Supermarket stocks may come to mind when you consider the basic necessities that every family requires, such as furniture, food, drink, hygiene products, and other commodities we can’t live without no matter what’s happening around the globe or how high inflation rises.

A 6 percent increase in food commodity prices as well as rising expenses for some farming inputs are predicted by Goldman Sachs. The consumer price index for groceries has increased by a staggering 11% in the last two years.

You have a wide range of options if these data have you set to purchase up supermarket stocks. To assist you sort through the research noise, we’ve selected the Best supermarket Stocks to Buy in the UK 2022 in this guide.

Why invest in Supermarket Stocks?

Stocks in consumer goods companies, such as supermarket chains, can increase portfolio diversification and provide stable growth, reliable dividends, and minimal volatility. Due to the high demand, supermarket stocks come with a built-in inherent bear market resistance. You can profit from costs that are transferred to customers by taking advantage of grocery retailers’ increased prices at the moment. Look for stocks of supermarket stores that have a competitive edge over rivals and growth-oriented trajectories.

Best Supermarket Stocks in 2022

So, which supermarket stocks should you include in your portfolio? Let’s look at our Top Eight choices of the best supermarket stocks you should buy in the UK in 2022.

- Sainsbury’s (LON: SBRY)

- Tesco (LON: TSCO)

- Target Corporation (NYSE: TGT)

- Ocado (LON: OCDO)

- Marks & Spencer’s (LON: MKS)

- Walmart Inc (NYSE: WMT)

- Albertsons Companies Inc. (NYSE: ACI)

- Costco Wholesale Corporation (NASDAQ: COST)

Best Cheap Stocks Analysis

Sainsbury’s (LON: SBRY)

J Sainsbury plc is a well-known British supermarket company. The corporation is worth more than 6.2 billion pounds and operates hundreds of outlets in the United Kingdom.

Sainbury’s performed well in 2021, as investors expected the company to become a suitable acquisition target for some of the biggest private equity firms. The auction of Morrison’s, the UK’s third-largest supermarket business, fueled conjecture.

The share price of Sainsbury’s has performed admirably in 2022. It is currently trading at 287p, which is around 6.6 percent higher than the year’s lowest point. When the business released optimistic forward guidance on Wednesday, the gains quickened.

The business announced that, following a prosperous Christmas season, it will report a bigger profit than anticipated. It anticipates underlying profitability of at least 720 million pounds.

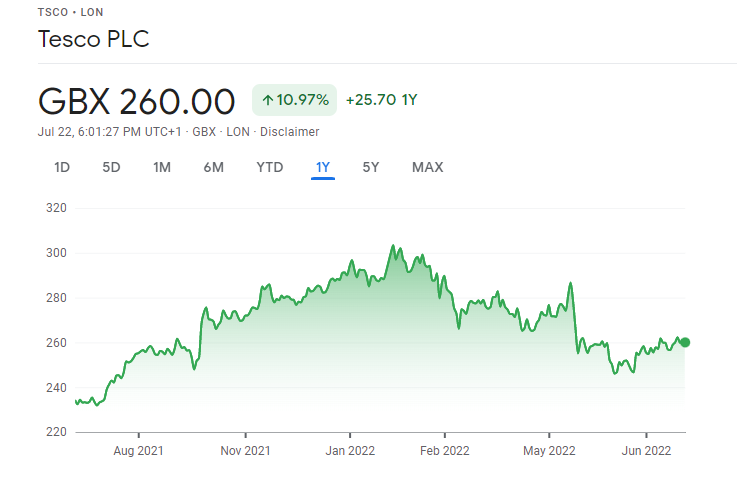

Tesco (LON: TSCO)

The largest retailer in the UK, Tesco, has a market capitalization of nearly 20 billion pounds. In the majority of British cities and suburbs, the corporation has locations.

Tesco is a good retailer because of its size and ability to maximize online sales. Additionally, it offers it a strong negotiation position when dealing with suppliers.

Tesco had a fantastic holiday season, just like Sainsbury’s. As a result of the corporation increasing its forward outlook, its stock price reached a multi-year high. Tesco is a reliable UK retail stock to buy due to its great returns and stability.

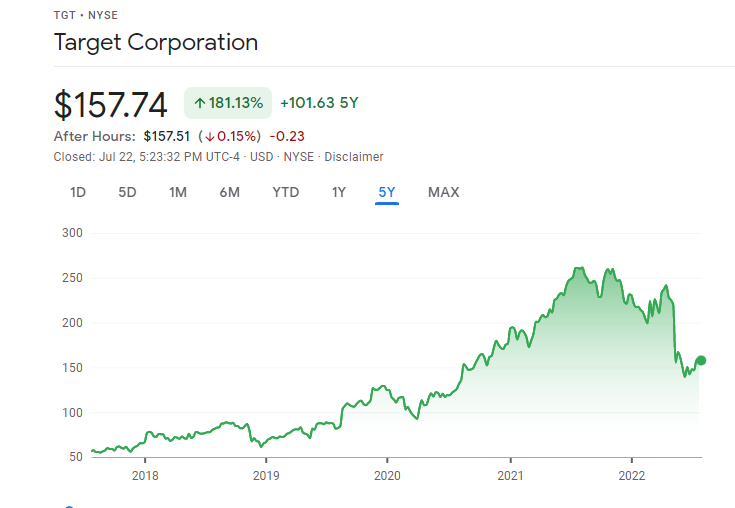

Target Corporation (NYSE: TGT)

The Target Corporation, with its headquarters in Minneapolis, Minnesota, runs and owns general merchandise stores around the US, offering food selections such as perishables, dry groceries, dairy, and frozen goods.

Target Corporation’s comparable sales increased by 8.9 percent in Q4 2021, following a 20.5 percent increase in Q4 2020.

Target’s overall revenue reached $106 billion in 2021, up nearly $28 billion, or more than 35%, over the previous two years. Comparable sales for the entire year increased by 12.7% above 19.3% in 2020.

Since 2019, Target’s overall revenues have increased by more than $27 billion, or $14 billion more in-store sales and roughly $13 billion more in internet sales. In 2021, all five of the key product categories experienced double-digit comparable sales growth.

Ocado (LON: OCDO)

Over the past few years, Ocado has grown steadily stronger. Even though it only has a tiny portion of the market at the moment, it is the biggest pure-play online grocery business and is growing. Although it will transfer to rival Marks & Spencer at the end of August 2020, Ocado’s online business has been supported by its automated warehouses and distribution centers, twinned with its alliance with luxury grocery chain Waitrose.

Sales at Ocado increased by 27% in the six months leading up to the end of May 2021 thanks to the coronavirus epidemic and the acceleration of online purchasing. One aspect of Ocado’s distinctiveness is its Solutions division, which licenses its technology to other grocery stores and retailers all around the world in an effort to increase productivity and lower labor costs. The number of businesses employing Ocado’s automation technology has grown over the past few years, and notable users include Morrisons, the American company Kroger, the Canadian company Sobeys, and the French company Casino Groupe.

Ocado is still expanding considerably more quickly than its more established competitors. Revenue increased to nearly $1 billion in the six months ending in May 2021 from just £800 million the year prior, but Ocado is still losing money and doesn’t pay a dividend.

Marks & Spencer (LON: MKS)

Although Marks & Spencer has historically been known for selling clothing and home goods, its food division has recently grown to be its most important segment. It generates over £10 billion in revenue annually, with 60% of that coming from food, 30% from its clothes and homewares line, and the remaining 35% coming from its overseas section, which is run on a franchise system globally.

After having bought half of Ocado’s grocery operation and negotiating an agreement to deliver goods to Ocado customers as the company’s contract with Waitrose expires later this year, it is looking to expand its food business. According to Marks & Spencer, it is fostering a “one business” approach with Ocado, which may be seen as a possible sign of future ties between the two businesses. In the midst of a transformation effort, Marks & Spencer’s is closing stores and laying off employees.

Food sales have been a top priority for Marks & Spencer’s when sales of its other products have underperformed, but it hasn’t stopped the business’s overall financial performance from decreasing in recent years. The company’s dividend was reduced by 70% in the year ending on March 28, 2020, as both revenue and profits decreased. The business said that it has no plans to distribute any dividends for the current fiscal year.

Walmart Inc (NYSE: WMT)

According to revenue, Walmart is the largest company in the world, the largest employer in the US, the largest retailer worldwide, and it has the greatest global network of supermarkets. The corporation is well-known in the UK as well, where it is in charge of the ASDA grocery chain, which is responsible for 17.6% of all food purchases made there online.

With 230 million clients served each week, the business has since expanded to rank among the biggest merchants worldwide. Revenue is likely to top $500 billion this year, and the stock is valued at roughly $400 billion.

Walmart announced third-quarter earnings on November 16th, 2021, and both the top and adjusted bottom lines beat expectations. Total revenue climbed by 4.3 percent to $141 billion, primarily to an increase in comparable sales of 9.9 percent in the United States.

Albertsons Companies Inc. (NYSE: ACI)

With its corporate office in Boise, Idaho, Albertsons Companies Inc. manages a chain of grocery and drug shops that also provide pharmacy, fuel, general merchandise, health and beauty care items, and other services. The business runs more than 2,000 outlets.

The business runs more than 1,500 pharmacies, 1,200 branded coffee cafes inside of stores, 400 neighboring fuel stations, 22 distribution centers, and 20 manufacturing facilities.

Digital sales climbed by 9 percent, while similar sales increased by 5.2 percent in the third quarter of fiscal 2021. The business claimed a staggering 234 percent increase in digital sales growth over a two-year period stacked. There was a $425 million discrepancy between net income and adjusted net income.

For the 12 weeks ended December 4, 2021, net sales and other revenue were $16.7 billion, up from $15.4 billion in 2020. The rise, according to the business, was caused by COVID-19 vaccinations and retail price inflation.

Comparing Q3 of fiscal 2021 to Q3 of fiscal 2020, adjusted net income increased to $457.2 million from $386.6 million. Adjusted EBITDA climbed to $1,051.2 million, or 6.3 percent of sales, in the third quarter of fiscal 2021 as compared to the third quarter of fiscal 2020.

Costco Wholesale Corporation (NASDAQ: COST)

Costco Wholesale Corp., based in Issaquah, Washington, manages membership warehouses and distributes food and sundries, fresh foods, and other products through its US operations, Canadian operations, and other foreign operations segments.

According to recent data, net sales for the second quarter and the first 24 weeks of the fiscal year 2022 increased by 16.1% to $50.94 billion from $43.89 billion the previous year. Net sales grew 16.4 percent in the first 24 weeks to $100.35 billion, up from $86.23 billion the previous year.

The net income for the quarter was $1,299 million, up from $951 million the previous quarter. Costs spent principally from COVID-19 premium wages totaled $246 million pretax and $0.41 per diluted share.

Costco reported net sales of $16.29 billion in February, up 15.9 percent from $14.05 billion the previous year. Net sales were $108.39 billion for the 26-week period ending February 27, 2022, up 16.3 percent from $93.16 billion the previous year.

How to purchase the best supermarket Stocks in UK?

After discussing the best supermarket stocks in the UK, we’ll walk you through the purchasing process.

Step 1: Choose a broker

For the purchase of supermarket stocks in the UK, you will require a reputable stockbroker. Your broker will decide which supermarket stocks you are allowed to trade. Additionally, many brokers offer various trading platforms and tools and charge various trading commissions.

In light of this, let’s take a deeper look at our top two recommendations for purchasing supermarket stocks in the UK:

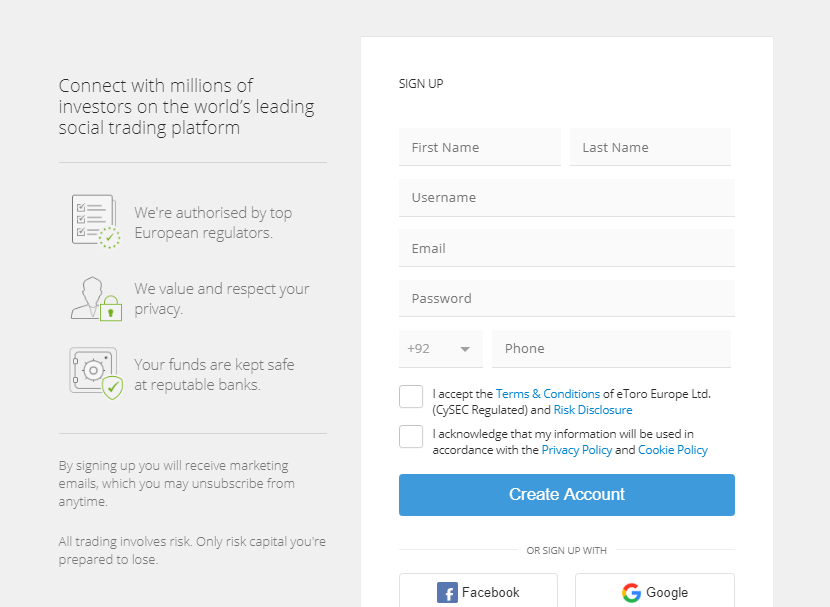

1. eToro

One of our top suggested UK brokers to purchase supermarket stock is eToro. This broker, which offers trading on over 800 shares in the United Kingdom, the United States, Europe, and other countries, allows you to trade practically all of the finest supermarket stocks. eToro now offers 450 exchange-traded funds (ETFs), many of which include supermarket stocks from the FTSE 100 and NYSE.

Furthermore, eToro offers some of the lowest spreads in the UK and does not charge a commission on stock CFD purchases or sales. On the platform, there are withdrawal and inactivity fees, although they are small and quite simple to avoid.

Additionally, eToro offers a social trading network that connects you to millions of other traders from across the globe. eToro uses this network to produce a market sentiment score for each stock, allowing you to assess whether it is trending higher or negatively. You can quickly build a diverse portfolio using the copy trading tool or mimic the transactions of experienced investors.

The Financial Services Compensation Scheme, which is overseen by the Financial Conduct Authority, protects eToro customers. Every day of the week, customers can contact customer support via phone or email.

2. Plus500

/plus500_source-5c5b58f746e0fb0001ca8550.png)

Plus500 has established a reputation for itself in the internet world since its inception in 2008 by providing zero commissions on a cutting-edge but very user-friendly trading platform. Hundreds of shares from different exchanges, including supermarket stocks, are available through CFDs if you choose Plus500. Plus500 charges a 1.25 percent margin when trading supermarket stocks with a minimum investment of 0.5 stocks. Additionally, a 5:1 leverage will be available for trading supermarket stocks.

This trading platform provides users with a fully functional trading environment that includes, among other features, an advanced charting tool, a number of risk management features, an economic calendar, and a price alerts service. Plus500 requires a minimum deposit of 100 euro, which can be made through credit/debit card, bank wire transfer, or PayPal. If you wish to test out the platform, you can open a free demo trading account and use fictitious funds.

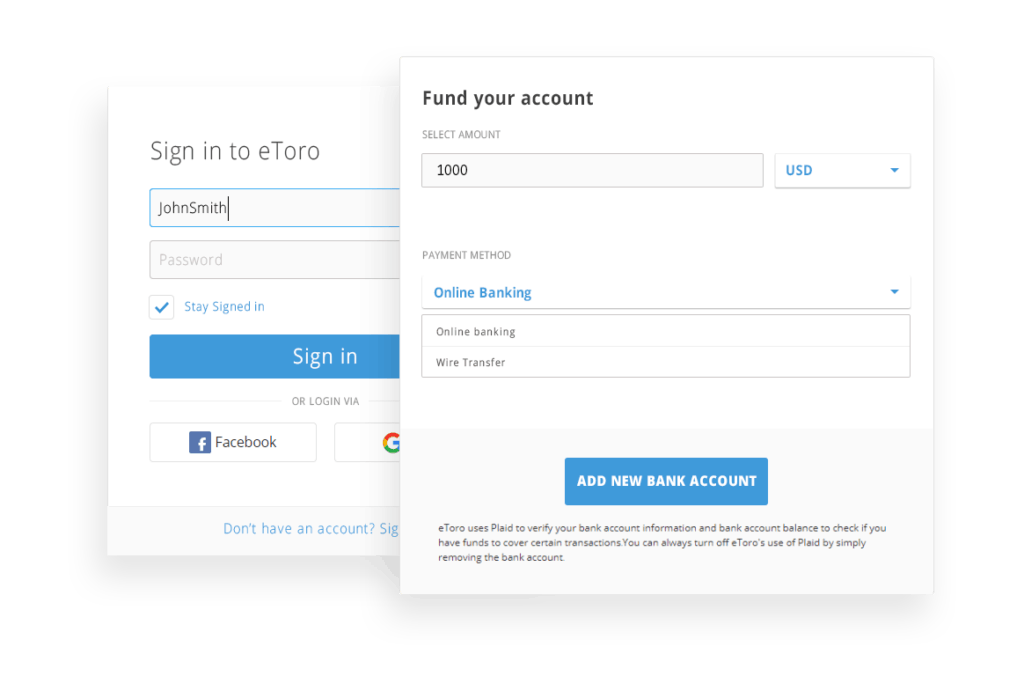

Step 2: Create an account

We’ll show you how to use eToro, which offers a wide selection of supermarket stocks and doesn’t charge a commission, to buy stocks.

Visit the eToro website to get started. You can sign up by clicking “Join Now” and using your Facebook, Google, or email address.

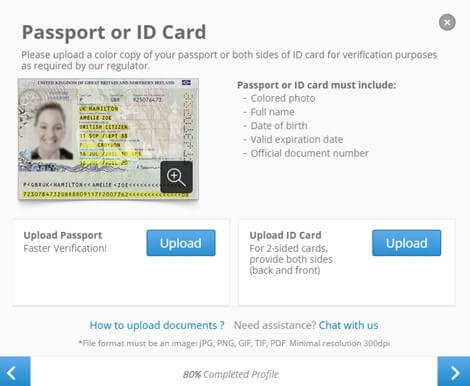

Step 3: Verification

eToro requests that you provide identification proof in order to comply with UK anti-money laundering regulations. A copy of your driver’s licence or passport must be submitted together with a current utility bill or financial statement to complete this step.

Step 4: Deposit Funds

The minimum deposit amount for eToro is £140, and this can be paid with a debit card, credit card, bank transfer, or e-wallet.

Step 5: Search for the Supermarket stock you want to buy

You are now ready to use eToro to buy your first stock in a supermarket. Use the search bar at the top of the page on your account dashboard to find the business you want to invest in. When it does, select “Trade” from the menu.

Step 5: Buy Supermarket Stocks

Complete out the order box with the sum of supermarket stock you want to buy. Once your order is prepared, click “Open Trade” to purchase supermarket stock.

Conclusion

The supermarket industry is growing quickly. The supermarket industry is already undergoing numerous changes, which might have a substantial impact on the market shares and values of the leading supermarkets in the US and the UK in the next years.

On the other hand, the best supermarket stocks have years of retail expertise. They’ve already shown that they can deal with challenging circumstances and make the required adjustments.

Investors are currently generally interested in the supermarket sector. Investors who are interested in supermarket stocks should look for businesses with enduring competitive advantages and the financial wherewithal to keep investing in growth.

If you want to purchase supermarket stocks in 2022, any of the eight companies mentioned above is a good place to start. To begin trading right away, open an eToro account!

Frequently Asked Questions

Where can I acquire supermarket stocks?

The best broker for commission-free stock purchases in supermarkets is eToro.

What is the biggest supermarket firm in the UK?

Tesco is the largest supermarket firm in the United Kingdom, accounting for 27 percent of the market. Tesco has a market value that exceeds £28 billion.

What stocks in supermarkets pay dividends?

Sainsbury’s and Tesco are two UK companies that provide dividends. The US stock Walmart pay dividends.