported markets. Last but not least, a variety of trading platforms, including MT4, MT5, cTrader, and TradingView, are supported by Pepperstone.

7. FOREX.com

UK-based traders can access the currency markets through Forex.com for affordable costs. The broker doesn’t charge any trading commissions for more than 80+ pairs.

Forex.com can be accessed online or through its mobile app for iOS and Android. Spreads start at 1 pip per slide on main pairings. Additionally, Forex.com provides a desktop trading platform. Retail clients from the UK can get leverage on popular forex pairs up to 1:30. On the Forex.com platform, there are a lot of key trading tools offered.

This includes news imported from Reuters, technical analysis, economic calendars, and currency signals. Users of Forex.com can trade a variety of other financial products, such as stocks, commodities, indices, and more. Once a Forex.com account has been set up, UK traders can fund it without incurring any fees using a bank transfer, debit/credit card, Skrill, or Neteller.

8. IG Markets

/IG-ef2684aaa37d4d218af819f98d676d02.png)

IG is a well-known brokerage and share dealing platform that was founded in 1974 and is headquartered in the UK. Access to more than 80 currency pairs is available through this supplier, which includes a variety of majors, minors, and exotic currencies. Retail clients in the UK can use leverage up to 1:30, and the platform provides protection against negative balances.

We appreciate that IG’s site provides three distinct options to trade FX. This includes DMA (Forex Direct) accounts, tax-free spread betting, and CFD instruments. The latter, however, is exclusively accessible to clients who are professionals. However, there are no commission fees for either the spread betting or CFD accounts.

IG provides spreads on EUR/USD at a minimum of 0.6 pips. However, this does result in an average daily movement of 1.13 pip. More than 18,000 markets are available with IG, including genuine stocks, ETFs, CFD indices, commodities, and more. UK customers must deposit at least $250 with IG, and Visa debit/credit card payments are 1 percent more expensive.

9. FXTM

The well-known forex trading platform FXTM provides UK citizens with three different account options. This makes certain that all investment profiles are taken into account. First off, the micro account offers spreads that begin at 1.5 pip trading that is commission-free.

A £50 minimum deposit is required for the Micro trading account. Anyone who can deposit at least £500 should think about opening an advantage account. Spreads begin at 0 pips while commissions are applied to each deal on average in the range of $0.40 and $2.

The same pricing structure as the micro option is available with the advantage plus account, but this one also grants access to a larger margin call ratio of 80%. FXTM accepts payments using e-wallets and debit/credit cards. There are no deposit fees for UK citizens.

10. CMC Markets

/cmc_productcard-5c61eb07c9e77c0001d93109.png)

The greatest forex trading platform in the UK for currency diversification is CMC Markets. This is because CMC Markets gives UK customers access to more than 330 different FX pairings. This will therefore be advantageous for traders who want to make predictions about the future value of exotic currencies like the TRY and ZAR.

Additionally, CMC Markets doesn’t charge any commissions for FX trading. In addition to equities, this is also true for other supported asset classes. CMC Markets’ most affordable spread, which is available on the USD/EUR, USD/JPY, and AUD/USD exchange rates, is 0.7 pips.

On all major pairs, leverage of up to 1:30 is available, and on minor and exotic pairings, leverage of up to 1:20. We also appreciate that CMC Markets gives customers the option of using spread betting or CFDs. Fast execution speeds are available from CMC Markets, with an average execution speed of 0.0045 seconds.

Factors for selecting the best Forex Trading Platforms

We concentrated on a number of important factors to distinguish between the best and worst forex trading platforms in the UK.

The primary criteria we consider while assessing UK Forex Trading Platforms are outlined below.

Regulation

UK traders should search for platforms that are sufficiently regulated when selecting a forex trading platform.

The FCA has approved and regulated the top Forex trading platforms in the UK that we assessed today, including Capital.com and eToro.

Range of Forex Pairs

Every single forex platform we’ve talked about today provides access to both major and minor pairings. But the finest Forex trading platforms also provide a large variety of exotics.

Trading Fees

Spreads and commissions are frequently included in trading fees. Top Forex Trading Platforms in the UK don’t charge commissions, and spreads have to be reasonable.

Non-Trading Fees

Charges for deposits, withdrawals, and dormant accounts are examples of non-trading fees. When looking into the top Forex trading platforms in the UK, this should be considered.

Tools and Analysis

Forex traders need to have a variety of tools at their disposal regardless of the trading strategy they use. Technical indicators, economic calendars, special order kinds, and extensive pricing charts are at the forefront of this.

Minimum Deposit

The finest forex trading platforms in the UK enable ordinary customers to open an account with a modest minimum deposit.

Demo Account

Picking a Forex Trading Platform that provides a free demo account is helpful. The user will have access to paper trading funds and conditions that replicate those of the live market. The user can then practice forex trading methods without having to utilize actual money. You can also read our previous guide of Best Forex Demo Account.

Mobile App

The majority of Forex Trading Platforms have a mobile app that links to the user’s account.

Capital.com provides the best forex trading app in the UK, which can be downloaded for free on iOS and Android smartphones.

How to begin Forex Trading?

The step-by-step tutorial below, which shows how to begin using the best Forex Trading Platform in the UK right now – Capital.com, may be helpful to complete beginners.

Step 1: Open an Account

People who don’t have a Capital.com account must register some personal information. Included are a first and last name, country, residential location, and mobile number.

Step 2: Upload ID

Upload some ID in order to get validated. The majority of traders will choose a passport or driver’s license.

Step 3: Deposit Funds

Next, if you’re using a debit/credit card or an e-wallet, make the $20 minimum deposit.

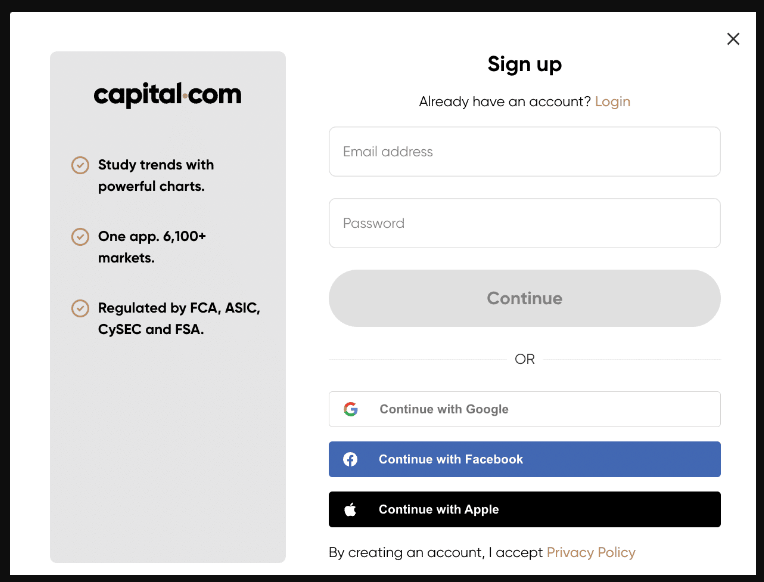

Step 4: Search for FX Pair

The user needs to enter the forex pair they want to bet on in the search bar.

In the image above, our example, we are looking for EUR/GBP.

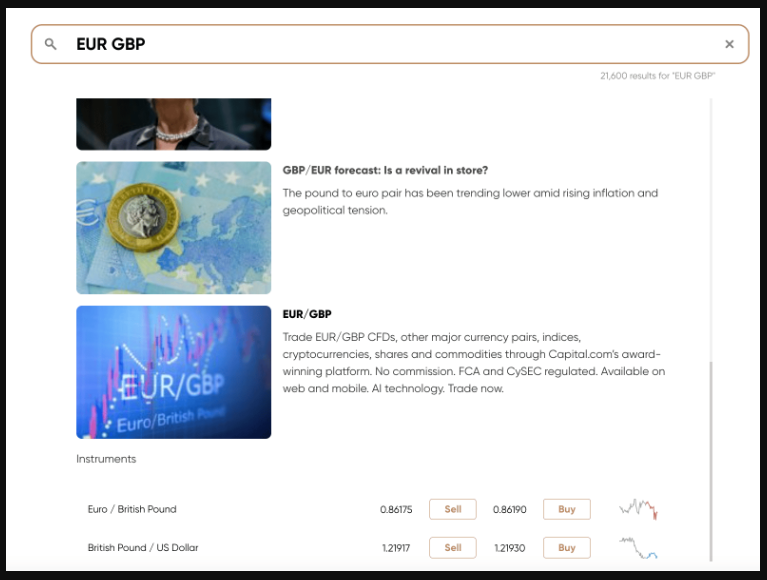

Step 5: Trade Forex

Decide whether to place a purchase (long) or sell (short) order and enter the necessary stake.

For the position to be taken in a risk-averse manner, set up a limit, stop-loss, and take-profit order.

To open a commission-free forex trading position at Capital.com, confirm the order.

Conclusion

This guide has analysed and done research on the best Forex trading platforms available in the UK. Key talking points relating to supported markets, commissions, spreads, payments, and more have been covered in our thorough research.

In conclusion, we discovered that Capital.com is the top UK Forex Trading Platform to take into account using right now. This platform doesn’t charge commissions, and its 138 supported pairs all have competitive spreads.

Additionally, opening a Capital.com account just takes a few minutes, and UK residents may get started with a £20 minimum first-time deposit.

Frequently Asked Questions

Which UK-based forex trading platform is the best?

Because it offers $0 commissions on 138 pairs, Capital.com is the best UK Forex Trading Platform in our opinion. The minimal investment needed with this FCA-licensed broker is a mere £20.

How much cash is required to begin trading foreign exchange in the UK?

The top UK Forex Trading Platforms normally give users access to lots starting at 0.01 in size. For instance, on the GBP/USD exchange, this would require a minimum commitment of £1,000. However, the minimum investment, in this case, would be reduced to £33.33 when trading with a leverage of 1:30.

Which UK-based forex trading platform offers the lowest spread?

Capital.com offers commission-free trading along with spreads of 0.6 pip. Pepperstone also offers spreads with no pip increments, although there is a $3.50 commission for each lot. Therefore, Capital.com is the superior choice of the two for novice traders.

Is it legal to trade forex in the UK?

It is permissible for UK traders, including retail clients, to trade foreign exchange online. However, it is suggested that traders remain with Forex Trading Platforms that the FCA has approved and regulated.