The most attractive companies in all of the main indices are presently trading substantially under their 52-week peak levels. As a consequence of the turbulence, long-term traders may be willing to transform some of the sufferers of the downturn into the best stocks to buy right now. The most recent decrease in some of today’s top companies may present an opportunity to start a new position in high-growth equities, even though value plays will aid in hedging against volatility in an era of rising interest rates.

The best stocks to buy right now are directly impacted by the Fed’s move to increase interest levels and combat inflation. The higher-rate environment will therefore not treat every company equally. The current economic climate will undoubtedly act as a stimulant for some businesses and a barrier for many others. We have therefore created a list of the businesses that ought to profit from current trends and outperform the overall market indices throughout the course of the next five to ten years.

Best Stocks to Buy Now 2022

The best stocks to buy right now for 2022 are as follows:

- Goldman Sachs Group (NYSE: GS)

- Walt Disney (NYSE: DIS)

- SoFi Technologies. (NASDAQ: SOFI)

- QUALCOMM (NASDAQ: QCOM)

- Apple (NASDAQ: AAPL)

- Shopify (NYSE: SHOP)

- Advanced Micro Devices (NASDAQ: AMD)

- Alphabet (NASDAQ: GOOGL)

- CrowdStrike Holdings (NASDAQ: CRWD)

- MercadoLibre (NASDAQ: MELI)

Analysis

Goldman Sachs Group (NYSE: GS)

Although Goldman Sachs is best recognized for its investment banking activities, the financial juggernaut has been quietly constructing a solid consumer banking division. In a fairly short period of time, Goldman Sachs has given users accessibility to credit card borrowing products, savings and loan facilities, and even a robo-advisory platform.

The bank’s consumer banking division reported a 67% year-over-year growth in its most recent results report. As Goldman Sachs was the bank behind both Apple and General Motors credit cards, the majority of the revenue was directly tied to each. In the future, Goldman Sachs hopes to diversify the sources of income coming from its consumer banking division. The management has already made hints that it will provide customers with checking accounts and more varieties of loans. Future revenue growth is more likely for the bank the more goods it successfully introduces.

Goldman Sachs is already among the best stocks to buy right now in its existing shape. At a fair price, the bank offers investors a strong defensive position in an inflationary climate. However, it should be highlighted that the stock’s current value appears to underestimate the bank’s potential for future revenue growth. There is no reason why Goldman Sachs shouldn’t be seen as one of the best stocks to purchase right now if it can successfully develop its consumer banking division.

Walt Disney Company (NYSE: DIS)

Disney, which is generally known as an entertainment enterprise, has a significant influence on the lives of millions of people worldwide. Disney’s stock price has been stagnant for more than a year despite the fact that it is among the most adored firms in the world.

Barely short of $200, Disney stock was trading around its all-time high at the beginning of the previous year. Shares are currently selling at about $120. The decline is principally caused by two elements: the Coronavirus’s continued suppression of in-person sales and Disney+’s lower-than-expected streaming figures. Making matters worse, rival streaming services are suffering greatly as a result of Netflix’s most recent earnings report.

In comparison to last year, Disney stock is currently trading at a considerable discount, and travel seems more accessible than ever. There is little reason to doubt that this summer will be a significant revenue boost for the business given that Disney resorts are the pinnacle of family vacation. Disney appears to be one of the greatest companies to buy right now as a result; both its long-term and short-term prospects seem too promising to ignore. The shares of Disney could soon reach new highs if they remain at their current level.

SoFi Technologies (NASDAQ: SOFI)

After coming public less than two years ago, SoFi Technologies, sometimes known as SoFi for short, is making an effort to establish itself as one of the best stocks to purchase.

SoFi was able to surpass analysts’ expectations thanks to all of the new business it generated in the quarter. For a business that isn’t yet successful, Sofi’s decrease in revenue of $0.12 per diluted share on overall revenue of $362.5 was also pretty inspiring. The banking platform was able to increase guidance for the remainder of the year as a result, which is something that not many businesses are doing in the current environment.

SoFi delivered investors with yet another impressive quarter, but since going public at the start of last year, shares have fallen by more than half. Shares are still trading at what seems to be a discount, after increasing by 23.8% on the most recent results announcement. Considering what seems to be a low stock price and a significant runway backed by secular tailwinds, SoFi may be one of the best stocks to buy in for years, if not decades.

Also read: Best Tech Stocks You Should Buy In UK 2022

QUALCOMM Incorporated (NASDAQ: QCOM)

With its corporate headquarters in San Diego, Qualcomm is a global business that specialises in developing hardware, software, and solutions for wireless technology.

In the announcement of the most recent performances, the management primarily applauded the quarter. Revenue exceeded forecasts, rising 37.0% over the prior year to $10.93 billion. At $2.96 per fully diluted share, adjusted earnings per share rose 54.0% from the prior year. In the end, Qualcomm actually surpassed all predictions made by analysts.

Qualcomm is anticipated to expand into many edge technologies, such as autos and IoT (Internet of Things) connections, in addition to assisting with the rollout of the 5G cycle. By doing this, Qualcomm will have more options and operational expansion space.

Despite having a difficult year, Qualcomm remains one of the best stocks to purchase right now. The most recent price decline presents a chance to acquire a fantastic business at a reasonable price. It may be a good thing for patient investors who can handle short-term volatility to have purchased shares during this downturn.

Apple (NASDAQ: AAPL)

The largest firm in the world right now is Apple, which has a $2.3 trillion market value. Apple hasn’t escaped the larger market selloffs, despite its status as a global leader in numerous areas. Over the course of 2022, there has been indiscriminate selling, and not even Apple may turn out to be an exception.

On the surface, Apple’s performance in 2022 appears to be lacking. But behind the surface, Apple’s fundamentals appear to be stronger than ever. Above all, the most recent share price decline has provided investors with a fantastic opportunity to start holding one of the greatest stocks.

Given the high level of inflation and the increasing likelihood of a recession, the potential of slowing growth is extremely real, but Apple is designed differently. The corporation has more than enough cash on hand to survive in a climate with significant inflation. Apple’s optionality and revenue sources are growing almost rapidly. Apple hitherto recognized only for its desktop computers, today provides top-tier services and products across several industries. Apple today appears to be cognizant of its evolving industry and more than capable of taking the necessary steps to maintain its relevance. One of the various strategies Apple will use in the upcoming years to elevate its position as one of the best stocks to purchase right away is “Buy now, pay later.”

Shopify (NYSE: SHOP)

Unsurprisingly, Shopify has emerged as one of the top places to shop during the epidemic because of its prominence in the e-commerce sector. Shopify prospered as lockdowns continued and more people started shopping online. It got to the point where, as recently as the Q4 of 2021, stocks of the e-commerce platform hit their all-time high of $1,762, up from about $416 when the epidemic was declared a worldwide emergency. Investors questioned the stock’s potential upside as revenue grew at an astonishing rate.

Shopify’s revenue increased by 86.0% and 57.0% during the previous two years, respectively. The pandemic’s trends of staying at home clearly benefited Shopify. Therefore, it would be incorrect to expect that revenue growth would continue in the same direction once the pandemic was over.

Shopify is a genuine industry pioneer in e-commerce. The stock is highly appreciated as a result. However, the most recent price decline makes the risk/reward profile much more alluring. In fact, Shopify appears to be one of the greatest stocks to buy right now given the years of positive tailwinds.

Also read: Best Supermarket Stocks You Should Buy In UK 2022

Advanced Micro Devices (NASDAQ: AMD)

The name Advanced Micro Devices has come to represent some of the best semiconductors, microprocessors, and graphics processing units available today.

The company’s present performance in relation to its valuation is the first argument that AMD should be considered one of the finest companies to purchase right now. AMD’s price-to-earnings-growth ratio, at 1.00x, is lower than the median for the overall semiconductor industry, which is 1.37x; as a result, AMD appears to be selling at a discount when predicted profits growth is taken into account. However, AMD’s most recent earnings report highlighted some outstanding achievements despite the low valuation.

AMD just reported $5.9 billion in revenue, an increase of 22% from the prior quarter and 71% from the previous year. Gross margins grew 48% year over year, largely as a result of stronger server processor revenue and the completion of the Xilinx acquisition.

AMD appears to be trading at a discount based on its present valuation. As a result, traders who purchase a stock in this company today and keep it for at least five to ten years could receive a nice payout. AMD should be one of the best stocks to buy right now and a solid long-term investment due to secular tailwinds in the technology sector.

Alphabet (NASDAQ: GOOGL)

Alphabet is not just one of the finest stocks to buy right now, but it is easily the best stock to buy in the current market.

Alphabet’s stock has now dropped by nearly 41% from its record high. After the decline, Alphabet trades at 1.14x, one of the lowest price-to-earnings-growth multiples in its sector. In other words, despite having a large competitive edge, Alphabet is selling at a disadvantage to its peers. The company is currently valued at its lowest level in ten years, despite the fact that throughout that time it has only increased cash flow, revenue, and earnings.

In fact, Alphabet has so much extra money that it recently unveiled a $70 billion share repurchase plan. Every share’s intrinsic value will rise if this is done. The money used for the buyback can be recovered in as little as five quarters if the company can just maintain its existing cash flow levels.

Since it first went public about 20 years ago, Alphabet has consistently been one of the greatest stocks to invest in. However, the company’s reign at the top seems to be just beginning. Along with a 30 percent operating margin that is more than enough to please shareholders, Alphabet just reported sales growth of 23 percent year-over-year.

CrowdStrike Holdings (NASDAQ: CRWD)

As illustrated by the most recent events in Ukraine, our reliance on the internet has raised the need for cybersecurity. The possibility of cyberattacks is more real than ever as tension rises on a worldwide scale.

Given how well CrowdStrike protects sensitive data, its services will become more essential as our reliance on technology grows. The market opportunity for CrowdStrike will reach $55 billion in 2022, according to management, but that will only be the beginning. According to estimates, the market opportunity for CrowdStrike might reach $116 billion by 2025 as a result of the positive momentum being created in the cybersecurity industry.

To be sure, CrowdStrike is a pricey stock, but it is currently trading for around 50% less than it did a few months ago. At this pricing, investors have a fantastic chance to begin a new stake in the greatest cybersecurity firm at a time when internet safety is more crucial than ever. Despite this, long-term investors may encounter some short-term volatility, but perseverance will probably be rewarded. CrowdStrike is one of the best stocks to buy now due to its current valuation. CrowdStrike appears to be a long-term winner.

MercadoLibre (NASDAQ: MELI)

MercadoLibre is an Argentinian business with headquarters in Buenos Aires that was founded in the US and runs an online platform for e-commerce, financial technology, and a variety of other services.

The introduction of internet services has already produced fantastic outcomes for the business. To reach $2.25 billion in the first quarter of the present year, revenue climbed by 63 percent over the prior year. On the other side, throughout the same time period, net income increased to $65 million. There is no question that the company is booming, and it seems like this is just the beginning. It’s difficult to dispute that MELI isn’t one of the greatest stocks to purchase right now, given that e-commerce penetration is expected to increase and MercadoLibre is expected to stay the market leader.

The company’s share price has increased significantly, but its long-term prospects are still more promising than ever. This is not to imply that MercadoLibre won’t experience short-term volatility brought on by high inflation and the residual effects of COVID-19, but rather to state that MELI appears to be one of the few businesses that will do well in the long run. MELI is one of the best stocks to buy right now, so traders who begin a new investment with it or grow an old one at these prices will likely look back on their acquisition with pleasure.

How to invest in the best Stocks?

To add the best stocks to your portfolio now, you must take a few steps. A step-by-step investment process for the best stocks is provided below:

Step 1: Choose a broker

You must locate a reliable stockbroker after choosing which stock to purchase. We’ve reviewed the best trading platform that offer some of the best stocks to buy to assist you in getting started.

eToro: Best site to invest in best stocks

A well-known online broker, eToro, offers more than 2,400 shares on 17 different markets. In fact, the platform allows you to purchase all of the top low-cost stocks that are listed on this page.

A commission-free trading platform is eToro. This implies that in order to buy the stocks you want, you won’t have to pay any share trading fees. This holds true for stocks listed internationally as well as for shares listed in the UK. Because of this, there won’t be a currency conversion fee.

You won’t be required to pay the standard 0.5 percent stamp duty tax if your preferred shares are traded on the LSE. The low spread broker for accessing the best stocks to buy right now is eToro because it pays the tax. Because it provides a free means to access the international stock markets as well as the ability to purchase fractional shares, eToro is well-known.

This broker has over 17 million investors and is governed by the FCA, ASIC, and CySEC. The FSCS mechanism also safeguards your funds. You can fund your account with eToro with a UK debit or credit card, an e-wallet, or a bank wire. Both the eToro investment app for iOS and the eToro app for Android can be used to complete the process.

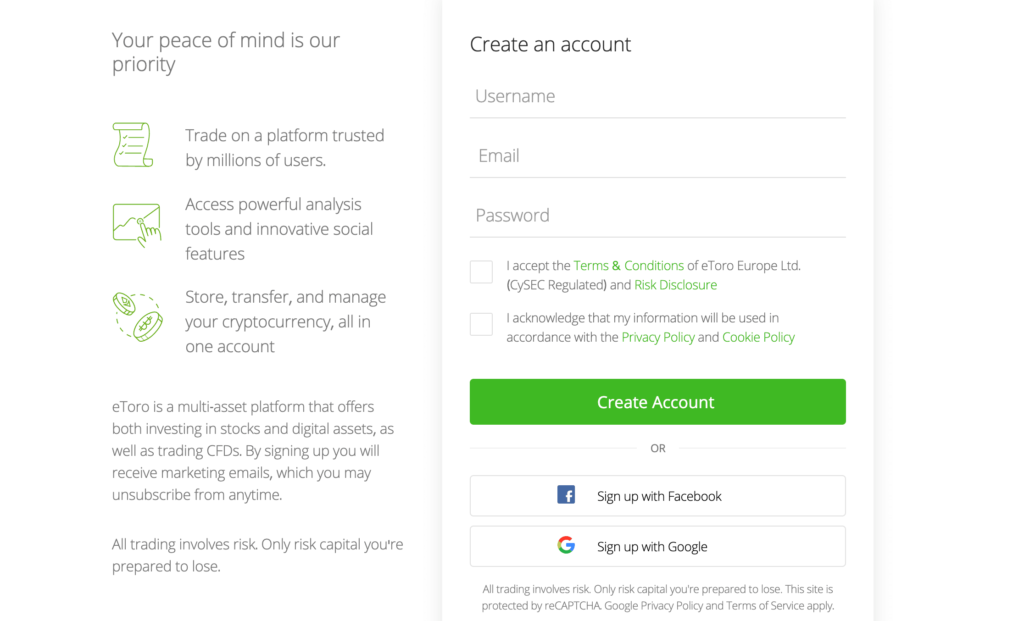

Step 2: Open an Account

To get started, go to the eToro internet site and register. Personal information is required, just like with any other share dealing platform governed by the FCA. We will include your name, address, phone number, and date of birth.

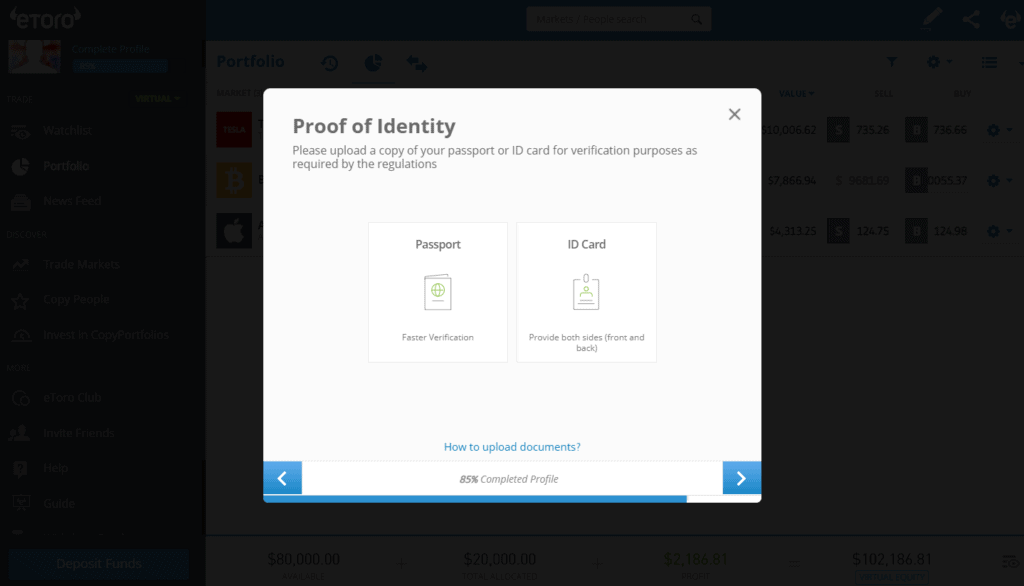

Step 3: Upload ID

Next, you’ll need to submit a copy of your passport or driver’s licence as well as proof of your present address. Either use your phone to take a clear picture of the document or upload it from your PC.

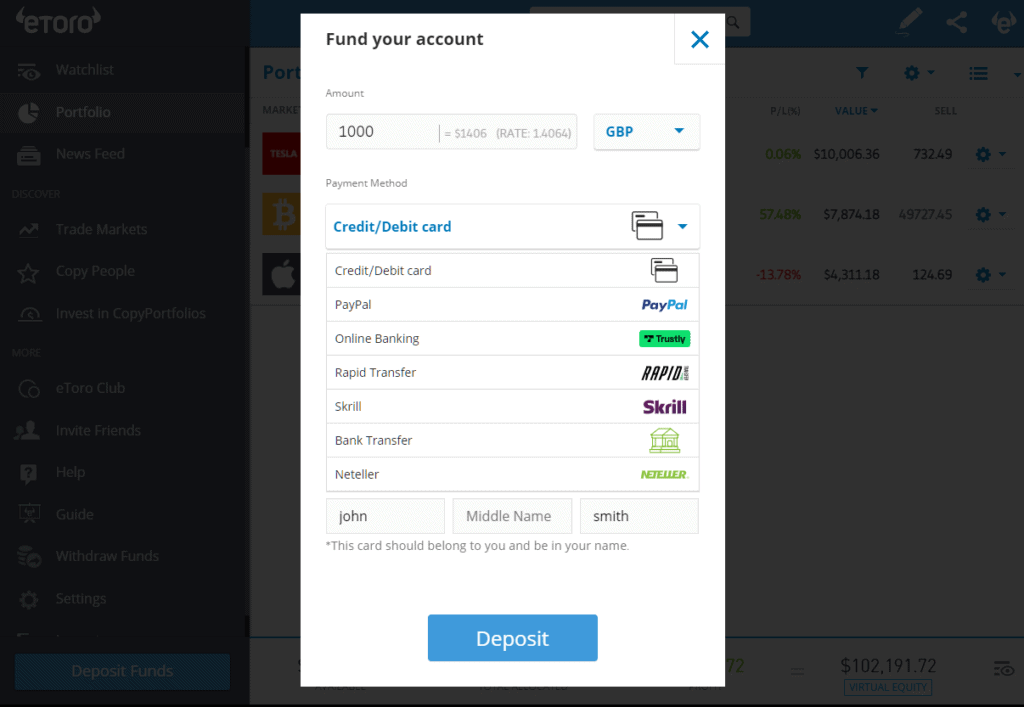

Step 4: Deposit Funds

At eToro, deposits are easy to make. With your debit/credit card or an online wallet like Paypal, Skrill, or Neteller, you can do this right away.

Step 5: Search for the best stocks

If you’ve read our guide to the best stocks to buy right now, you’ve probably already decided which stocks to purchase. In that scenario, check for the stock at the top of the page. In the following example, we’re trying to purchase Apple shares.

Step 6: Buy stocks

The process is finished by filling out an order form. The share you want to buy will appear on the screen as soon as you click the ‘Trade’ button next to it.

Put your investment’s amount in the “Amount” box after that. Although you can spend as little as $50, you are free to pay as much as you want.

In order to purchase the best stocks without paying a fee, finally, select “Open Trade”!

Conclusion

Finding the finest stocks to purchase right now requires more research than simply reading an article and buying a position in a new firm five minutes later. In reality, buyers need to understand what they require from their investment portfolio before even considering investing a dollar on a single investment. The finest stocks aren’t where they are now only due to each company’s performance, but rather due to how well they perform in a particular economic climate. For patient investors, the rare combination of excellent firms and favorable macroeconomic conditions will present unrivaled chances.

Because the broker doesn’t charge a commission on any of the stocks featured on this page, we found that eToro is the ideal platform to buy the best stocks.

Frequently Asked Questions

Where can I locate the best stocks?

At eToro, you can purchase the best stocks, such as significant tech stocks, dividend stocks, and growth stocks. Trading stocks and ETFs is available on this completely regulated replica trading platform with no commissions. Additionally, fractional shares can be purchased for as little as $50.

What Nasdaq stocks have the best trading volume?

The three most traded equities on the NASDAQ today are Apple Inc., Alphabet, and Sofi.